Get the free Form 990

Get, Create, Make and Sign form 990

How to edit form 990 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 990

How to fill out form 990

Who needs form 990?

A Comprehensive Guide to Form 990

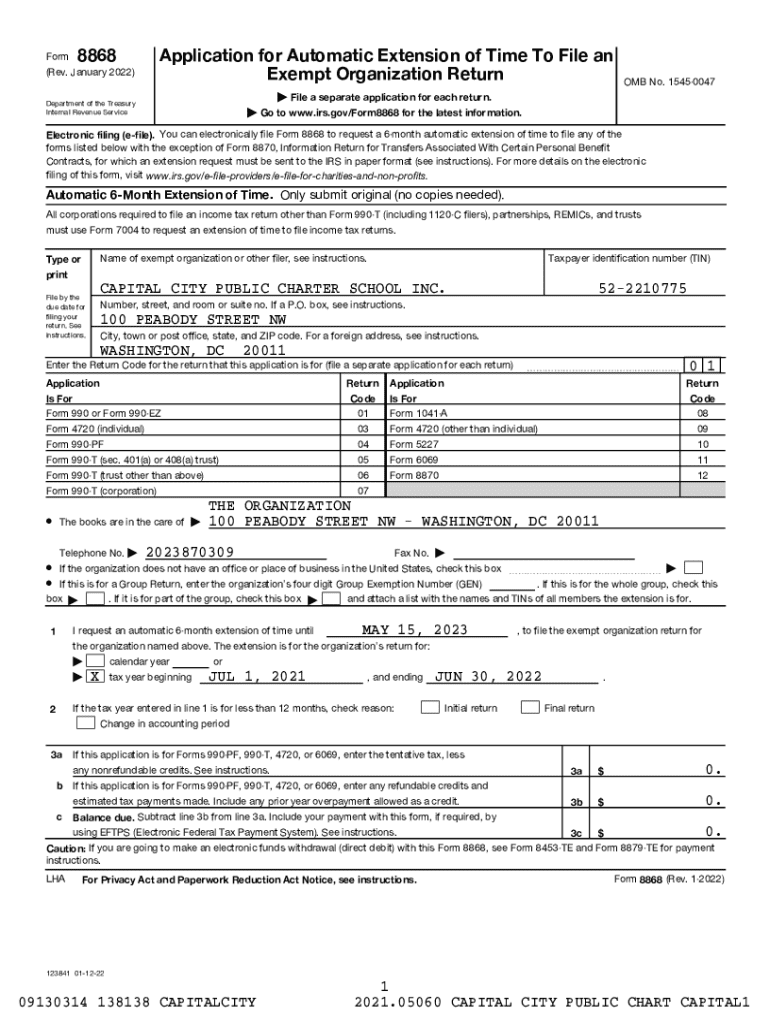

Understanding the Form 990

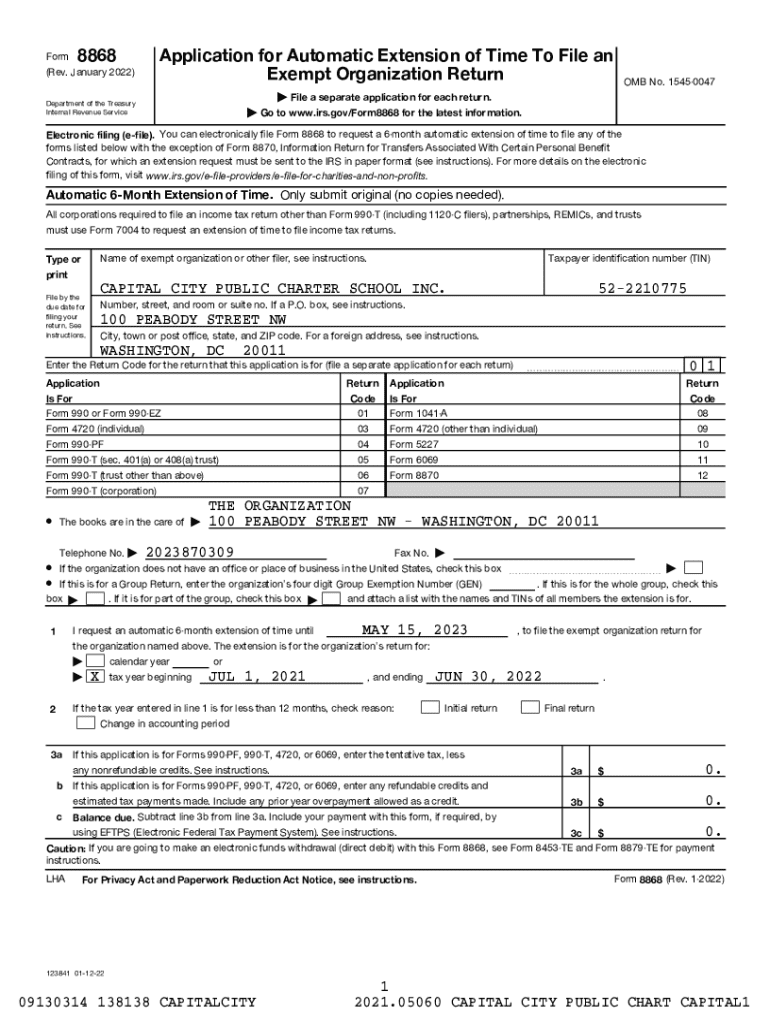

Form 990 is the annual information return that tax-exempt organizations in the United States must file with the Internal Revenue Service (IRS). It serves as a public document to provide transparency regarding the financial activities of nonprofit organizations, detailing their income, expenditures, and various operational activities. Nonprofit entities—including charities, foundations, and certain non-profit educational organizations—are required to submit this form to maintain their tax-exempt status.

The importance of Form 990 cannot be overstated. It allows the IRS and the public to monitor the financial health of nonprofits, ensuring that they operate within the confines of their tax-exempt status. This form is crucial for accountability, helping maintain public trust, and facilitating informed donor decisions.

Types of Form 990

The IRS provides several versions of Form 990 to accommodate different types of organizations and their size. Understanding the distinctions between these forms is essential for compliance and accurate reporting.

Special cases exist as well, such as Form 990-PF which is specifically for private foundations and Form 990-T for organizations reporting unrelated business income. Each form serves its unique set of requirements tailored to the organizational structure and size.

Detailed breakdown of the form sections

Form 990 consists of several key parts, each dedicated to specific areas of financial reporting and organizational governance.

Filling out the Form 990: Step-by-step guide

Completing Form 990 can be streamlined with proper preparation and an understanding of the required information. Start by gathering essential documents—this includes financial statements, management structure details, and statements of past accomplishments. Ensuring all team members are aligned and aware of their roles in providing information can save time and prevent errors.

Next, delve into filling out each section carefully. Pay attention to the definitions of income and expenditures as stated by the IRS to avoid misreporting. Utilize spreadsheets for organizing financial data before inputting it into the form to ensure accuracy.

Interactive tools for managing Form 990

Managing Form 990 electronically can greatly simplify the process. Several online tools are available that can assist organizations in completing and filing this vital document. For instance, pdfFiller aids nonprofits in creating, editing, signing, and sharing Form 990 with unparalleled ease.

The platform provides guided completion features to lead users through each step of the form, minimizing the risk of missing key information. Furthermore, utilizing cloud-based document management allows teams to collaborate seamlessly, ensuring that multiple stakeholders can contribute and review essential parts without the hassle of paperwork.

Frequently asked questions about Form 990

Navigating the complexities of Form 990 can sometimes lead to questions or concerns. Here are some common queries organizations might have filled with advice.

Recent changes and updates to Form 990

Staying informed about the latest changes to Form 990 is crucial for compliance. The IRS periodically updates various sections of the form to reflect new regulatory requirements or enhance transparency. For instance, recent revisions may include more detailed disclosures on governance and financial reporting.

These updates can have significant implications for how nonprofits disclose their activities. Organizations need to familiarize themselves with these changes and assess how they can adapt their practices to remain compliant and uphold transparency.

Best practices for filing Form 990

Maintaining a proactive approach throughout the year can ease the pressure during the filing period. Implement robust record-keeping practices that ensure you're tracking income and expenses accurately on a consistent basis.

Consider engaging a CPA or financial advisor to assist in preparing your Form 990. They can provide invaluable expertise in navigating the complexities of not only the form itself but also ensuring compliance with IRS guidelines.

Resources for additional guidance

Organizations seeking more information about Form 990 can benefit greatly from available resources. The IRS provides extensive guidance and materials specifically tailored for nonprofit entities. Furthermore, professional organizations and local nonprofit networks offer workshops and training on effective filing practices.

Next steps after filing Form 990

Once Form 990 is filed, organizations should ensure that they retain copies of submitted forms and related documentation for their records. This will be useful in case of follow-up queries from the IRS or audits. Additionally, organizations can leverage data from their Form 990 filings for subsequent fundraising campaigns or grant applications.

Anticipating potential IRS questions or clarifications post-filing is also prudent. This understanding can assist organizations in being proactive in addressing areas that might attract scrutiny, ensuring continued compliance and transparency.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send form 990 for eSignature?

Can I create an eSignature for the form 990 in Gmail?

How do I fill out the form 990 form on my smartphone?

What is form 990?

Who is required to file form 990?

How to fill out form 990?

What is the purpose of form 990?

What information must be reported on form 990?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.