Get the free Form 990

Get, Create, Make and Sign form 990

How to edit form 990 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 990

How to fill out form 990

Who needs form 990?

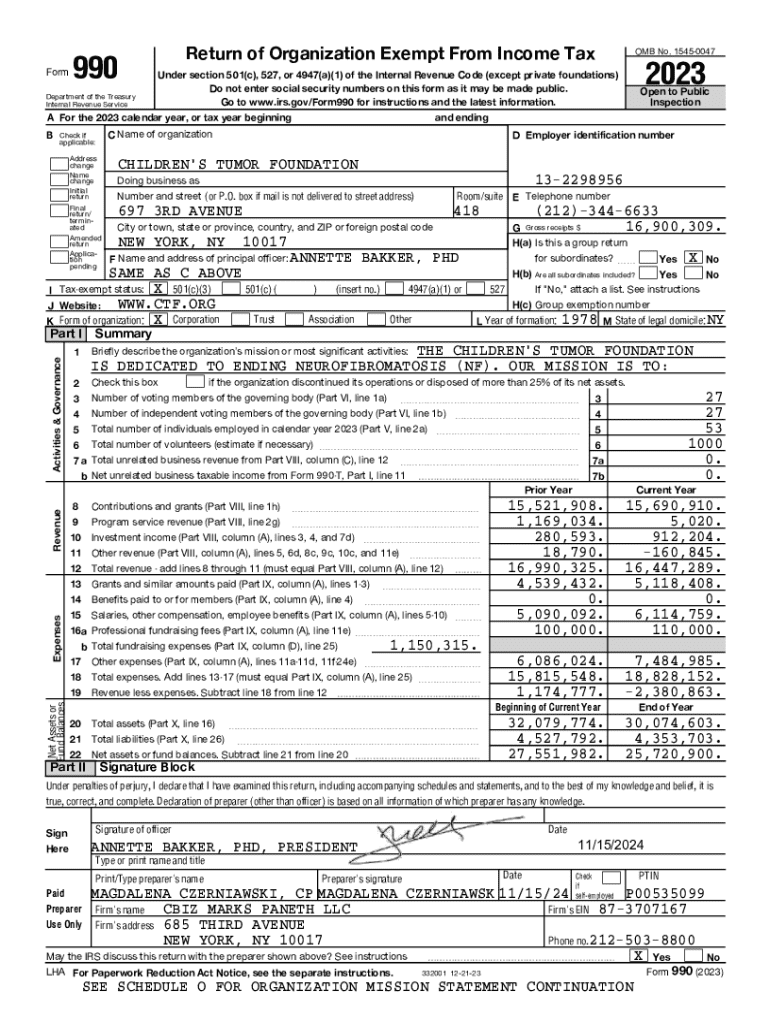

A Comprehensive Guide to Form 990: Understanding, Completing, and Managing Nonprofit Filings

Understanding Form 990

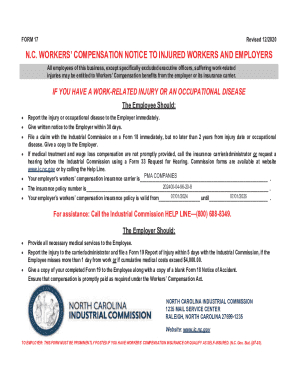

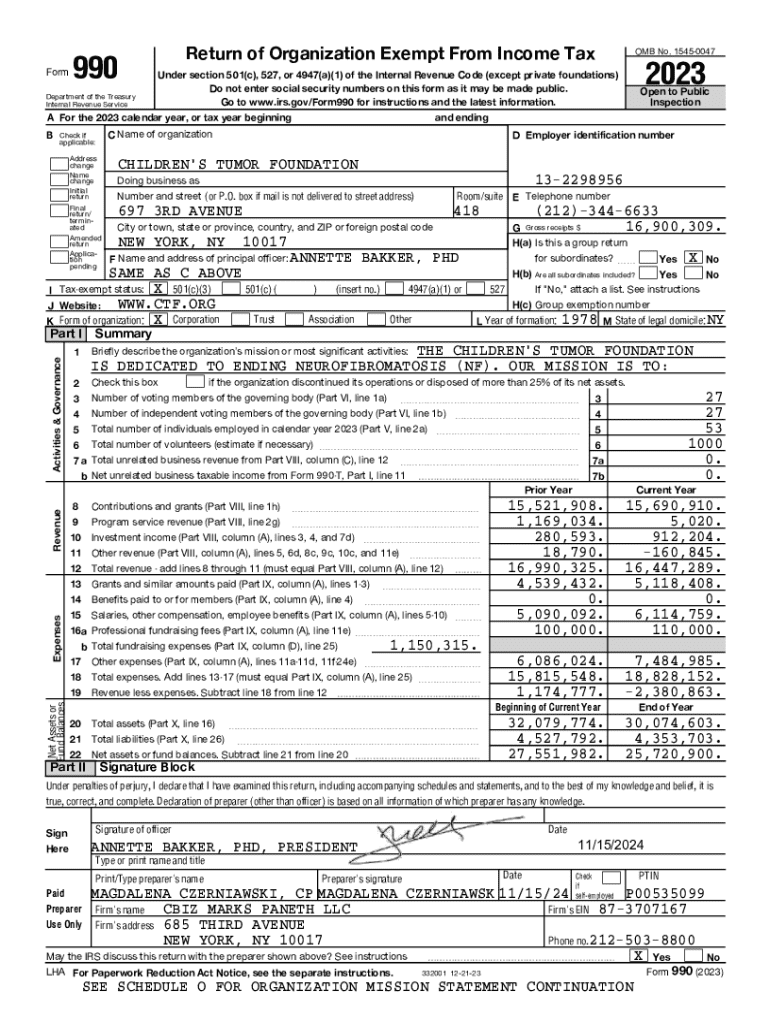

Form 990 is a crucial document filed by tax-exempt organizations in the United States, providing the IRS with essential information about a nonprofit's activities, governance, and financial performance. It serves as an 'annual information return' that offers greater transparency about how nonprofits operate, allowing both the government and the public to assess their adherence to their charitable mission.

Important for accountability, Form 990 also helps these organizations maintain their tax-exempt status. The information contained within this form can influence public trust and can impact funding opportunities, making a precise understanding of its components essential for nonprofits.

Key components of Form 990

Understanding the key components of Form 990 is essential for accurate completion. The form features several parts, each designed to capture specific information about the organization. Here's a breakdown of some major sections you should be familiar with.

In addition to these parts, specific schedules such as Schedule A, Schedule B, and Schedule G provide deeper insights into the organization’s charitable status, contributions, and fundraising practices.

Step-by-step instructions for completing Form 990

Completing Form 990 requires meticulous attention to detail, starting with gathering the necessary information. Accurate financial statements that represent the organization's fiscal year are crucial, alongside detailed information about board members and key personnel within the organization.

As you fill out each section, focus on providing clear and precise data. For instance, Part I should succinctly summarize financial data, while detailed techniques can help ensure the information comes across accurately. Using tools like pdfFiller can drastically simplify this process, allowing you to enter and edit data efficiently.

Common challenges and how to overcome them

Many organizations face common pitfalls when preparing Form 990. Errors in financial reporting, misclassification of contributions, and incomplete program descriptions can lead to audits and fines. To counter these risks, organizations should establish a thorough review process involving multiple stakeholders.

Addressing potential issues with the IRS promptly is also essential. Questions regarding filings or discrepancies should be resolved swiftly to minimize any possible penalties.

Interactive tools for Form 990 management

Tools that facilitate the editing, signing, and management of Form 990 are crucial, especially for organizations with limited resources. pdfFiller stands out as an exceptional platform that empowers users to collaborate effectively in managing their documents.

These features not only enhance productivity but also ensure that all necessary participants are engaged in the filing process, leading to better transparency and communication.

Keeping track of deadlines and compliance

Filing Form 990 on time is essential for maintaining good standing with the IRS. Organizations must be aware of important filing dates to avoid penalties. The standard deadline for Form 990 is the 15th day of the 5th month after the end of your organization’s accounting period, with extensions available under certain conditions.

Efficient document management through platforms like pdfFiller can substantially streamline your compliance efforts and ensure that you’re always prepared for your next filing.

Understanding the consequences of non-compliance

Failure to file Form 990 correctly or on time can lead to severe repercussions. The IRS imposes penalties for late filings, potentially amounting to thousands of dollars, depending on the size of the organization. Additionally, consistent non-compliance can jeopardize tax-exempt status, significantly impacting an organization's ability to operate.

Using pdfFiller can ensure adherence to compliance standards, providing a structured approach to filing and documentation that can protect your organization from these risks.

Case studies: Successful Form 990 filings

Reviewing successful Form 990 filings can offer valuable insights. Notable nonprofits have excelled in their reporting, demonstrating transparency and community engagement that foster trust and attract donations.

From these examples, other organizations can learn the importance of clarity, detail, and transparency in their filings, using Form 990 to enhance their credibility.

User tips for post-submission management

After submitting Form 990, it’s crucial to manage documentation efficiently. Secure storage of filed forms is essential for compliance, especially in case of IRS inquiries. Utilizing a digital platform like pdfFiller can allow for easy access to these documents whenever needed.

Implementing these practices can greatly enhance your organization’s administrative efficiency and compliance readiness.

Find more by

For individuals and teams seeking further resources on Form 990 and nonprofit management, pdfFiller offers a variety of templates and guides. These tools make navigating the complexities of regulatory requirements straightforward and user-friendly.

Leveraging these resources can simplify the ongoing management of compliance and enhance your organization’s operations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send form 990 for eSignature?

How do I make edits in form 990 without leaving Chrome?

Can I edit form 990 on an Android device?

What is form 990?

Who is required to file form 990?

How to fill out form 990?

What is the purpose of form 990?

What information must be reported on form 990?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.