Get the free Form 990

Get, Create, Make and Sign form 990

How to edit form 990 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 990

How to fill out form 990

Who needs form 990?

Understanding and Navigating Form 990: A Comprehensive Guide

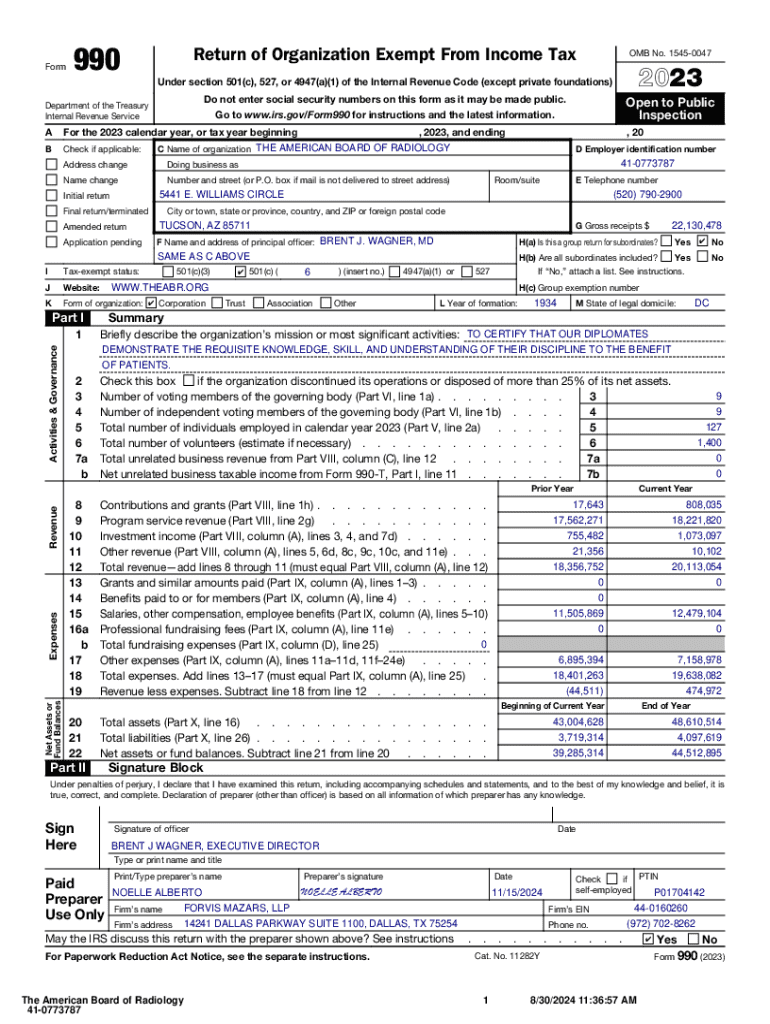

Understanding Form 990: An overview

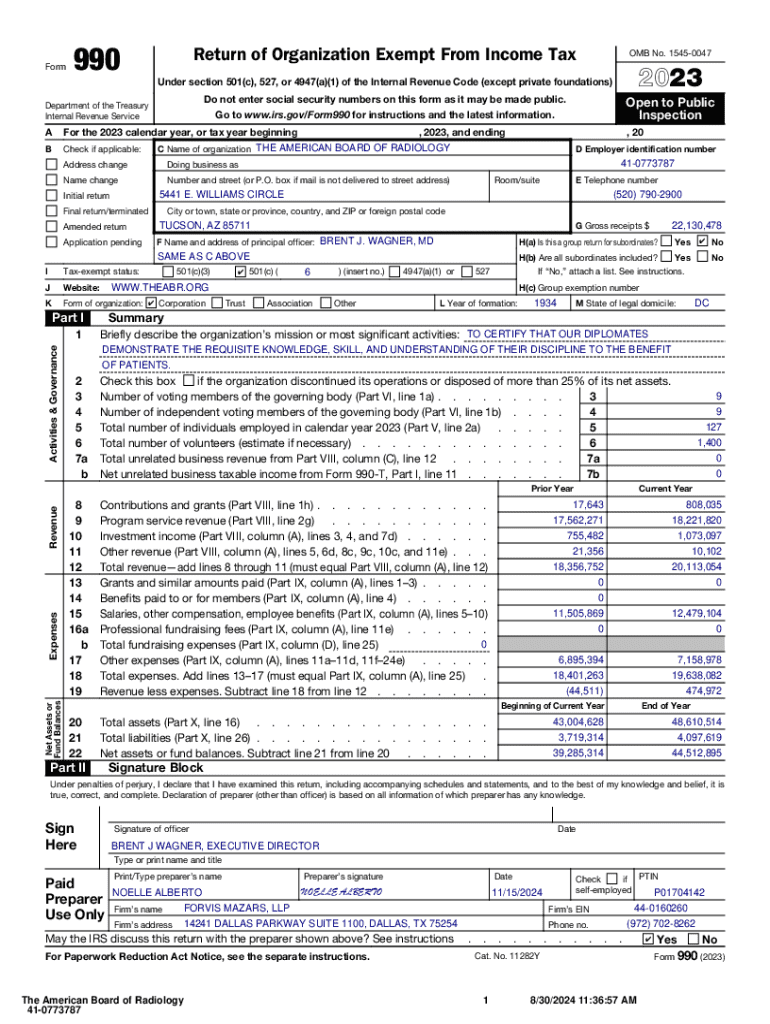

Form 990 is the IRS reporting return that tax-exempt organizations must use to provide the Internal Revenue Service with information about their financial activities. Essentially, it serves as an annual report that offers transparency regarding finances and organizational governance. This form is greatly significant in the nonprofit sector as it allows donors, potential donors, and the general public to assess how effectively an organization is managing its resources.

The importance of Form 990 for tax-exempt organizations cannot be understated. It not only functions as a financial record but also reflects the organization’s commitment to transparency and accountability. The key components of Form 990 include financial statements, mission statements, program descriptions, governance policies, and information about contributions and grants, making it a multifaceted document critical for nonprofit credibility.

Who must file Form 990?

According to IRS guidelines, organizations that are classified as tax-exempt under Section 501(c)(3) must file Form 990 if they have annual gross receipts exceeding $200,000 or total assets exceeding $500,000. However, even smaller organizations have a requirement to file a simpler version of the form, known as Form 990-EZ, if their gross receipts are over $50,000.

Different types of organizations required to file Form 990 include charities, educational institutions, and many religious organizations. However, there are exemptions to the filing requirements; for example, churches and some other faith-based organizations usually do not need to file Form 990, regardless of their income or asset levels.

Deep dive into Form 990 components

Delving into the components of Form 990 reveals its multifaceted structure, vital for capturing the essence of the organization. Starting with mission statements and vision, it’s crucial for organizations to articulate their mission clearly, as this sets the tone for their identity and purpose. A well-defined mission can attract support, volunteers, and funding, thereby enhancing philanthropic efforts.

Financial information included in Form 990 provides a breakdown of revenue, expenses, and net assets. The IRS requires organizations to disclose their operating budget, facilitating transparency that will assure stakeholders about the financial health of the organization. Another vital component pertains to program services; this section must detail how resources are allocated towards charitable programs and the impact these programs generate on the communities served.

Governance details, including the board of directors' structure and the policies in place, play a critical role in showing compliance with regulations. Finally, the contributions and grants information helps elucidate on funding sources, including individual, corporate, and federal donations, serving as a valuable insight for potential funders and partners.

Step-by-step guide to filling out Form 990

Filling out Form 990 may seem daunting, but approaching it methodically can simplify the process significantly. Firstly, compile an essential documents checklist; this includes financial statements, details of programs and services, board of directors information, and previous Form 990 filings. Gathering these documents beforehand streamlines the data entry process.

Section A: Summary of Organization

The Summary of Organization is a vital section where key fields must be completed accurately. This includes the organization's name, address, mission statement, and total revenue and expenses. Each of these details acts as a brief profile and helps readers quickly understand who you are and what you do.

Section B: Governance

In the Governance section, you'll need to answer questions about your governance structure. Considerations include the number of board members, governance policies in place, and how often the board meets. This section emphasizes the responsibility and integrity of your organization’s leadership.

Section : Financials

Moving on to the Financials section, you will report detailed financial data, such as revenue streams and disbursements. Accuracy is imperative here due to the complexity of revenue sources—make sure all income is accounted for, including contributions, grants, and program service revenue.

Section : Program Revenue

In Section D, accurately reporting on program revenue is vital; this section focuses on income generated from activities that uphold your organization's mission. Be thorough and honest in detailing these activities, as they symbolize your organization's effectiveness in fulfilling its mission.

Section E: Forms and Schedules

Lastly, the Forms and Schedules section may include additional reports that support your Form 990 submission. This can involve filing Schedule A to provide additional information on public charity status or Schedule B to report substantial contributors. Ensure you check the IRS requirements for any schedules pertinent to your organization’s activities.

Common mistakes to avoid when filing Form 990

Navigating the process of filing Form 990 comes with its pitfalls. One significant mistake often arises from incomplete or inaccurate reporting. Failing to provide the necessary data can lead to delays or, worse, the denial of tax-exempt status. Another crucial area of concern is maintaining proper documentation. Nonprofits should retain adequate records supporting all reported information; inadequate documentation can lead to discrepancies or misunderstandings.

Missed deadlines can result in penalties for organizations, undermining their ability to maintain fiscal responsibility and accountability. It’s crucial for organizations to be aware of filing deadlines and to allow ample time for unforeseen complications during the preparation process. Setting internal deadlines ahead of the IRS submission date will minimize the risk of late filings.

Editing and managing your Form 990 with pdfFiller

Using pdfFiller to manage Form 990 brings a wealth of advantages. This platform streamlines the document preparation process by allowing organizations to edit PDFs easily and efficiently. Whether it's inserting financial data or restructuring narrative sections, pdfFiller's user-friendly interface makes it simple to collaborate with team members, ensure quality checks, and manage paperwork effectively.

Features offered by pdfFiller empower users to manage data effectively while ensuring compliance. The platform supports e-signatures, facilitating faster approvals from board members or stakeholders. Additionally, interactive tools within pdfFiller allow organizations to track changes, comments, and progress, ensuring that everyone is on the same page.

Resources for filing Form 990 successfully

Numerous resources are available to help organizations file Form 990 successfully. The IRS provides comprehensive guidelines and instructions detailing what’s required for different forms and schedules. Organizations can find links to these resources on the IRS website for direct access.

For software solutions designed to simplify nonprofit management, tools like pdfFiller prove invaluable. By transforming the traditionally tedious document preparation process, pdfFiller offers interactive functionalities and templates tailored for Form 990. Partnering with community forums and support networks enriches the knowledge base, allowing organizations to learn best practices and share experiences.

FAQs about Form 990 filing

When it comes to Form 990 filing, many questions can arise. For instance, organizations often ask about the filing deadlines. Most nonprofits are required to submit Form 990 by the 15th day of the 5th month following the end of their fiscal year. However, organizations can file for an automatic extension if more time is needed.

Penalties for late or inaccurate filings can be steep, emphasizing the need for precision and timeliness. Additionally, organizations can amend their Form 990 if they need to correct errors, but it’s crucial to take this step promptly to ensure ongoing compliance. Establishing effective practices for year-round compliance with IRS regulations will simplify the process when the annual tax reporting season arrives.

Interactive tools for Form 990 preparation

Interactive tools offered by pdfFiller serve as a pivotal resource for nonprofits preparing Form 990. These tools enable organizations to leverage customizable templates that guide them through each section, making the task less daunting. Users can access step-by-step guides within the platform, allowing them to fill in necessary fields while ensuring that nothing is overlooked.

These interactive templates equip users with an intuitive interface to help with the documentation process, ultimately reducing the time and effort involved in filing. Moreover, the incorporation of digital signatures facilitates secure collaboration among team members, allowing for prompt submissions and effective review processes.

Find more by

For those seeking additional resources related to Form 990, pdfFiller offers a host of similar forms and templates tailored to nonprofit organizations. Visitors can explore related articles and guides centered around compliance, financial management, and effective nonprofit strategies.

Additionally, maintaining an easy-to-navigate platform ensures users can find necessary information quickly. The integration of interactive tools enhances accessibility, making the preparation process for Form 990 more user-friendly and efficient.

You are here

For easy navigation, this guide has been structured to allow quick links back to relevant sections. This feature aids users in moving seamlessly from one part of the article to another, ensuring an efficient learning experience while navigating the complexities of Form 990.

The visual guide to the filing process using Form 990 encapsulates all essential information, strengthening a reader's understanding of the journey from preparation to submission.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send form 990 to be eSigned by others?

How do I complete form 990 online?

How do I edit form 990 online?

What is form 990?

Who is required to file form 990?

How to fill out form 990?

What is the purpose of form 990?

What information must be reported on form 990?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.