Get the free Form 13f-hr

Get, Create, Make and Sign form 13f-hr

How to edit form 13f-hr online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 13f-hr

How to fill out form 13f-hr

Who needs form 13f-hr?

A comprehensive guide to Form 13F-HR: Understanding, Preparation, and Submission

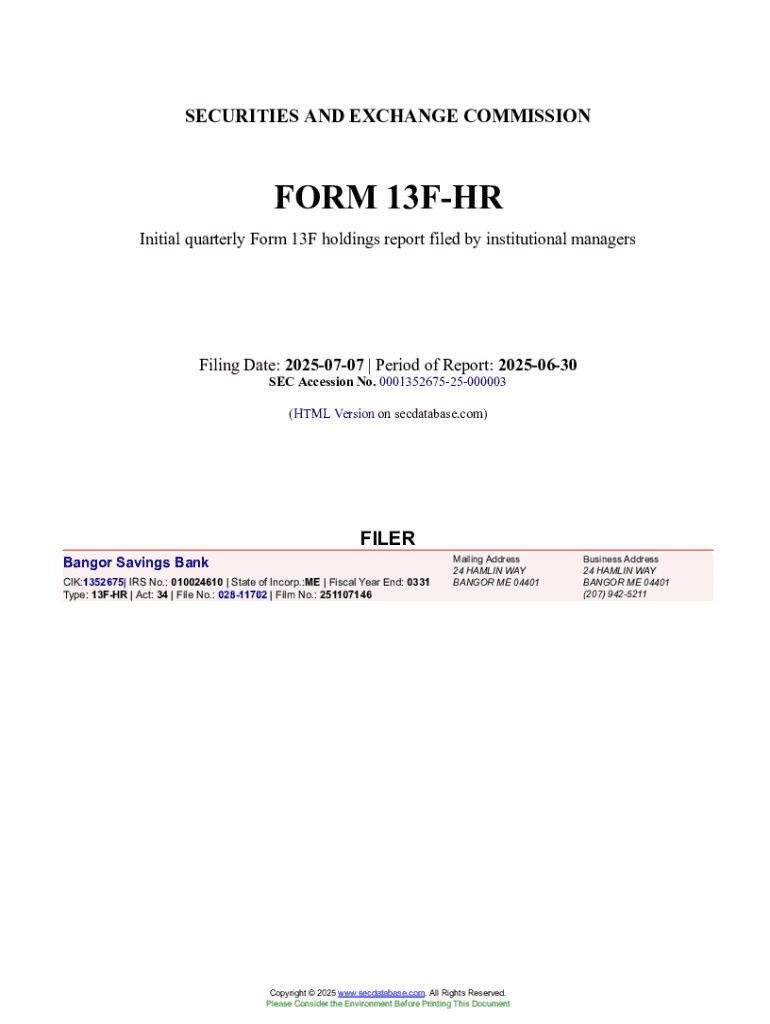

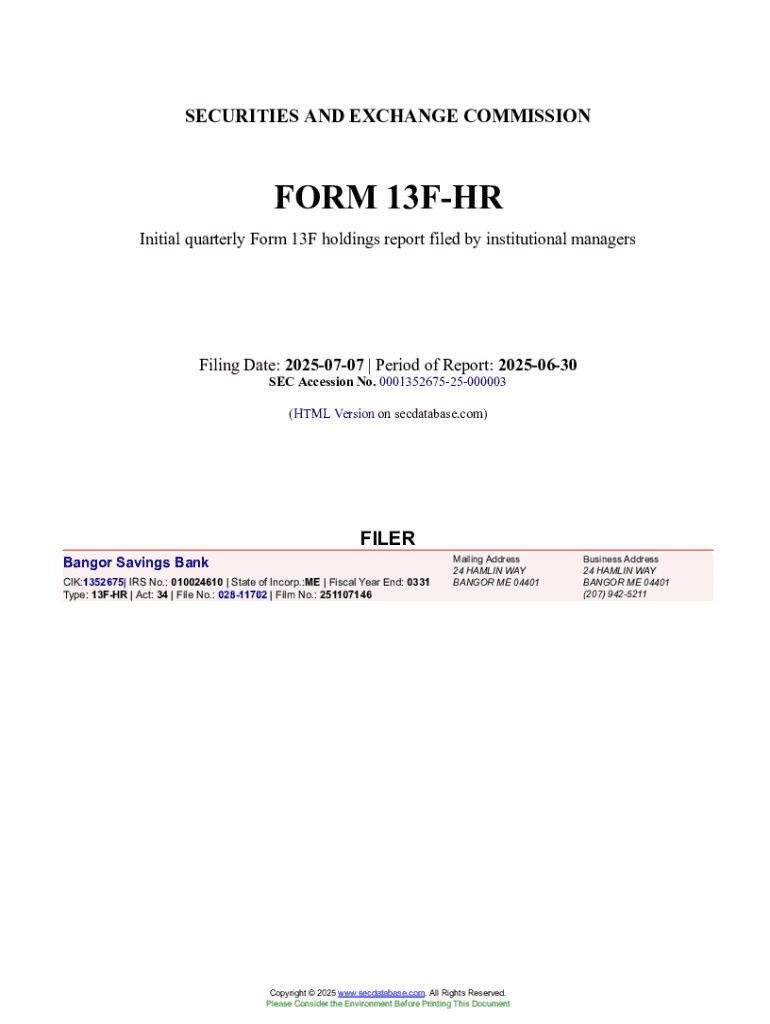

Understanding Form 13F-HR

Form 13F-HR is a critical document filed by institutional investment managers with the U.S. Securities and Exchange Commission (SEC). It provides a comprehensive view of the securities held by these institutions, including stocks, options, and convertible bonds. The purpose of this form is to enhance transparency in financial markets and facilitate regulatory oversight. Under SEC regulations, institutional managers must file this form quarterly, disclosing their equity holdings.

Compliance is not just a legal obligation but a vital part of maintaining the integrity of the financial system. By requiring institutional managers to disclose their holdings, Form 13F-HR contributes to a more informed marketplace and helps prevent potential abuses related to insider trading and market manipulation.

Who needs to file Form 13F-HR?

Institutional investment managers who manage assets of $100 million or more are required to file Form 13F-HR. This includes mutual funds, pension funds, hedge funds, and other similar entities. The requirement ensures that those who have significant influence over market investments provide the necessary information to regulators and the public.

The relevance of Form 13F-HR in financial markets

Form 13F-HR plays a significant role in improving market transparency. By mandating institutional investment managers to disclose their holdings, it builds investor confidence. This transparency allows investors to understand market dynamics better and leads to informed decisions. For instance, when large institutional investors adjust their portfolios, it can signal to the market about evolving sector trends or asset valuations.

Furthermore, the data gathered from Form 13F-HR filings can be analyzed to identify emerging investment strategies and market behaviors. This benefit is not just theoretical; many investors and analysts look to these filings to gauge the movements of influential market players and adjust their strategies accordingly.

Preparing to file Form 13F-HR

Preparation for filing Form 13F-HR involves meticulous organization and data collection. First, investors need to compile a complete list of securities held by the institution. This can include stocks, call options, and other relevant securities, categorized properly to ensure accuracy on the form.

Once the list of securities is compiled, it’s crucial to align with the SEC guidelines. This includes understanding the reporting rules, maintaining deadlines, and submitting the required documentation correctly. One common pitfall is failing to adhere to submission timelines, which can result in penalties and additional scrutiny from regulators.

Step-by-step guide to completing Form 13F-HR

To begin the filing process, the first step is to access Form 13F-HR, which can generally be downloaded directly from the SEC's official website. Familiarizing yourself with the form layout can help streamline completion.

Each section of the form must be completed accurately. Start with the information regarding the institutional investment manager, including name and address. In Part 1, summarize your holdings, indicating the total market value. Part 2 requires a detailed list of each security held, including the title and number of shares or principal amount.

eSigning and submitting Form 13F-HR

After completing Form 13F-HR, it’s essential to review your submission for accuracy. Using tools like pdfFiller can simplify the eSigning process by allowing users to edit the form easily, invite colleagues to review it, and add digital signatures securely. Collaborative features enable teams to manage submissions seamlessly.

Once signed, the form must be submitted electronically to the SEC. It is vital to ensure that you receive a confirmation of receipt as proof of submission. Tracking your submission provides peace of mind and addresses any potential processing issues.

Post-submission: What to expect

After submission of Form 13F-HR, you can anticipate public disclosure of your holdings. This transparency can influence your investment strategy moving forward, as market participants will analyze your organization’s positioning. Supplying this information can influence how other investors perceive your activities, thus making it crucial to prepare for the market's reaction.

In case any amendments are necessary, understanding the process for correcting submitted documents is essential. Situations warranting amendments might include clerical errors or changes in ownership stakes. Following the structured amendment process ensures compliance and maintains the integrity of the documentation.

Managing your Form 13F-HR documentation with pdfFiller

pdfFiller provides users with a robust framework for organizing and managing Form 13F-HR documentation efficiently. Users can create specific folders for various filings, ensuring an easy and clear retrieval process. This organization is essential, especially when preparing for future filings or audits.

In addition to individual organization, pdfFiller facilitates team collaboration by allowing multiple users to access forms, leave comments, and annotate documents. Such collaborative tools enhance team efficiency and ensure everyone involved is on the same page, reducing the likelihood of errors.

Advanced insights: Analyzing Form 13F-HR data

Investment professionals can utilize the data filed on Form 13F-HR to recognize trends among institutional investors. Analyzing this data through various tools can provide insights into changing investment strategies and priorities. Researchers and analysts often aggregate this information to identify which sectors are gaining traction or losing favor among mega funds.

Real-world case studies also highlight how particular institutions’ strategies, disclosed through Form 13F-HR filings, have affected market directions or subsequent investor behavior. The ability to observe such trends not only clarifies prevailing market conditions but allows other investors to anticipate movements effectively.

Conclusion: The role of Form 13F-HR in financial literacy

Form 13F-HR serves as an essential tool in promoting financial literacy among investors. By revealing the activities of institutional investment managers, it empowers individual investors with information needed to make informed choices. Such transparency is fundamental in fostering a more equitable investment environment.

The necessity of staying compliant and effectively managing documents cannot be overstated. By utilizing platforms like pdfFiller, firms can ensure that their filings are accurate and timely, securing their place as trusted participants in the financial realm.

Interactive tools and features on pdfFiller

pdfFiller not only provides easy access to Form 13F-HR templates but also offers a variety of interactive tools that enhance the completion and management of documents. Users can fill out forms digitally, collaborate in real-time, and ensure seamless integration between team input and overall document accuracy.

These features empower teams to work harmoniously while maintaining meticulous attention to details within their form submissions. Utilizing pdfFiller helps streamline the entire filing process, making it easier for investment managers to focus on strategic decision-making rather than administrative burdens.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get form 13f-hr?

Can I create an electronic signature for the form 13f-hr in Chrome?

Can I create an eSignature for the form 13f-hr in Gmail?

What is form 13f-hr?

Who is required to file form 13f-hr?

How to fill out form 13f-hr?

What is the purpose of form 13f-hr?

What information must be reported on form 13f-hr?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.