Get the free Preliminary Offering Statement

Get, Create, Make and Sign preliminary offering statement

How to edit preliminary offering statement online

Uncompromising security for your PDF editing and eSignature needs

How to fill out preliminary offering statement

How to fill out preliminary offering statement

Who needs preliminary offering statement?

Preliminary Offering Statement Form - A Comprehensive Guide

Understanding the preliminary offering statement

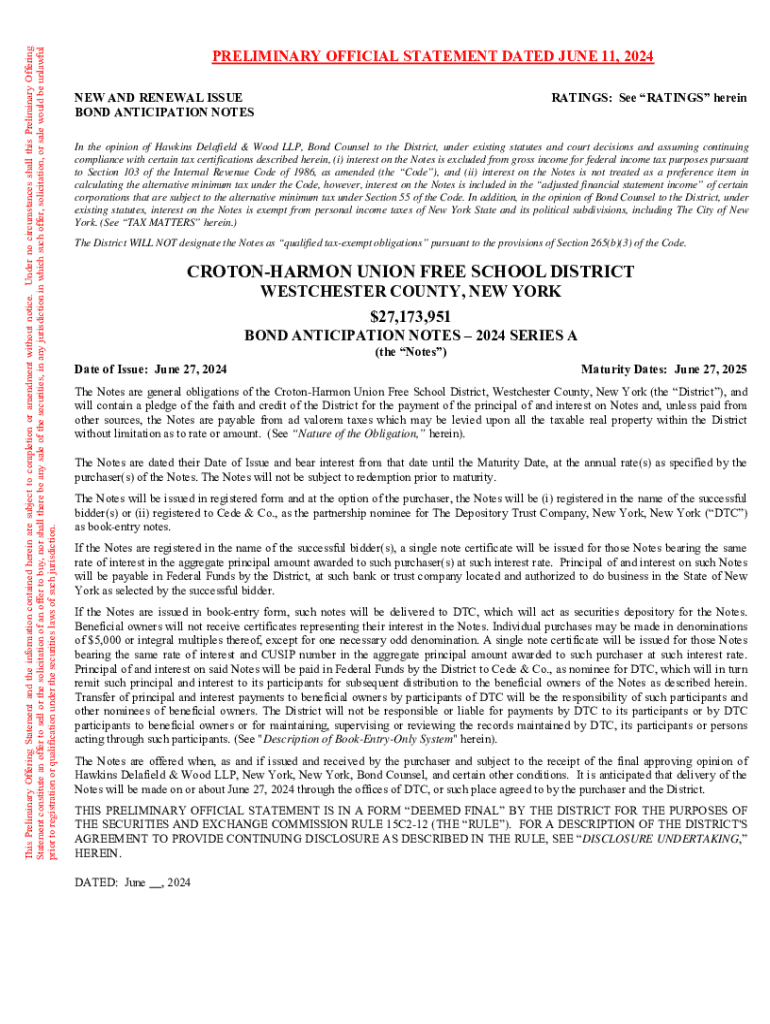

A Preliminary Offering Statement (POS) is a key document in the fundraising process for municipalities and corporations. It provides prospective investors with detailed information about financial offerings, including bonds and securities, prior to their official sale. The primary purpose of a POS is to ensure that all essential facts about the offerings are disclosed, allowing investors to make informed decisions.

The importance of a Preliminary Offering Statement cannot be overstated. Not only does it serve as a primary source of information for potential investors, but it also aids issuers in ensuring compliance with regulatory requirements. By clearly outlining the terms and conditions of the offerings, the POS fosters transparency in the financial markets.

The role of preliminary offering statements in the financial market

For investors, a Preliminary Offering Statement is crucial as it provides a comprehensive overview of the offering that informs their investment decisions. It highlights significant details such as how the offered securities will operate, associated risks, and the overall financial health of the issuer. Access to this document allows investor assessment of whether the securities align with their financial goals and risk tolerance.

Issuers have legal obligations to accurately present the information within the POS. Material omissions or inaccuracies could lead to severe penalties and loss of investor trust. Hence, it is pivotal for issuers to meticulously prepare this document following the guidelines set forth by regulatory bodies such as the Securities and Exchange Commission (SEC).

The POS is integrated into a broader compliance framework that emphasizes transparency and full disclosure. Regulatory bodies require issuers to provide ongoing updates to registered documents, which fosters an environment of integrity within the market.

Step-by-step guide to preparing a preliminary offering statement

Preparing a Preliminary Offering Statement is a comprehensive process that requires meticulous attention to detail. To begin, gather all necessary data and documentation that will support the information provided in the POS. This may include financial records, risk assessments, and descriptions of the use of funds. A well-structured organization of this information can streamline the preparation process and ensure accuracy.

Next, proceed to complete the Preliminary Offering Statement Form itself. This form typically includes sections for the issuer's details, offering terms, risks, and more. Each section must be filled with specific information, following the guidelines laid out by regulatory authorities. Common pitfalls include providing incomplete information or failing to disclose material risks, which can lead to compliance issues.

After completing the form, it’s essential to edit and review the document thoroughly. This review process should involve collaboration among team members involved in the offering to ensure that every detail is correct. An additional layer of quality control can be achieved by having external legal counsel review the final draft for compliance with relevant regulations.

Essential tips for using pdfFiller for your POS

pdfFiller offers a seamless document editing experience for users preparing their Preliminary Offering Statement forms. The platform allows users to upload their PDF files directly and provides tools to edit, add text, and format the document as necessary. Utilizing templates can greatly enhance efficiency, saving time while ensuring that all required information is captured effectively.

Once the document is prepared, eSigning is a critical feature that pdfFiller offers. Users can add electronic signatures securely, ensuring compliance with legal standards. Additionally, the platform includes features for document collaboration, making it easier for multiple team members to work on the POS together in real-time.

Common mistakes and how to avoid them

While preparing a Preliminary Offering Statement, there are common pitfalls that issuers should be aware of. Frequently made errors include providing incomplete data, overlooking key risks associated with the offering, and failing to adhere to SEC guidelines. Such mistakes can have serious repercussions, including potential investigations and fines.

To ensure compliance, adhering to best practices is essential. This includes keeping abreast of changes in regulations that might affect the requirements for the POS and ensuring that all disclosures are thorough and accurate. Engaging reliable legal counsel throughout the process can mitigate risks associated with oversight and enhance the credibility of the offering.

Frequently asked questions about preliminary offering statements

A common question pertains to the difference between a Preliminary Offering Statement and an Official Statement. While a POS is a preliminary document that seeks to inform potential investors about the terms and conditions of the offering before it is finalized, an Official Statement is the finalized version of the document that is provided once the offering is ready to go to market.

Typically, entities that need to file a Preliminary Offering Statement include municipalities and corporations preparing for a securities offering. Their responsibilities entail presenting a comprehensive overview of the offering and ensuring compliance with relevant legal frameworks.

Post-filing of a POS, issuers prepare to sell the securities, transitioning into the next steps of the regulatory process, which include finalizing their offering documents and marketing them to potential investors.

Case studies: successful use of preliminary offering statements

To illustrate the effective use of a Preliminary Offering Statement, we can examine a successful municipal bond offering where the issuer provided a POS that detailed the project use of funds, outlined potential risks, and included comprehensive financial data. This transparency instilled investor confidence, leading to a successful sale of the bonds.

Another example comes from a corporate issuer who utilized their POS to not only disclose relevant financial information but to engage investors with a narrative about their strategic goals. The clarity and transparency in their POS attracted a wider investor base, demonstrating how a well-prepared document can have significant impacts on the success of an offering.

Navigating regulatory changes affecting preliminary offering statements

Staying updated with recent regulatory developments is crucial when preparing a Preliminary Offering Statement. Changes in laws and compliance measures can directly impact the structure and content of the POS. For example, updates from the SEC may introduce new disclosure requirements that need to be integrated into your document.

To prepare for future changes, issuers should regularly review guideline updates, participate in industry webinars, and consult with legal experts who specialize in financial regulations. Adjusting to evolving frameworks not only enhances compliance but also builds investor trust through transparency.

Exploring alternative tools and solutions

While pdfFiller stands out as an excellent tool for managing Preliminary Offering Statements, it’s beneficial to compare it with other document management solutions available in the market. Platforms like Adobe Sign or DocuSign also provide unique features suited for digital document management, offering various levels of editing and signing capabilities.

Choosing pdfFiller is advantageous due to its comprehensive features tailored for POS forms. The platform's focus on facilitating seamless editing, efficient collaboration, eSigning, and cloud storage positions it as a robust choice for individuals and teams seeking an all-in-one solution for managing their documents.

Engaging with the community and the marketplace

Building connections within the investor relations community can provide valuable insights and resources for individuals and teams preparing a Preliminary Offering Statement. Engaging with investor networks not only aids in staying informed about market trends but also encourages the sharing of best practices to enhance the POS preparation process.

Resources such as webinars, industry forums, and continued education on market dynamics can be crucial tools for anyone engaged in financial offerings. These resources support staying up-to-date and informed, ultimately contributing to the successful preparation and execution of Preliminary Offering Statements.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit preliminary offering statement from Google Drive?

How can I edit preliminary offering statement on a smartphone?

Can I edit preliminary offering statement on an iOS device?

What is preliminary offering statement?

Who is required to file preliminary offering statement?

How to fill out preliminary offering statement?

What is the purpose of preliminary offering statement?

What information must be reported on preliminary offering statement?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.