Get the free form 4506 c instructions

Get, Create, Make and Sign 4506 c form

Editing form 4506 c instructions online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 4506 c instructions

How to fill out form 4506-c instructions

Who needs form 4506-c instructions?

Form 4506- Instructions Form: A Comprehensive Guide

Understanding Form 4506-

Form 4506-C is a request form used by taxpayers to obtain a copy of their tax return transcripts from the IRS. This form plays a crucial role in various financial contexts, particularly when obtaining loans. Its significance is amplified by its use in Small Business Administration (SBA) loan applications, where lenders require verification of income to assess an applicant’s financial standing.

Primarily, Form 4506-C serves to give taxpayers a simple mechanism to access their tax records, which can be vital for personal tax filers, business owners, and teams preparing loan applications. The clarity and transparency this form provides are essential for both the IRS's efficiency and the borrower’s ability to secure necessary funding.

Who needs to use Form 4506-?

Individuals seeking personal loans, business owners applying for SBA loans, and professionals filing tax-related documents are among those who must use Form 4506-C. Key distinctions emerge between individuals filing for personal purposes and teams collaborating on business loan applications. Individuals may require this form for their own financial assessments, while teams could need it for collective documentation and loan submission.

Common scenarios that necessitate this form include securing a mortgage, applying for business loans, or verifying income and tax history for other financial processes. Individuals and businesses alike find that understanding when and how to use Form 4506-C streamlines their application procedures and fosters better communication with financial institutions.

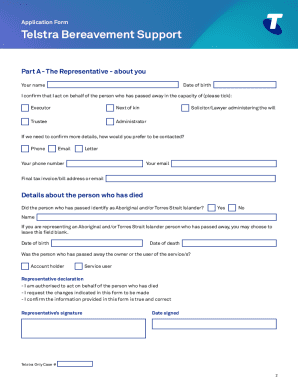

Detailed instructions for completing Form 4506-

Completing Form 4506-C accurately is essential for receiving timely and correct tax return information. Here’s a step-by-step guide to ensure you fill out the form correctly.

Step-by-step guide

Common mistakes to avoid

Some frequent errors include incorrect TINs, missing signatures, and providing an invalid mailing address. Double-checking all information is critical to prevent delays or denials of your request.

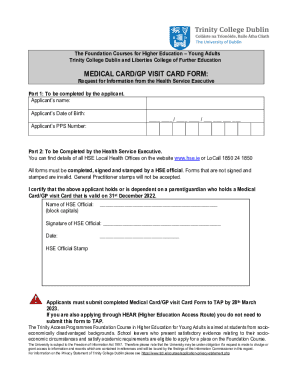

Tips for editing and signing your Form 4506-

Using tools like pdfFiller can significantly simplify the editing process for Form 4506-C. With pdfFiller, you can access the latest version of the form directly from any device, allowing you the flexibility to fill in details at your convenience.

Using pdfFiller for seamless editing

When you access Form 4506-C on pdfFiller, you can take advantage of features such as auto-fill options, reusable templates, and easy navigation. These enhancements eliminate confusion and streamline the form-filling process.

Adding your electronic signature

To add your electronic signature on pdfFiller, follow these simple steps: first, navigate to the signature section of the form. Then you can select from options to draw, type, or upload an image of your signature. pdfFiller implements security measures to ensure your signature remains secure, providing peace of mind as you finalize your document.

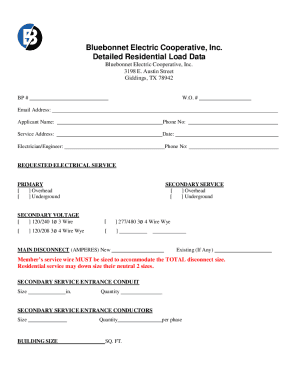

Managing your Form 4506-

Once you've completed Form 4506-C, efficient document management becomes crucial. With pdfFiller's cloud-based management system, users can store and retrieve their forms from anywhere, making it easier to keep all your essential documents organized.

Storage and access from anywhere

Make use of the cloud storage feature in pdfFiller to systematically organize your documents for easy retrieval. You can create folders for different categories of forms, allowing quick access whenever you need them.

Collaboration features

If you're part of a team, pdfFiller enables collaboration on Form 4506-C. You can invite colleagues to review, edit, and sign the document collaboratively, which is particularly beneficial for teams working on business loan applications. Setting permissions and tracking changes ensures security and accountability throughout the process.

Frequently asked questions (FAQs)

Addressing common concerns about Form 4506-C can help clarify the process for users. Here are some of the frequently asked questions surrounding this form.

Related documents

In addition to Form 4506-C, there are other forms that facilitate income verification. For instance, Form 4506-T enables taxpayers to request a transcript for verification without necessarily requesting a copy of their tax return.

SBA loan documentation

When applying for an SBA loan, having supporting documents like Form 4506-C is vital. This form is often required alongside financial statements and other documentation to provide a comprehensive picture of your financial health.

Special announcements

It's essential to stay updated on IRS policies that may affect the processing of Form 4506-C. Recent announcements have indicated improved processing systems, which may expedite requests.

pdfFiller features for enhanced document management

pdfFiller continues to evolve its platform with innovative tools for IRS form handling. These new features are designed to improve user experience and streamline form management effectively.

Footer navigation

For additional resources on handling IRS forms, pdfFiller offers a variety of how-to guides and tools tailored for various documents. Users can easily navigate the platform to access these resources.

If you have questions regarding Form 4506-C or any other form-related queries, pdfFiller provides support channels for timely assistance.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit form 4506 c instructions online?

Can I create an electronic signature for the form 4506 c instructions in Chrome?

How can I fill out form 4506 c instructions on an iOS device?

What is form 4506-c instructions?

Who is required to file form 4506-c instructions?

How to fill out form 4506-c instructions?

What is the purpose of form 4506-c instructions?

What information must be reported on form 4506-c instructions?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.