Get the free Form 990 (2023)

Get, Create, Make and Sign form 990 2023

Editing form 990 2023 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 990 2023

How to fill out form 990 2023

Who needs form 990 2023?

Form: A Comprehensive Guide for Non-Profits

Understanding Form 990: An overview

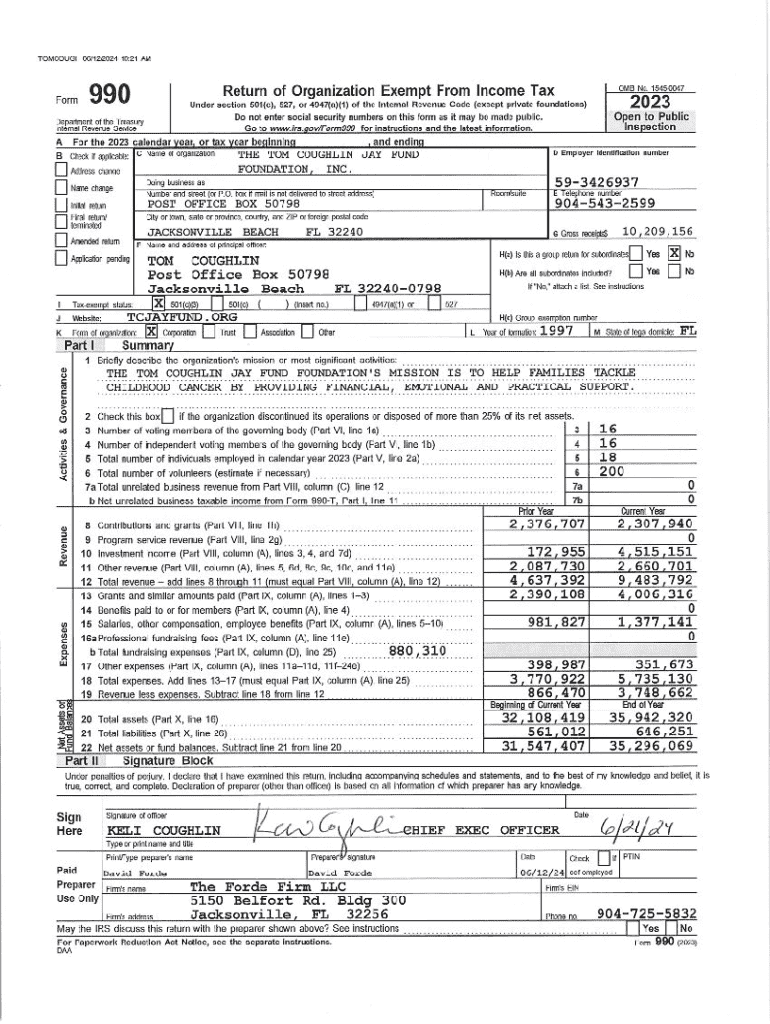

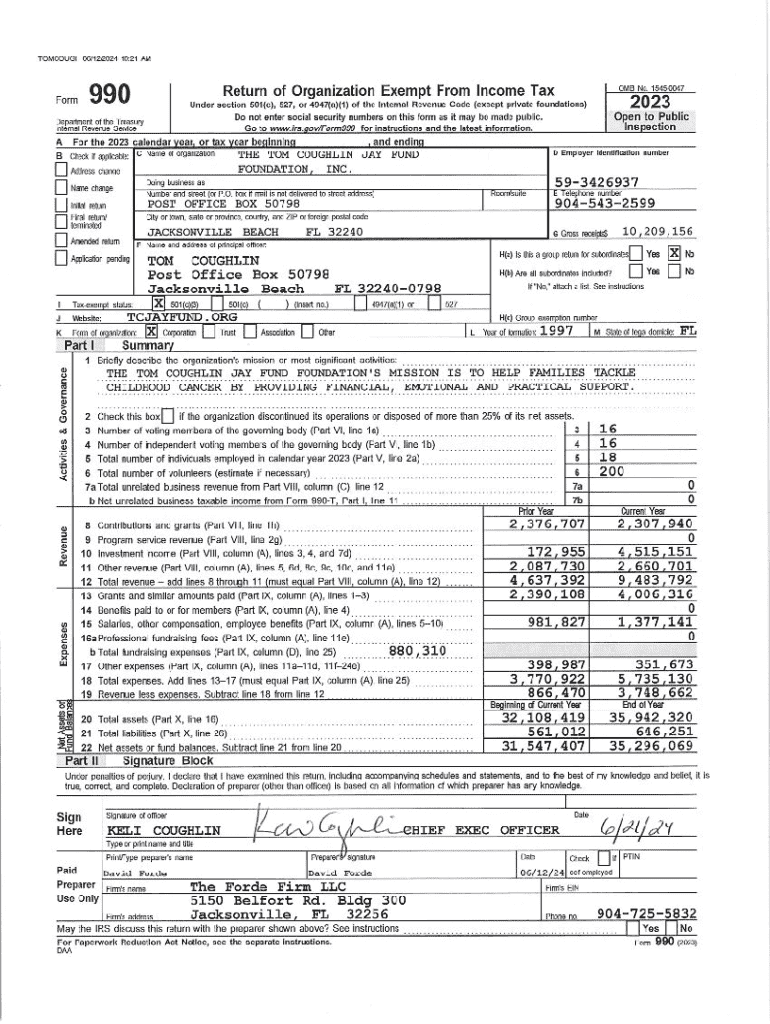

Form 990 serves as a critical financial reporting document for tax-exempt organizations, acting like a tax return for nonprofits. It helps the IRS assess compliance and ensure accountability in the usage of funds. This form not only fulfills federal requirements but also provides stakeholders, including donors, insights into an organization's financial health and operational transparency.

In 2023, understanding the specifics of Form 990 becomes even more vital as the number of tax-exempt organizations in the United States continues to grow. According to the National Council of Nonprofits, there are over 1.8 million registered nonprofits. Each entity has an obligation to file an appropriate version of Form 990 annually, depending on its revenue, ensuring that the financial impact of these organizations is documented and made accessible to the public.

Key changes to Form 990 in 2023

The 2023 edition of Form 990 introduces several significant updates aimed at enhancing transparency and accountability. Among these updates are new reporting requirements that reflect changes in organizational governance practices and funding trends. For example, organizations are now expected to provide additional disclosures related to compensation practices and reporting of contributions.

Another noteworthy change is the emphasis on financial transparency. Nonprofits are now urged to disclose more detailed information regarding revenues and expense allocation. This not only increases accountability to donors and stakeholders but also aims to improve the overall public perception of non-profits by fostering trust through greater transparency.

For organizations navigating these changes, anticipating the impacts on compliance processes is crucial. Ensuring timely and accurate reporting not only avoids penalties but can significantly influence public and donor trust.

Who needs to file Form 990?

Eligibility for filing Form 990 varies based on the organization's classification as a public charity or private foundation. Public charities—organizations funded by public donations—are required to file Form 990 as long as they exceed the revenue thresholds set by the IRS. Private foundations, typically funded by a single source, need to file Form 990-PF.

Failing to file the appropriate form can lead to significant consequences, including penalties, loss of tax-exempt status, and the inability to receive federal funding. Nonprofits must ensure they meet all filing obligations to maintain compliance.

A step-by-step guide to filling out Form 990

Filing Form 990 may seem daunting, but breaking it down into manageable steps can simplify the process. The first crucial step involves gathering necessary documentation compiled from various financial records and operational data. Accurate record-keeping allows for seamless completion and ensures all necessary details are captured.

Once documentation is organized, the next phase is completing the form. Each section must be carefully filled out, reflecting the organization’s financial state and operational success.

To ensure accuracy and completeness, reviewing the completed form multiple times can help avoid mistakes. Utilizing document management tools like pdfFiller can also streamline this process significantly.

Common mistakes to avoid

Even experienced filers may encounter common mistakes that can complicate the filing process. These include submitting incomplete information, inaccuracies in financial reporting, and missing deadlines. Each organization should be cautious and allocate sufficient time for review before submission.

Leveraging pdfFiller’s tools can be an effective strategy for mitigating these mistakes. Its user-friendly features enable organizations to edit forms easily, ensuring accuracy before submission.

Interactive tools to facilitate the process

Utilizing interactive tools enhances the filing experience for Form 990. pdfFiller offers various features tailored for non-profits, such as live editing, signing capabilities, and collaboration tools that streamline the completion process.

One significant advantage of electronic filing through platforms like pdfFiller is the reduction in processing times compared to traditional paper forms. Additionally, organizations can access completed forms directly from anywhere, making it easier to manage submissions and necessary revisions promptly.

Collaborating with your team: Best practices

Collaboration is essential for successfully filling out Form 990. Organizations should establish clear communication channels and assign specific roles and responsibilities among team members based on their areas of expertise. This ensures a comprehensive approach to data collection and reporting.

Fostering a collaborative environment can lead to more successful filings, allowing for shared ownership of the process and accountability in meeting deadlines.

Document management post-filing

Post-filing document management is crucial for maintaining compliance and preparing for potential audits. Organizations should implement best practices for tracking changes and organizing their filed documents effectively.

Tools like pdfFiller provide essential features for managing revisions and maintaining organized records for audits, enabling organizations to uphold transparency and accountability at all times.

Additional insights on non-profit financial reporting

In addition to Form 990, non-profits may need to be aware of other essential forms and documents. For example, Form 990-T is used to report unrelated business income, while Form 990-PF is designated for private foundations. Understanding these forms can significantly bolster operational transparency.

As donor expectations evolve, the importance of financial transparency in non-profit funding cannot be overstated. Organizations are increasingly recognized for their ability to maintain trust and demonstrate accountability, ultimately fostering a loyal donor base that feels confident in their contributions.

Engaging with your stakeholders

How organizations communicate the outcomes of their Form 990 filings is crucial for building relationships with stakeholders. Transparent reporting on an organization’s financial health and program success can significantly enhance trust among donors and the community.

Using Form 990 effectively as a tool can improve stakeholder relations. Organizations can disclose areas of impact and growth, allowing stakeholders to see where their contributions are making a difference.

Case studies: Successful filers of Form 990

Certain organizations exemplify best practices when filing Form 990, opening the door for valuable lessons for others. For instance, organizations like Habitat for Humanity and the American Red Cross have established robust systems for ensuring accuracy and transparency in their filings.

Analyzing these case studies reveals key takeaways: prioritizing clarity in disclosures, embracing technology for electronic filing, and maintaining open lines of communication both within the organization and with stakeholders. Implementing these practices can contribute to a nonprofit's long-term success.

Conclusion

Filing Form 990 accurately and timely remains an essential responsibility for all tax-exempt organizations. The implications of these filings reach far beyond compliance, influencing perceptions, trust, and donor relations. By utilizing tools like pdfFiller for efficient document management, nonprofits can enhance their filing processes and maintain accountability effectively.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get form 990 2023?

How do I execute form 990 2023 online?

How do I edit form 990 2023 straight from my smartphone?

What is form 990?

Who is required to file form 990?

How to fill out form 990?

What is the purpose of form 990?

What information must be reported on form 990?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.