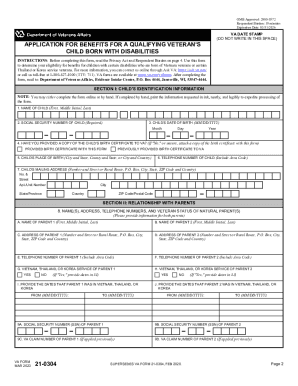

Get the free pnb rtgs form

Get, Create, Make and Sign pnb rtgs form

How to edit rtgs form pnb bank online

Uncompromising security for your PDF editing and eSignature needs

How to fill out punjab national bank rtgs form download

How to fill out pnb rtgsneft form

Who needs pnb rtgsneft form?

Understanding the PNB RTGS/NEFT Form

Overview of PNB RTGS/NEFT transactions

RTGS (Real-Time Gross Settlement) and NEFT (National Electronic Funds Transfer) are two essential banking services provided by Punjab National Bank (PNB) for transferring money seamlessly and efficiently. While both services cater to electronic fund transfers, they function quite differently. RTGS is designed for high-value transactions, processed in real-time, whereas NEFT processes transactions in batches, making it more suitable for lower-value payments.

The benefits of using RTGS and NEFT are manifold. Customers enjoy quick transfer times, reduced paperwork, and the convenience of initiating transactions from anywhere with internet access. Additionally, both services comply with RBI regulations, ensuring safety and reliability. This comprehensive suite makes them a favorable choice for both personal and business transactions.

Understanding the PNB RTGS/NEFT Form

The PNB RTGS/NEFT form is a crucial document that facilitates electronic fund transfers from one bank account to another. This form serves as a formal request to initiate the transaction, ensuring that all necessary information is recorded accurately. Filling this form correctly is paramount because even minor errors can lead to transaction delays or failures.

Common uses of the PNB RTGS/NEFT form include transferring money for personal needs like paying tuition fees, settling bills, or transferring wages. It also plays a pivotal role in business settings where vendors and suppliers require prompt payments. The form streamlines the entire transaction process, confirming recipients' details and ensuring that funds reach their intended destination without hassle.

Accessing the PNB RTGS/NEFT Form

Accessing the PNB RTGS/NEFT form is straightforward. Customers can obtain it online through platforms such as pdfFiller, which provides a user-friendly interface for filling out and editing forms. Alternatively, physical copies are readily available at all Punjab National Bank branches across the country, simplifying access for individuals who prefer traditional methods.

Frequently asked questions regarding the form's access typically include its availability, the steps to download the online version, and how to fill it out. The integration of pdfFiller makes the process even smoother, allowing users to have access to the form anytime and anywhere, eliminating unnecessary trips to the bank.

Step-by-Step Guide to Filling Out the PNB RTGS/NEFT Form

Filling out the PNB RTGS/NEFT form requires careful attention to detail. Here’s a simple three-step guide:

Editing and managing your PNB RTGS/NEFT form

After filling out the PNB RTGS/NEFT form, you may need to make corrections. Tools provided by pdfFiller allow for easy editing of the document. Users can adjust not only the text but can also change details and collaborate with team members to ensure accuracy.

Furthermore, electronically signing the form enhances the security of the document, making it easy to authenticate. Once completed, you can easily save, print, or share the document as necessary, providing further flexibility.

Additional considerations when using the PNB RTGS/NEFT form

While filling out the PNB RTGS/NEFT form, keep the following considerations in mind: accuracy is paramount for avoiding delays. Typically, the bank may require you to re-submit the form if errors are detected. To prevent common pitfalls during the submission process, utilizing templates provided by tools like pdfFiller can be beneficial.

Security is another critical aspect when engaging in online financial transactions. Ensuring you understand the security features of pdfFiller can give you peace of mind. The platform also provides encryption and secure storage, enhancing your overall experience.

What to do after submitting the PNB RTGS/NEFT form

After submitting the PNB RTGS/NEFT form, you can expect to receive a confirmation of the transaction shortly. Understanding the different types of receipts and acknowledgments associated with the process can provide clarity regarding the status of your transfer.

Furthermore, you can track the status of your transaction via Punjab National Bank's online banking platform. This feature allows users to stay updated on their transaction progress and helps in identifying any potential issues quickly.

Troubleshooting common issues with PNB RTGS/NEFT transactions

Encountering issues during the filing of the PNB RTGS/NEFT form is not uncommon. Some of the most prevalent errors include incorrect account numbers, discrepancies in the IFSC codes, and failing to provide complete beneficiary details.

To resolve discrepancies, always double-check the entries made in the form. If issues persist, contacting customer support is recommended. Knowing the right time to seek assistance can alleviate various concerns, ensuring a seamless transaction experience.

Expert insights on PNB RTGS/NEFT services

Banking professionals often emphasize the advantages of using RTGS and NEFT for secure financial transactions. According to experts, these forms of electronic transfers optimize cash flow, particularly for businesses reliant on timely payments to vendors.

Several tips can enhance your online banking experience. For example, advocating for regular checks on your account statements can aid in identifying unauthorized transactions swiftly. Also, understanding the banking cycle for processing transactions with PNB can ensure that you initiate payments at the right times to avoid delays.

User experiences with the PNB RTGS/NEFT form

User testimonials reveal that many individuals enjoy how straightforward the PNB RTGS/NEFT form is to use. Many appreciate the online accessibility via pdfFiller, which allows for quick modifications and electronic signing. Users report that they can effortlessly manage their transactions and feel secure during their online banking activities.

Case studies highlight numerous successful transactions facilitated by pdfFiller, showcasing how the tool not only enhances user experience but also improves efficiency in money transfers, ultimately contributing to better financial management.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in rtgs form of pnb without leaving Chrome?

How do I fill out the pnb neft form form on my smartphone?

How do I edit pnb rtgs form fill on an iOS device?

What is pnb rtgsneft form?

Who is required to file pnb rtgsneft form?

How to fill out pnb rtgsneft form?

What is the purpose of pnb rtgsneft form?

What information must be reported on pnb rtgsneft form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.