Get the free Form 10-q

Get, Create, Make and Sign form 10-q

Editing form 10-q online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 10-q

How to fill out form 10-q

Who needs form 10-q?

Understanding Form 10-Q: A Comprehensive Guide

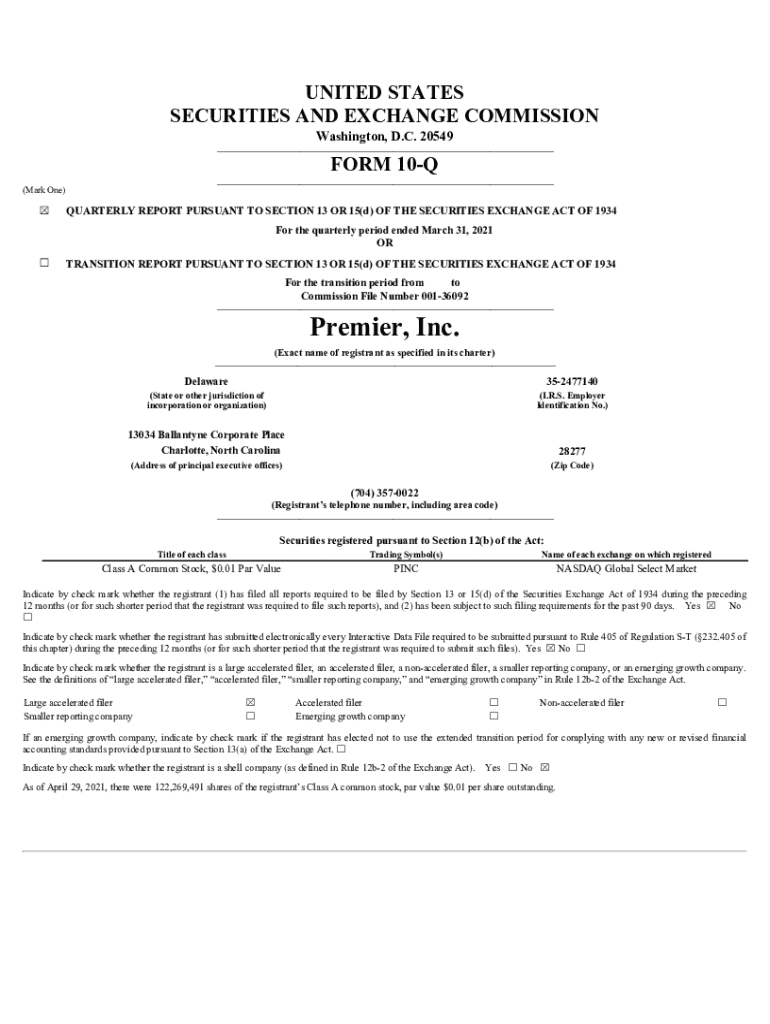

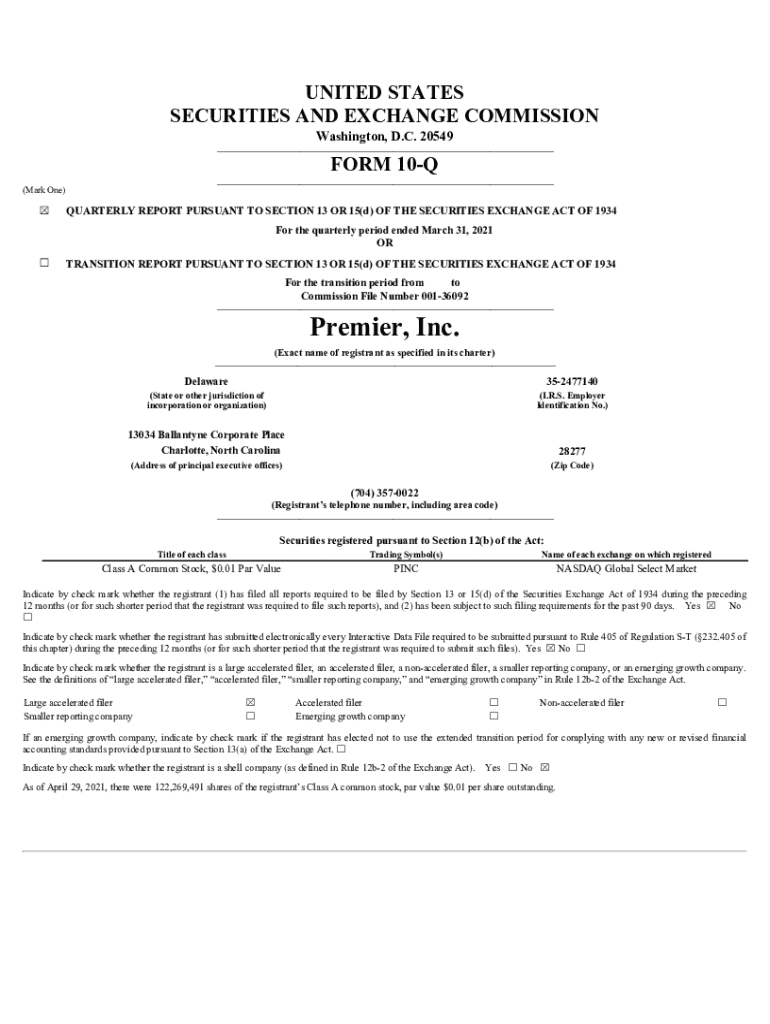

Understanding the Form 10-Q

A Form 10-Q is a quarterly report mandated by the U.S. Securities and Exchange Commission (SEC) for publicly traded companies. It is designed to provide an ongoing view of the company's financial position and performance throughout the year, allowing stakeholders to stay informed between the annual reporting cycles.

The importance of the Form 10-Q cannot be overstated. For investors, it offers critical insights into the company's financial health and operational results in a timely manner. Stakeholders, including creditors and analysts, depend on this documentation to make informed decisions. With the SEC overseeing these filings, the integrity and transparency of the information provided is ensured, creating a level playing field for all investors.

Breakdown of a Form 10-Q

The Form 10-Q consists of several key components, each providing specific insights into the company's ongoing business health. The financial statements form the backbone of the report, including the balance sheet and income statement, which present a detailed picture of the company’s financial status and earnings during the quarter.

Moreover, the Management’s Discussion and Analysis (MD&A) section is crucial as it provides managerial insights on performance, significant trends, and future plans, giving depth to the raw financial data. Other essential components include an analysis of risk factors that may affect the company's operations and an overview of internal controls and procedures, assuring stakeholders of the company’s operational integrity.

Unlike the Form 10-K, which is filed annually and contains a comprehensive overview of the company’s performance, the 10-Q is less extensive and focuses on the current quarter’s results, making it less formal but equally important in financial oversight.

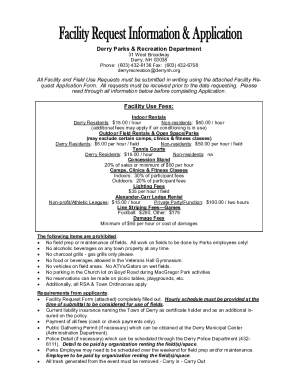

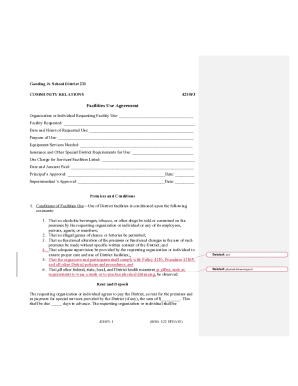

Navigating the filing process

Filing a Form 10-Q may seem daunting, but it becomes manageable with a step-by-step approach. Firstly, determine the filing requirements applicable to your company, especially if it falls under specific categories defined by the SEC.

Once the requirements are clear, begin gathering the necessary financial data accumulated throughout the quarter. After that, prepare the financial statements such as the balance sheet and income statement, ensuring accuracy and compliance with GAAP (Generally Accepted Accounting Principles). Completing each section of the form follows, including the MD&A and risk management sections, before filing the report electronically through the SEC’s EDGAR system.

Utilizing interactive tools like pdfFiller can streamline this process, allowing you to create, edit, and sign documents easily. Avoiding common mistakes is also crucial; errors in financial figures or missing components can lead to SEC scrutiny or penalties.

Details on specific items included in Form 10-Q

Each Form 10-Q requires detailed information about several critical items. Starting with Item 1, financial statements present the core data reflecting the company’s financial condition at the time of filing. Item 2 requires a comprehensive discussion through the MD&A, which contextualizes the financial performance and highlights any significant changes from the previous quarters.

Item 3 focuses on quantitative and qualitative disclosures about market risk, where companies are expected to explain potential risks posed by external factors such as market volatility. Lastly, Item 4 discusses internal controls, assuring stakeholders of the steps taken to manage risks and enhance financial reporting processes.

Tailoring responses specific to your company's circumstances is essential and must comply with SEC regulations to avoid penalties.

Timelines and deadlines

Understanding the compliance calendar is vital for any finance department. The SEC requires quarterly reports to be filed within 40 days after the end of each fiscal quarter. For emerging growth companies, the timeline may differ, so always check the specific requirements applicable to your organization.

Failing to adhere to these deadlines may result in fines, reputational damage, or loss of trust from investors. To help manage these timelines, using calendar reminders and alerts with tools like pdfFiller can streamline the filing process and ensure nothing is overlooked.

Accessing and reviewing Form 10-Qs

Finding filed Form 10-Q documents online is straightforward through the SEC's EDGAR database. Investors and analysts can easily search for any public company's filings by name or ticker symbol. Third-party financial services also offer access, often providing additional analytical tools to evaluate a company’s performance.

When reviewing a Form 10-Q, it is important to focus on key indicators such as revenue trends, expense variances, and risk disclosures. Utilizing tools to monitor updates on competitors’ 10-Q filings can provide valuable insights into market conditions and competitive positioning.

Best practices for managing and updating your Form 10-Q

Regular updates and strategic revisions are essential for a successful Form 10-Q. Creating an internal process for continuous collaboration among finance, legal, and operational teams helps ensure that everyone is on the same page and all inputs are accurate. Using features from platforms like pdfFiller enhances collaboration, allowing relevant stakeholders to edit, comment, and review documents collectively.

Additionally, maintaining an audit trail is critical for compliance and transparency, which is indispensable for building trust with investors and regulatory bodies alike.

FAQs about Form 10-Q

Several questions often arise regarding the Form 10-Q. For instance, many wonder what companies are required to file one. Generally, all publicly traded companies must file annual and quarterly reports, including Form 10-Q.

Another common question is whether a filed 10-Q can be amended. Yes, companies can file amendments to a 10-Q if necessary, although this is generally not the norm. Lastly, failing to meet filing deadlines can lead to penalties, emphasizing the importance of proper timeline management.

Conclusion: maximizing the utility of Form 10-Q

Leveraging insights from Form 10-Q filings can provide immense value for business expansion and strategic planning. Companies that analyze and utilize the data presented in their 10-Qs can forecast trends, identify areas for improvement, and communicate effectively with stakeholders.

With pdfFiller streamlining the document management experience, users are empowered to edit, eSign, collaborate, and maintain compliance all from a single cloud-based platform, enhancing efficiency and accuracy in the filing process.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify form 10-q without leaving Google Drive?

Can I sign the form 10-q electronically in Chrome?

How can I edit form 10-q on a smartphone?

What is form 10-q?

Who is required to file form 10-q?

How to fill out form 10-q?

What is the purpose of form 10-q?

What information must be reported on form 10-q?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.