Get the free Taos County Lodger's Tax Fund Application

Get, Create, Make and Sign taos county lodgers tax

How to edit taos county lodgers tax online

Uncompromising security for your PDF editing and eSignature needs

How to fill out taos county lodgers tax

How to fill out taos county lodgers tax

Who needs taos county lodgers tax?

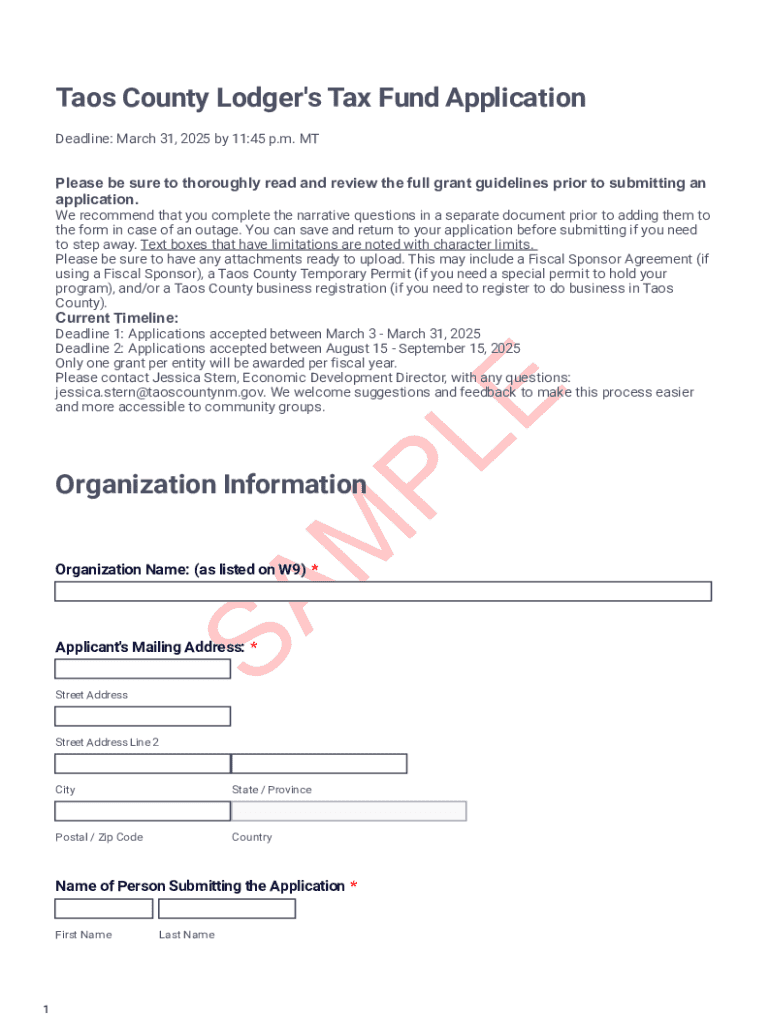

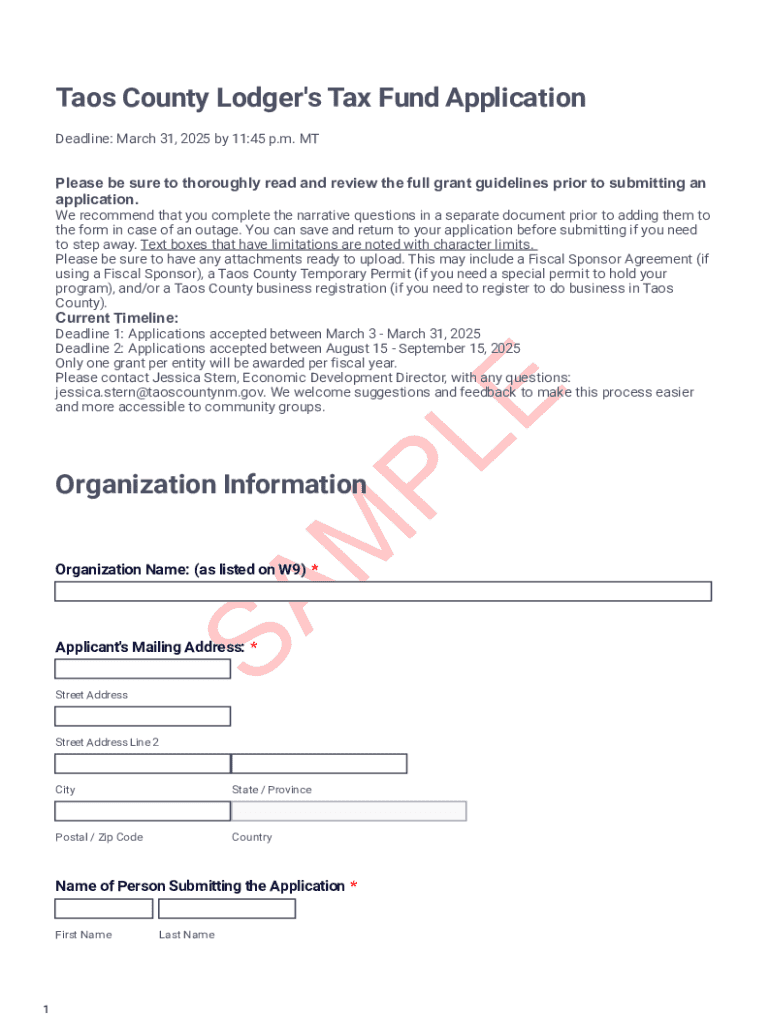

A Complete Guide to the Taos County Lodgers Tax Form

Overview of the Taos County lodgers tax

The Taos County lodgers tax is a critical component of the local economy in New Mexico, designed to generate revenue that supports community services and tourism initiatives. It applies to businesses that provide lodging services, ensuring that tourists contribute to the funding of facilities and programs that enhance the visitor experience and benefit residents alike.

In Taos County, anyone who rents out lodging – including hotels, motels, vacation rentals, and any other facility – is required to file this tax form. Compliance is essential not only for legal reasons but also to maintain good standing within the community. The revenue collected is reinvested into local programs like those facilitated by the Taos County Chamber of Commerce and the Economic Development Director, benefiting both visitors and local residents.

Key details regarding the lodgers tax form

The Taos County lodgers tax form serves as a reporting mechanism for businesses to declare their earnings from lodging services. This form includes sections that require specific information to determine the amount of tax owed based on the revenue generated by lodging services.

Notably, the following information is crucial for completing the lodgers tax form:

Filing deadlines for the lodgers tax form can vary, typically requiring businesses to submit this form either monthly or quarterly, depending on their earnings. Staying updated with these deadlines ensures compliance and prevents potential penalties.

Step-by-step guide to completing the Taos County lodgers tax form

Completing the Taos County lodgers tax form can be straightforward if approached methodically. Here’s a step-by-step guide to assist you throughout the process.

Step 1: Gathering necessary documents

Before starting, ensure you have all necessary documentation. This could include previous tax filings, books of accounts showcasing income from lodging services, and any correspondence regarding tax inquiries.

Step 2: Accessing the lodgers tax form

The lodgers tax form can be accessed through the Taos County official website or via third-party services such as pdfFiller, which offer the form in an editable format.

Step 3: Completing sections of the form

Step 4: Reviewing your form (tips for accuracy)

Double-checking all entered information is vital before submission. Ensure there are no typos, especially in tax IDs and financial figures, which might result in unnecessary complications or fines.

Step 5: Submitting the form

Forms can be submitted online through certain platforms or via traditional mail. If opting for mail, consider using a method that provides tracking to confirm receipt by the tax office.

Interactive tools for simplifying the filing process

Utilizing online tools can significantly ease the lodgers tax form completion process. Platforms like pdfFiller allow seamless editing, e-signing, and collaboration, which are particularly beneficial for teams managing lodging services.

Cloud-based solutions not only streamline document handling but also provide secure storage options and easy access anytime, mitigating concerns about losing important papers. Team members can access the document concurrently, reducing delays and miscommunication.

Common mistakes to avoid when filing the lodgers tax form

Filing errors can lead to challenges, as well as added costs. Here are some common pitfalls to be aware of:

Handling errors and issues post-submission

If you discover an error in your lodgers tax submission after the fact, acting swiftly is crucial. Contact the Taos County tax office for advice on how to amend a submitted form. Generally, you can file an amendment to correct discrepancies.

For inquiries or more information, the tax office offers various contact methods, including phone numbers. It’s advisable to reach out as soon as you notice an error to address potential fines or issues sooner rather than later.

Additional information and FAQs

Many lodging providers have questions about how specific changes in business structures or operations impact their filing. Common inquiries include aspects such as the implications of scaling up operations or shifts in ownership.

Additionally, understanding penalties for late filings is crucial. The Taos County tax advisory board can provide guidance on applicable penalties and help you navigate any policy updates regarding lodging taxes.

Related forms and resources

Lodging businesses may need additional forms depending on their operations. Familiarizing yourself with these can save time and money. For an overview of all relevant forms, consult the Taos County official website.

If you require further assistance, local tax advisory services can provide personalized advice. Connections with local professionals enable a broader understanding of funding proposals and various programs, fostering a strong community among lodging businesses.

Digital transformation of document handling

Incorporating modern tools like pdfFiller into your routine enhances document management. Users experience an array of benefits, from ease of access to e-signatures and collaborative features. This platform fosters productivity by integrating various document handling capabilities, ultimately benefiting lodging businesses.

Additionally, customer testimonials frequently highlight the time savings and stress reduction associated with using pdfFiller. This streamlined approach to managing tax forms, including the Taos County lodgers tax form, ensures lodging providers can focus on improving their services rather than getting bogged down in paperwork.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my taos county lodgers tax directly from Gmail?

How do I fill out the taos county lodgers tax form on my smartphone?

How can I fill out taos county lodgers tax on an iOS device?

What is taos county lodgers tax?

Who is required to file taos county lodgers tax?

How to fill out taos county lodgers tax?

What is the purpose of taos county lodgers tax?

What information must be reported on taos county lodgers tax?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.