Get the free Form 990

Get, Create, Make and Sign form 990

How to edit form 990 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 990

How to fill out form 990

Who needs form 990?

Understanding Form 990: A Comprehensive Guide

Understanding Form 990

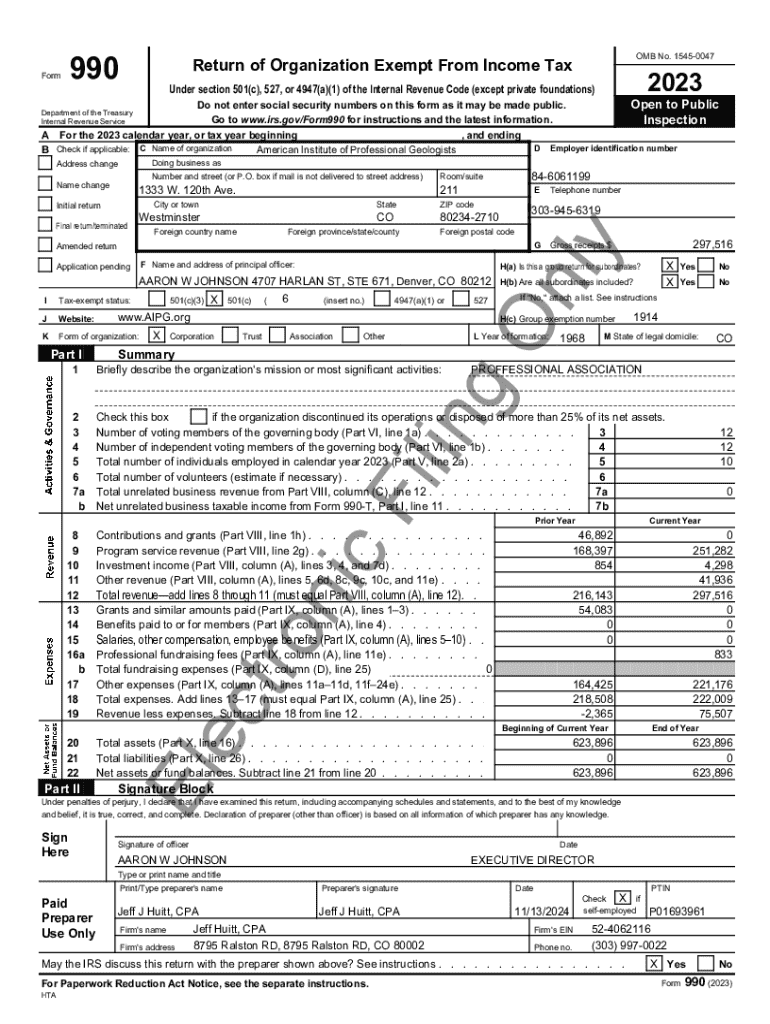

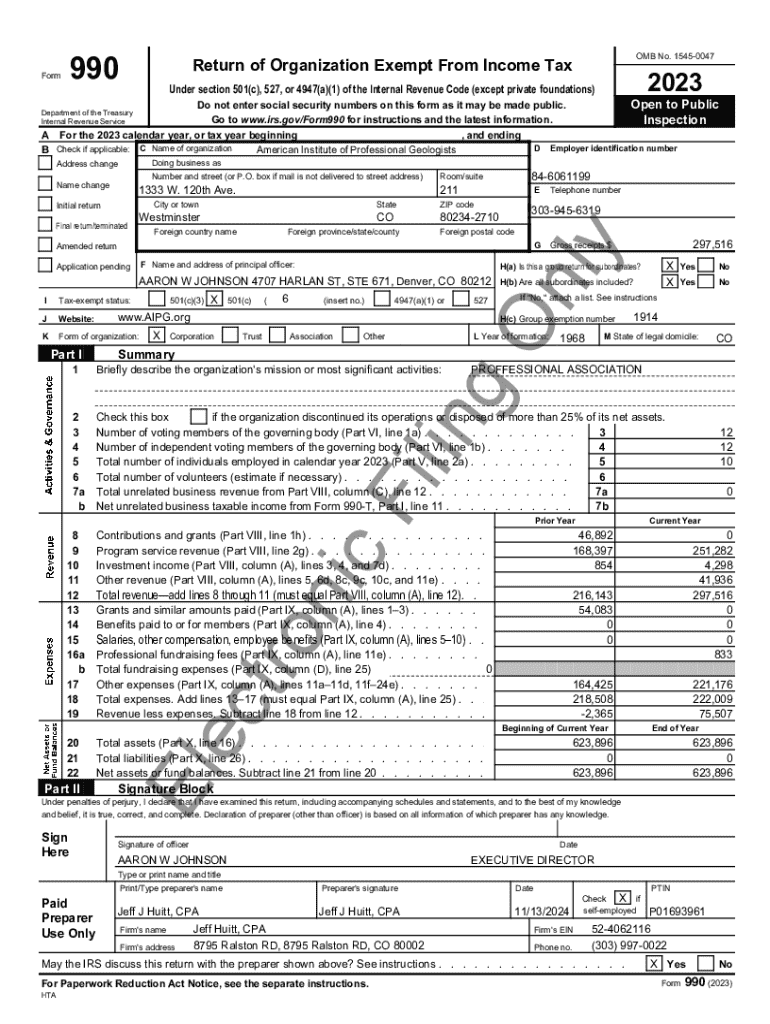

Form 990 is a pivotal document used by tax-exempt organizations, including nonprofits, to provide detailed information about their financial performance, governance, and operational practices. This form, required by the IRS, serves as an annual reporting tool that helps ensure transparency and accountability among organizations that benefit from their tax-exempt status. By filing Form 990, nonprofits can demonstrate their commitment to public trust and financial integrity, crucial for maintaining donor confidence and securing funding.

Types of Form 990

There are several variations of Form 990, specifically designed to cater to organizations of different sizes and complexities. The most common forms include Form 990, Form 990-EZ, and Form 990-N. Each type has specific eligibility criteria regarding the revenue and operational scale of the organization, thus affecting which one needs to be filed.

Importance of Form 990 in the nonprofit sector

Form 990 plays a crucial role in fostering transparency and accountability in the nonprofit sector. By providing comprehensive financial data, it allows stakeholders—including donors, grant-making foundations, and the public—to assess the organization’s performance. This transparency is vital, as it builds trust and credibility, which are essential for nonprofits to thrive in a socially conscious funding environment. Organizations that consistently file Form 990 demonstrate their commitment to responsible management of donor funds.

Funding and compliance

The ability to secure funding hinges significantly on an organization’s reputation and financial integrity. Accurate Form 990 filings provide potential funders with essential insights into an organization's revenue streams and expenditure allocations. Furthermore, adherence to IRS compliance guidelines mitigates risks associated with late filings or inaccuracies, which could otherwise jeopardize an organization’s tax considerations and future funding opportunities.

Components of Form 990

Form 990 consists of several critical components that paint an overall picture of an organization's financial health and operational practices. Understanding these components will enable organizations to fill out the form accurately and completely. Among these components, basic identification information, financial overviews, expense breakdowns, governance disclosures, and additional schedules must be addressed.

Step-by-step instructions on filling out Form 990

Filling out Form 990 can be a daunting task, but following a structured approach can ease the process. Start by gathering all necessary information ranging from financial records to governance structures. Establishing a timeline can help streamline the filing process and minimize last-minute rushes. Each section of Form 990 should be completed carefully, ensuring accurate representation of your organization’s activities.

Tools and resources for Form 990 management

Utilizing effective tools and resources simplifies the management of Form 990. One of the prime solutions available is pdfFiller. This cloud-based platform allows users to fill out, edit, eSign, and manage their Form 990 seamlessly, ensuring that all aspects of document manipulation are accommodated from a single interface. Knowing how to leverage such technology aids in ensuring compliance, safeguarding tax-exempt status, and building better governance practices.

FAQs about Form 990

It’s natural to have questions when navigating the Form 990 filing process. Many organizations may wonder what happens if the form is filed late, how to amend a submitted Form, or if all nonprofits are obligated to file. Addressing these common inquiries reinforces the importance of understanding the regulations governing Form 990, as well as the implications of compliance, or lack thereof.

In addition to common questions, specialized scenarios exist that touch upon unique types of organizations, such as charities or private foundations, that may flow differently in respect to the requirements and obligations of Form 990.

Best practices for future Form 990 filings

Proper planning for Form 990 is critical. Establishing a robust recordkeeping system ensures that accurate financial records are maintained year-round, reducing the burden near the filing deadline. Staying informed about potential changes in IRS regulations can also prepare organizations for necessary adjustments. Utilizing tools like pdfFiller for ongoing compliance can offer insights into how adjustments may impact future filings.

Interactive tools for Form 990 engagement

Engagement with Form 990 can be enhanced through various interactive tools, helping organizations visualize their data better and streamline the filing process. Digital templates and sample forms can serve as guides for newcomers or those revisiting the process, ensuring accuracy and efficiency with every submission. Additionally, interactive checklists can help organizations track their progress and completion status, reducing the likelihood of oversights in their filings.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify form 990 without leaving Google Drive?

How can I send form 990 to be eSigned by others?

How do I execute form 990 online?

What is form 990?

Who is required to file form 990?

How to fill out form 990?

What is the purpose of form 990?

What information must be reported on form 990?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.