Get the free Form 990

Get, Create, Make and Sign form 990

How to edit form 990 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 990

How to fill out form 990

Who needs form 990?

Form 990 Form: A Comprehensive How-to Guide

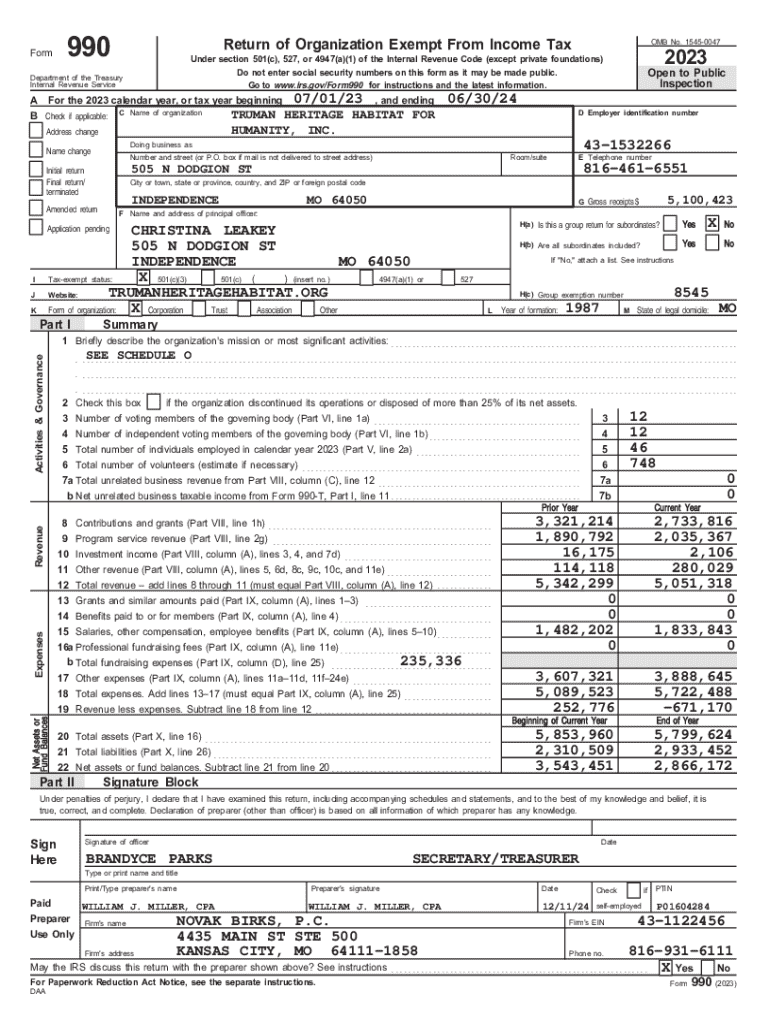

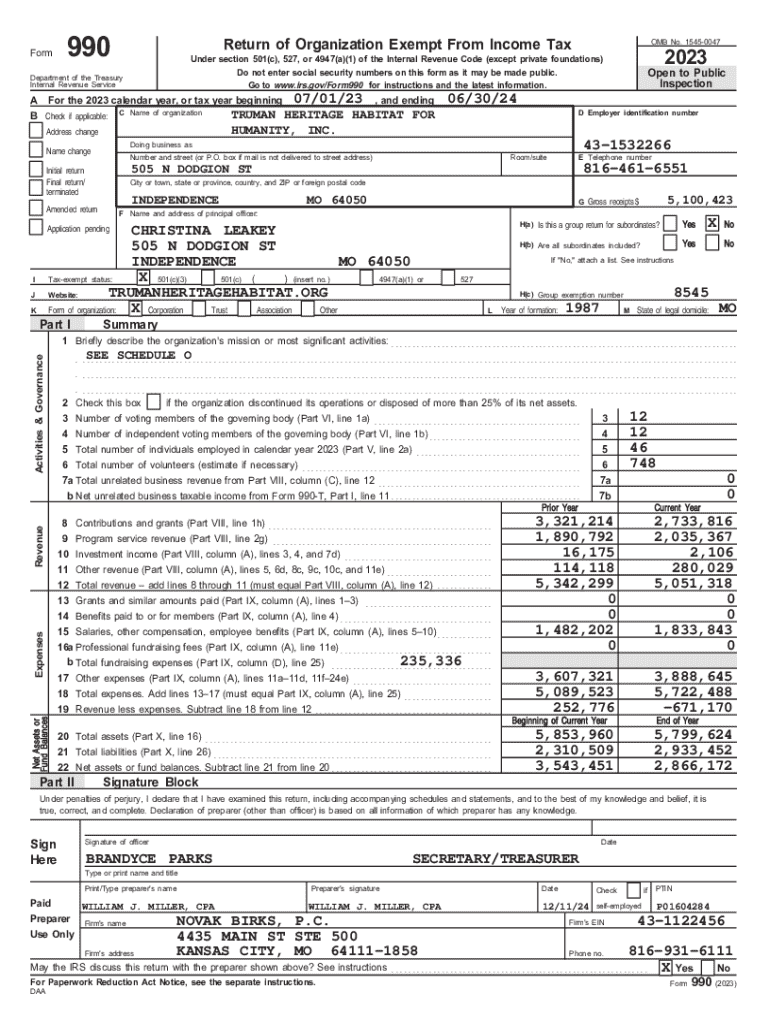

Understanding the Form 990 Form

Form 990 is a crucial document filed by tax-exempt organizations in the United States. It serves multiple purposes, primarily providing transparency regarding the financial health and operations of nonprofit entities to both the IRS and the public. This form is vital for maintaining tax-exempt status and ensuring accountability, as it requires organizations to disclose vital information about their revenue, expenses, and governance practices.

Nonprofits are expected to maintain compliance with federal regulations, and Form 990 plays a key role in this process. By filing this form, organizations contribute to a culture of transparency within the nonprofit sector, which fosters public trust and enhances fundraising efforts. An accurate Form 990 can also provide valuable insights into the effectiveness of a nonprofit’s programs, informing donors and stakeholders.

Who needs to file Form 990?

Not all organizations are required to file Form 990. The eligibility criteria for filing vary based on several factors, including the organization’s size, structure, and activities. Primarily, charitable organizations, private foundations, and certain other tax-exempt organizations must file this form annually. However, there are different types of Form 990, including Form 990-EZ and Form 990-N, each catering to specific organizational needs.

For instance, small organizations with gross receipts below $50,000 may only need to file Form 990-N, also known as the e-Postcard. On the other hand, larger nonprofits often file the more comprehensive Form 990 to provide detailed insights into their operations. Understanding these requirements is essential for compliance to avoid penalties or loss of tax-exempt status.

Key components of Form 990

Form 990 consists of several essential sections that provide a comprehensive overview of the organization. Each section serves a specific purpose, from summarizing the organization's mission to detailing its financial performance. These components include organizational information, financial narratives, and a breakdown of governance structures.

Additionally, organizations must often attach schedules that delve deeper into specific areas, such as compensation for highest-paid employees, fundraising activities, and contributions. Understanding the various components of Form 990 is critical to ensure that all necessary information is accurately reported.

Preparing to fill out Form 990

Before filling out Form 990, it's essential to collect all necessary documentation. This includes financial statements, such as balance sheets and income statements, as well as records related to governance, programs, and fundraising activities. Having these documents ready will streamline the process and ensure accuracy in reporting.

Another critical aspect of preparation is understanding the deadlines for submission. Organizations must typically file Form 990 on the 15th day of the 5th month after the end of their fiscal year. Failing to meet this deadline can result in penalties, including loss of tax-exempt status. Therefore, establishing an internal timeline to ensure timely filing is vital.

Step-by-step guide to completing Form 990

Completing Form 990 requires careful attention to detail and organized information. The process can be broken down into several manageable steps, making it easier for organizations to compile the necessary content.

Using pdfFiller for Form 990

Utilizing pdfFiller can significantly streamline the process of filling out Form 990. This platform offers various features designed to simplify document management for tax-exempt organizations.

One of the standout features is the ability to edit your Form 990 conveniently. You can format sections with ease, ensuring clarity and professionalism in your submission. Additionally, pdfFiller allows for electronic signatures, making it straightforward to finalize your document. Collaboration tools facilitate teamwork, enabling multiple stakeholders to review and contribute to the form efficiently.

Common mistakes and how to avoid them

Even seasoned organizations can stumble during the filing of Form 990, frequently making errors that could have significant implications. Being aware of common pitfalls helps in creating a more accurate submission.

To help minimize errors, conducting a thorough review is essential. Take advantage of pdfFiller’s review features, which allow for easy collaboration and verification among team members before finalizing the document.

Frequently asked questions (FAQs) about Form 990

As organizations tackle the intricacies of Form 990, several common questions frequently arise. Understanding the answers to these questions can provide valuable clarity.

Case studies and examples

Examining real-world examples of Form 990 filings help illuminate best practices and common errors. Successful organizations often showcase well-prepared Form 990 submissions that effectively highlight their mission and accomplishments.

These case studies provide valuable insights into what works and what doesn’t in the reporting landscape, emphasizing the necessity of thorough preparation and strategic communication.

Conclusion: The importance of proper filing

Accurate and timely filing of Form 990 is critical for nonprofits, not just for compliance but also for fostering trust with donors and stakeholders. Proper reporting can open doors to funding opportunities and enhances organizational visibility.

By harnessing tools like pdfFiller, organizations can streamline the document management process, ensuring that their Form 990 is completed efficiently and effectively. This cloud-based platform simplifies the task of filling, editing, signing, and managing essential documents, making it a valuable asset for any nonprofit navigating the complexities of compliance.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit form 990 in Chrome?

Can I sign the form 990 electronically in Chrome?

Can I create an electronic signature for signing my form 990 in Gmail?

What is form 990?

Who is required to file form 990?

How to fill out form 990?

What is the purpose of form 990?

What information must be reported on form 990?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.