Get the free Beneficiary Designation Form

Get, Create, Make and Sign beneficiary designation form

How to edit beneficiary designation form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out beneficiary designation form

How to fill out beneficiary designation form

Who needs beneficiary designation form?

Comprehensive Guide to the Beneficiary Designation Form

Understanding the beneficiary designation form

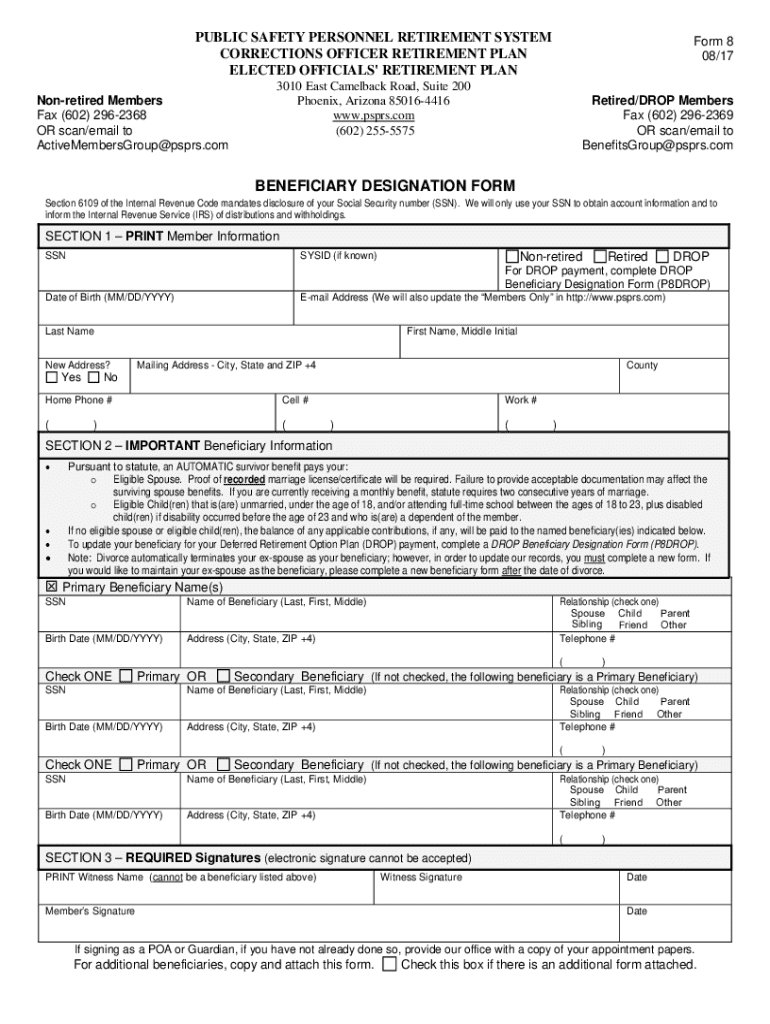

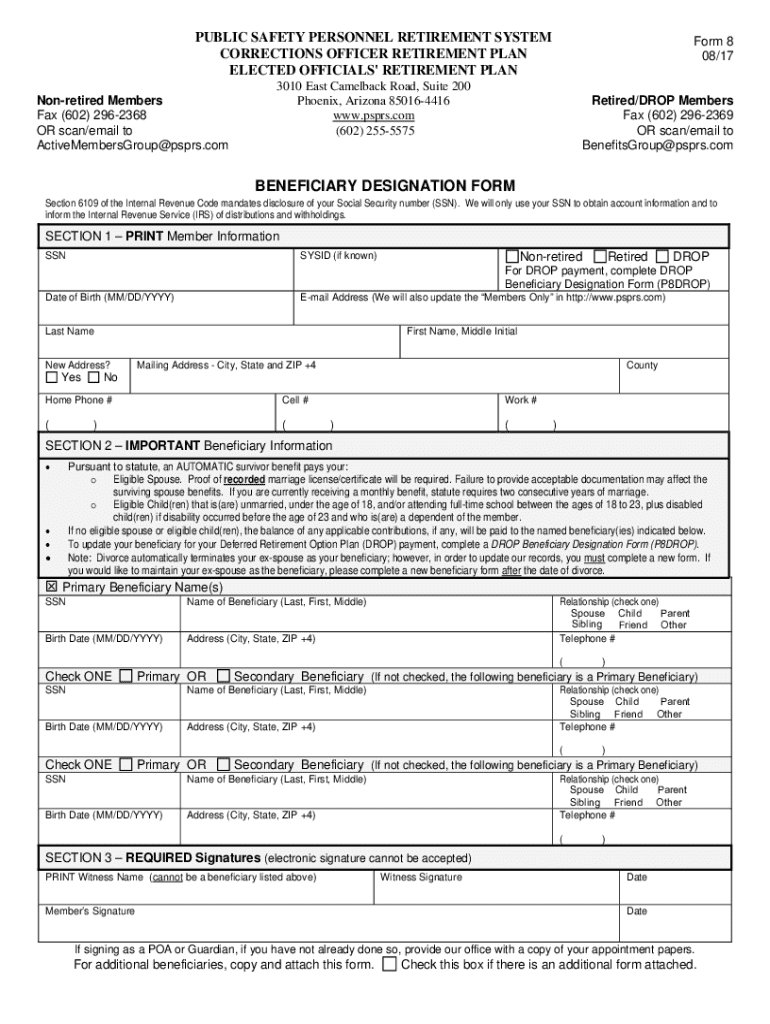

A beneficiary designation form is a legal document that allows individuals to specify who will inherit their assets after their passing. This form plays a crucial role in the estate planning process, ensuring that assets like life insurance benefits, retirement accounts, and other financial instruments are transferred according to the individual's wishes. Accurately completing this form is essential; any errors or omissions can lead to delays in asset distribution or, worse, unintended beneficiaries receiving what was meant for someone else.

There are various types of beneficiary designation forms tailored for specific assets. These include beneficiary forms for life insurance policies, retirement accounts such as Individual Retirement Accounts (IRAs) and 401(k)s, and medical and financial powers of attorney. Each of these forms serves to protect the asset holder's intentions and provides clear direction regarding the distribution of their estate.

Key elements of a beneficiary designation form

When filling out a beneficiary designation form, several key elements must be included to ensure clarity and compliance with legal standards. Essential personal information is required, including the name, contact information, and relationship to the beneficiaries. This information helps establish legitimacy and facilitates easier navigation during the asset distribution process.

It's critical to distinguish between different types of beneficiaries. Primary beneficiaries are the first in line to receive assets, while contingent beneficiaries will inherit if the primary beneficiary has passed. Beneficiaries can also be individual persons or entities, such as trusts or charities. Additionally, specific designations outline how assets will be allocated, including percentage distributions and any special instructions for how beneficiaries should receive their inheritance.

Step-by-step guide to completing the beneficiary designation form

Completing a beneficiary designation form requires careful planning and attention to detail. Begin by gathering necessary information about yourself and your desired beneficiaries. This includes full names, contact details, and relationships to you. Ensuring this information is accurate is vital in preventing any legal disputes later.

Next, choose your beneficiaries. Consider your relationships and long-term intentions when selecting individuals or entities. Consulting with family members or financial advisors can provide insights into the implications of your choices. Once you have indicated your beneficiaries, fill out the form accurately. Double-check to avoid common mistakes—such as misspelling names or incorrect percentages—which could disrupt your plans.

After filling out the form, it's crucial to review your designations thoroughly. This step promotes accuracy and provides an opportunity to ensure everything aligns with your intentions. Seeking a second opinion from a legal or financial professional can also be beneficial. Finally, submit and store the form safely, ensuring it is easily accessible for future reference.

Editing and updating your beneficiary designation form

Life circumstances can significantly impact your beneficiary choices, making it essential to keep your beneficiary designation form updated. Events such as marriage, divorce, the birth or death of a child, or changes in financial circumstances warrant a review of your designations. Regular updates ensure alignment with your current wishes and prevent any confusion or potential legal challenges.

Amending your designation can be relatively straightforward, often involving a simple amendment or a new form submission. Every change should be documented meticulously to maintain a clear record of your intentions over time. It’s advisable to also communicate these changes with your family members or beneficiaries to avoid any misunderstandings.

Common challenges with beneficiary designation forms

Miscommunication among family members can lead to significant challenges regarding beneficiary designations. To prevent disputes, it is essential to have open discussions with family members about your choices and the reasons behind them. Transparency can alleviate potential tensions and provides a smoother transition of assets.

Another frequent issue arises from outdated designations, which can lead to legal complications, especially if the form is not reviewed after losing a loved one or upon major life changes. Additionally, complex situations such as designating minors or dependents with special needs require thoughtful planning and potentially legal guidance to ensure that these beneficiaries are adequately cared for.

Interactive tools for managing your beneficiary designation

Managing your beneficiary designation form can be simplified with interactive tools like those available through pdfFiller. This platform provides users with easy access to templates and forms that streamline the process of completing beneficiary designations. Moreover, the cloud-based solutions offered by pdfFiller enable users to edit, sign, and collaborate on documents remotely.

With pdfFiller, you not only have the capability to fill out forms accurately but also enjoy essential tools for collaboration. This can be particularly beneficial when you're involving family members or financial advisors in discussions regarding your beneficiary choices. The convenience of cloud storage allows for secure and organized document management, accessible anytime and anywhere.

Case studies: Effective use of beneficiary designation forms

Examining case studies offers valuable insights into the effective use of beneficiary designation forms. One example is a family that successfully designated beneficiaries for their life insurance policy after discussing their options openly. This dialogue ensured that all family members understood the choices made and reduced the chances of disputes when the claim was filed.

In contrast, a family that failed to update their beneficiary forms after the birth of a child encountered a difficult situation when the assets went to unintended beneficiaries. This scenario underlines the importance of regularly reviewing and adjusting your beneficiary designations to reflect life changes and family dynamics.

Frequently asked questions (FAQs) about beneficiary designation forms

One common question surrounding beneficiary designation forms is, 'What happens if you do not complete a form?' Without a completed form, the default rules of intestacy will apply, which may not align with your wishes, potentially leading to disputes among heirs. Another frequently posed question is whether beneficiaries can be changed after the form is filed. The answer is yes; beneficiaries can usually be amended at any time, depending on the policies governing the specific account or asset.

Lastly, individuals often ask if a verbal agreement is sufficient for beneficiary designations. Unfortunately, verbal agreements typically hold no legal weight, especially regarding financial assets, where written agreements in a beneficiary designation form are necessary to ensure your wishes are honored.

Security and privacy considerations

When it comes to completing and managing beneficiary designation forms, security and privacy are paramount. These documents contain sensitive information that, if mismanaged, could lead to identity theft or asset misallocation. Therefore, it's essential to understand the confidential nature of these designations.

Best practices for securing your information include storing physical copies in a safe place and ensuring that digital copies are stored in secure, password-protected platforms or cloud solutions like pdfFiller. When sharing your designations, ensure that you do so with trusted parties only, adding an extra layer of protection for your sensitive information.

Conclusion

In conclusion, ensuring the proper completion and management of your beneficiary designation form is a critical aspect of estate planning. By accurately filling out this form, you protect your wishes and streamline the asset transfer process for your loved ones. Staying informed and proactive about changes in your life can help maintain the integrity of your beneficiary designations.

Utilizing tools like pdfFiller not only simplifies filling out and managing these forms but also enhances collaboration with family members and advisors. By taking these steps, you can ensure that your assets are distributed according to your intentions and provide peace of mind for yourself and your beneficiaries.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify beneficiary designation form without leaving Google Drive?

How can I get beneficiary designation form?

How do I make changes in beneficiary designation form?

What is beneficiary designation form?

Who is required to file beneficiary designation form?

How to fill out beneficiary designation form?

What is the purpose of beneficiary designation form?

What information must be reported on beneficiary designation form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.