Get the free Certificate of Liability Insurance

Get, Create, Make and Sign certificate of liability insurance

How to edit certificate of liability insurance online

Uncompromising security for your PDF editing and eSignature needs

How to fill out certificate of liability insurance

How to fill out certificate of liability insurance

Who needs certificate of liability insurance?

Certificate of Liability Insurance Form: A Comprehensive Guide

Understanding the certificate of liability insurance

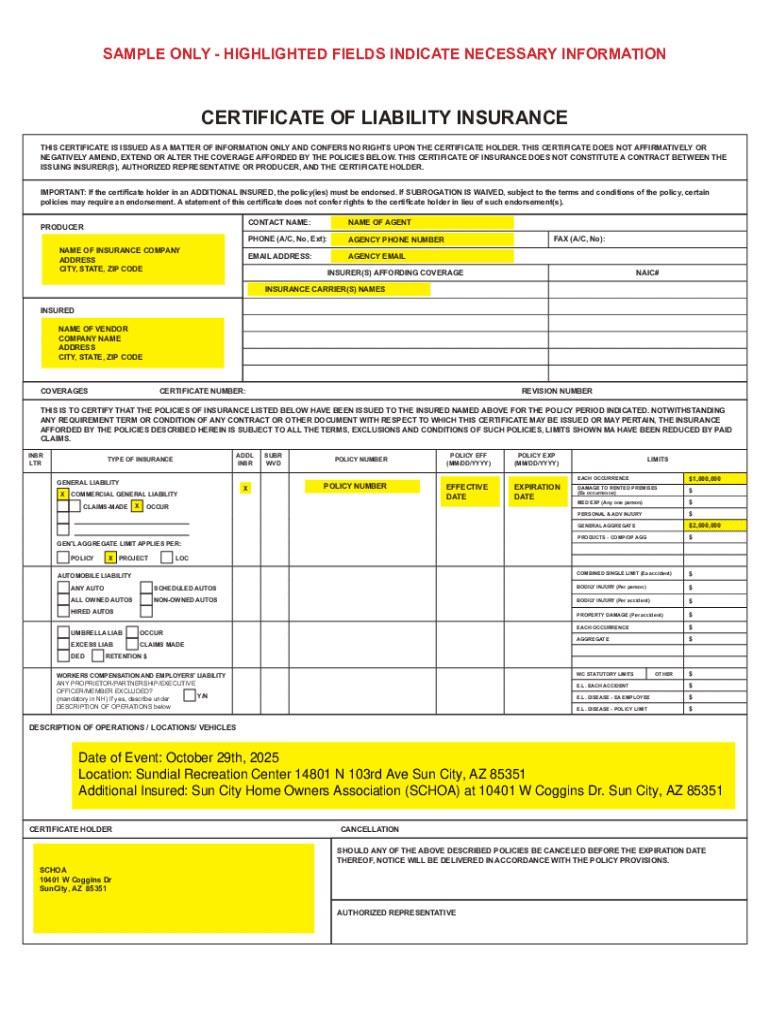

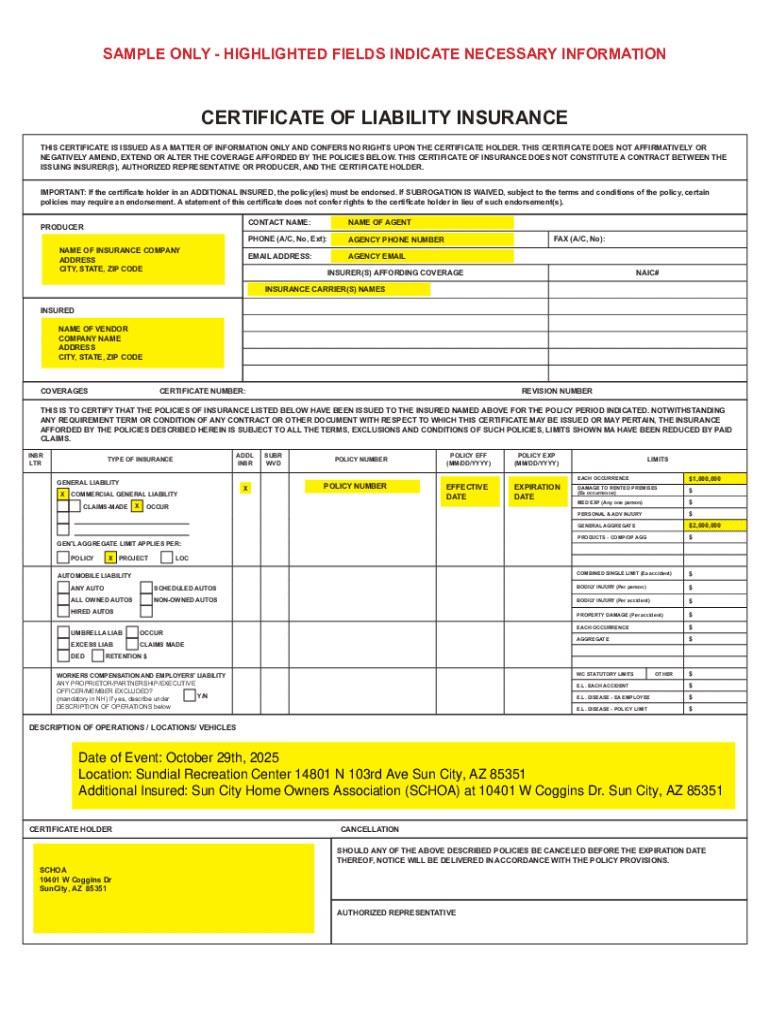

A certificate of liability insurance (COI) is a crucial document that provides evidence of liability insurance coverage. This form serves as a verification tool that shows businesses have purchased the necessary insurance to protect against claims related to bodily injury, property damage, or personal injury that may occur during the course of their operations. Essentially, a COI is a summary of your insurance policy, providing essential details without disclosing the full terms.

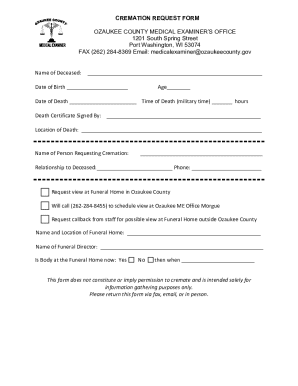

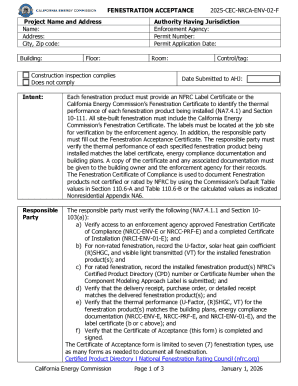

Key components typically found in a COI include the name and address of the insured party, the types of insurance coverage provided, policy numbers, effective dates, liability limits, and any additional insured parties. Understanding these components is vital, as they can significantly impact a business’s ability to secure contracts or fulfill regulatory requirements.

Having a certificate of liability insurance is essential for various reasons. It not only demonstrates to clients and partners that you carry adequate protection but can also foster trust and credibility in the marketplace. Additionally, many industries require proof of liability insurance before allowing businesses to operate on their sites or engage in contracts.

Types of liability insurance

Understanding the different types of liability insurance is critical when assessing your business's needs for a certificate of liability insurance. Here are some common forms:

When you need a certificate of liability insurance

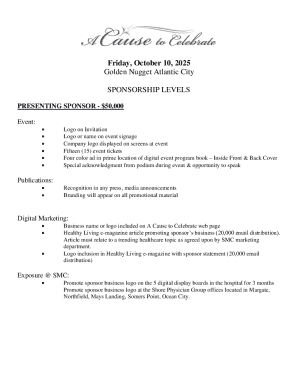

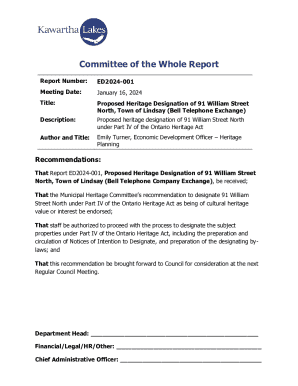

Numerous scenarios necessitate the requirement for a COI. Most commonly, businesses request a COI when entering contracts, applying for permits, or as a part of vendor onboarding processes. It's also frequently requested in industries like construction, healthcare, and transportation, where the risk of claims is heightened.

Regulatory requirements can differ significantly by state or industry. For example, construction companies typically need a COI to demonstrate compliance with safety regulations, while professional services may need to provide proof of liability insurance to meet client contractual obligations.

Costs associated with obtaining a COI

The costs associated with obtaining a certificate of liability insurance can vary widely depending on several factors. On average, liability insurance premiums range from $400 to $3,000 annually, depending on coverage amounts, industry type, and business size.

Additional fees may relate to policy modifications, administrative costs, or special endorsements needed for specific projects. Factors influencing premiums include the nature of your business, the claims history, employee count, and the types of coverage required.

How to obtain your certificate of liability insurance

The process of obtaining a certificate of liability insurance involves several steps:

The certificate of liability insurance form explained

When examining the COI form, you will find several commonly included fields that are critical to understand:

Interpreting this information is essential, as it establishes the scope of your protection and identifies what liabilities are covered under your policy.

Best practices for filling out the certificate of liability insurance form

Filling out the certificate of liability insurance form accurately is paramount to avoid delays and complications. Here are some best practices to follow:

Managing your liability insurance certificate after issuance

Once your COI is issued, proper management becomes essential. This involves tracking expiration dates, handling requests from clients and vendors, and ensuring easy access to the document.

Frequently asked questions about certificate of liability insurance

Several common questions arise regarding the certificate of liability insurance that potential policyholders should consider. Here are a few:

Real-world applications of COI

The significance of a certificate of liability insurance is best illustrated through real-world applications. For instance, construction companies often required COIs to demonstrate their risk management practices while working on state-funded projects.

Similarly, professional services firms may not engage in contracts without presenting their COI, ensuring potential clients that they are adequately insured against any errors that may occur during service delivery.

Testimonials from clients who have utilized liability insurance reveal the critical role COIs play in protecting businesses, enhancing their reputation, and ultimately allowing them to secure contracts and projects that would otherwise be out of reach.

Leveraging pdfFiller for your certificate of liability insurance documentation

pdfFiller provides a seamless experience for managing your certificate of liability insurance documentation. By utilizing this tool, users can easily create, edit, and collaborate on COI documents without tedious paperwork.

With interactive tools such as templates and forms, pdfFiller allows for quick adjustments to accommodate specific client or contractual needs. Additionally, the platform's eSigning capabilities and collaboration features facilitate prompt sharing of COIs, ensuring that the right documentation is always at your fingertips.

Conclusion: Empowering your business with the right insurance

Effectively managing your certificate of liability insurance is vital for any business looking to maintain operational integrity and secure contracts. By staying on top of your COI requirements and using tools like pdfFiller, businesses can seamlessly improve their documentation management process.

Ultimately, securing the right insurance coverage and efficiently handling COI documentation can strengthen your business's reputation, fulfilling both client expectations and regulatory responsibilities.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send certificate of liability insurance to be eSigned by others?

Can I create an eSignature for the certificate of liability insurance in Gmail?

How do I fill out the certificate of liability insurance form on my smartphone?

What is certificate of liability insurance?

Who is required to file certificate of liability insurance?

How to fill out certificate of liability insurance?

What is the purpose of certificate of liability insurance?

What information must be reported on certificate of liability insurance?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.