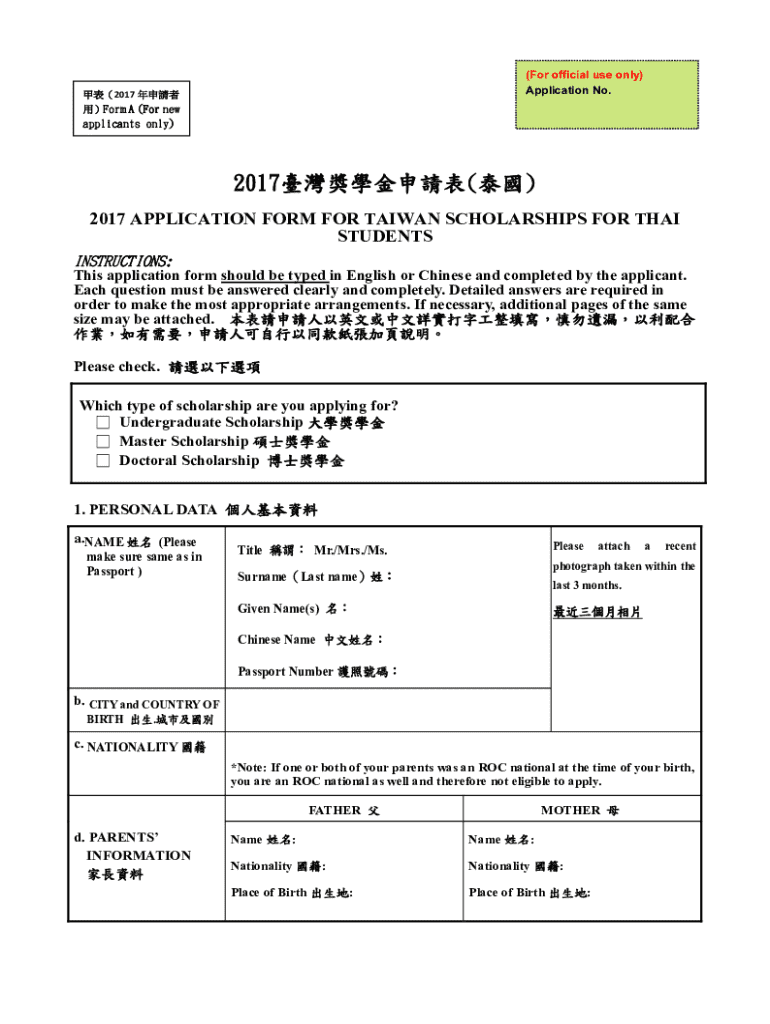

Get the free 2017臺灣獎學金申請表(泰國)

Get, Create, Make and Sign 2017

Editing 2017 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2017

How to fill out 2017

Who needs 2017?

2017 Form: A Comprehensive Guide for Taxpayers

Overview of the 2017 Form

The 2017 Form encompasses a variety of tax documents that reflect financial activities during the tax year. Understanding this form is crucial for taxpayers to comply with the tax department regulations and ensure accurate reporting of income.

Filing the 2017 form is significant for both individuals and businesses. For individuals, it lays out their income and deductions, ultimately determining tax obligations or potential refunds. For teams in business, it serves as a way to report employees' income and tax withholdings, affecting financial planning for both the employees and the organization.

Types of 2017 forms available

The 2017 form includes various types designed for specific taxpayer needs. For personal income tax, the most common forms are the 1040, 1040A, and 1040EZ, each catering to different types and levels of financial complexity.

For businesses, forms such as W-2s and 1099s come into play. The W-2 reports wages paid to employees, while 1099s are essential for reporting various types of income other than wages, tips, or salaries, serving freelancers and contractors.

Preparing to fill out the 2017 form

Preparation is key when it comes to filling out the 2017 form. Start by gathering the necessary documents such as W-2s, 1099s, and any relevant receipts. This ensures you have all information at hand to complete your tax filing accurately.

Understanding eligibility requirements concerning tax credits and deductions is also crucial. Consider income thresholds and your filing status—individual, head of household, or married filing jointly—as these factors influence available tax benefits.

Step-by-step instructions for completing the 2017 form

Using pdfFiller simplifies the process of filling out the 2017 form. The platform's user interface is intuitive, making document editing a breeze, and you can easily select the appropriate 2017 form template.

eSign and collaboration features of pdfFiller

pdfFiller offers seamless eSign capabilities, allowing users to digitally sign the 2017 form quickly. This feature helps ensure the form is legally valid and ready for submission without the hassle of printing and scanning.

Additionally, collaboration features enable sharing of your completed form with colleagues or tax professionals for review. This is particularly beneficial in ensuring that no detail is overlooked before submission.

Managing your 2017 form and records

Storing tax documents securely is essential. pdfFiller provides reliable cloud storage capabilities, allowing you to keep your 2017 form as well as related records accessible yet secure.

In addition, pdfFiller makes it easy to access past forms whenever needed. This can be particularly helpful during audits or when applying for certain benefits that require proof of taxpayer history.

Common mistakes and how to avoid them

When filling out the 2017 form, many taxpayers encounter common pitfalls. Frequent errors include misreporting income, omitting eligible deductions, and failing to double-check personal information. Staying alert to these potential issues can save time and prevent audit triggers later on.

If you find yourself struggling with any section of the 2017 form, numerous resources are available for assistance. Tax professionals, community organizations, and even online platforms like pdfFiller offer valuable guidance.

FAQs about the 2017 form

Many taxpayers often have questions regarding the 2017 form. Common queries include how to handle specific deductions or what to do if an error is found after submission.

Getting help and support

If you're seeking assistance in navigating the complexities of the 2017 form, pdfFiller offers extensive support. Their support team can be reached through various channels, including chat, email, and phone.

Moreover, users can access a wealth of online resources, such as step-by-step guides and tutorials to equip them with everything needed to complete their tax obligations confidently.

About pdfFiller

At pdfFiller, our mission is to empower users with tools that simplify document creation and management. Providing a platform where individuals and teams can efficiently edit PDFs, eSign, and collaborate sets us apart in the marketplace.

Our commitment to community and customer feedback is at the core of our operations. We continuously strive to enhance our offerings based on user needs, ensuring that pdfFiller remains a reliable solution for document management.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the 2017 electronically in Chrome?

Can I edit 2017 on an iOS device?

How do I complete 2017 on an iOS device?

What is 2017?

Who is required to file 2017?

How to fill out 2017?

What is the purpose of 2017?

What information must be reported on 2017?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.