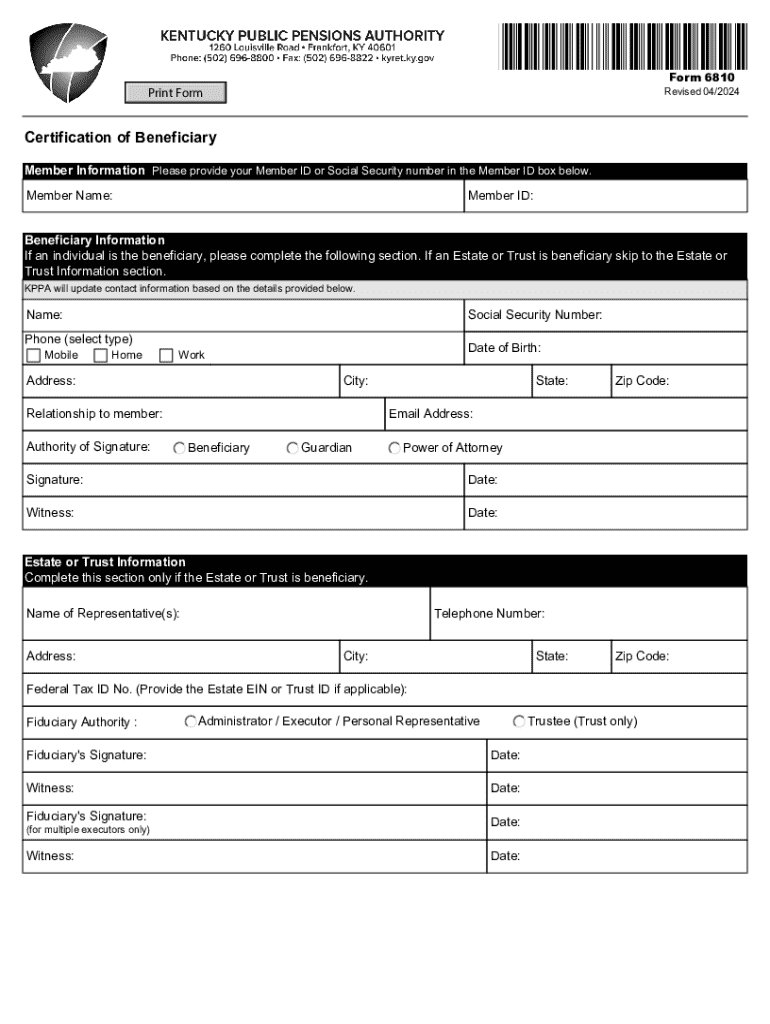

Get the free beneficiary certificate

Get, Create, Make and Sign beneficiary certificate form

Editing beneficiary certificate form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out beneficiary certificate form

How to fill out form 6810

Who needs form 6810?

How to Fill Out Form 6810

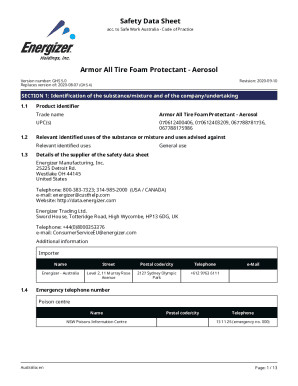

Understanding Form 6810

Form 6810 is a critical document used within various sectors for compliance and reporting purposes. It serves to streamline data collection, submission timelines, and maintain uniformity across similar documents. Understanding its purpose goes beyond merely filling it out; it's about recognizing its implications for tax obligations, statutory requirements, and organizational procedures.

The importance of Form 6810 lies in ensuring that all requisite details are accurately captured and submitted in time. Many organizations use this form to comply with federal regulations, thereby reducing the risk of penalties. Understanding the intricacies of Form 6810 can lead to better recordkeeping and enhance the transparency of reporting.

Key components of Form 6810

Form 6810 is divided into several sections, each requiring specific information. Typically, initial sections request general details such as the entity name, address, and identification information. Further sections delve into details such as reporting periods, types of transactions, and relevant tax classifications. Familiarity with these components can significantly reduce the time taken to complete the form.

Common terminology associated with Form 6810, such as 'declaration', 'submission', and 'identification number', can sometimes lead to confusion. Becoming comfortable with this jargon will not only improve efficiency but also let you navigate the form with greater confidence.

Preparing to fill out Form 6810

Before tackling Form 6810, gathering the necessary documentation is crucial. Ensure you have access to financial reports, identification numbers, and any previous submissions, if applicable. Reviewing these documents can prevent oversights that might occur while filling out the form. Collecting all relevant materials beforehand can save time and ensure accuracy.

Furthermore, understanding the eligibility criteria is vital. Typically, organizations or individuals who meet specific tax obligations or compliance regulations are required to submit this form. Checking your eligibility against the requirements laid out by the governing body can save you from unnecessary delays or complications.

Step-by-step instructions for completing Form 6810

Filling out Form 6810 might seem daunting at first, but the process can be simplified with a section-by-section approach. Begin by entering the overall entity details in Section 1, ensuring accuracy in the information provided. This step lays the foundation for the rest of the form. Moving on to Section 2, carefully input financial summaries and transaction types, making sure to double-check figures for accuracy and compliance.

Finally, in Section 3, ensure that the form is duly signed and certified. This part is crucial as it confirms the authenticity of the information provided. Each entry is vital; inaccurate data can lead to delays or rejections of your submission. Being methodical in this approach will ensure that no details are overlooked.

Common mistakes to avoid

There are some frequent errors that individuals commonly encounter when completing Form 6810. These can include misreporting financial figures or omitting essential details such as identification numbers. It's advisable to maintain a checklist to ensure all necessary components are completed. Additionally, failing to sign the form or not adhering to submission timelines can result in significant delays or penalties.

Difficulty in deciphering financial terminology is another common pitfall. Utilizing a glossary can aid in understanding these terms, ensuring that errors related to misinterpretation are minimized. Reviewing the completed form for clarity and coherence before submission can help significantly.

Editing and reviewing Form 6810

Once you’ve completed Form 6810, utilizing tools like pdfFiller for document editing can enhance accuracy and efficiency. The platform allows for easy adjustments, making it simple to correct errors without hassle. This feature is especially useful if you entered the data incorrectly or need to update certain figures based on new information.

Moreover, collaborating on the form with team members through pdfFiller's collaboration features can lead to improved accuracy. This platform allows multiple users to review and provide input concurrently, ensuring a comprehensive check before finalization. By viewing changes and comments in real time, the editing process becomes much more streamlined.

Signing and finalizing Form 6810

The final stages of handling Form 6810 involve signing and submitting the completed document. Electronic signatures are becoming increasingly accepted, and pdfFiller provides a straightforward step-by-step process for adding an eSignature. This method is not only convenient but also ensures the legality of the signed document.

After signing, various options are available for saving your completed form, including printing for mailing or retaining it digitally for your records. Being familiar with how to submit the form electronically can further enhance efficiency. Always follow specific guidelines regarding file format and submission methods as outlined by the governing body to avoid complications.

Managing submitted Form 6810

Post-submission management of Form 6810 involves tracking its progress and ensuring that everything is in order. After submitting the form, it is advisable to confirm receipt and monitor its status. Many agencies provide tools or online portals for submission tracking, facilitating seamless follow-ups if necessary.

In cases where corrections or follow-ups may be required, knowing the proper channels can expedite the process. It’s also essential to access and store your completed forms digitally; adopting best practices for digital organization will help maintain an orderly record of your submissions, essential for future reference.

Further assistance and troubleshooting

Navigating the complexities of Form 6810 can lead to questions or concerns, and it's crucial to know where to get help. Typical queries revolve around discrepancies detected during the submission or clarification about specific sections of the form. The availability of FAQs can provide immediate answers to such common issues and ease the user experience.

In some cases, however, it may become apparent that professional assistance is warranted. If you're facing difficulties that relate to compliance, complex financial matters, or legal implications, seeking expert advice can alleviate stress. Connecting with professionals who specialize in these areas can provide further clarity and ensure that your form is fully compliant.

Advanced features of pdfFiller for enhanced management

Exploring advanced features of pdfFiller can further streamline your use of Form 6810. By integrating pdfFiller with other platforms, users can create a seamless workflow for document management. This interconnectedness allows for easier access, sharing, and revisions of forms saved across different accounts, promoting efficiency in document handling.

Additionally, utilizing analytics within pdfFiller helps monitor document usage. This feature can track who accessed the form, when it was viewed, and how many revisions were made. Such insights can lead to better management practices and an overall enhancement in collaborative efforts.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send beneficiary certificate form for eSignature?

How do I execute beneficiary certificate form online?

How do I edit beneficiary certificate form on an Android device?

What is form 6810?

Who is required to file form 6810?

How to fill out form 6810?

What is the purpose of form 6810?

What information must be reported on form 6810?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.