Get the free Form 990

Get, Create, Make and Sign form 990

How to edit form 990 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 990

How to fill out form 990

Who needs form 990?

Form 990 form: A Comprehensive How-to Guide

Understanding Form 990: An overview

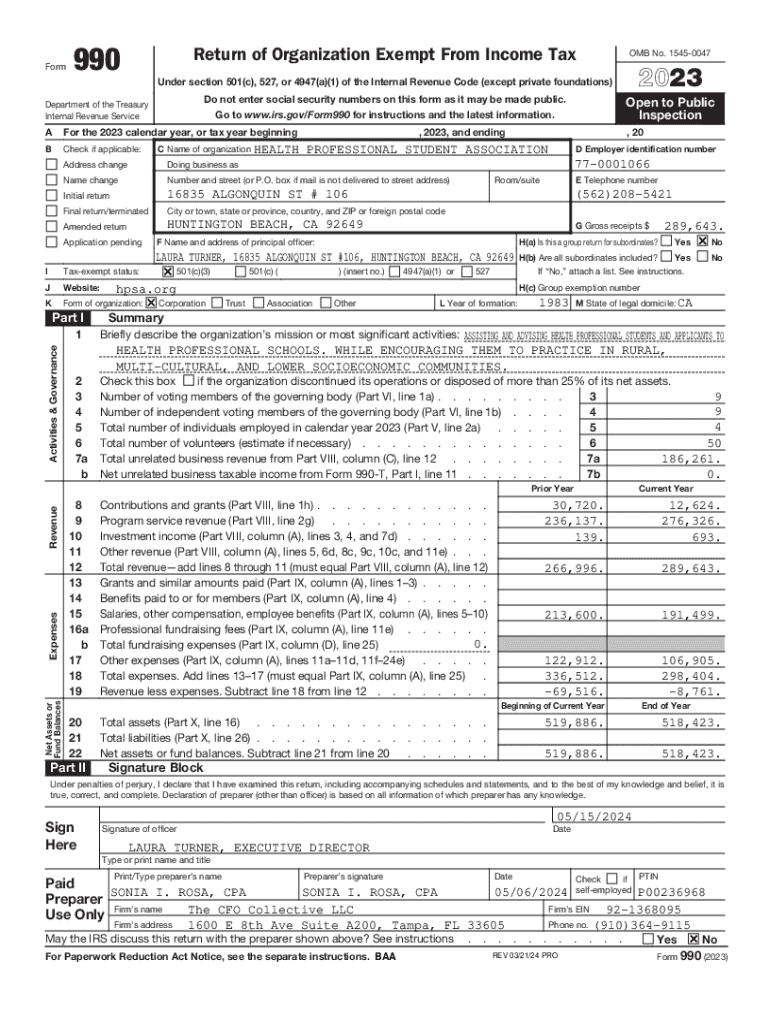

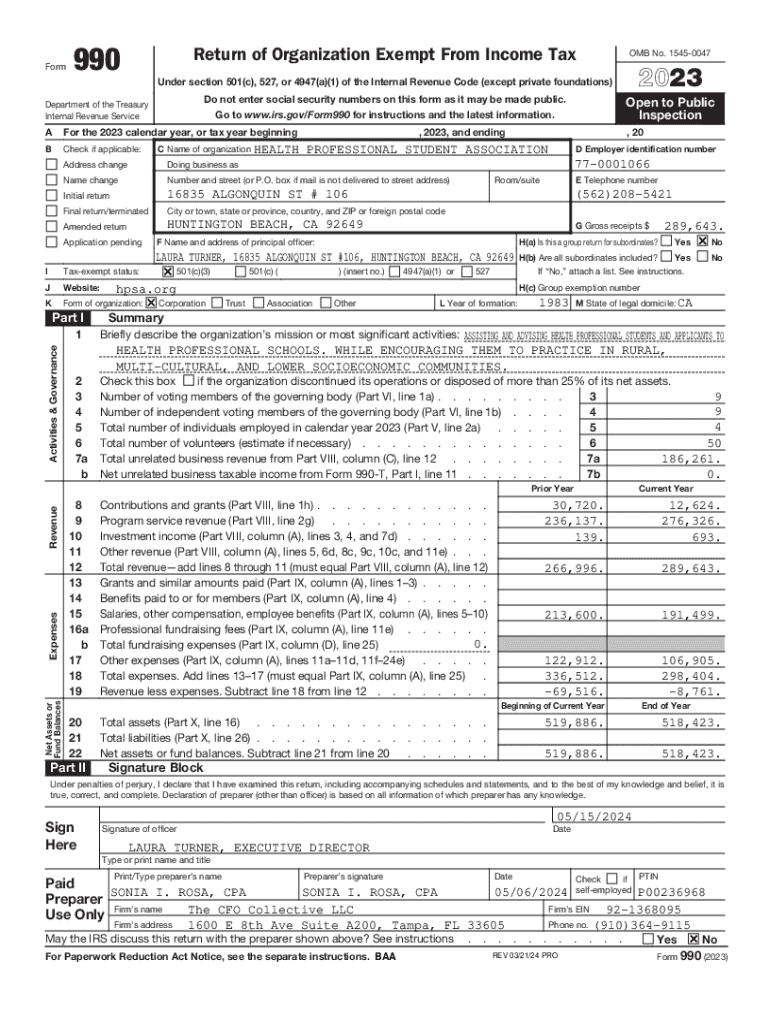

Form 990 is an essential document that provides the Internal Revenue Service (IRS) with vital information about a nonprofit organization’s financial activities. This form serves multiple purposes: it demonstrates how a nonprofit operates under its tax-exempt status, showcases its revenue sources, and elucidates its spending, thereby offering a transparent view of its operations. Nonprofits are not just required to file this form; it allows them to disclose their governance and programmatic achievements, fostering trust with donors, the public, and other stakeholders.

The importance of Form 990 cannot be overstated—it acts as a tool of accountability within the nonprofit sector. By detailing where funds come from and how they are utilized, it enables nonprofits to be transparent about their operations and fiscal responsibilities. This, in turn, grants potential donors and the community insight into the organization’s effectiveness and commitment to its mission, facilitating informed decisions about support and partnership.

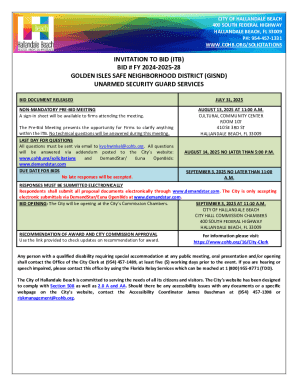

Who needs to file Form 990?

Not every organization is required to file Form 990. Generally, tax-exempt organizations, including charities and foundations, must meet certain criteria set forth by the IRS to submit this form. Generally, organizations with gross receipts of $200,000 or more or total assets of $500,000 or more are required to file a complete Form 990. Those with revenues below these thresholds might only be required to file Form 990-EZ or Form 990-N, depending on their size and income.

However, some organizations may be exempt from filing altogether. These include religious organizations, political organizations, and certain types of trusts, among others. It's crucial for organizations to understand their specific filing requirements to maintain their tax-exempt status and avoid penalties.

Types of Form 990

Form 990 comes in several versions, catering to different types and sizes of organizations. The primary forms include Form 990, Form 990-EZ, and Form 990-N. Understanding which variant to utilize is critical for compliance with IRS regulations and to accurately reflect an organization’s financial situation.

Form 990 is the comprehensive long-form for larger organizations, whereas Form 990-EZ is a shorter version intended for smaller nonprofits. Form 990-N, often referred to as the e-Postcard, is a quick and simplified version meant for organizations with less than $50,000 in gross revenue. Choosing the right form depends largely on the organization’s size, revenue, and complexity of operations.

Key sections of Form 990

Form 990 is structured into several key sections, each designed to depict different aspects of an organization’s functioning. The initial component covers basic organizational information, including mission statements, governance structures, and services offered. This section is vital for establishing the nonprofit’s identity and purpose to the public.

Moving deeper into the form, financial statements reveal critical data on assets, liabilities, revenues, and expenditures. This financial insight is crucial for stakeholders evaluating the organization’s overall health and financial viability. Moreover, Schedule A is dedicated to disclosing public charity status and levels of public support, enhancing transparency in funding sources. There are other schedules like B, C, and D that provide additional details relevant to certain specifics, further enriching the dataset provided to the IRS.

Step-by-step guide to completing Form 990

Completing Form 990 can appear daunting, but breaking down the process into manageable steps greatly simplifies it. First and foremost, organizations should prepare all necessary records related to their operations. This includes financial data, descriptions of fundraising activities, and a narrative of program service accomplishments.

Once the necessary documents are compiled, filling out Form 990 can commence. Start by entering the organization’s financial data accurately, ensuring all income and expenses are reflected correctly. Reporting fundraising activities should capture the methods and success levels of these events, providing insight into their effectiveness. Don’t forget to concisely summarize program accomplishments, showcasing the impact of the organization’s efforts. Be vigilant about common pitfalls, such as missing required disclosures or mismatched figures, to avoid delays or complications.

Tools and features for editing and managing your form

Using pdfFiller can significantly enhance the process of completing and managing your Form 990. This versatile platform allows users to edit PDFs conveniently, ensuring that the final document is polished and professionally formatted. Begin by uploading the relevant document into the pdfFiller interface, providing seamless access to all necessary editing features.

In addition to editing tools, pdfFiller offers digital signature capabilities, enabling organizations to eSign their completed forms securely. Teams can collaborate efficiently by giving input and reviewing changes in real-time. This collaborative functionality streamlines workflows, making the completion of Form 990 a cohesive effort between team members.

Submitting your Form 990

Once the Form 990 is completed, the next significant step is submission. Organizations can choose between filing online or submitting a paper version. Online filing is often preferred for its efficiency and tracking capabilities, allowing for immediate confirmation of submission. The IRS mandates specific deadlines based on the organization’s fiscal year, typically the 15th day of the fifth month after the organization's fiscal year ends.

Timely filing is essential to avoid penalties and ensure compliance with IRS regulations. Organizations should keep records of their submission and any communication with the IRS for future reference. Utilizing pdfFiller’s tracking features can help users stay organized and ensure that they meet all required deadlines.

Frequently asked questions (FAQs) about Form 990

Several questions frequently arise regarding Form 990. Organizations often seek clarity on their filing requirements, including which form version to use based on their revenue and size. Common technical difficulties arise when using online platforms like pdfFiller, particularly in navigating features or ensuring document accuracy. Organizations also inquire about how to handle IRS responses to queries related to their filings, seeking guidance on addressing concerns or corrections.

Addressing these FAQs is vital as it not only aids organizations in their filing processes but also cultivates a greater understanding of the form's nuances and requirements. Organizations can access resources through pdfFiller and IRS guidelines to resolve these common concerns, providing clarity in the filing landscape.

Real-world examples and case studies

Examining real-world examples of completed Form 990 submissions can provide valuable insights into best practices. Organizations that have effectively used this form to showcase their financial health and transparency have successfully attracted support and trust from the community. Looking into case studies will help identify strategies employed by these successful organizations to streamline their filing processes and improve stakeholder communication.

For instance, a community-focused nonprofit might illustrate how they reported on a successful fundraising campaign, providing clear metrics on how the funds were distributed and the outcomes of their programs. Observing these examples can serve as a roadmap for other nonprofits looking to enhance their Form 990 submissions and leverage them as a tool for greater transparency and engagement.

Navigating the post-filing landscape

Once an organization submits its Form 990, the work does not end there. Maintaining compliance with IRS regulations is crucial for ongoing tax-exempt status. Organizations should familiarize themselves with the processes for amending their filings if discrepancies arise or new information necessitates updates. Keeping meticulous records of their submission and subsequent communication with the IRS is essential for future filings and audits.

This step ensures that nonprofits remain accountable and transparent, reinforcing trust among stakeholders while paving the way for future fundraising and community engagement. Organizations should also cultivate an ongoing relationship with their accounting professionals to preemptively address any complications regarding their filings.

Additional considerations and best practices

Implementing strategies for streamlining future Form 990 filings is vital for organizations aiming to enhance efficiency. Establishing a routine of maintaining organized financial records and documenting program activities throughout the year can significantly reduce the workload when it comes time to file. Leveraging technology, such as cloud-based solutions like pdfFiller, allows for effective document management and easy access to necessary files from anywhere.

Being aware of IRS changes that may affect Form 990 filing requirements is also crucial. Keeping abreast of policy updates ensures that organizations remain compliant and can adapt to new regulations. By fostering a proactive and informed approach to Form 990, nonprofits can mitigate risks associated with filing errors and enhance their operational transparency.

Interactive tools and resources on pdfFiller

pdfFiller stands out as a user-friendly platform that offers a variety of interactive tools to facilitate document management. Users can benefit from features that enhance collaboration, like commenting and reviewing, which are integral when working on forms such as Form 990. These tools not only streamline file handling but also enhance the accuracy of final submissions, ensuring that all elements are correctly addressed.

Additionally, pdfFiller permits organizations to create and store templates for future use, making subsequent filings more manageable. This feature is particularly useful for large organizations with multiple grants or projects, as it allows them to maintain consistent reporting practices while minimizing redundancy in input.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit form 990 from Google Drive?

How can I get form 990?

How do I execute form 990 online?

What is form 990?

Who is required to file form 990?

How to fill out form 990?

What is the purpose of form 990?

What information must be reported on form 990?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.