Get the free Form 990

Get, Create, Make and Sign form 990

How to edit form 990 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 990

How to fill out form 990

Who needs form 990?

Understanding Form 990: A Comprehensive Guide for Non-Profits

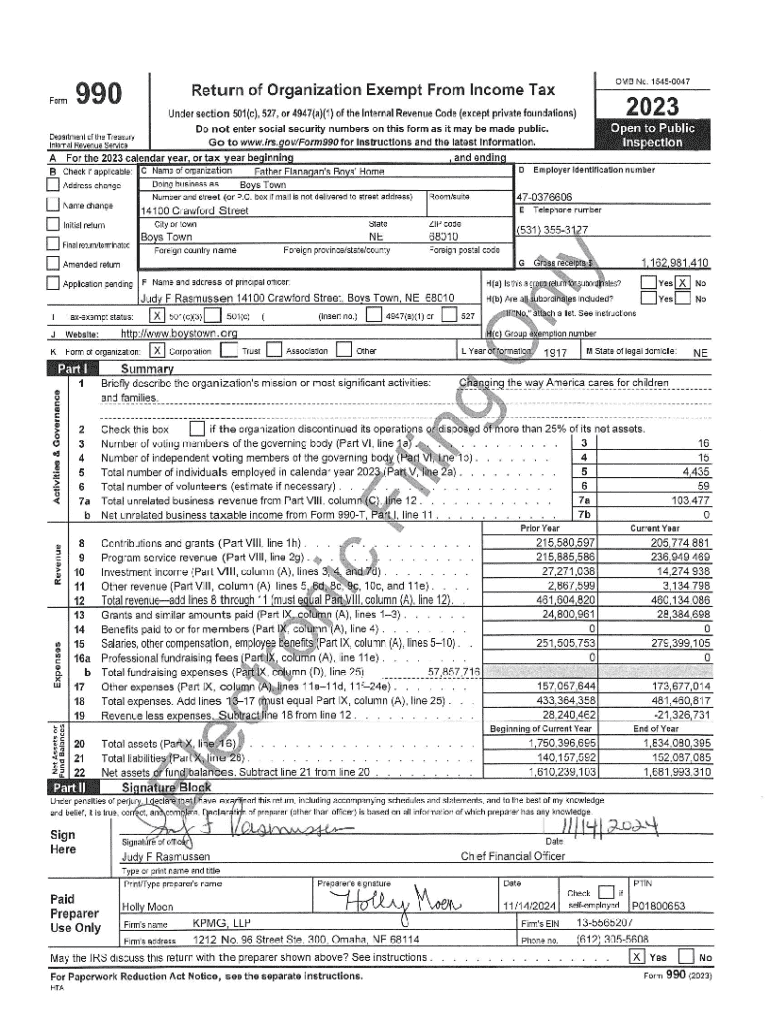

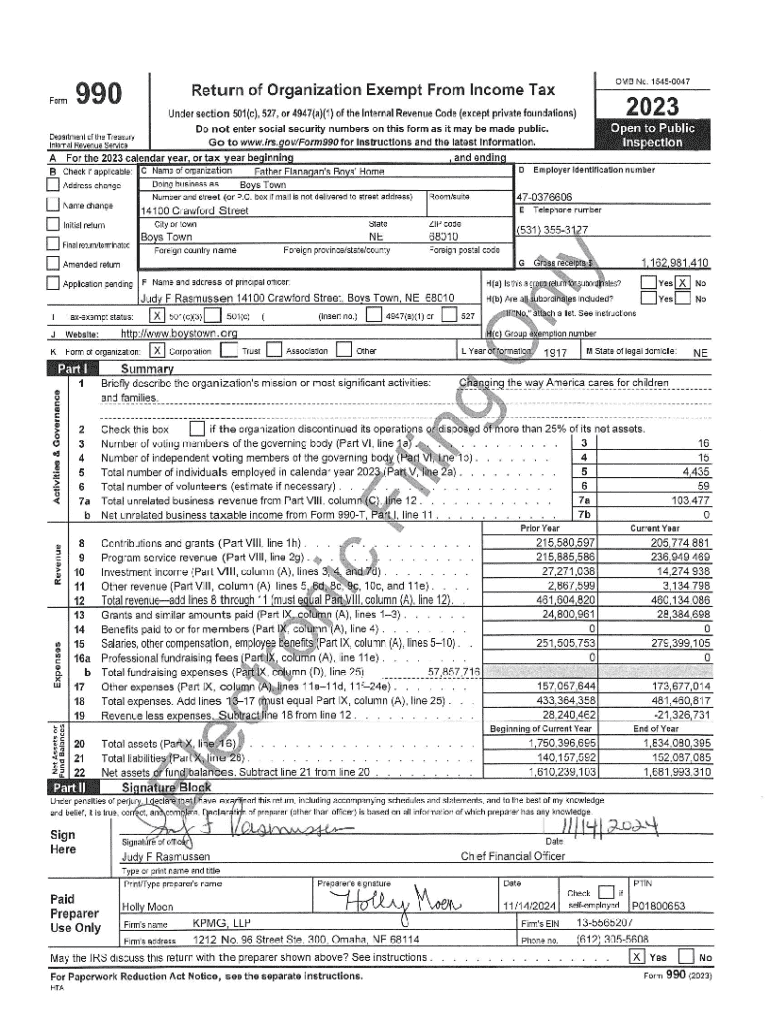

Understanding Form 990: An overview

Form 990 is a crucial document that tax-exempt organizations in the United States must file annually. It serves multiple purposes including providing essential information about a nonprofit's finances, governance, and activities to the IRS and the public. This form is not just a tax return, but a transparency tool that promotes accountability within the nonprofit sector.

The importance of Form 990 lies in its requirement for tax-exempt organizations, which allows the IRS to monitor compliance with tax regulations. Moreover, it also serves as a valuable resource for donors and stakeholders interested in understanding an organization's financial health and mission efficacy.

Who must file Form 990?

According to the IRS guidelines, organizations are required to file Form 990 if they are recognized as tax-exempt under section 501(c)(3) or other applicable sections, and their annual gross receipts exceed specific thresholds. Essentially, filing requirements apply to organizations expecting to receive public support or contributions exceeding $200,000 in gross receipts or non-profit organizations with total assets exceeding $500,000.

Different types of organizations required to file include public charities, private foundations, and social welfare organizations, among others. However, some smaller organizations may be eligible to file a simpler version known as Form 990-EZ or the 990-N (e-Postcard) if their gross receipts are under $50,000. It's crucial to note that certain religious organizations and government entities are often exempt from filing Form 990.

Deep dive into Form 990 components

Form 990 consists of several key components that help paint a clear picture of your organization. Starting with the mission statement, this part must effectively articulate your organization’s goals and values. A well-crafted mission statement can not only help fulfill IRS filing requirements but also serves as a guiding compass for operational strategies.

Financial information is another critical component, where organizations are required to provide detailed breakdowns of their revenue, expenses, and net assets. This transparency is essential for stakeholders to understand the financial health of the nonprofit.

Moreover, organizations must report on program services, detailing the impact of their charitable programs. This is followed by sections focused on governance, where organizations detail their board of directors and any policies that foster compliance. Finally, contributions and grants section quantify funding sources that support the organization’s work.

Step-by-step guide to filling out Form 990

To accurately complete Form 990, begin with a preparation checklist to gather essential documents and data including financial statements, mission statements, and governance details. Having all these records at hand will streamline the filing process and ensure accuracy.

Section A involves summarizing your organization, including its mission and key operational activities. This is vital as it provides context for the rest of the form, ensuring that reviewers understand your organization’s objectives.

In Section B, focus on governance practices. It’s critical to answer questions regarding board member compensation, diversity, and any executive compensation policies thoroughly. This portrays your commitment to accountability and best practices.

Section C is dedicated to financial information. Organizations must accurately report revenue streams and expenditures, including both program and operational costs. Highlight any sources of revenue such as donations, grants, or service income.

Section D emphasizes program revenue, where organizations should delve into specifics about income generated from mission-related activities. It’s crucial to convey how this revenue supports the organization’s overall mission.

Finally, Section E includes various forms and schedules essential for comprehensive reporting. Depending on your organization’s activities, you might need to complete schedules such as Schedule A for public charity status, or Schedule B for donor disclosures.

Common mistakes to avoid when filing Form 990

When completing Form 990, organizations often make common mistakes that can lead to corrective actions or penalties. One of the most significant errors is incomplete or inaccurate reporting, which can result from poor documentation or lack of clarity about what needs to be included.

Failing to maintain proper documentation is another prevalent issue. Nonprofits must keep supporting documents for all financial transactions, which substantiates claims made in the form. Missing K-1 forms or inaccurate revenue figures all compromise integrity.

Additionally, ensuring timely submission is crucial. Late filings can result in penalties or even loss of tax-exempt status. To avoid these pitfalls, having a deadline calendar can be beneficial. Make sure the board reviews and approves the report before submission.

Editing and managing your Form 990 with pdfFiller

pdfFiller offers a seamless platform for editing and managing Form 990, making document preparation straightforward for tax-exempt organizations. By using pdfFiller, you can streamline your document workflow, ensuring that you have all forms accurately filled out and securely stored.

Key features include a robust PDF editor that allows users to make changes quickly and efficiently, e-signature capabilities ensuring compliance, and collaboration tools that can enhance teamwork. This is particularly useful when multiple stakeholders need to review the form before submission.

By using pdfFiller, organizations can enhance their compliance with IRS filing requirements by utilizing templates and guidance built into the platform, ensuring a more organized approach to document management.

Resources for filing Form 990 successfully

It’s essential to align your filing of Form 990 with IRS resources and guidelines to ensure accurate reporting. IRS websites not only provide Form 990 but also include instructions and FAQs that can be highly beneficial for first-time filers.

Recommended tools, such as accounting software specifically tailored for nonprofit management, can also facilitate accurate data entry and reporting. Investing in such software can simplify tracking and record-keeping, improving compliance overall.

Furthermore, participating in community forums and support networks allows nonprofits to share insights and experiences regarding Form 990. Collaboration within such forums can often lead to discovering tips that are not readily available through official channels.

FAQs about Form 990 filing

Numerous questions arise regarding Form 990, with many organizations seeking clarity on aspects like filing deadlines, potential penalties, and processes for amending submitted forms. It's critical to remember that Form 990 is typically due on the 15th day of the 5th month after the end of your tax year. Extensions are available, but it's essential to file form 8868 to secure additional time.

Penalties can be severe for late filings, up to $20 per day, capped at $10,000, or 5% of gross revenue — whichever is less. Therefore, nonprofits should maintain meticulous records year-round to simplify year-end reporting and compliance.

When amendments are necessary, organizations can do so by filing Form 990-X to make corrections. This demonstrates the organization’s commitment to transparency and accuracy, a vital public trust factor in the nonprofit sector.

Interactive tools for Form 990 preparation

pdfFiller hosts a range of interactive tools that assist users in the preparation of Form 990. These tools streamline the usually tedious process into a manageable experience. The platform's interactive templates allow organizations to fill out sections sequentially while receiving instant feedback on compliance with IRS regulations.

Utilizing these templates correctly can make the complexities of Form 990 more approachable. With data integration capabilities, users can even auto-fill information across different sections, minimizing errors and saving time.

Find more by

For further resources on Form 990 and related documents, check out pdfFiller's offerings. The site provides similar forms and templates that can help organizations maintain compliance in various areas, including volunteer management and audit preparations.

Additionally, the platform hosts articles and guides focused on nonprofit compliance, helping organizations navigate the complex regulatory landscape more effectively. You can access everything from governance best practices to financial management strategies tailored specifically for non-profits.

You are here

To aid in navigation, quick links are provided to relevant sections throughout this comprehensive guide. This ensures easy access to distinct areas, facilitating a smoother reading experience.

Moreover, visual aids such as flowcharts can help delineate the filing process for Form 990, further clarifying the sequence of necessary steps organizations need to follow when preparing their reports.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in form 990?

How do I edit form 990 on an iOS device?

How do I complete form 990 on an Android device?

What is form 990?

Who is required to file form 990?

How to fill out form 990?

What is the purpose of form 990?

What information must be reported on form 990?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.