Get the free automatic bank draft

Get, Create, Make and Sign automatic bank draft form

Editing automatic bank draft form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out automatic bank draft form

How to fill out bank draft information

Who needs bank draft information?

A Comprehensive Guide to the Bank Draft Information Form

Understanding the bank draft information form

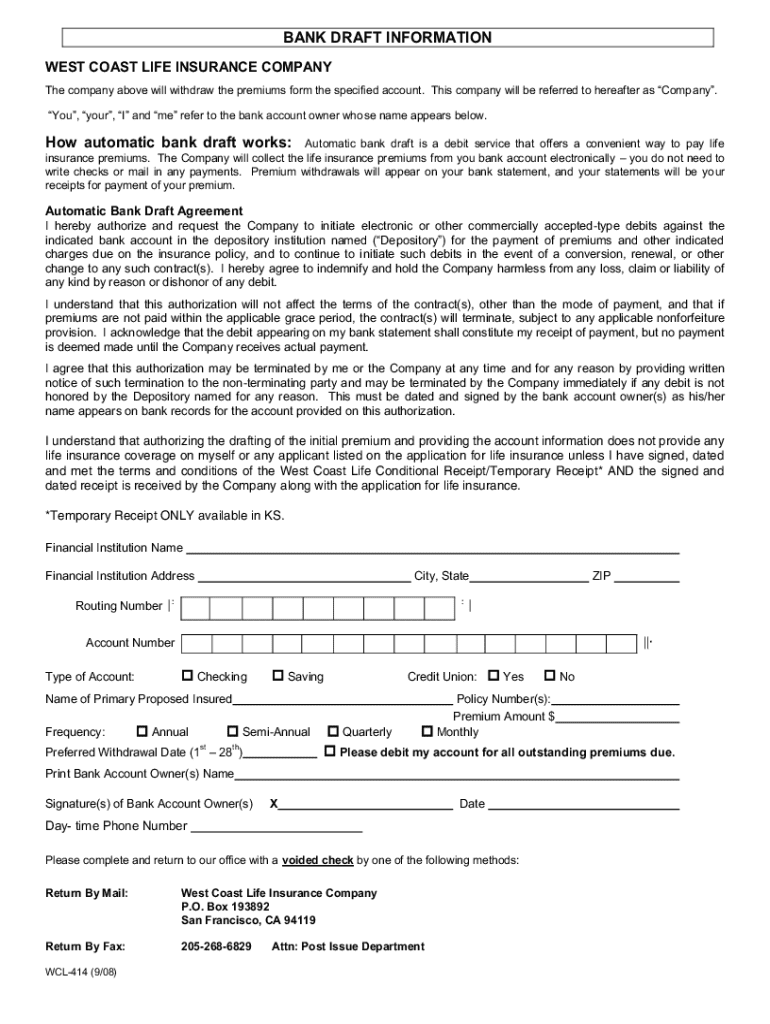

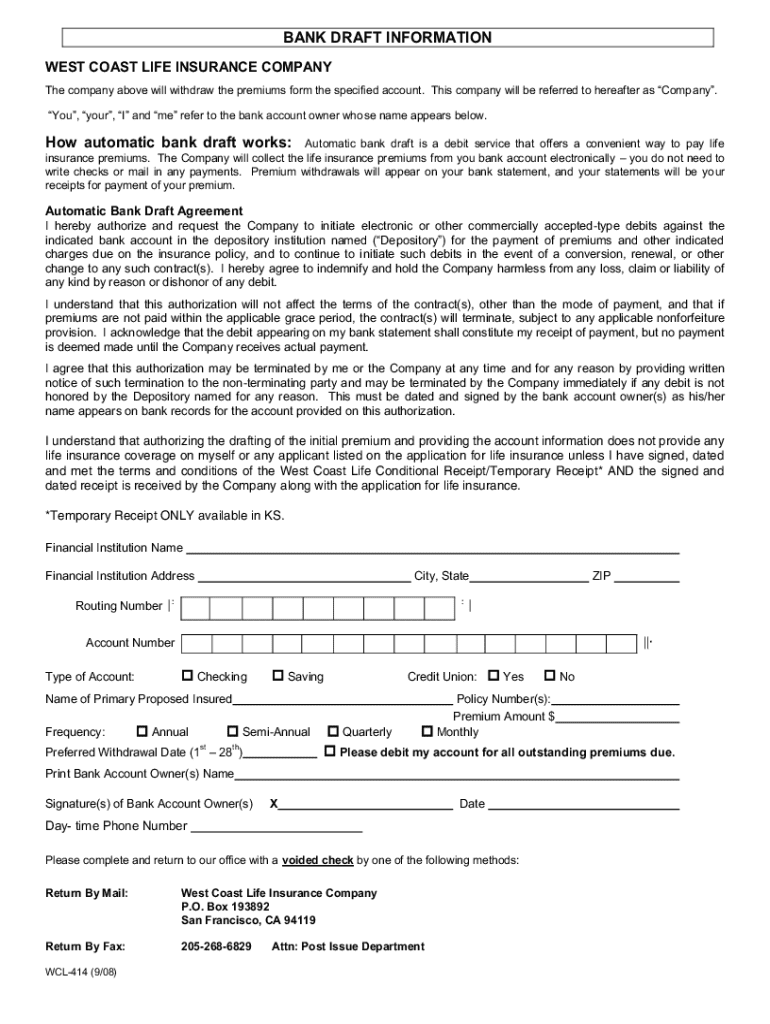

A bank draft is a payment instrument issued by a bank on behalf of a customer, guaranteeing the payment of a specified amount to a designated payee. The bank drafts funds directly from the bank’s account rather than the customer’s personal account, adding a layer of security and trust in the transaction. The bank draft information form plays a crucial role in initiating this process, as it collects essential details needed to facilitate the transaction smoothly.

The importance of the bank draft information form cannot be understated, as it helps prevent errors, and misunderstandings, and ensures a clear record of the transaction. By providing a structured format for submitting necessary details, this form standardizes how bank drafts are processed.

Key components of the bank draft information form

Filling out the bank draft information form requires specific data to ensure accuracy and prevent any delays in processing the draft. The required information includes personal details, banking information, and particulars about the draft itself.

Mandatory sections generally require your name, address, and contact details to identify the requester. Additionally, you must provide your bank details, including account numbers and routing numbers. Finally, the draft details section captures critical information such as the amount being drafted, the currency type, and the purpose of the transaction.

While these details are necessary, you may also find optional fields on the form. Signature fields often allow for direct authorization of the draft, and there may be sections to include additional instructions or notes relevant to the payment.

How to access the bank draft information form on pdfFiller

When you need to access the bank draft information form, pdfFiller provides a user-friendly platform that simplifies the process. You can begin by navigating to the dedicated section for financial forms on the pdfFiller website.

Once on the platform, use the search function to find 'bank draft information form.' pdfFiller’s interactive interface allows users to locate documents quickly, streamlining your document creation and management experience. Familiarizing yourself with the tools and features available will help make this process smoother.

Step-by-step guide to filling out the bank draft information form

Filling out the bank draft information form can be straightforward if you have all necessary documents ready. Start by gathering identification, such as a driver’s license or passport, and any financial documents that may support your request, including account statements or verification letters from your bank.

Next, begin filling out the form by providing accurate personal information. Double-check that the spelling of your name matches your identification. Input your banking information precisely, and ensure the account number is correct to avoid any discrepancies. When entering the draft details, verify the amount and currency; mistakes here can lead to prolonged processing times or the need for resubmission.

After completing the form, it's important to review it thoroughly. Look for common errors such as mismatched account information or incorrect amounts. A final checklist prior to submission will help ensure that your form meets all requirements and is ready for processing.

Editing and customizing the form with pdfFiller

The pdfFiller platform not only enables you to fill out the bank draft information form but also to edit and customize it as needed. Utilizing pdfFiller's editing tools enhances the overall flexibility of the document management process.

You can use options to add text, images, and annotations directly onto the form. This allows for customization that might be necessary for specific circumstances. Additionally, the platform provides resizing and formatting options, ensuring that your document adheres to any required specifications.

Once your edits are completed, be sure to save your changes. pdfFiller offers various formats for saving your draft, whether you choose to export it as a PDF, Word document, or directly into the cloud for future access.

Signing and submitting the bank draft information form

When it comes to finalizing your bank draft information form, eSigning provides a legal and secure method for confirming your identity and authorizing transactions. This digital approach not only speeds up the submission process but also simplifies record-keeping and management.

pdfFiller makes this process even easier by incorporating an intuitive eSigning feature directly within the platform. Users can quickly sign documents electronically, reducing the need for printing, signing, and scanning, which can be cumbersome and time-consuming.

Once signed, you can submit the bank draft information form. Ensure that all information is correct and that you have kept a copy for your records before final submission.

Managing your bank draft information form with pdfFiller

Managing your bank draft information form after submission is crucial for keeping track of transactions and ensuring accountability. The pdfFiller platform provides tools to monitor the status of your submission easily.

You can receive notifications when the form is received, adding an additional layer of oversight. Keeping records of all documents submitted ensures that you can reference and review your transactions at any time, which is especially useful for both personal and business accounting.

Should there be a need to modify an existing draft, pdfFiller allows for easy adjustments. Follow guidelines for making quick alterations or resubmitting drafts to ensure they meet necessary specifications.

Frequently asked questions about bank drafts

It's common to have questions regarding the use of bank drafts, especially concerning their security and differences from other payment methods. One typical concern is distinguishing between bank drafts and checks; bank drafts are backed by the bank itself, offering a guaranteed payment method, whereas checks depend on the sender's account balance.

When it comes to submitting forms through pdfFiller, various troubleshooting resources are available. If your draft is rejected, potential corrective steps can facilitate resubmission, ensuring minimal disruption of services.

Best practices for utilizing bank drafts

For individuals using bank drafts, recognizing when and how often to leverage this payment method can be beneficial. Frequent usage can lead to better record-keeping and streamlined financial transactions. Keep track of expenses meticulously, especially related to larger purchases.

For businesses, employing bank drafts can streamline payment processes while enhancing cash flow management. Establishing a system for tracking drafts ensures that payments are made timely, which can protect longstanding relationships with suppliers.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the automatic bank draft form electronically in Chrome?

How can I fill out automatic bank draft form on an iOS device?

How do I fill out automatic bank draft form on an Android device?

What is bank draft information?

Who is required to file bank draft information?

How to fill out bank draft information?

What is the purpose of bank draft information?

What information must be reported on bank draft information?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.