Get the free Form Sc 13g/a

Get, Create, Make and Sign form sc 13ga

How to edit form sc 13ga online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form sc 13ga

How to fill out form sc 13ga

Who needs form sc 13ga?

Form SC 13G/A: A Comprehensive How-to Guide

Understanding the SC 13G/A form

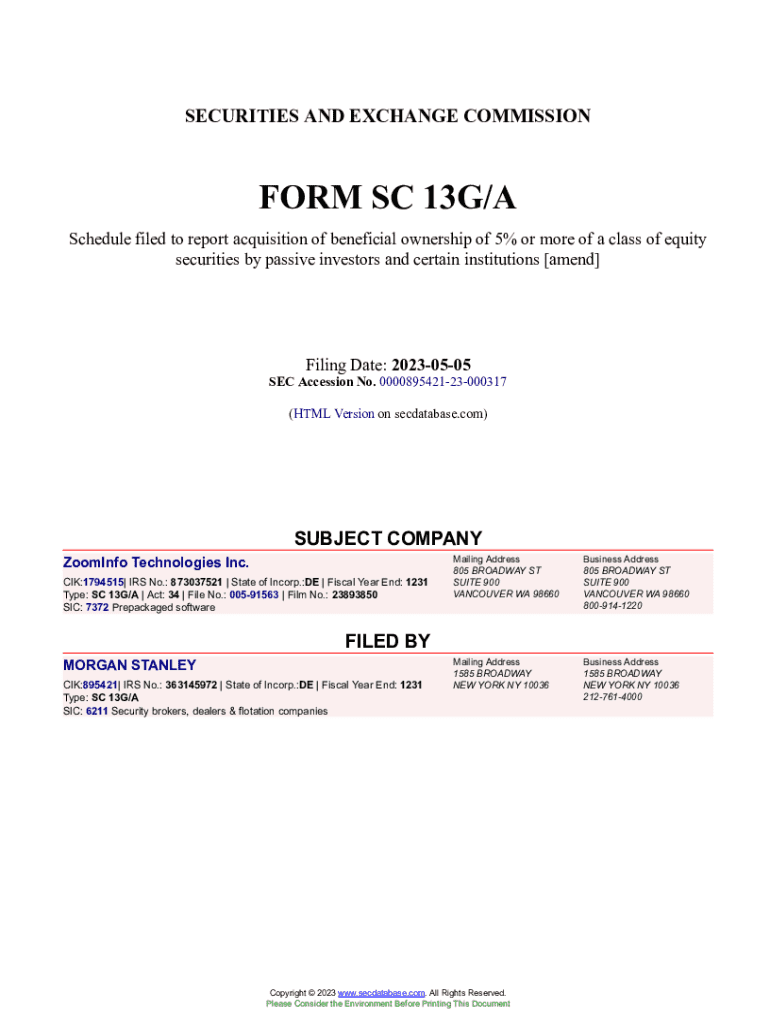

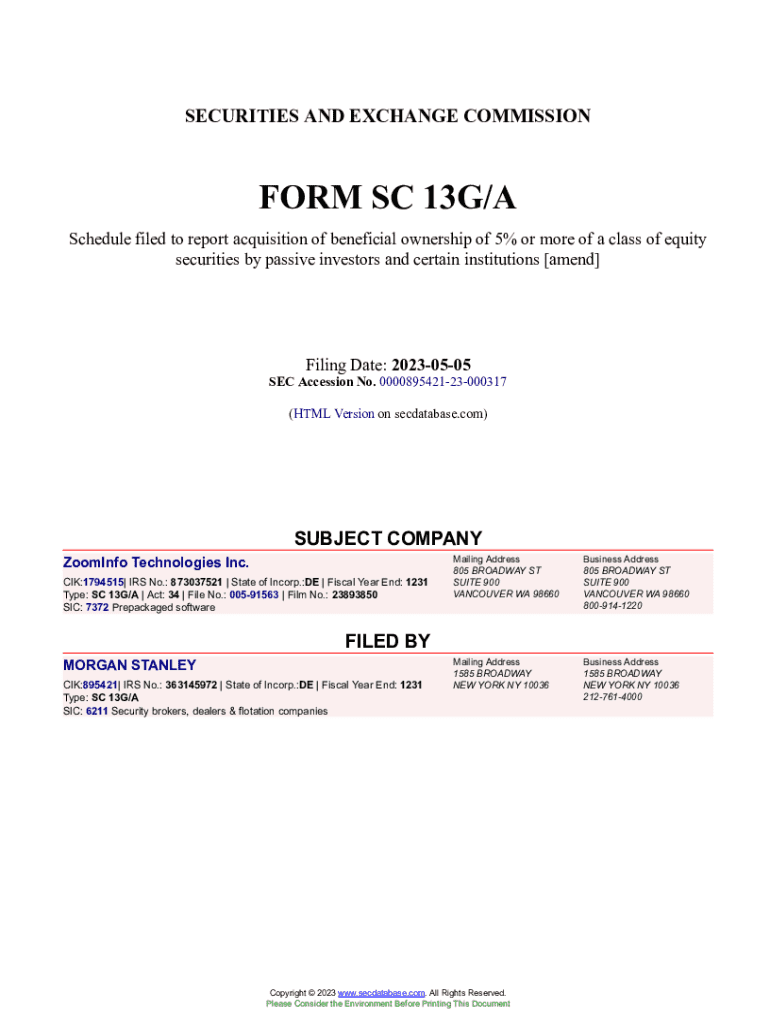

The SC 13G/A form, known as the 'Beneficial Ownership Report for Securities,' is a critical document in the realm of investment and securities regulation, filed with the U.S. Securities and Exchange Commission (SEC). This form is primarily utilized by investors who hold beneficial ownership of a company's equity securities, simplifying the report process for passive investors. It differs significantly from the SC 13D form, which is intended for active investors engaging in changes that could affect corporate control or strategy.

Beneficial ownership reporting is crucial for transparency within capital markets. The SC 13G/A not only helps to maintain a clear picture of ownership but also aids in the enforcement of compliance with securities laws. Although initially filed as SC 13G, when a change in ownership occurs or additional information must be disclosed, a revision is submitted as SC 13G/A, indicating an amendment to the original report.

Who needs to file an SC 13G/A?

Primarily, the SC 13G/A form must be filed by passive investors—those who own more than 5% of a company's outstanding securities but do not intend to influence control or management of the company. This includes institutional investors such as mutual funds and pension funds, which may be granted exemptions based on their investment strategies. Filing is mandatory except in specific cases defined by SEC rules.

Timeliness is critical; the SC 13G/A must be filed within 10 days of the end of each calendar year, reflecting any changes in ownership throughout the prior year. Understanding these filing requirements is essential for compliance, as missing a deadline could lead to penalties or regulatory scrutiny.

Key components of the form SC 13G/A

Form SC 13G/A is structured into several key sections, each serving a unique purpose in the reporting process. Precisely completing these sections is crucial for accuracy and compliance. The essential sections include:

Understanding ownership thresholds is pivotal. Notably, if a person or group acquires more than 5% of a security class, prompt filing becomes necessary. This threshold's implications extend beyond mere reporting; it can prompt scrutiny and affect market perception.

Step-by-step instructions for filling out SC 13G/A

Filling out the SC 13G/A form requires meticulous preparation. Start by gathering all necessary information and documents, which typically include the current shareholder registry and relevant financial statements. The following steps provide a clear route to ensure accuracy and compliance throughout the process:

Accurate reporting is paramount. Common pitfalls to avoid during filing include misstatements regarding ownership percentage and failure to update the form when necessary. Tools like pdfFiller can enhance accuracy by providing features that allow for easy validation of data and streamlined document manipulation.

Editing and managing your SC 13G/A filings

Managing your SC 13G/A filings effectively is essential for compliance and record-keeping. Utilizing platforms like pdfFiller can expedite this process by facilitating seamless document management. With pdfFiller, users can upload and edit documents efficiently, ensuring that past filings can be updated quickly when necessary.

The platform's ability to utilize templates for recurring filings can reduce errors while saving valuable time. By creating a repository of commonly used phrases and figures, teams can streamline their filing processes significantly. This centralized repository also supports collaboration among team members, where documents can be shared, feedback provided, and approvals managed all within the platform.

Signing and submitting your form SC 13G/A

Once the SC 13G/A form is completed, the next step is to ensure it is properly signed and submitted. Utilizing electronic signature tools available in pdfFiller can simplify this process. Easily adding your signature electronically allows for quick turnaround times while maintaining compliance with SEC regulations.

When submitting your filing to the SEC, remember there are various methods available, including online submissions through the SEC's Electronic Data Gathering, Analysis, and Retrieval system (EDGAR) or traditional mail. Regardless of the chosen method, it is vital to confirm submission and track the filing status to ensure compliance and address any issues proactively.

Frequently asked questions (FAQs) about SC 13G/A

A common query regarding the SC 13G/A form relates to the implications of failing to file on time. Such oversight may result in penalties or fines imposed by the SEC for non-compliance. Additionally, if ownership status changes significantly, investors may wonder if they can amend their SC 13G/A filing. The answer is yes; amendments can be filed whenever necessary to reflect current ownership holdings accurately.

Keeping track of changes in ownership can be challenging. One effective strategy is to establish a regular review schedule, aligning with quarterly or annual financial assessments. Investors should also consider when to switch to SC 13D filings; generally, if there is an intention to influence control of a company or if substantial changes in ownership occur, this transition may be required.

The importance of compliance in SEC filings

Navigating the regulatory landscape for SEC filings necessitates a thorough understanding of obligations and consequences tied to improper filing. Penalties for non-compliance can be severe, including fines and potential legal action, which underscores the importance of diligent adherence to documentation requirements.

To stay informed about ongoing changes or updates in SEC guidelines, investors and corporate entities should reference reliable resources. These might include direct communications from the SEC or subscription-based services that track regulatory changes. Ensuring adherence promotes trust with stakeholders, enhancing overall market integrity and investor confidence.

Conclusion: The value of pdfFiller's cloud-based solutions for document management

Leveraging technology, such as pdfFiller, can vastly simplify the process of creating, editing, and managing SEC filings like the SC 13G/A. The seamless integration of document management features allows users to focus more on investment strategy and compliance, rather than the intricacies of paperwork.

The future of document handling lies in adaptable, efficient cloud-based solutions. By employing pdfFiller, users can ensure their document workflows are streamlined, ultimately easing the burdens associated with regulatory compliance and improving overall productivity.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send form sc 13ga for eSignature?

Can I edit form sc 13ga on an iOS device?

How do I complete form sc 13ga on an iOS device?

What is form sc 13ga?

Who is required to file form sc 13ga?

How to fill out form sc 13ga?

What is the purpose of form sc 13ga?

What information must be reported on form sc 13ga?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.