Get the free C3 Cash Receipts Monetary Contributions - web pdc wa

Get, Create, Make and Sign c3 cash receipts monetary

Editing c3 cash receipts monetary online

Uncompromising security for your PDF editing and eSignature needs

How to fill out c3 cash receipts monetary

How to fill out c3 cash receipts monetary

Who needs c3 cash receipts monetary?

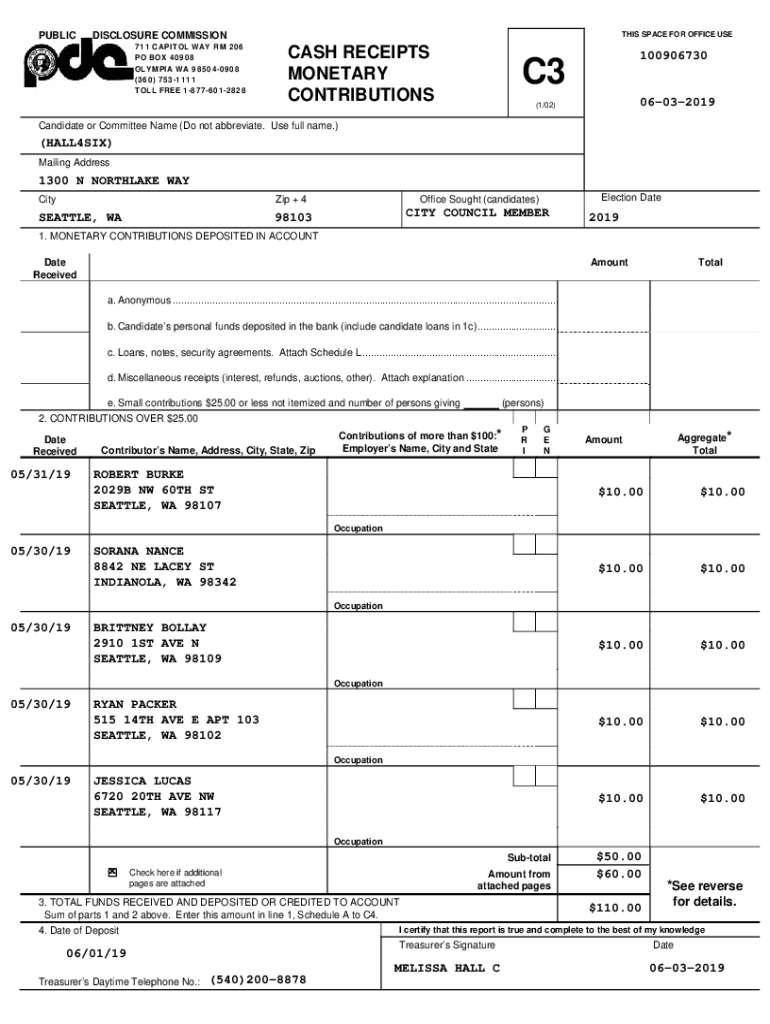

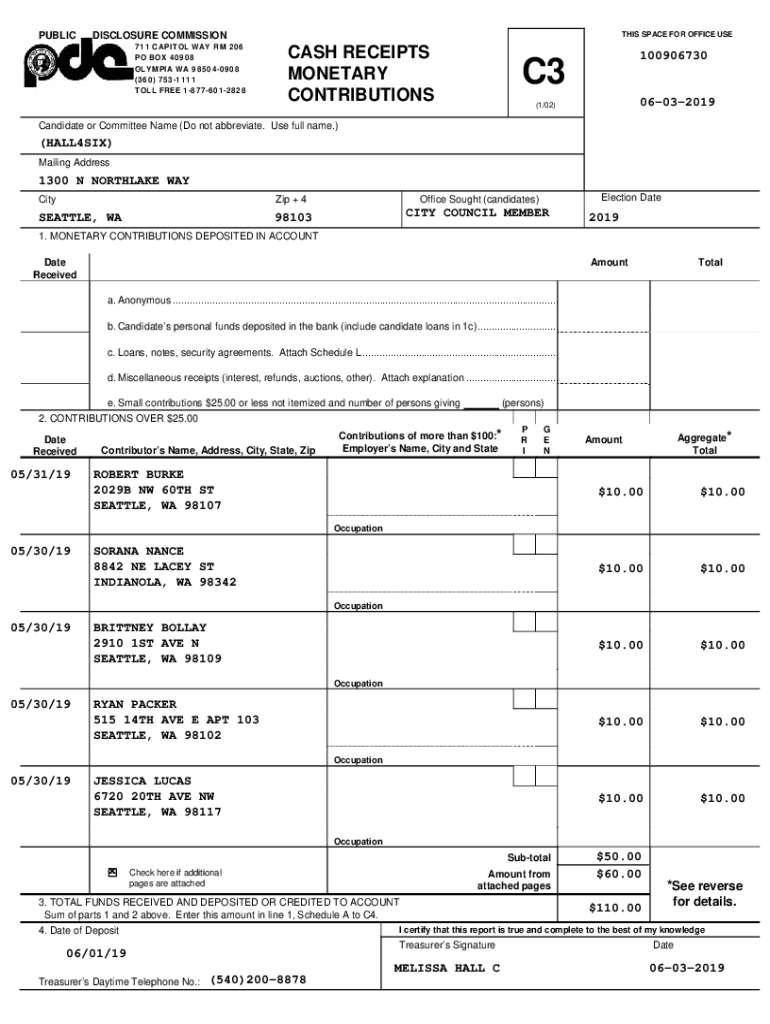

Understanding the C3 Cash Receipts Monetary Form: A Comprehensive Guide

Overview of C3 Cash Receipts

The C3 Cash Receipts form is a vital document utilized by organizations, especially within the nonprofit sector, to acknowledge monetary contributions received. This form serves as both a receipt for the donor and an essential tracking tool for the receiving organization, ensuring that all financial transactions are accurately recorded and reported. By implementing such formalized documentation, organizations can uphold transparency and accountability in their financial operations.

The significance of the C3 Cash Receipts form cannot be overstated. Accurate financial tracking is essential for maintaining donor trust and ensuring compliance with tax regulations. This form plays a pivotal role in documenting contributions, making it easier for organizations to manage their finances effectively.

Importance of C3 Cash Receipts in Financial Management

The C3 Cash Receipts form is an integral part of record-keeping practices within any organization. Its primary function is to enhance transparency regarding monetary contributions. When donors receive a C3 Cash Receipts form, they gain assurance that their contributions are documented and recognized. This is particularly crucial in the nonprofit sector, where trust and credibility are paramount.

Moreover, the role of C3 Cash Receipts extends beyond mere documentation; it significantly facilitates the audit process. Organizations that maintain accurate records of contributions through C3 Cash Receipts can easily provide verifiable information during audits, ensuring compliance with state and federal regulations. The implications of using C3 Cash Receipts are profound, impacting both tax reporting obligations and overall budgeting and financial planning processes.

Getting started with the C3 Cash Receipts form

Accessing the C3 Cash Receipts form is straightforward. Organizations can often obtain the template through their respective state agency or relevant committees. Websites like pdfFiller offer easy access to download the C3 Cash Receipts form in various formats. Users can select from PDF, Word, or Excel templates depending on their operational preferences.

It’s crucial for organizations to ensure that their chosen software is compatible with the format of the downloaded form. Most commonly used programs like PDF editors and word processors will work seamlessly with the C3 Cash Receipts template, allowing for easy customization and filling.

Detailed guide to filling out the C3 Cash Receipts form

Filling out the C3 Cash Receipts form requires attention to detail to ensure accuracy and completeness. Follow these step-by-step instructions to guide you through the process:

While filling out the form, it’s vital to avoid common mistakes. Misreporting amounts can lead to serious issues, including donor dissatisfaction and potential audits. Additionally, neglecting to sign or date the form may render it invalid, complicating record-keeping efforts.

Editing and customizing the C3 Cash Receipts form

Once the C3 Cash Receipts form is filled out, editing and customizing it for future use can enhance efficiency. Platforms like pdfFiller provide tools to facilitate the modification of the form digitally. Users can easily upload the form to pdfFiller and make necessary adjustments using their suite of editing tools.

Moreover, pdfFiller enables users to sign documents electronically, simplifying the process of obtaining necessary approvals. Understanding the legal considerations surrounding electronic signatures is crucial, but pdfFiller ensures compliance with relevant regulations, securing the authenticity of documents.

Managing your C3 Cash Receipts

Organizing your C3 Cash Receipts is essential for effective financial management. An organized system not only streamlines record-keeping but also aids in quick retrieval during audits. Implement a system of categorization based on transaction types or donor profiles to enhance accessibility. Utilizing cloud-based storage options like pdfFiller offers a secure solution to keep these important documents organized and easily accessible.

Tracking and reporting contributions using C3 Cash Receipts should involve best practices such as regular updates to entry logs and reconciling receipts with bank statements. Establishing a routine process for financial reporting creates consistency and ensures stakeholders receive timely information on monetary contributions.

Frequently asked questions about C3 Cash Receipts

Many users often have questions regarding the C3 Cash Receipts form. Here are responses to some of the most common inquiries:

Best practices for utilizing the C3 Cash Receipts form

Maintaining compliance and accuracy in using the C3 Cash Receipts form is paramount. Organizations should establish regular reviews of processes to ensure that all documentation aligns with current regulations. Training sessions for team members involved in handling cash receipts will promote a culture of accuracy and attention to detail.

Leverage the features of pdfFiller by utilizing collaborative tools which allow multiple team members to work on the same document simultaneously. Engaging with cloud storage solutions ensures that your documents are securely stored and easily accessible, mitigating the risk of data loss due to local issues.

Integration with other financial forms

The C3 Cash Receipts form can be efficiently integrated with other financial documentation. Linking cash receipts to budgeting forms creates a comprehensive financial overview, allowing organizations to align incoming contributions with outgoing expenses. Additionally, cross-referencing with expense reports facilitates proper allocation of funds, ensuring comprehensive funding oversight.

By streamlining these connections, organizations can present a cohesive picture of their financial health to stakeholders, promoting transparency and fostering trust in their monetary management practices.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute c3 cash receipts monetary online?

How can I edit c3 cash receipts monetary on a smartphone?

How do I edit c3 cash receipts monetary on an iOS device?

What is c3 cash receipts monetary?

Who is required to file c3 cash receipts monetary?

How to fill out c3 cash receipts monetary?

What is the purpose of c3 cash receipts monetary?

What information must be reported on c3 cash receipts monetary?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.