Get the free Form 990

Get, Create, Make and Sign form 990

How to edit form 990 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 990

How to fill out form 990

Who needs form 990?

Form 990 Form: A Comprehensive How-to Guide

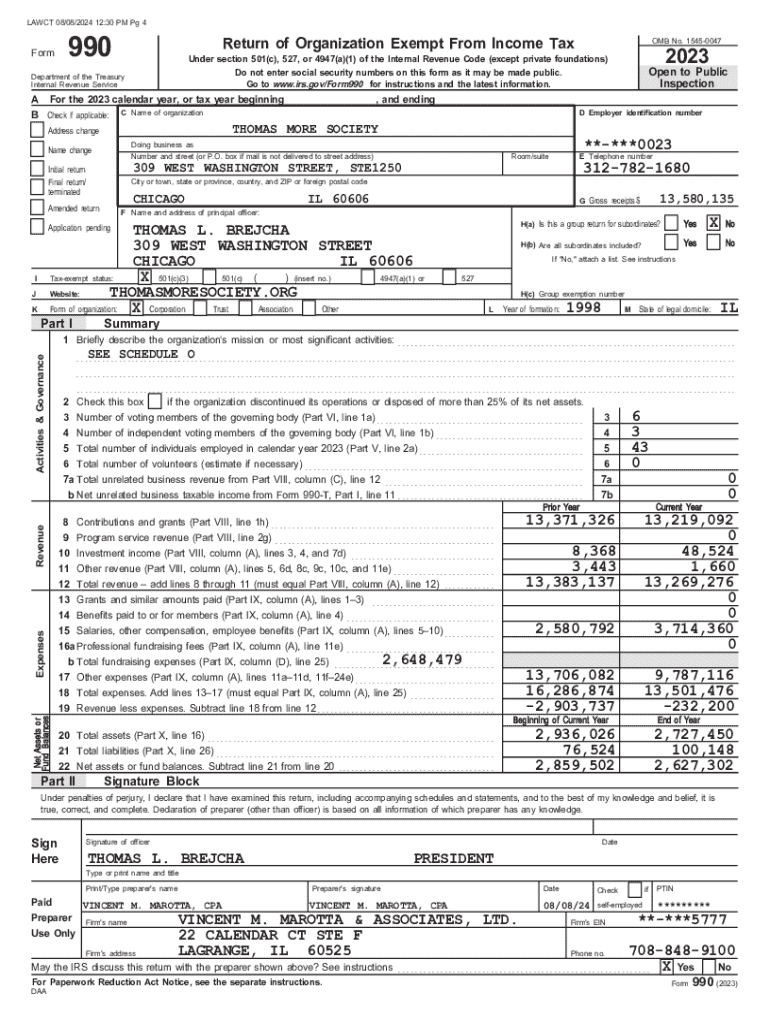

Understanding Form 990

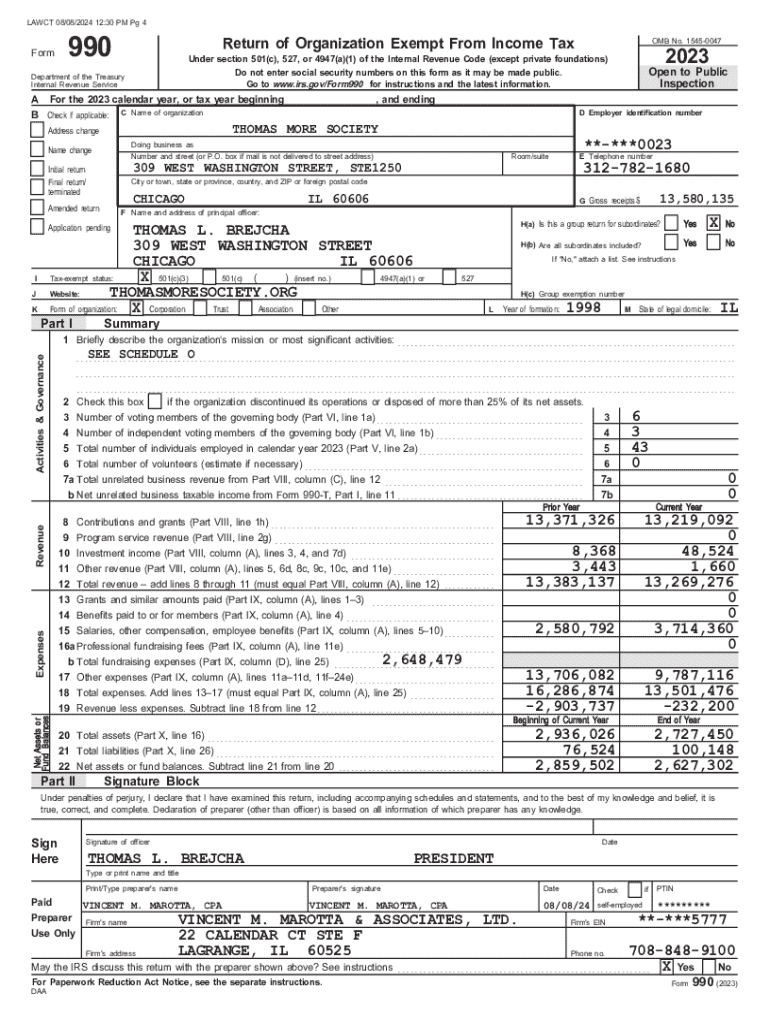

Form 990 is a critical document filed annually by tax-exempt organizations to report their financial information to the Internal Revenue Service (IRS). This form serves multiple purposes, including ensuring transparency and accountability among nonprofits and other entities under IRS codes. By detailing sources of revenue, expenses, and governance policies, Form 990 plays a pivotal role in fostering public trust in charitable organizations.

For organizations, proper filing of Form 990 is paramount. It not only signifies compliance with tax regulations but also enhances credibility with donors and the general public. A properly completed form reflects the organization’s transparency, which can help in attracting funds and support.

Types of organizations required to file Form 990

A variety of organizations must file Form 990, including:

Key components of Form 990

Structurally, Form 990 is segmented into key sections that gather core information, financial statements, and compliance issues pertinent to tax-exempt organizations. Understanding these components is fundamental for effective and accurate filing.

The main sections of Form 990 are:

Step-by-step instructions for completing Form 990

Completing Form 990 requires meticulous attention to detail and organized information. Start by gathering all relevant documents to facilitate an accurate filing process.

Before commencing the form, collect the following essential documents:

With your information at hand, follow these steps to complete each section of Form 990:

Common mistakes to avoid when filing Form 990

Navigating the complexities of Form 990 can be fraught with challenges. Here are common pitfalls to avoid to ensure a smooth filing process.

Tools and resources for managing Form 990

Utilizing interactive and cloud-based tools can simplify the challenges associated with completing Form 990. Solutions that help streamline document management are invaluable.

pdfFiller offers various tools that enhance the process of filling and editing Form 990. Here’s how:

Frequently asked questions about Form 990

Addressing common queries surrounding Form 990 can provide deeper insights into its importance and nuances.

Real-world examples and case studies

Practical insights from real organizations can illuminate the complexities of Form 990 and offer guidance for others.

For instance, several nonprofits have shared experiences detailing hurdles faced during their first Form 990 submission, often revolving around misunderstanding the depth of financial disclosures required. Adjustments and improvements made led to improved program funding by raising awareness among stakeholders about their impactful work.

Additionally, a sample completed Form 990 can provide visual guidance, showcasing precisely how to present the necessary information and navigate each section confidently.

Finding more about Form 990

Expanding knowledge around Form 990 can further assist those involved in nonprofit management. Utilizing online resources to learn about compliance and reporting is advisable.

The pdfFiller platform offers a search functionality that enables users to access a range of related forms and templates. Additionally, there are various online courses, webinars, and articles dedicated to nonprofit compliance, providing users with deeper understanding and ongoing education.

Your path to compliance

Maintaining an organized approach to preparing Form 990 facilitates compliance and enhances accuracy. Best practices in documentation and record-keeping can significantly reduce the stress surrounding the filing process.

Consulting with professionals such as accountants and nonprofit attorneys might be necessary, particularly when dealing with intricate financial situations or navigating changing IRS guidelines.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I edit form 990 on an iOS device?

How do I edit form 990 on an Android device?

How do I fill out form 990 on an Android device?

What is form 990?

Who is required to file form 990?

How to fill out form 990?

What is the purpose of form 990?

What information must be reported on form 990?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.