Get the free Form 990

Get, Create, Make and Sign form 990

Editing form 990 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 990

How to fill out form 990

Who needs form 990?

Form 990 form: A Comprehensive How-to Guide

Understanding the Form 990: What it is and Why it Matters

Form 990 is a crucial document that nonprofit organizations and charities in the United States are required to file annually with the IRS, providing transparency about their financial health and operational activities. As a publicly accessible form, it plays a pivotal role in maintaining accountability and fostering trust within the community and among donors. Not only does this form provide a comprehensive overview of a nonprofit's revenue, expenses, and governance, but it also serves as a vital tool for regulatory bodies and the general public to monitor the effectiveness of charitable endeavors.

The importance of Form 990 cannot be overstated. It differentiates legitimate organizations from fraudulent ones, making it easier for stakeholders to make informed decisions. With the IRS mandating its submission for organizations with annual gross receipts over a specific threshold, understanding the nuances of this form is essential for effective charitable management. This section will delve deeper into the filing requirements and what they entail.

Who Needs to File Form 990?

Not every nonprofit organization needs to file Form 990, but those that do must adhere to certain eligibility criteria. Generally, organizations with annual gross receipts exceeding $200,000 or total assets larger than $500,000 are required to file this form. Specific types include 501(c)(3) charitable organizations, social welfare organizations, labor organizations, and business leagues, among others. For smaller nonprofits, there are alternatives available, such as Form 990-EZ and Form 990-N (e-Postcard), which can simplify the filing process.

Certain exceptions apply. For instance, religious organizations, political organizations, and organizations with minimal revenue may be exempt from filing, allowing them to focus on their core missions without the burden of extensive reporting. Understanding these nuances ensures compliance and helps avoid potential penalties.

Navigating the Form 990: Key Sections Breakdown

Form 990 comprises several key sections, each designed to present a detailed snapshot of an organization’s operations and financial status. The initial section summarizes the organization’s activities, providing insight into its mission and daily operations. Following this, a financial overview breaks down the income and expenses, showcasing how resources are allocated. Each part has specific requirements that must be fulfilled to ensure compliance and provide transparency.

Navigating these sections with clarity is essential, and using an interactive tool can assist in breaking down complex sections, thereby simplifying the filing process. By understanding each part’s context and requirements, organizations can effectively communicate their contributions and needs.

Step-by-Step Instructions for Filling Out Form 990

Filling out Form 990 might seem daunting, but when approached systematically, it becomes manageable. Begin by gathering necessary documentation, including the previous year’s Form 990, financial statements, and your organization’s operational details. Having all relevant data on hand ensures a smoother filling process and accuracy of the reported information.

When starting to complete the form, focus first on inputting personal and organizational information in Part I. Follow this by reporting income and expenses accurately to reflect the organization’s financial activities. Detailed descriptions in Part III regarding program service accomplishments are vital; these demonstrate how funds are utilized for mission-driven objectives.

By following these steps and tips, organizations can maintain clarity and accuracy while fulfilling their obligations, which ultimately supports their mission and bolsters public trust.

eSigning and Submitting Form 990

Once Form 990 is completed, attention must turn to submission. Understanding the eSignature process is crucial in today’s digital landscape, allowing organizations to sign and submit their forms without the need for paper documentation. eSigning ensures a streamlined and secure way to submit forms, facilitating faster processing by the IRS.

To submit Form 990 electronically, you must utilize the IRS-authorized e-filing provider. It's important to account for the deadlines: generally, Form 990 must be filed by the 15th day of the 5th month after the close of your fiscal year, with extensions available under certain circumstances. Missing these deadlines can result in fines and penalties, which can significantly impact an organization’s financial stability.

Managing, Editing, and Storing Your Form 990

After submission, managing your filed Form 990 is crucial for future reference and possible audits. Tools like pdfFiller allow you to edit Form 990 as needed, making adjustments straightforward and accessible. This means if operational changes occur or program details need updates, your stored copy remains relevant and reflective of your organization's current state.

Secure storage options are equally important. Ensuring that your documentation is organized, easily retrievable, and protected against data loss should be a key focus. Additionally, collaborating with team members on document preparation enables multiple insights and promotes thoroughness in reporting, further enhancing the integrity of the submitted information.

FAQs About Form 990

Despite thorough preparation, questions may still arise during the filing process. Addressing common questions can ease anxiety and clarify processes. For example, organizations often ask, 'What happens if I miss the filing deadline?' The IRS imposes penalties for late submissions, which can accumulate over time, impacting financial health. Understanding options for appeals or extensions can alleviate some stress surrounding this issue.

Resources are available for further clarification, ensuring organizations remain compliant while effectively managing their reporting responsibilities.

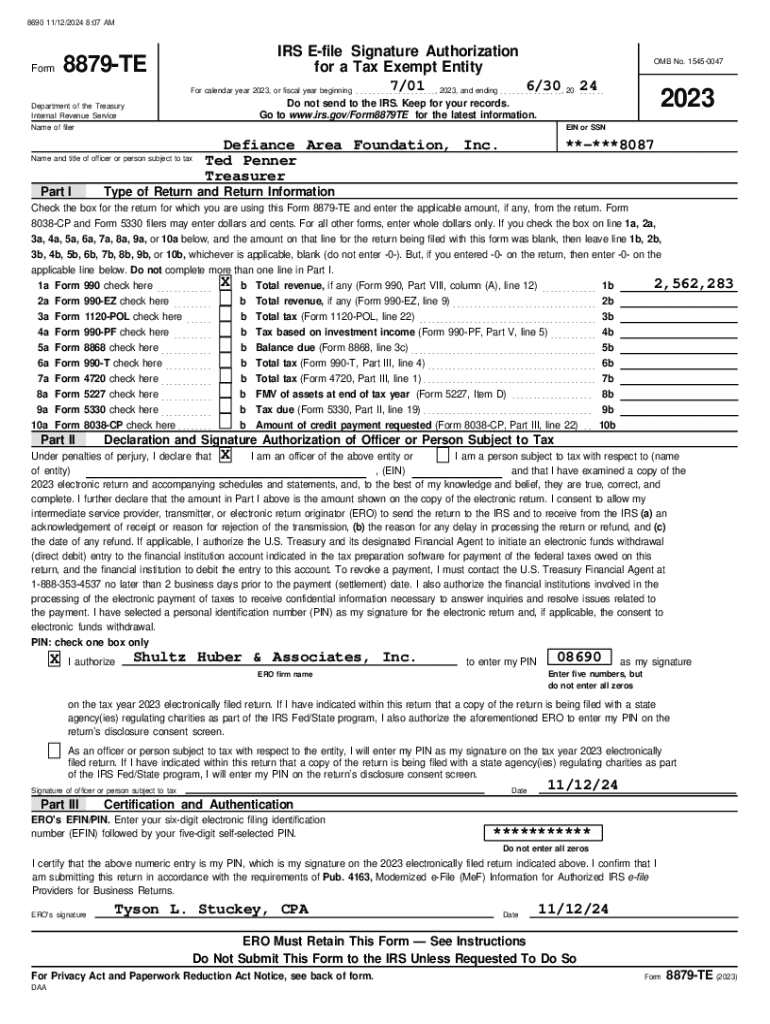

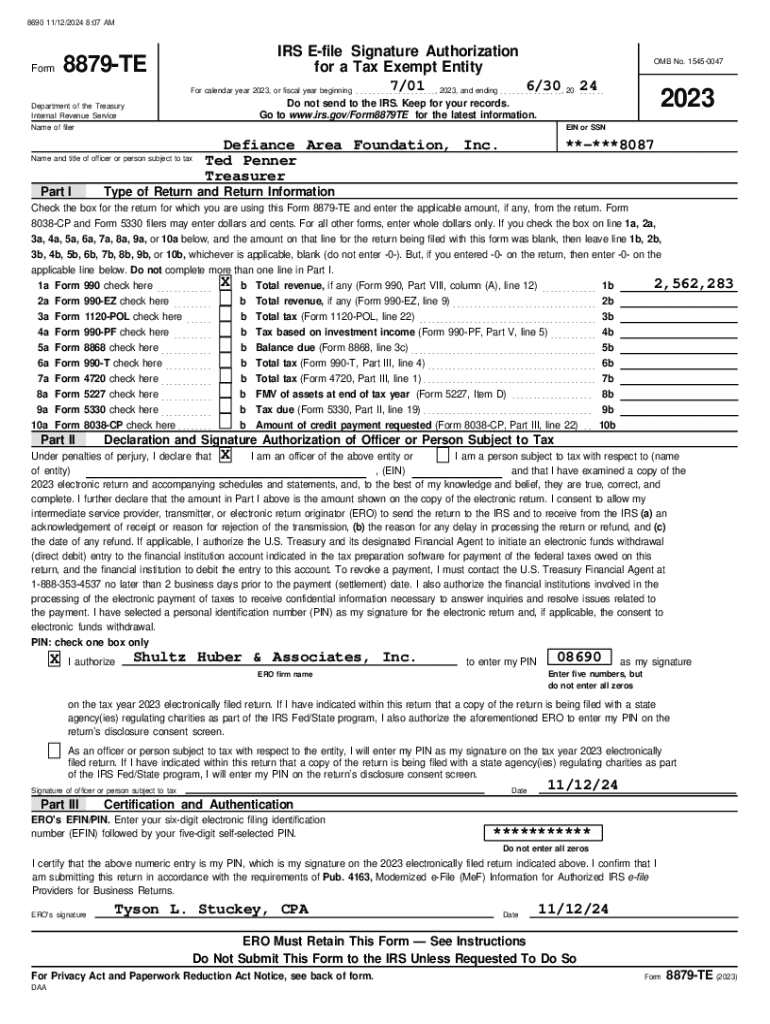

Sample Form 990: Real-World Example

Seeing a real-world example of a completed Form 990 can be incredibly beneficial. Walking through a sample provides insights into best practices and key considerations when filling out the form. It captures both common sections and significant details that databases look for, ultimately serving as a useful benchmark.

A downloadable sample form would aid in structured preparation as organizations reference their own operational data against established benchmarks.

Key Takeaways for Successful Form 990 Filing

Filings are an opportunity, not just a requirement. By treating Form 990 as a platform to tell the organization’s story, nonprofits can effectively engage stakeholders. Best practices include maintaining comprehensive and accurate financial records, ensuring narrative descriptions are clear and compelling, and encouraging team contributions throughout the process.

Furthermore, having key contacts for assistance, such as legal advisors, tax professionals, or auditor referrals, can streamline the filing experience. Continuous learning, through engagement with training materials or webinars, enhances future filings. Resources abound for organizations seeking to succeed beyond just filing compliance, paving a road for impactful reporting.

Explore More Forms and Templates

Once you're well-versed with Form 990, exploring other necessary IRS forms can further streamline your organization's operations. Quick links to other important forms and templates, especially those relevant to nonprofits, can save time and provide necessary documentation for compliance. Understanding and utilizing additional forms, such as Form 1023 (Application for Recognition of Exemption) or state-specific filings, further positions organizations for operational success.

Embracing these resources through pdfFiller equips organizations with the knowledge and tools to manage their document requirements efficiently and effectively. Continuous learning and adaptation will ensure compliance and reporting continues to meet not just minimum standards but maximal transparency and impact.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in form 990 without leaving Chrome?

Can I sign the form 990 electronically in Chrome?

How do I fill out the form 990 form on my smartphone?

What is form 990?

Who is required to file form 990?

How to fill out form 990?

What is the purpose of form 990?

What information must be reported on form 990?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.