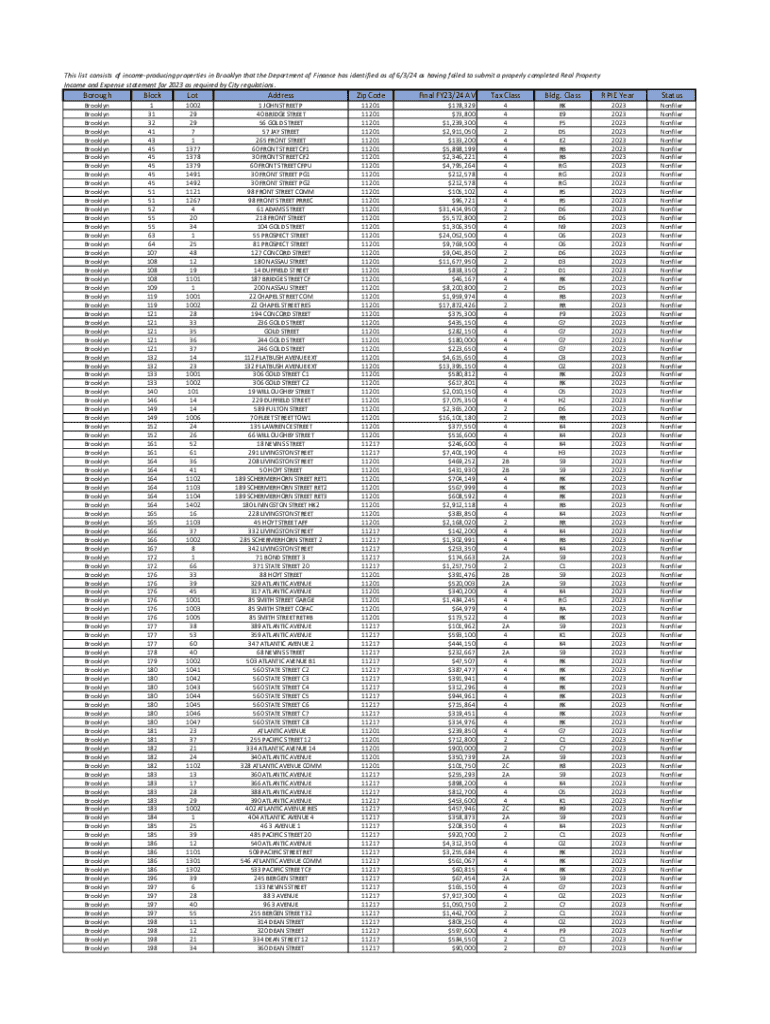

Get the free Distribution of the Burden of New York City's Property Tax

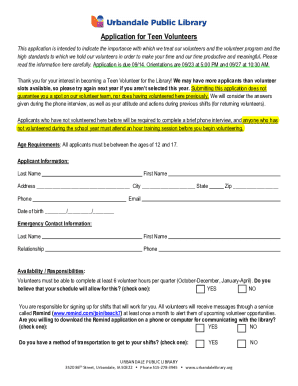

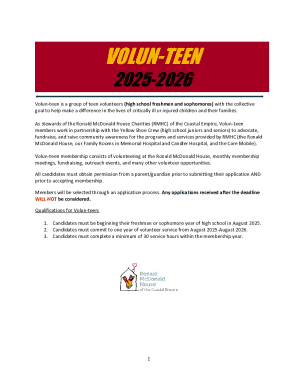

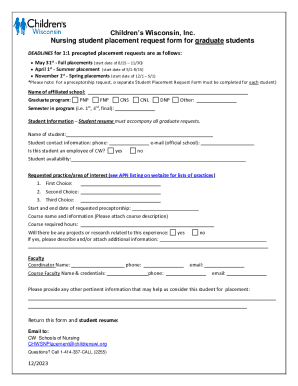

Get, Create, Make and Sign distribution of form burden

How to edit distribution of form burden online

Uncompromising security for your PDF editing and eSignature needs

How to fill out distribution of form burden

How to fill out distribution of form burden

Who needs distribution of form burden?

Distribution of Form Burden: Streamlining Your Processes with pdfFiller

Understanding form burden

Form burden refers to the various weights and complexities associated with completing, submitting, and managing forms required by employers, government entities, and health plans. Understanding form burden is crucial for both individuals and organizations because it directly impacts operational efficiency and compliance with laws. When employees feel overwhelmed by cumbersome forms, it can lead to errors, delays, and even compliance issues for businesses.

Types of burdens include financial, time, and compliance aspects. Financial burden involves the costs associated with printing, filing, or even missing deadlines due to poor form management. Time burden is the energy spent filling out and submitting forms—often a significant drain on productivity—while compliance burden can stem from the legal repercussions of improperly handled paperwork. Specific forms, such as IRS forms 1095 or health plan enrollment forms, exemplify these burdens, as they often bring about confusion and errors if not managed effectively.

Why form burden matters

Excessive form burden can severely impact both individuals and organizations. For employees, navigating complicated paperwork can lead to frustration and reduced job satisfaction. For employers, it translates into inefficiencies, with many hours wasted on form management instead of productive work. Such burden negatively influences the bottom line as staff shifts their focus from core activities to administrative tasks.

Moreover, tackling form burden is not only a matter of efficiency but also of legal compliance. Businesses must navigate laws and regulations such as the Paperwork Reduction Act (PRA), which aims to minimize the paperwork burden on the public. The PRA emphasizes the need to reduce unnecessary paperwork and streamline processes, making organizations accountable for the efficiency of the forms they require.

Strategies for minimizing form burden

Streamlining form processes begins with simplifying form design and implementation. Organizations should follow several best practices: Firstly, ensure clarity in form instructions by using straightforward language and step-by-step guidance to reduce confusion. Secondly, user-friendly layouts minimize the time employees spend deciphering forms. Utilizing visual elements such as icons can further enhance understanding.

Leveraging technology plays a critical role. Solutions like pdfFiller allow for automation in form management, enabling users to fill out forms, sign documents, and even collaborate in real-time from any internet-connected device. Cloud-based platforms further enhance accessibility and facilitate collaboration, guiding teams towards effective document management.

Tools for managing form burden

Interactive tools available through pdfFiller significantly ease the form burden, offering features for easy editing, signing, and tracking of forms. The use of templates tailored to specific needs allows organizations to standardize forms, which can decrease errors and streamline processes. This efficiency helps in tackling the overwhelming nature of forms, providing a time-saving solution to common paperwork challenges.

Integrations with other software systems, like CRMs and payroll applications, are vital for effective form management. When form tools are synced with existing business systems, it alleviates duplication of work and promotes seamless data transfer. This harmony among business applications can ensure that all stakeholders have access to the latest documents required for compliance, ultimately enriching the workflow of the organization.

Best practices for filling out and managing forms

Individuals filling out forms should adhere to several best practices to avoid common pitfalls. For example, start by carefully reading the instructions to fully understand what information is needed. Use clarity when providing data, as mistakes can lead to delays or compliance issues with forms like IRS 1095. Common mistakes to avoid include skipping required fields, misinterpreting instructions, or failing to double-check for accuracy before submission.

On a team level, fostering collaboration can lead to more efficient handling of forms. Establish clear communication channels to discuss upcoming paperwork requirements and encourage team members to share experiences or tips on managing forms effectively. Feedback loops should be instituted, allowing teams to review and refine the process continually. This dynamic engagement will help increase the accuracy of forms submitted and improve overall productivity.

Case studies: Successful form burden reduction

Organizations have successfully implemented strategies to reduce form burden, showcasing various outcomes worth noting. One case study features an employer who integrated pdfFiller into their human resources department. By digitizing their form processes, they reported a 40% reduction in the time employees spent on paperwork. This translated into significant boosts in employee satisfaction and productivity, as staff could focus on core functions rather than administrative tasks.

Another organization focused on simplifying initial enrollment forms for health plans. By redesigning their forms to eliminate unnecessary fields and leveraging pdfFiller’s built-in templates, they managed to decrease submission errors by 60%, significantly increasing compliance with IRS requirements and leading to smoother audit processes. These case studies illustrate the tangible benefits of taking a proactive stance on managing form burdens.

Future trends in form management

The landscape of form management is poised for transformation through emerging technologies. AI and machine learning offer promising avenues for ongoing optimization, potentially offering intelligent suggestions when filling out forms. Predictive analytics could streamline identification of common errors or bottlenecks, thus mitigating future form burdens.

As consumer expectations shift, there is a growing preference for digital forms over traditional paper-based alternatives. Organizations should anticipate user needs, offering platforms that prioritize accessibility, mobile use, and intuitive interfaces. Adapting quickly to these trends can provide a competitive advantage, ensuring that companies are equipped to handle evolving expectations around document management.

Testimonials from users

Users of pdfFiller have shared compelling stories of how the platform alleviated their form burdens. One user remarked, 'The ability to edit and eSign documents directly in the cloud has saved me countless hours that I used to spend on form management. My productivity has soared since implementing pdfFiller.'

Another noted, 'Before integrating pdfFiller, filling out IRS forms felt daunting. Now, the templates are easy to navigate, and I feel confident about compliance. It’s revolutionized the way I handle paperwork!' These real-world experiences underscore the transformative nature of effective form management solutions.

Frequently asked questions (FAQs)

Many queries arise regarding form burden and its management. One common misconception is that digital forms inherently eliminate form burden; however, if poorly designed, they can still create challenges. It’s essential to focus on both the content and the user experience when considering digitalizing forms.

Another frequent question is about the capabilities of pdfFiller. Users often ask if it can assist with compliance management; the answer is a resounding yes. With built-in templates and collaborative features, pdfFiller enables seamless compliance monitoring, helping users adhere to regulatory requirements effectively.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit distribution of form burden online?

How do I make edits in distribution of form burden without leaving Chrome?

How do I complete distribution of form burden on an iOS device?

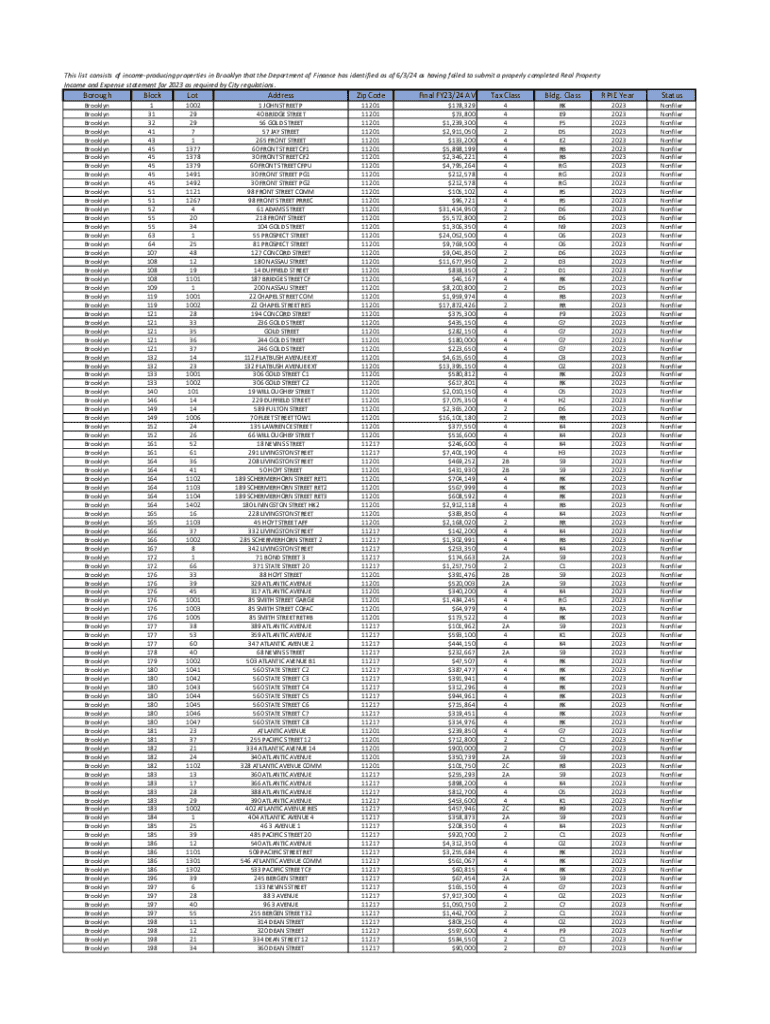

What is distribution of form burden?

Who is required to file distribution of form burden?

How to fill out distribution of form burden?

What is the purpose of distribution of form burden?

What information must be reported on distribution of form burden?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.