Get the free Form 990

Get, Create, Make and Sign form 990

Editing form 990 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 990

How to fill out form 990

Who needs form 990?

Understanding Form 990: A Complete Guide for Non-Profits

Understanding Form 990: An overview

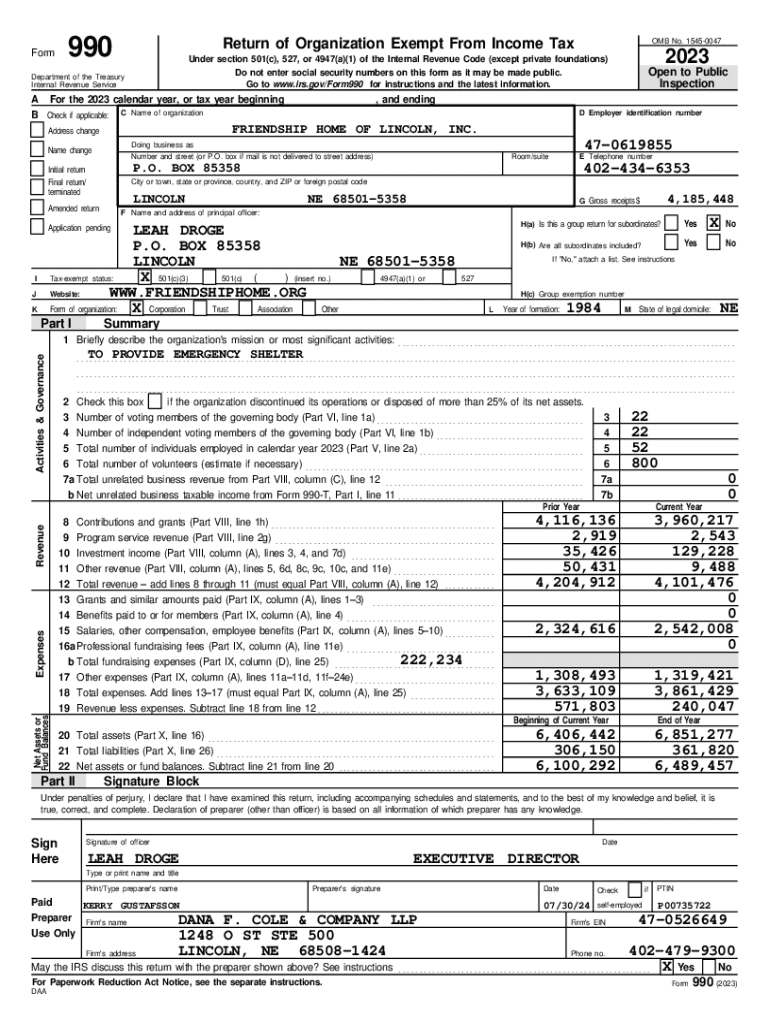

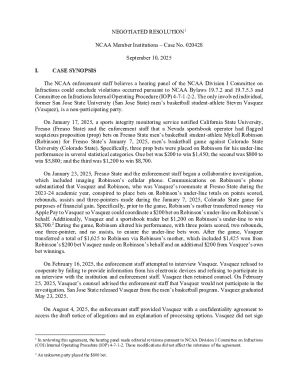

Form 990 is a crucial reporting return that tax-exempt organizations in the United States must file annually. This form serves as the public disclosure document for organizations classified under 501(c)(3) and other sections of the Internal Revenue Code. By submitting Form 990, organizations provide the IRS with key financial information, including revenue and expenses, which helps maintain transparency and accountability to the public and donors.

The importance of Form 990 cannot be overstated. For tax-exempt organizations, it not only fulfills a legal requirement but also enhances credibility with potential donors and participants. The form's comprehensiveness allows organizations to convey their missions, operations, and the impact of their programs, thereby facilitating philanthropic engagement. Key components of Form 990 include the organization's mission statement, financial summaries, governance practices, and strategic initiatives.

Who must file Form 990?

Determining who must file Form 990 depends largely on the organization's classification as defined by the IRS. Generally, any tax-exempt organization with gross receipts over a certain threshold must file the form. Specifically, organizations that receive over $200,000 in gross receipts or have total assets exceeding $500,000 are required to submit a complete Form 990.

Different types of organizations that must file include charitable organizations, private foundations, and social welfare organizations. However, some organizations may be exempt from filing Form 990 based on their size, age, or structure. For example, organizations that have gross receipts of less than $50,000 can file Form 990-N, also known as the e-Postcard, while religious organizations often qualify for exemptions.

Deep dive into Form 990 components

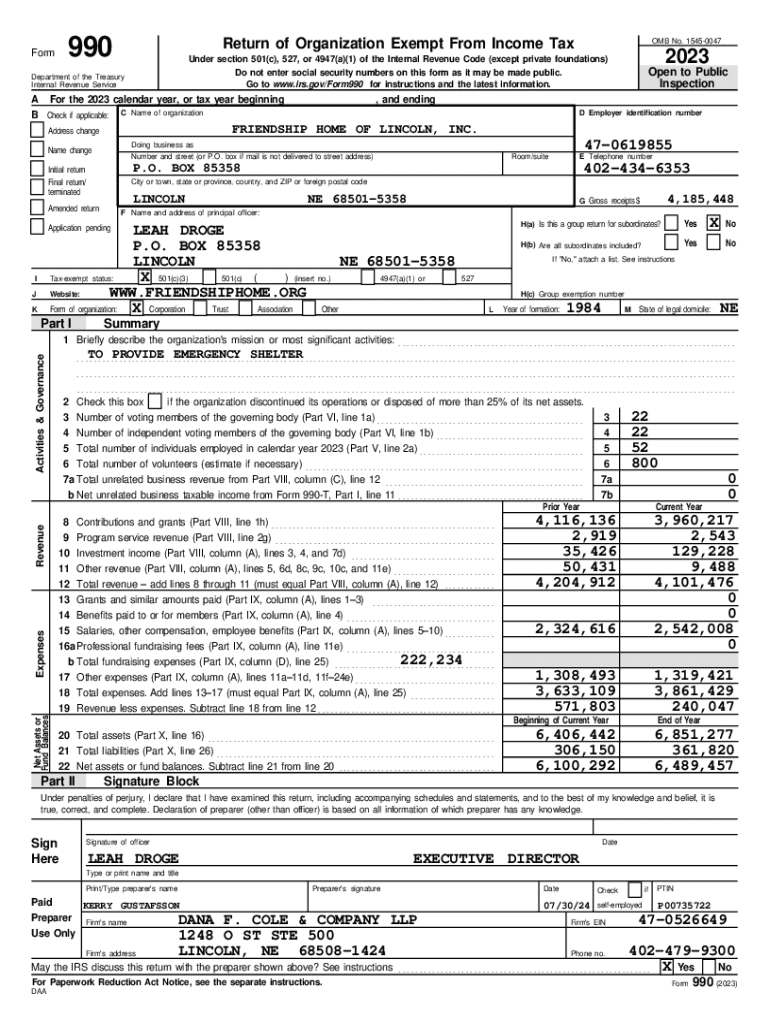

A thorough understanding of Form 990's components is essential for accurate reporting. First, the organization’s mission statement and vision should be articulated clearly. This section outlines your organization's purpose and objectives, which guide every activity and program you pursue. Crafting a compelling mission statement can resonate with donors, grantors, and the community, fostering better engagement and support.

Next is the financial information section, where organizations must break down their revenue sources, expenses incurred, and overall net assets. This section provides transparency regarding the financial health of the organization. Key areas to include are fundraising, program service revenue, investment income, and administrative costs. Precisely reporting these elements reinforces credibility and demonstrates effective financial management.

Program services reporting is another critical aspect, where organizations detail what charitable programs are in place and the tangible impact they provide to the community. This showcases both accountability and the effectiveness of philanthropy efforts. Governance reporting gives insight into the board of directors, operational policies, and compliance measures—ensuring organizations meet regulatory requirements and ethical standards.

Lastly, the contributions and grants section requires organizations to report all funding sources accurately. Transparency in funding promotes trust and integrity, vital for maintaining donor relationships. Together, these components form a comprehensive overview of the nonprofit’s operations, offering stakeholders a clear picture of its mission, financial practices, and community engagement.

Step-by-step guide to filling out Form 990

Before diving into the actual filling process, preparation is key. Create a checklist of essential documents and data required to complete Form 990 accurately. Items to gather include financial statements, previous Form 990 filings, by-laws, governance policies, and records of contributions and grants. Having organized documentation will not only streamline the process but also reduce errors.

Section A of Form 990 requires a summary of the organization—key fields include the name, address, and mission statement. Each field must be filled out with precise information since inaccuracies can lead to complications. Section B focuses on governance, which entails answering questions about the board structure and policies, ensuring that governance practices are transparent and aligned with best practices.

Moving to Section C, the financials segment is crucial. Here, you'll outline financial data, including all revenue streams and disbursements. Understanding how to categorize these accurately will reflect your organization’s sustainability and operational health. Section D focuses on program revenue where organizations report income derived specifically from mission-related activities, helping to demonstrate effective outcomes.

The final part, Section E, delves into the forms and schedules. Additional forms like Schedule A (Public Charity Status) or Schedule B (Schedule of Contributors) may be necessary depending on your organization’s activities. Familiarize yourself with these additional requirements to avoid missing critical information, as failing to submit required schedules can jeopardize your filing.

Common mistakes to avoid when filing Form 990

Filing Form 990 can be daunting, and common pitfalls can detract from its effectiveness. One of the most frequent issues is incomplete or inaccurate reporting, which can lead to significant penalties from the IRS. It's essential to double-check all figures and narratives to ensure consistency and accuracy before submission.

Another mistake is failing to maintain proper documentation to support the reported figures. The IRS may require additional information during audits, and having insufficient records can weaken your case. Additionally, keeping track of deadlines is crucial; missing the filing deadline can lead to fines and tarnish the organization’s reputation. Schedule reminders and establish internal processes to mitigate these risks.

Editing and managing your Form 990 with pdfFiller

pdfFiller revolutionizes the document preparation process for Form 990. The platform allows users to edit PDFs seamlessly, ensuring entries are clear and accurate. Utilizing its robust features for form editing and data management can significantly enhance your efficiency. With pdfFiller, users can navigate interactive templates designed to simplify the filing process, reducing the time spent on document preparation.

Collaboration is another outstanding feature of pdfFiller. Multiple team members can work on the form simultaneously, ensuring all necessary insights are integrated effectively. Moreover, the platform ensures compliance with electronic signing requirements, making it easy to gather the signatures needed for submission. By using pdfFiller, organizations can maintain privacy, streamline workflows, and improve overall data management.

Resources for filing Form 990 successfully

The IRS provides extensive resources and guidelines for organizations to understand Form 990 requirements. Visiting the IRS website is essential for accessing the latest updates, instructional guides, and FAQs related to the filing process. Moreover, numerous software solutions designed for non-profits are available, simplifying the management of finances, donor relations, and compliance.

Community forums and support networks also play a vital role in successful filing. Engaging with other non-profit professionals can yield valuable insights and best practices. These platforms often provide shared resources, templates, and collaborative spaces for discussing challenges and solutions. Utilizing these networks can empower organizations to enhance their filing process and receive support as needed.

FAQs about Form 990 filing

Addressing frequently asked questions about Form 990 can help clarify common concerns. For instance, the filing deadline is generally the 15th day of the 5th month after the organization's fiscal year ends. Failing to meet this deadline can result in penalties that vary based on the severity of the delay. The IRS also allows for extensions, which organizations should consider if more time is needed.

Organizations often inquire about what to do if they need to amend their Form 990. In such cases, submitting Form 990-X is the necessary step to make corrections. Keeping your organization’s compliance intact year-round is essential. Implementing robust financial management practices and maintaining thorough documentation can streamline future filings and ensure IRS compliance.

Interactive tools for Form 990 preparation

pdfFiller offers some outstanding interactive tools specifically designed for Form 990 preparation. One of the main benefits is the availability of templates that guide users through each section. These templates provide structured formats that help ensure all required elements are accounted for, minimizing the risk of incomplete filings.

The platform also integrates helpful resources that can assist users during the preparation process. Step-by-step guidance and user-friendly interface support organizations in navigating the complexities of Form 990 filing efficiently. Taking advantage of these tools can simplify the task and enhance overall accuracy in reporting, leading to a smoother experience.

Find more by

In addition to Form 990, pdfFiller provides access to similar forms and templates essential for non-profit compliance. Engaging with related articles and guides on non-profit management broadens your understanding of operational best practices. Staying informed about the specific requirements for various forms can empower organizations, aligning their processes with IRS regulations.

You are here

Navigating through the filing process of Form 990 can be overwhelming, but pdfFiller ensures easy access to relevant resources and guides. Quick links back to these sections facilitate user-friendly navigation, making the whole process more manageable. Visual aids throughout the content help illustrate filing steps, enhancing comprehension and user engagement.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I fill out the form 990 form on my smartphone?

How do I complete form 990 on an iOS device?

Can I edit form 990 on an Android device?

What is form 990?

Who is required to file form 990?

How to fill out form 990?

What is the purpose of form 990?

What information must be reported on form 990?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.