Get the free Business Tax Receipt

Get, Create, Make and Sign business tax receipt

How to edit business tax receipt online

Uncompromising security for your PDF editing and eSignature needs

How to fill out business tax receipt

How to fill out business tax receipt

Who needs business tax receipt?

A Complete Guide to the Business Tax Receipt Form

Understanding the business tax receipt form

A business tax receipt (BTR) is a document issued by local government entities that permits businesses to legally operate within a jurisdiction. It serves as a crucial indicator of compliance, ensuring that businesses meet necessary regulations. A BTR is essential for both new and existing businesses, reflecting their legitimacy and commitment to lawful practices in their respective areas.

The importance of a BTR cannot be overstated. Not only does it provide proof of business registration, but it also ensures that firms are accountable for local taxes and fees. Without it, a business may face penalties, including fines or even closure.

Who needs a business tax receipt?

Eligibility for a business tax receipt typically depends on the type of business and local regulations. Most businesses operating storefronts or providing services in specified areas require a BTR. This includes various business structures such as sole proprietorships, partnerships, corporations, and even mobile food trucks.

Local regulations can vary significantly; some cities have stricter rules while others might be more relaxed. For instance, in Orlando (32801), businesses such as restaurants or retail stores are required to obtain a BTR, while online-based services might not fall under the same mandates. It's essential to investigate your local requirements to ensure compliance.

Types of business tax receipts

Business tax receipts vary based on the scope of operation—local versus state-level requirements are significant factors. Local receipts often reflect the specific regulations enforced by individual cities, while state-level receipts typically encompass broader guidelines applicable to diverse regions. Specific forms may exist to cater to different business types, such as sole proprietorships, LLCs, or corporate entities.

In general, obtaining a BTR requires different documentation depending on your jurisdiction. For instance, a mobile food truck may need additional certifications compared to a retail shop, necessitating a thorough understanding of local ordinances and the steps needed to obtain the appropriate documentation.

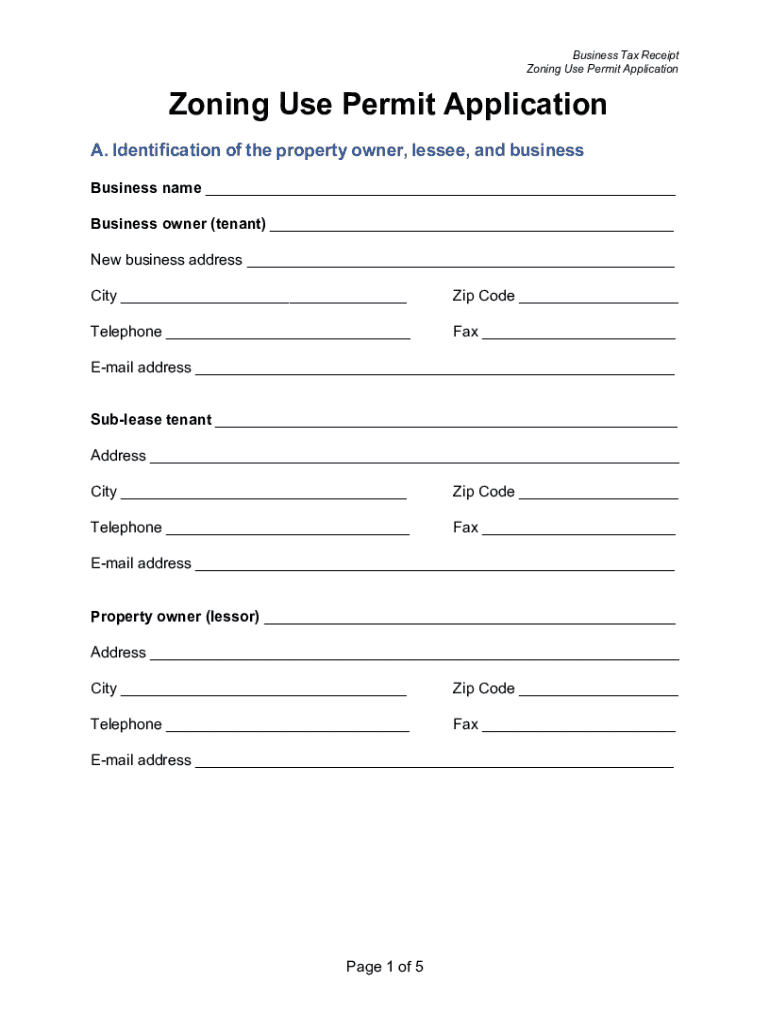

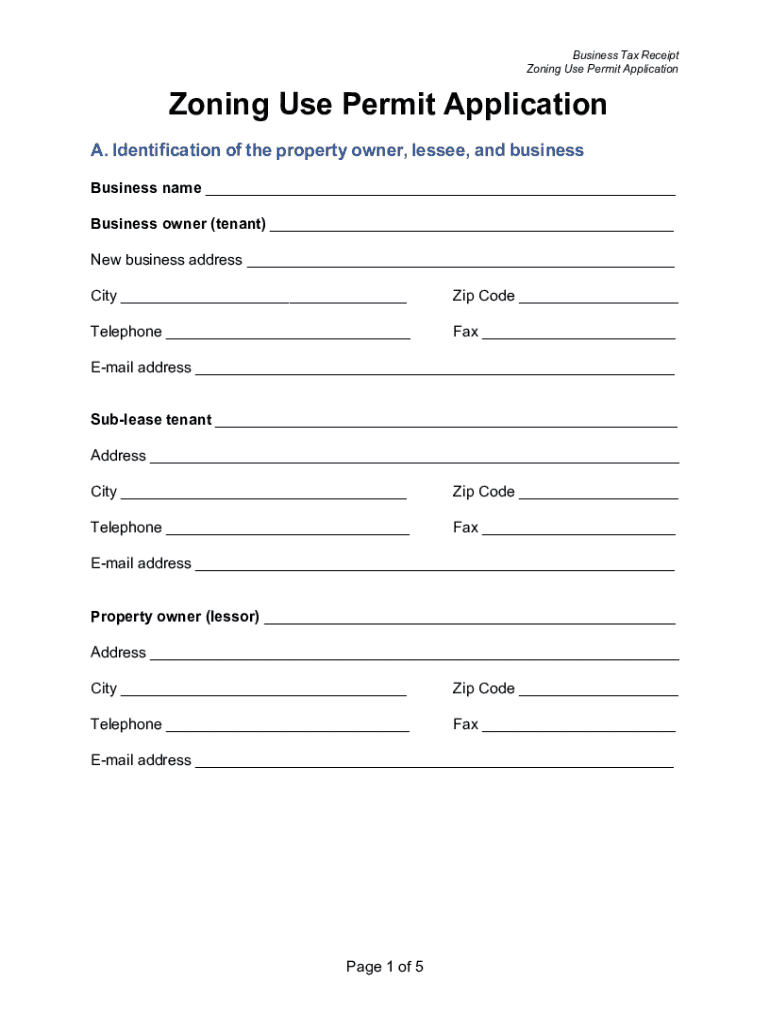

Preparing to fill out the business tax receipt form

Before filling out your business tax receipt form, it’s crucial to gather the necessary information. Essential details include your business name, address, and type of operation. Additionally, financial information such as revenue and the number of employees may be required, depending on your local regulations.

Utilizing document creation tools can ease the form-filling process significantly. Platforms like pdfFiller provide editing capabilities that allow users to fill in forms promptly and effectively. Their cloud-based solutions mean you can access documentation from anywhere, making it ideal for modern businesses that need flexibility.

Step-by-step guide to completing the business tax receipt form

Accessing the business tax receipt form can typically be done through your city or county's official website. For users seeking a simplified experience, pdfFiller offers an intuitive platform where you can access forms directly, fill them out digitally, and save changes easily.

When filling out the form, be sure to follow these steps for clarity and completeness.

Ensure accuracy by double-checking all entries to avoid common pitfalls such as incorrect information or omissions that could delay processing.

Submitting your business tax receipt form

Once completed, the business tax receipt form can be submitted either online or through physical mailing. Online submissions are growing increasingly popular due to their convenience and speed. Platforms like pdfFiller streamline this process, allowing you to send forms directly to the appropriate office.

Understanding processing times is also crucial. Depending on the jurisdiction, approval times can vary. Most businesses are advised to check how to track their submission status to stay informed on any delays or additional requirements.

Managing your business tax receipt and compliance

Once you've received your business tax receipt, proper management is key. Digital copies should be stored securely, with easy access for audits or renewal processes. pdfFiller offers cloud storage solutions that enhance document management and ensure that your business receipts are safe yet retrievable at a moment’s notice.

Ongoing compliance requires staying updated on renewal periods. Many local governments stipulate that business tax receipts must be renewed annually or biannually, depending on the type of business. Familiarizing yourself with any changes in regulations will help you maintain compliance and avert penalties.

Troubleshooting common issues with the business tax receipt form

Common errors when filling out the business tax receipt form can be easily avoided with some foresight. Frequently seen mistakes include entering incorrect business information or failing to provide the necessary financial documents. Utilizing a checklist can help mitigate these errors, ensuring all components of the form are complete.

In case of unresolved issues, it's essential to know who to contact for assistance. Local government offices often have dedicated teams for business inquiries and can provide clarity on specific rules. Additionally, pdfFiller offers support resources to guide users through the process.

Additional features of pdfFiller for document management

Beyond filling out the business tax receipt form, pdfFiller provides advanced editing tools that allow users to not only edit PDFs but also collaborate with team members seamlessly. Users can sign documents electronically, add annotations, and streamline workflows without needing multiple platforms.

Integrating pdfFiller with other business tools enhances usability, allowing for efficient document management across different departments. This integration capacity ensures that no document is left unattended and every communication is streamlined for optimal productivity.

Real-life case studies

Many businesses have found success using pdfFiller to manage their document needs effectively. For instance, a local coffee shop streamlined its application process for a business tax receipt by utilizing pdfFiller’s document editing capabilities, which allowed them to complete forms accurately and submit them without delays.

Small businesses often share testimonials highlighting user experiences with pdfFiller, illustrating how easy it is to navigate form-filling and document management tasks. These success stories emphasize the impact of using such tools on operational efficiency.

Explore more templates and forms

In addition to the business tax receipt form, many other important forms are required for business operations. These could range from tax filing forms to employee contracts. pdfFiller makes it easy to access a wide array of templates tailored for different business needs.

Utilizing pdfFiller not only assists with the business tax receipt but also provides the flexibility to manage other necessary documentation in one platform, helping maintain a cohesive business management strategy.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my business tax receipt directly from Gmail?

How can I edit business tax receipt from Google Drive?

How do I fill out business tax receipt on an Android device?

What is business tax receipt?

Who is required to file business tax receipt?

How to fill out business tax receipt?

What is the purpose of business tax receipt?

What information must be reported on business tax receipt?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.