Get the free Form 990

Get, Create, Make and Sign form 990

Editing form 990 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 990

How to fill out form 990

Who needs form 990?

Form 990 Form - How-to Guide Long-Read

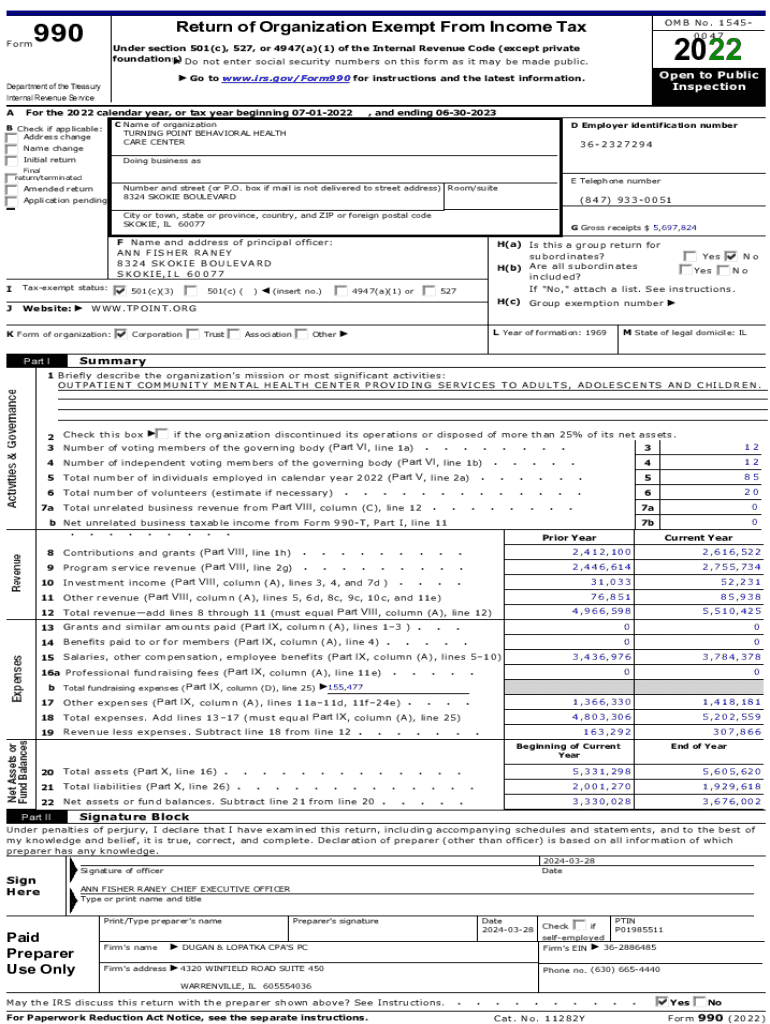

Understanding Form 990

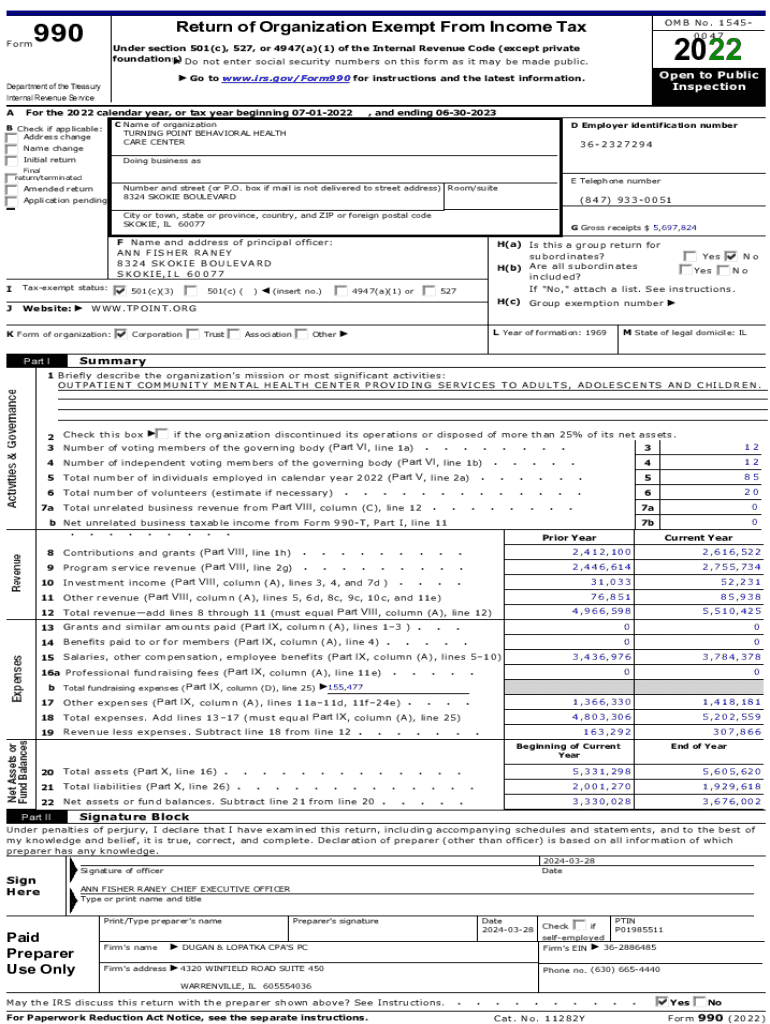

Form 990 is an essential document that tax-exempt organizations must file annually with the Internal Revenue Service (IRS). It serves multiple purposes: providing transparency about an organization’s activities, finances, and governance, while also helping to ensure compliance with federal regulations. Nonprofit organizations depend on this form to maintain their tax-exempt status, assuring donors and the public that they meet rigorous operational standards.

The importance of Form 990 extends beyond compliance; it plays a vital role in promoting accountability and trust. By making this document publicly available, organizations not only exhibit sound management practices but also empower stakeholders to make informed decisions about where to allocate their resources.

Types of organizations required to file Form 990

The IRS mandates that various types of organizations file Form 990, including nonprofit organizations, charitable organizations, and social clubs, among others. Specifically, entities recognized as tax-exempt under sections 501(c)(3) and 501(c)(4) of the Internal Revenue Code must file to disclose their financial activities.

Key components of Form 990

Form 990 has a structured layout that includes multiple sections, each designed to capture specific information regarding an organization's financial health and operational effectiveness. Understanding these key components ensures that organizations can report accurately and comprehensively.

The main sections of Form 990 include core organizational information, detailed financial statements, compliance information, and a checklist of required schedules, which helps nonprofits work through necessary documentation systematically.

Detailed breakdown of each section

Step-by-step instructions for completing Form 990

Completing Form 990 requires careful planning and attention to detail. To ensure compliance and accuracy, organizations must gather all necessary information beforehand. This includes financial statements, organizational bylaws, previous tax returns, and any documentation that pertains to grants received or awards given.

Common mistakes to avoid when filing Form 990

Filing Form 990 can be tricky, and even minor mistakes can lead to complications or delays. One frequent pitfall is submitting incomplete information, which can result in the IRS rejecting your return.

Incorrect financial reporting is another significant concern. Reported figures must be accurate and reflect actual records. Organizations often overlook deadlines, which can incur penalties and jeopardize tax-exempt status. You must also stay informed about recent IRS changes to ensure that all forms align with current regulations.

Tools and resources for managing Form 990

The filing process of Form 990 has become more streamlined thanks to various interactive tools and resources available today. Organizations can simplify the process with platforms like pdfFiller, which provide robust features for filling, editing, signing, and managing the form efficiently.

Using cloud-based solutions for document management also presents numerous benefits, such as easy collaboration and instantaneous access from any location. Utilizing tools like pdfFiller enhances teamwork, facilitating seamless editing and digital signing, which can significantly expedite the filing process.

Frequently asked questions about Form 990

Organizations often have several questions when preparing to file Form 990. Knowing the filing deadline is one key focus: Form 990 must generally be submitted by the 15th day of the 5th month after the end of the organization’s fiscal year.

Identifying the correct version of Form 990 is crucial as well. Organizations with gross receipts under $200,000 may use the simpler Form 990-EZ, while others will require the standard Form 990. If an organization fails to file on time, it may face penalties or even loss of tax-exempt status. Necessary measures to amend a filed Form 990 include filing Form 990-X or making a note in the next year’s filing.

Real-world examples and case studies

Examining real-world examples of completed Form 990 helps organizations grasp the intricacies involved in filling out this crucial document. By reviewing a sample completed Form 990, organizations can understand how to present their information clearly and concisely while adhering to IRS requirements.

Additionally, stories from nonprofits that successfully navigated the challenges surrounding Form 990 provide key lessons. These tales demonstrate proactive approaches to compliance, addressing common pitfalls, and highlight the significance of transparency in building community trust and sustaining donor relationships.

Finding more about Form 990

Organizations seeking further details and insights into Form 990 can utilize various online resources. The pdfFiller website provides robust search functionality to access different templates and other essential forms tailored to nonprofit reporting needs.

Recommended educational resources such as online courses, webinars, and articles can empower organizations by enhancing their understanding of nonprofit compliance and reporting. These learning materials are invaluable facing the complexities of tax-exempt reporting.

Your path to compliance

Maintaining compliance while managing Form 990 can be streamlined through practical organization and diligent planning. Implementing best practices for document management ensures that all records are readily accessible and up-to-date throughout the year, simplifying the filing process.

Moreover, consulting with professionals such as accountants or nonprofit attorneys can be beneficial, especially during complicated filings or when unique circumstances arise. Such expertise can enhance compliance accuracy and help mitigate potential issues before they emerge.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send form 990 to be eSigned by others?

Can I create an electronic signature for the form 990 in Chrome?

How do I edit form 990 on an iOS device?

What is form 990?

Who is required to file form 990?

How to fill out form 990?

What is the purpose of form 990?

What information must be reported on form 990?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.