Insurance Certification Template Form: A Comprehensive Guide

Overview of insurance certification

Insurance certification serves as a formal document that verifies an individual’s or a business's insurance coverage. This certificate often holds significant implications, as it is commonly required by third parties—such as clients or lending institutions—to prove that the necessary insurance is in place. Understanding how insurance certification works is crucial, especially given its role in risk management and legal compliance.

Various types of insurance certifications exist, including certificates of liability insurance, property insurance, and workers' compensation, among others. Each type serves a distinct purpose and often is formatted differently. Accordingly, having the right insurance certification template form ensures clarity and compliance with specific requirements.

Importance of an insurance certification template

Using an insurance certification template form plays a vital role in streamlining documentation processes. The template standardizes the information required, promoting efficiency while reducing errors that can arise from inconsistent formatting and data entry. This is especially important for individuals and teams who frequently manage multiple forms across different accounts or insurance types.

Furthermore, compliance with legal and organizational standards is a paramount concern. Different sectors have specific regulations regarding insurance coverage that must be adhered to. Utilizing a well-structured template ensures that all necessary components are included, which in turn supports compliance with local laws and industry standards.

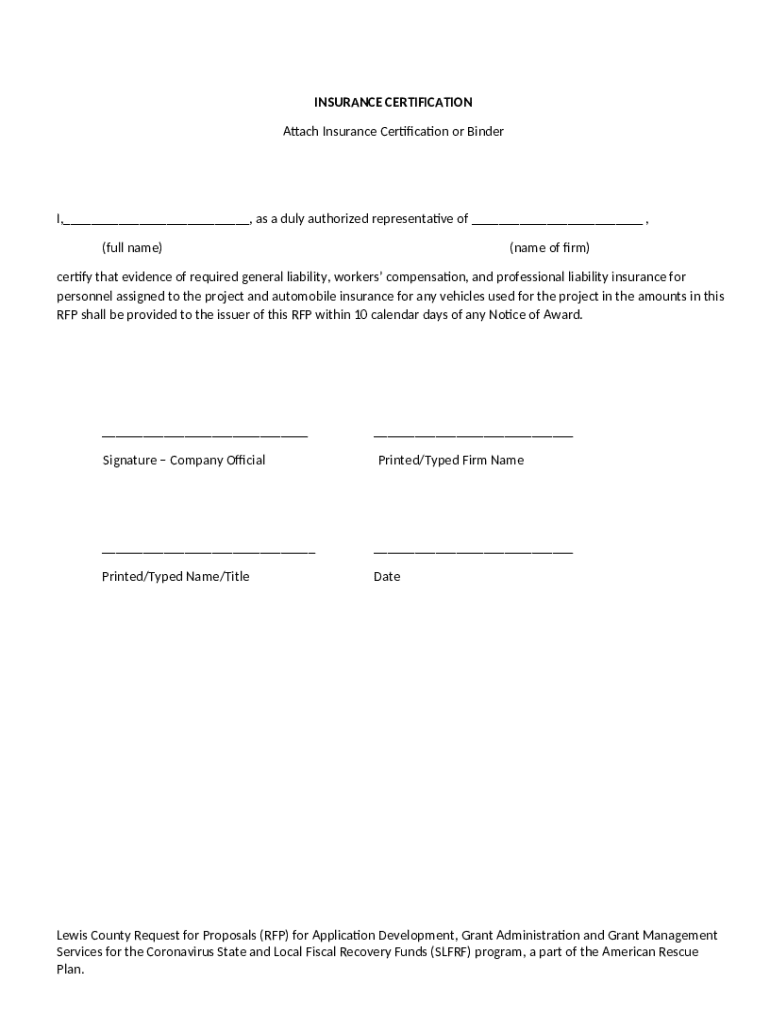

Components of an insurance certification template

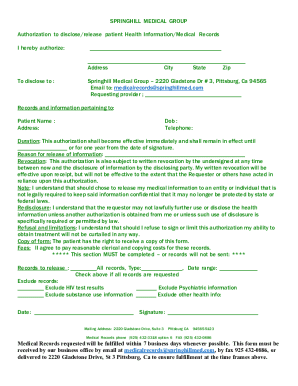

A well-designed insurance certification template should include essential fields that provide all necessary information at a glance. Key components often include:

The name and contact details of the individual or organization covered by the insurance.

The name and contact information of the insurance company providing the coverage.

An overview of the insurance coverages in place, including limits and types.

While these elements are foundational, additional optional fields might enhance the template. For instance, endorsements or additional coverage options can be valuable additions, especially for businesses with complex insurance needs. When formatting the document, keeping it clear and easy to read is crucial; the use of recommended font styles and sizes can significantly contribute to the document's professional appearance.

Step-by-step guide to filling out the insurance certification template

Filling out your insurance certification template correctly requires careful attention and preparation. Here’s a step-by-step approach:

Gather all necessary documents and information. This may include your insurance policy details, contact information, and past certification examples.

Enter complete and accurate details about the policyholder. It’s essential to verify this information to avoid any discrepancies later.

Include the insurance provider’s details. Contact your insurance provider if you need clarification or confirmation of specific details.

Include relevant coverage details tailored to the specific type of insurance. For instance, the coverage limits for general liability would differ from those in property insurance.

Before submission, thoroughly check all entries for accuracy. Utilize checklists or peer reviews to enhance the verification process.

Customization options for your template

Customization is key to ensuring your insurance certification template meets your unique needs. pdfFiller provides an array of interactive tools that allow for tailored edits. For example, the platform enables users to modify templates directly within the system, adding specialized fields relevant to their industry or organization.

Moreover, collaboration tools on pdfFiller allow users to share the document with team members for input and approval. This feature ensures that everyone who needs to be involved in the certification process can provide timely feedback and make necessary adjustments before finalization.

Common mistakes to avoid when using the template

Even with the best templates, errors can occur. Here are some common pitfalls to steer clear of:

Always ensure that the details provided accurately reflect the insurance policy to avoid legal implications.

Insurance details can change; ensure financial and coverage updates are reflected in your certification.

Finalizing the document typically requires signatures from both the policyholder and insurance provider; failing to include these can render the certification invalid.

Troubleshooting and FAQs

Encountering issues while using your template is not uncommon. If you face difficulties, pdfFiller offers robust support options. You can access guided tutorials or reach out to customer support directly through the platform. Common questions, such as 'What if I need to make a change after submission?' can often be addressed through readily available FAQs.

Focusing on clarity and ensuring all elements are correct significantly reduces the need for follow-up inquiries. It’s wise to consult the platform’s resources if uncertain about any processes associated with your insurance certification.

Next steps after completing the insurance certification

Once you've finalized your insurance certification template form, understanding the submission protocols is the next crucial step. Submission may vary based on the requirements of the third party requesting the certification, whether that involves email, hard copy, or online submission portals. Knowing where and how to submit your documentation can simplify the process.

Tracking submissions is equally important. pdfFiller allows users to monitor their documents, ensuring you know when it has been received and processed by the covering entity. Utilizing available tracking tools can prevent misunderstandings and help you maintain clear communication lines with involved parties.

Benefits of using pdfFiller for your insurance certification needs

pdfFiller was designed with extensive features focused on document management. The platform's eSigning capabilities simplify the process of obtaining necessary agreements from involved parties, making it easy to keep track of signed documents in one central location.

With cloud-based solutions, your documents are accessible from anywhere with an internet connection. This poses significant advantages for those needing to make real-time edits or share information swiftly, especially for teams working across different geographical locations.

Contacting customer support

For users needing assistance with their insurance certification template form, pdfFiller’s customer service can be reached through various channels. Quick links to help resources are available on the website, ensuring easy navigation to find the support you need.

Live chat options and comprehensive tutorials can help users maximize their experience on the platform. Engaging with customer support provides an additional layer of confidence in using the template, ensuring expectations are met and processes run smoothly.