Get the free form 5330 electronic filing

Get, Create, Make and Sign form 5330 electronic filing

How to edit form 5330 electronic filing online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 5330 electronic filing

How to fill out form 5330

Who needs form 5330?

Form 5330: A Comprehensive Guide

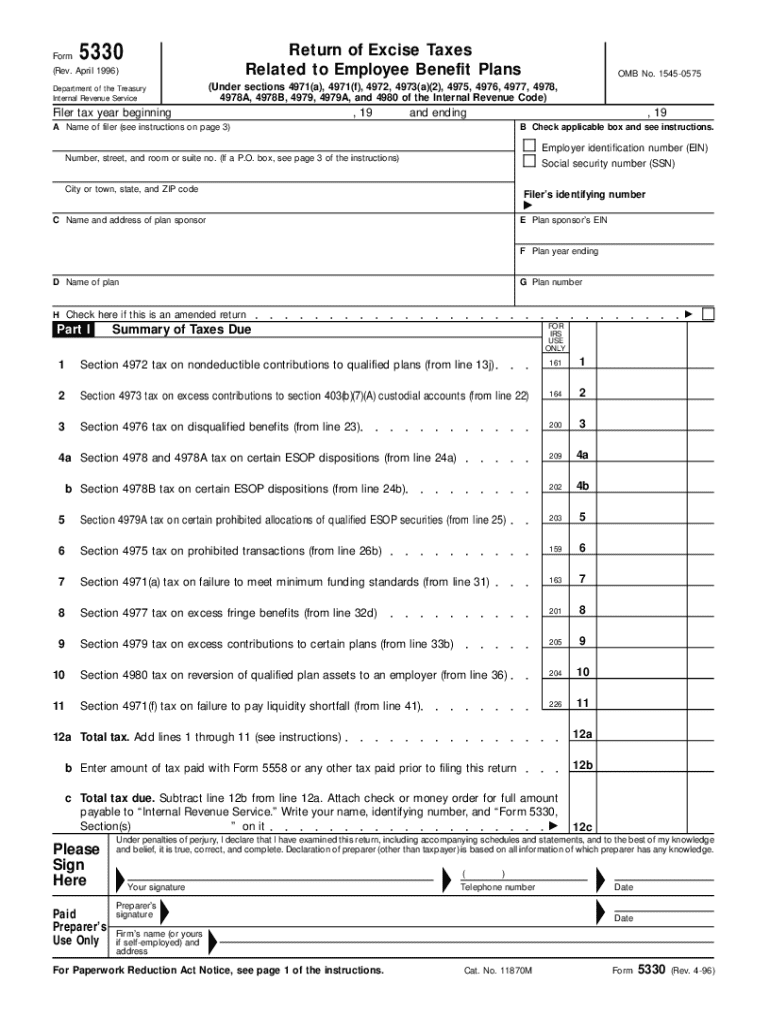

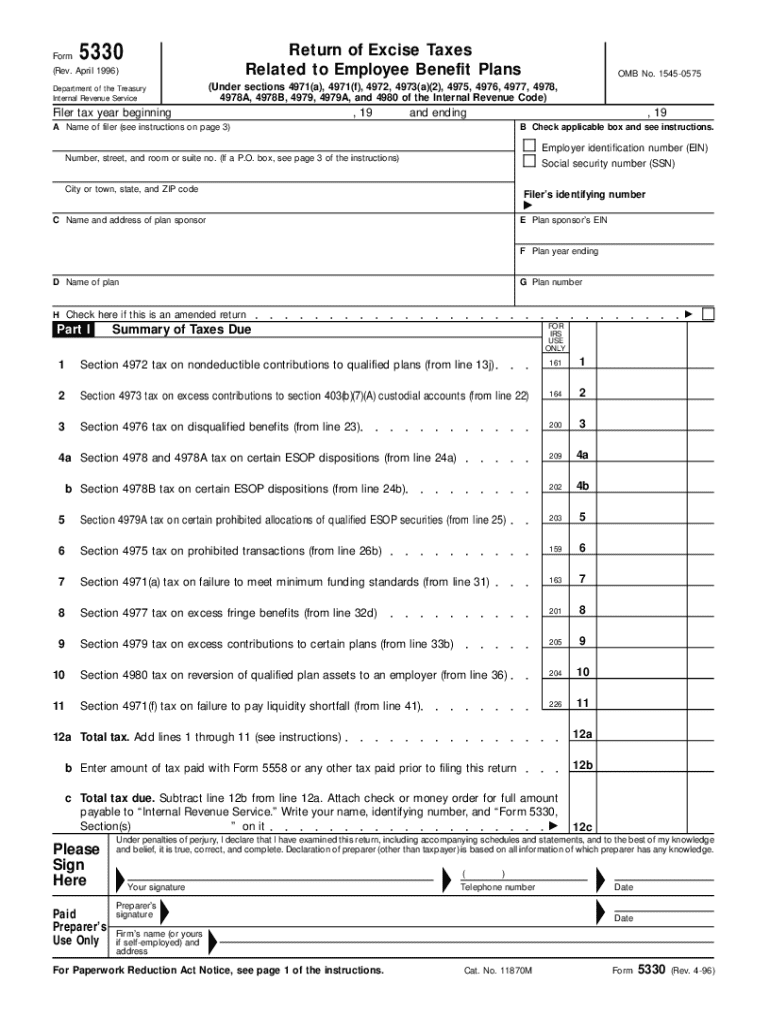

Understanding Form 5330

Form 5330 serves as a crucial reporting tool for organizations maintaining retirement plans. Primarily, the form is utilized to report and compute excise taxes owed due to certain violations related to retirement contribution requirements. Its timely and accurate submission is critical for maintaining compliance with IRS regulations, thus avoiding hefty penalties.

Organizations required to file Form 5330 include employers with defined benefit plans, 401(k) plans, and similar retirement arrangements where contributions were either late or not made according to IRS schedules. By recognizing who needs to file, stakeholders ensure their retirement plans remain compliant.

Importance of timely contributions

The repercussions of late deposits are significant for both the financial health of the retirement plan and the responsibilities of the employer. Timely contributions are essential as they protect the retirement plan's tax-qualified status. If employers fail to deposit contributions when due, they risk incurring tax penalties and affecting employees' retirement funds.

Moreover, noncompliance doesn't just have financial implications; it also impacts the retirement plan's trustworthiness among stakeholders. Participants may doubt the organization's commitment to their future, affecting their overall confidence in the management of their benefits.

When your plan needs Form 5330

Understanding when to file Form 5330 is vital for effective compliance. Organizations must file this form under several circumstances, primarily when a late contribution occurs, or if the plan fails to meet specific funding requirements. The IRS typically mandates that the form be filed within 15 days of discovering the failure, making promptness key.

Common triggers for filing Form 5330 include the delayed contribution of employee deferrals or employer matching funds. Employers should be aware of their timelines to ensure compliance and mitigate the risk of penalties.

Step-by-step guide to filling out Form 5330

Filling out Form 5330 requires meticulous attention to detail, starting with gathering all necessary documents and information beforehand. This ensures accurate completion and minimizes potential errors. Before diving into the form, familiarize yourself with its specific sections, such as the identifying information and the event description.

To fill out Form 5330 effectively, concentrate on understanding each part of the document. Part I requires basic information about the plan, while Part II should detail the events that prompted the form's completion. The most complex part, Part III, focuses on the computation of any excise taxes owed—a key section that demands careful calculation.

One common pitfall is miscalculating the excise tax. Ensure you double-check all figures and computations to avoid unnecessary penalties.

Calculating owed excise taxes

Understanding how to calculate owed excise taxes on Form 5330 is another critical aspect of the filing process. Typically, the formula used involves determining the number of days the contribution was late and applying the IRS specified tax rate for those occurrences. Factors influencing the amount can range from the type of retirement plan to the timing of the deposit.

To illustrate the importance of clear calculations, consider the following scenario: if a $10,000 contribution is late by 15 days, the excise tax could amount to a substantial penalty based on the current IRS rates, which are subject to change. Using software tools, like pdfFiller, can enhance accuracy and streamline the calculation process.

Correcting late deposits and avoiding penalties

Once a late deposit has been identified, correcting it and filing Form 5330 promptly is essential. Best practices for compliance include not only making timely corrections but also properly documenting all actions taken. Using Form 5330 to communicate these corrections to the IRS is vital in demonstrating good faith efforts to remain compliant.

Organizations should also consider maintaining a proactive approach to compliance by regularly reviewing their deposit schedules and understanding how to use Form 5330 effectively for corrective measures. Reliable resources, including the IRS guidelines and tools such as pdfFiller, can play a vital role in this process.

Interactive tools for enhanced management

Leveraging features from tools like pdfFiller ensures organizations can efficiently manage their Form 5330 submissions. The eSignature capabilities simplify filing processes, allowing users to sign forms digitally and submit them securely without delays. Collaborative tools within the platform also foster team communication, making it easier to manage retirement plan compliance.

Additionally, pdfFiller enables users to access their forms seamlessly from various devices, ensuring that important filing deadlines are met regardless of location. Such flexibility is invaluable for organizations seeking to streamline their document management while remaining compliant with IRS requirements.

Related insights on retirement plan compliance

It's essential for organizations to stay informed about related compliance topics, like how to effectively manage retirement plan audits. Regular audits help avoid complications, and using best practices for recordkeeping can significantly reduce headaches when filing Form 5330.

Ongoing education regarding IRS regulations is also vital. Profitably engaging with educational resources ensures that stakeholders understand their responsibilities and can adapt to changing guidelines, thus keeping their retirement plans in good standing.

Frequently asked questions

Form 5330 can often lead to various questions, particularly from those involved in managing retirement plans. Common inquiries include understanding when the form is due, how to amend previously submitted filings, and the consequences of failing to file on time. Employers are encouraged to familiarize themselves with these aspects to avoid potential complications.

Understanding the implications of ignoring the filing requirement is equally critical. Failing to submit Form 5330 may result in excessive penalties and complicate compliance efforts, putting retirement plans at risk.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute form 5330 electronic filing online?

Can I edit form 5330 electronic filing on an iOS device?

How can I fill out form 5330 electronic filing on an iOS device?

What is form 5330?

Who is required to file form 5330?

How to fill out form 5330?

What is the purpose of form 5330?

What information must be reported on form 5330?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.