Get the free Form 990

Get, Create, Make and Sign form 990

Editing form 990 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 990

How to fill out form 990

Who needs form 990?

Understanding Form 990: A Comprehensive Guide for Nonprofits

Understanding Form 990: A comprehensive overview

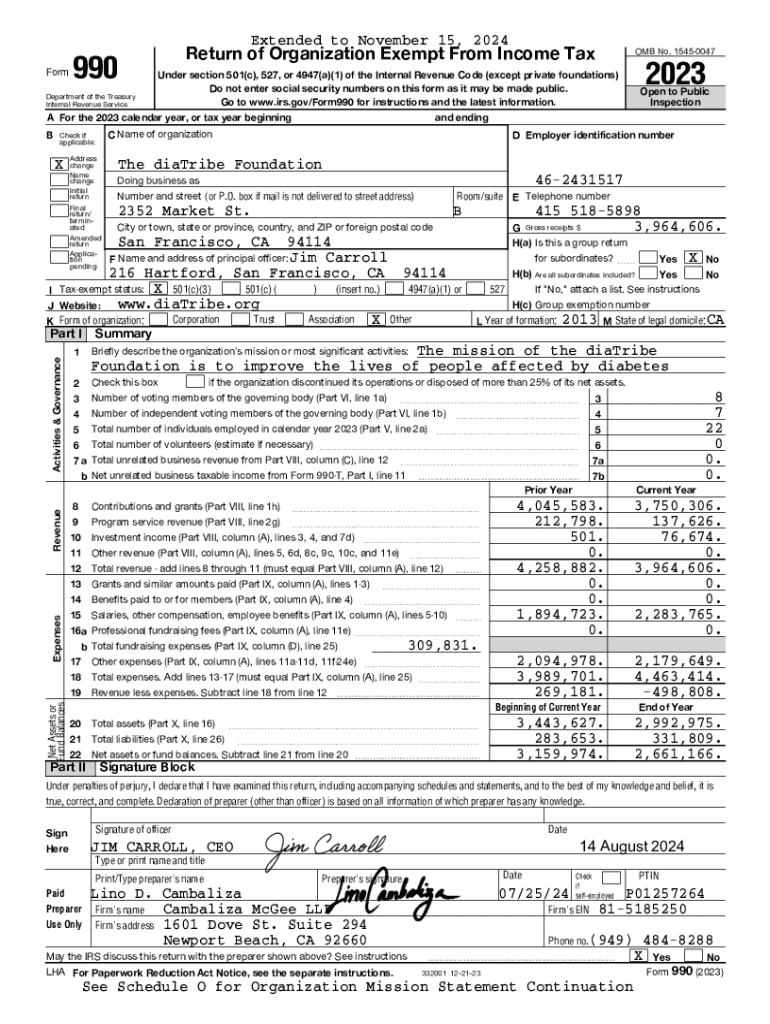

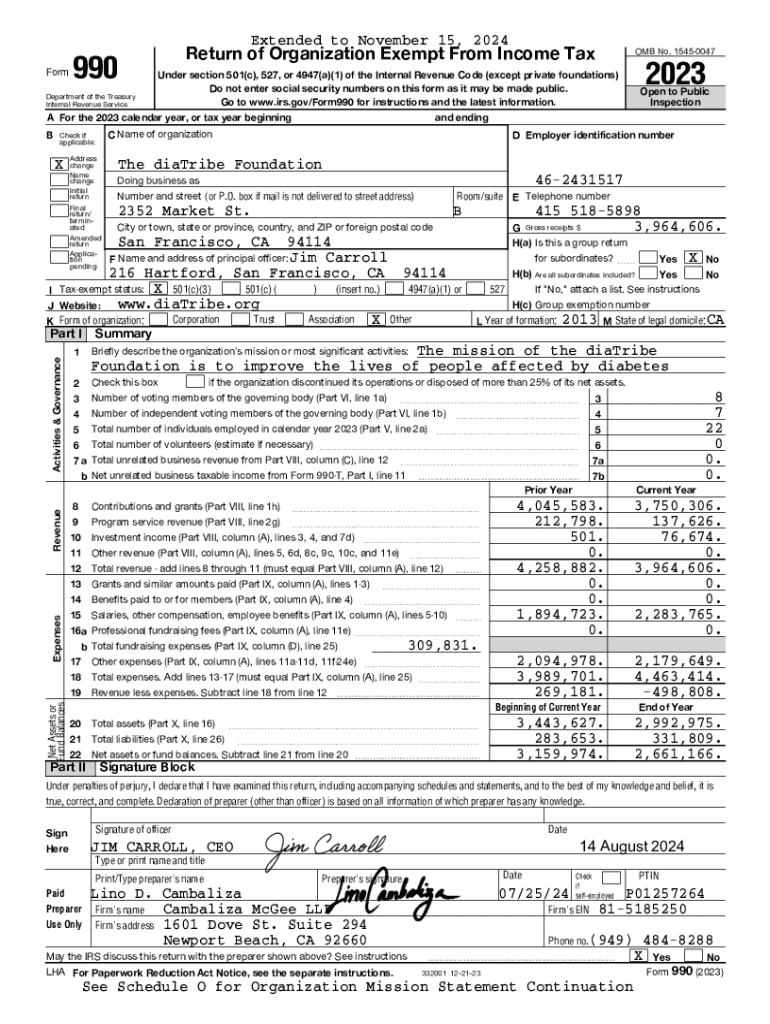

Form 990 is an annual report that nonprofit organizations must file with the Internal Revenue Service (IRS) to maintain their tax-exempt status. Unlike traditional corporate tax returns, Form 990 provides in-depth information about the nonprofit’s mission, programs, and finances. The form aims to promote transparency and accountability in the nonprofit sector, allowing the IRS, potential donors, and the general public to assess the organization’s financial health and operational effectiveness.

Importance of Form 990 cannot be understated, as it serves multiple roles. It holds nonprofits accountable for their operations, ensures compliance with federal tax regulations, and serves as a key tool for fundraising. Donors often rely on Form 990 to evaluate the efficiency and effectiveness of charitable organizations before committing their financial support. It’s also a critical document in the nonprofit sector’s efforts to maintain public trust.

Who needs to file Form 990?

Eligibility for filing Form 990 primarily includes 501(c)(3) organizations and other IRS-recognized nonprofits with gross receipts above a certain threshold. This threshold varies depending on the specific type of organization and its revenue. Generally, organizations with gross receipts exceeding $200,000 or total assets above $500,000 are required to submit Form 990 annually.

Exceptions do exist, allowing certain charities to avoid filing. Organizations that earn less than $50,000 can submit Form 990-N, a simplified electronic notice known as the 'e-Postcard.' Additionally, religious organizations and governments are typically exempt from this requirement, as they often report to different regulatory bodies. It’s crucial to stay aware of state-specific filing requirements, which may have their own rules and deadlines.

Types of Form 990

Form 990 comes in various versions, each designed for different types of organizations. The primary forms include Form 990, the standard version for larger organizations; Form 990-EZ, a shorter form for smaller nonprofits; and Form 990-N, which is an e-Postcard for organizations earning less than $50,000. Depending on the organization’s gross receipts and total assets, choosing the right form is essential for compliance.

Understanding the implications of each type on financial reporting is vital. While Form 990 provides detailed financials, Form 990-EZ offers a streamlined approach that maintains some reporting but requires less information overall. On the other hand, Form 990-N is designed to serve the simplest need, requiring limited data yet still fulfilling the annual reporting obligation to the IRS.

Step-by-step guide to filling out Form 990

Filling out Form 990 requires meticulous attention to detail and accurate data. Start by gathering necessary documentation such as financial records, governance policies, and if applicable, last year’s Form 990. Accurate financial records will form the backbone of your filing, ensuring each line is filled out correctly and reflective of the organization’s financial condition. Determine all program activities and their associated costs to illustrate the impact of your organization’s work.

Detailed instructions for each section of Form 990 are provided on the IRS website, but here's a brief overview of its structure:

Be cautious of common pitfalls such as incomplete or inaccurate reporting, which can trigger audits or fines. Furthermore, missing deadlines can result in penalties or loss of tax-exempt status. It's paramount to create a timeline for filing and establish a checklist to ensure all requirements are fulfilled before submission.

Using pdfFiller for Form 990

pdfFiller offers an efficient platform for completing Form 990, simplifying document management tremendously for nonprofits. Users can utilize pdfFiller’s features to edit, sign, and collaborate on Forms effortlessly. The intuitive interface allows organizations to upload their financial documents and gather team feedback in real-time, making the filing process collaborative and less burdensome.

Step-by-step instructions for using pdfFiller tools include:

Using a cloud-based solution like pdfFiller not only enhances efficiency but also ensures compliance, allowing team members to access the required documents from anywhere with internet connectivity.

Managing Form 990 after submission

After submission, maintaining organized records is crucial. Best practices for record keeping include saving copies of submitted forms and supporting documents in a secure cloud environment. It’s advisable to track changes and amendments made to the Form 990 after filing, as this will keep financial reports consistent and facilitate future filings.

If the IRS raises inquiries about your submission, respond promptly with the requested documentation. Establishing a detailed record-keeping system not only aids in compliance but also prepares your organization for any potential audits, ensuring you can confidently address questions related to your organization’s financial activities.

Frequently asked questions (FAQs)

Organizations may wonder about certain nuances related to Form 990. For instance, "What if my organization doesn’t meet the filing threshold?" In such cases, it is still prudent to keep detailed records as the IRS recommends good governance regardless of formal filing requirements. Another common question is, "How does Form 990 impact public perception of my nonprofit?" A well-prepared Form 990 enhances credibility and can influence donor decisions positively.

Additionally, organizations must recognize the potential for penalties: "Are there penalties for late or incorrect filings?" The IRS imposes fines on organizations that fail to file on time or provide accurate information, potentially damaging an organization’s reputation and funding prospects. The importance of timely and truthful reporting cannot be overstated.

Real-life examples and case studies

Examining success stories of effective Form 990 filing can provide valuable insights for nonprofits. For instance, an organization that filed meticulously documented growth statistics attracted more donations and increased its community engagement. Conversely, some nonprofits faced challenges due to incomplete filing, leading to audits and a tarnished public image. Learning from others’ experiences can help nonprofits refine their reporting and promote transparency.

Interactive tools and resources

To assist organizations further, pdfFiller offers valuable interactive tools such as a Form 990 interactive checklist to guide filing. Additionally, sample completed forms are available for reference, allowing organizations to visualize expectations. Direct links to IRS resources and guidelines serve as essential resources to navigate the complex form-filing landscape.

Conclusion

Utilizing pdfFiller’s services greatly enhances the Form 990 submission process. With user-friendly tools, organizations can seamlessly edit, eSign, and collaborate on their forms. By ensuring each submission is accurate and timely, nonprofits can uphold their commitment to transparency and accountability, ultimately building trust with their supporters and stakeholders.

We invite you to share your nonprofit’s success story and engage with the broader community of organizations dedicated to making a difference.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the form 990 in Chrome?

How do I edit form 990 on an iOS device?

Can I edit form 990 on an Android device?

What is form 990?

Who is required to file form 990?

How to fill out form 990?

What is the purpose of form 990?

What information must be reported on form 990?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.