Get the free Form 990

Get, Create, Make and Sign form 990

How to edit form 990 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 990

How to fill out form 990

Who needs form 990?

The Comprehensive Guide to Form 990 Form

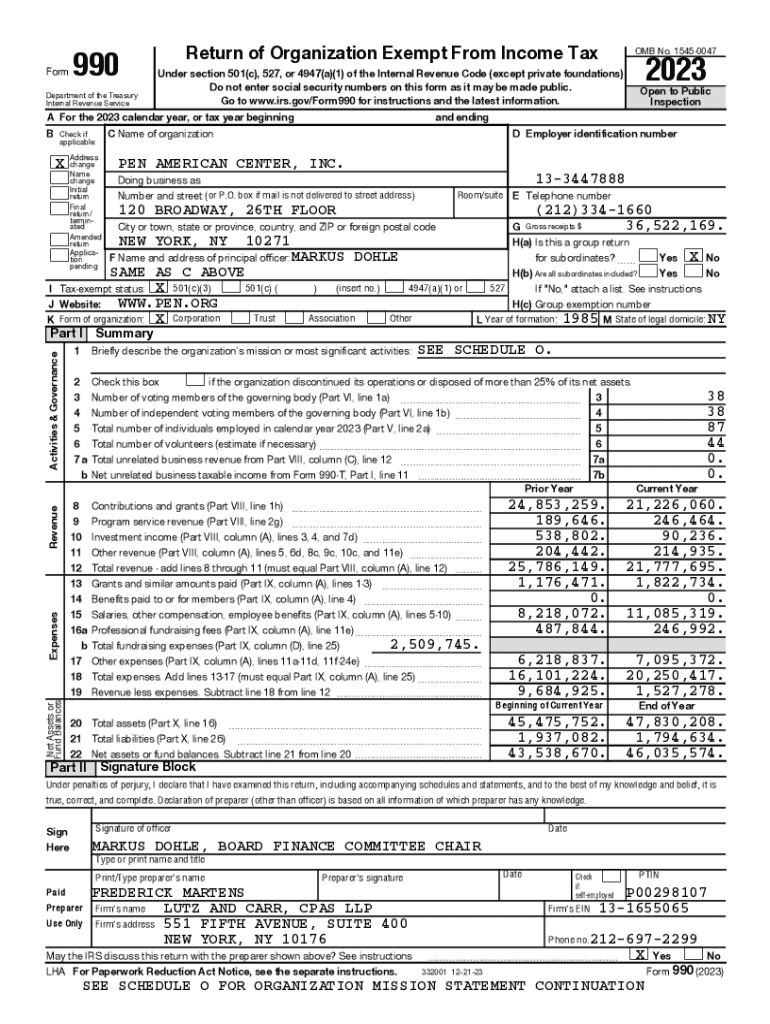

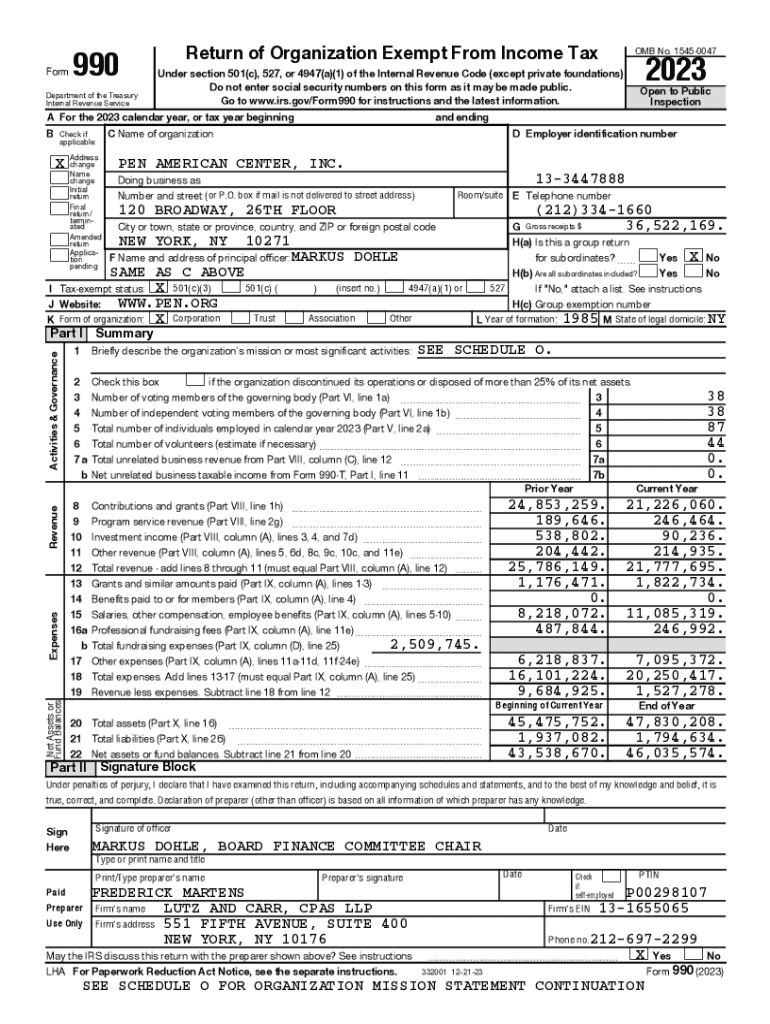

Understanding Form 990

Form 990 serves as an essential reporting return for tax-exempt organizations in the United States. This IRS form is designed to provide vital information about an organization's mission, programs, and finances, ensuring transparency and accountability in the non-profit sector.

The importance of Form 990 cannot be overstated. It is a critical tool for the IRS and the public to evaluate how organizations use their resources, making its completion vital to uphold the trust of donors and stakeholders.

Types of organizations required to file

Most tax-exempt organizations, including charities, foundations, and other non-profits, need to file Form 990 annually. However, there are exceptions. Smaller organizations qualifying as 501(c)(3) entities with gross receipts under $50,000 may opt to file Form 990-N (e-Postcard) instead.

The structure of Form 990

Form 990 is organized into several key sections, each addressing different aspects of an organization’s operations. Understanding these sections is crucial for accurate reporting and compliance.

Among the core sections, financial statements disclose monetary details about an organization’s assets and liabilities, while governance sections provide insights into the board's composition and management practices. Compliance sections demonstrate adherence to federal regulations, a necessity for maintaining tax-exempt status.

Common terminology in Form 990

Navigating the terminologies in Form 990 is important to avoid confusion. For example, 'contributions' refer to donations and funding, while 'program service revenue' denotes income earned through specific programs that align with the organization's mission.

Step-by-step guide to completing Form 990

Filling out Form 990 requires a meticulous approach. Organizations must start by gathering pertinent information, including financial records, organizational structure, and program descriptions. Ensuring all financial data is accurate is paramount for a smooth filing process.

This process involves collating documentation from various departments, verifying compliance with IRS regulations, and preparing narratives that clearly describe program achievements and financial stewardship.

Filling out each section

Completing Form 990 entails addressing each section methodically. Here’s a brief overview of critical components:

Common challenges and how to overcome them

Filing Form 990 is fraught with challenges, often due to common mistakes such as reporting inaccuracies or missing deadlines. Awareness of these pitfalls can significantly enhance the filing process. For example, failure to reconcile financial statements with supporting documents can lead to discrepancies that may trigger IRS audits.

To address these frequent errors, organizations should implement robust auditing processes, establish a timeline for gathering documents, and create a checklist prior to submission. By using these tactics, organizations can minimize mistakes and prioritize precise reporting.

Navigating IRS regulations

The IRS regularly updates requirements for Form 990 filing. Keeping abreast of these changes is essential for compliance. Organizations should actively monitor IRS publications and use tools available on platforms like pdfFiller to stay informed.

Tools for filling out Form 990

Utilizing advanced tools like pdfFiller can significantly streamline the completion of Form 990. Its interactive features simplify document management, ensuring that the filing process is both efficient and comprehensive.

pdfFiller offers eSigning capabilities that enable seamless collaboration among team members while handling sensitive information securely. Additionally, these tools can enhance document sharing and filing, ensuring readiness for submission and compliance.

Integrating Form 990 into your workflow

Incorporating Form 990 into your organization's workflow can enhance operational efficiency. Use pdfFiller within your teams to facilitate collaborative editing, track changes, and ensure that everyone involved in the filing process has access to the latest documents.

Filing and after submission

Submitting Form 990 can be done either electronically or via paper submission. E-filing is encouraged by the IRS, providing quicker processing times and immediate confirmation of receipt.

Understanding the review process after submission is crucial. Organizations should anticipate receiving acknowledgment from the IRS, and any issues may prompt a request for additional information, which should be addressed promptly to maintain compliance.

Understanding the review process

The IRS review can be swift or lengthy, depending on various factors including the complexity of the returns and the completeness of the information provided. Generally, organizations can expect reviews to take several weeks to a few months.

Frequently asked questions

What to do if you miss the deadline?

Missing the Form 990 submission deadline can lead to penalties. Organizations should file as soon as possible and consider requesting an extension if needed. The IRS provides relief for minor delays when submissions are made promptly.

How to amend a filed Form 990?

Amending Form 990 is essential when errors or omissions are discovered after submission. Organizations can file Form 990-X to correct previous submissions, indicating what was adjusted and providing the correct information.

Resources for additional support

Utilize both IRS publications and resources from organizations specializing in non-profit compliance for additional support. Resources like pdfFiller also offer tools designed to assist in the preparation and filing processes, enhancing organizational capacity.

Finding further information and assistance

The IRS provides extensive materials regarding Form 990, including detailed instructions and updates on regulatory changes. Consulting these resources can be beneficial for staying compliant and enhancing filing accuracy.

Engaging with professional support

A qualified accountant or tax professional can offer invaluable insights into the complexities of Form 990. Organizations should not hesitate to seek assistance, particularly during periods of significant transition, to ensure that their filings remain compliant.

Real-world examples and case studies

Reviewing sample completed Form 990 filings can illustrate effective practices and compliance. Observing successful organizations can shed light on strategies for conveying mission impact through clear data presentation.

Success stories from organizations mastering Form 990 filing highlight the importance of accurate documentation and timely submissions, significantly enhancing not only compliance but also the ability to attract funds.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my form 990 directly from Gmail?

How do I make changes in form 990?

How do I complete form 990 on an iOS device?

What is form 990?

Who is required to file form 990?

How to fill out form 990?

What is the purpose of form 990?

What information must be reported on form 990?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.