Get the free Form 990

Get, Create, Make and Sign form 990

Editing form 990 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 990

How to fill out form 990

Who needs form 990?

Everything You Need to Know About IRS Form 990

Understanding Form 990: A Comprehensive Overview

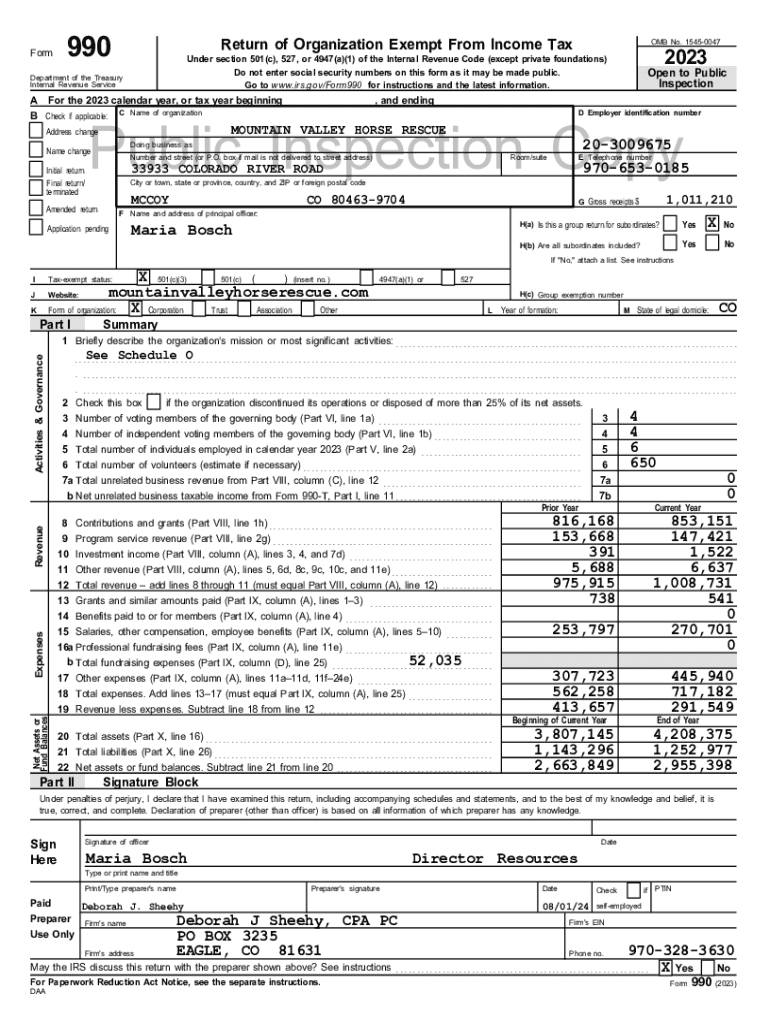

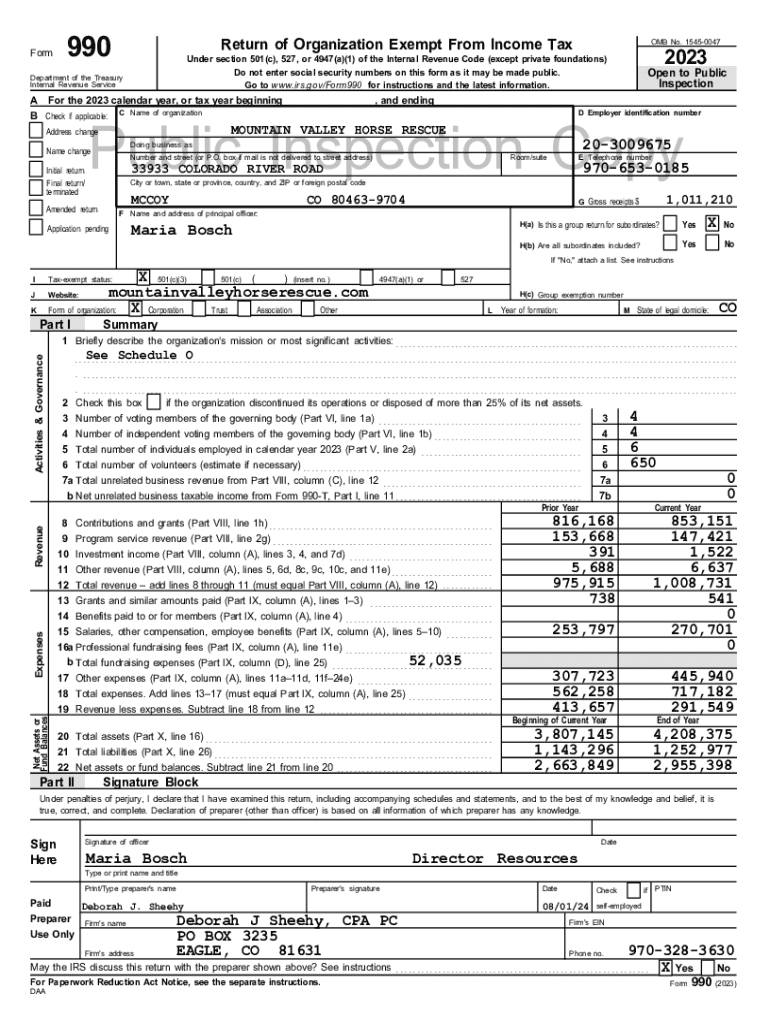

IRS Form 990 is a critical document that non-profit organizations must file annually to provide the Internal Revenue Service (IRS) with detailed insight into their financial activities. This form serves to promote transparency and accountability within the non-profit sector, ensuring that organizations uphold their commitment to public service.

The importance of Form 990 cannot be understated; it not only aids in maintaining tax-exempt status but also builds trust with donors and stakeholders by providing clear visibility into the organization's revenue sources and expenditures.

Types of filers for Form 990

Different organizations have different requirements for filing. Non-profits can file one of several versions of Form 990, depending on their size and revenue. The main forms include Form 990, Form 990-EZ, and Form 990-N, each catering to different levels of compliance.

Understanding these differences is crucial for organizations to ensure they file the correct form. Form 990 is for larger organizations with over $200,000 in gross receipts or $500,000 in assets, while Form 990-EZ is a simplified version for those with less than those amounts. Form 990-N, or the e-Postcard, is for small organizations with gross receipts under $50,000.

Key elements and structure of Form 990

Form 990 is structured into multiple parts (I to XII), each focusing on different aspects of the organization's operations and financial status. Major sections include revenue and expenses, balance sheets, governance, and management disclosures.

Eligibility criteria for filing Form 990

Not all organizations are required to file Form 990. Generally, organizations that are recognized as tax-exempt under Section 501(c)(3) of the IRS code need to file, but there are exceptions based on revenue and operational status.

Small non-profits with annual gross receipts under $50,000 can file Form 990-N instead. Earning less than the threshold for Form 990-EZ also exempts organizations from filing the longer form, allowing for the simpler e-Postcard submission instead.

Preparing to fill out Form 990

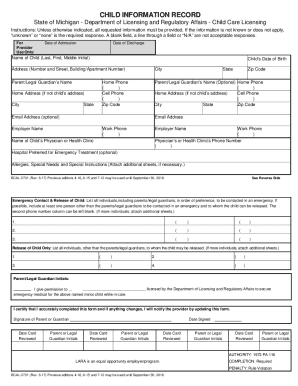

Preparation is key when filling out Form 990. Gathering essential financial data, previous year’s tax return, and organizational documents is critical to accurately completing this form. This preparation helps avoid common pitfalls that can delay processing or lead to compliance issues.

Essential documentation includes financial statements that detail income, expenses, and other financial activities from the past year. Knowing what to collect beforehand ensures a smoother and more organized filing process.

Step-by-step instructions for filling out Form 990

Filling out Form 990 requires careful attention to each section. Start with Part I, which summarizes revenue and expenses, breaking down income sources accurately to depict the organization's financial health.

It's important to be meticulous, especially when categorizing expenses. Missing or misreporting expenses can lead to audits or loss of tax-exempt status.

Editing and reviewing Form 990

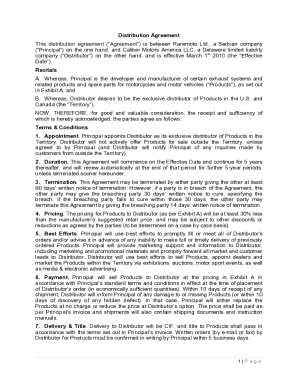

After filling out Form 990, it's crucial to edit for accuracy. Utilizing tools like pdfFiller’s editing features can help streamline the review process. Utilize its capabilities to highlight inconsistencies, and ensure clarity throughout the document.

Collaborating with team members for a thorough review can help catch errors that one might overlook. Shared editing features allow multiple users to provide input, enhancing the collective accuracy of the submission.

Submitting Form 990

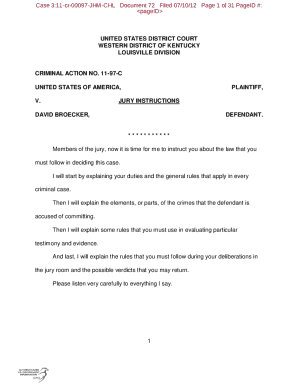

Form 990 can be submitted electronically, which is the preferred method due to its efficiency and confirmation of receipt. Electronic submissions can be made via the IRS e-File system, ensuring timely processing.

For organizations opting for paper filing, ensure to follow strict guidelines for mailing and retain copies of the documents sent. Submit by the designated deadlines to avoid penalties or loss of tax-exempt status.

Frequently asked questions about Form 990

Form 990 is a frequently misunderstood aspect of non-profit compliance. Knowing what happens after filing can alleviate concerns for many organizations. After submission, the IRS reviews the form as part of their oversight responsibilities.

Public access to Form 990 records through websites like GuideStar can aid transparency by allowing donors and stakeholders to evaluate non-profits before contributing. This is central to maintaining community trust.

Managing Form 990 after filing

Post-filing activities are crucial for maintaining compliance with IRS regulations. Keeping detailed records and supporting documents is vital for future filings and audits. Ensuring all necessary documentation is organized and accessible will help simplify any inquiries or follow-ups from the IRS.

It’s also essential to plan for future Form 990 filings by staying updated on changes in IRS requirements and adjusting documentation and practices accordingly to reflect organizational growth or changes in operational scope.

Interactive tools and resources

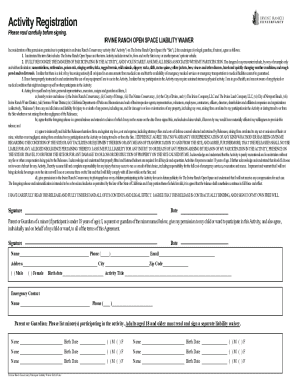

Utilizing interactive tools can enhance the Form 990 filing process. pdfFiller offers resources that guide users through each section of the form. With its cloud-based platform, users can easily edit, sign, and manage documents efficiently.

Linking to IRS resources ensures that organizations have access to the most current information regarding Form 990 and any recent changes to the filing process.

Navigating common challenges with Form 990

Filing Form 990 can come with complexities, particularly for organizations with multifaceted financial situations or those undergoing changes in governance. Addressing these common challenges with strategic solutions can alleviate stress during the filing process.

Resources for support include tax professionals who are well-versed in non-profit compliance and can provide guidance on tricky situations. Utilizing the right tools can also ease the process and ensure accuracy.

Finding more by

Exploring additional resources can provide deeper insights into the world of Form 990 and non-profit management. Tools for searching related forms and templates can facilitate the documentation process for organizations aiming to streamline their reporting efforts.

User testimonials and case studies regarding successful filings through platforms like pdfFiller can inspire confidence and provide real-world examples of effective filing practices.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in form 990 without leaving Chrome?

Can I create an electronic signature for signing my form 990 in Gmail?

How do I fill out the form 990 form on my smartphone?

What is form 990?

Who is required to file form 990?

How to fill out form 990?

What is the purpose of form 990?

What information must be reported on form 990?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.