Get the free 512-sa

Get, Create, Make and Sign 512-sa

Editing 512-sa online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 512-sa

How to fill out 512-sa

Who needs 512-sa?

512-SA Form How-to Guide

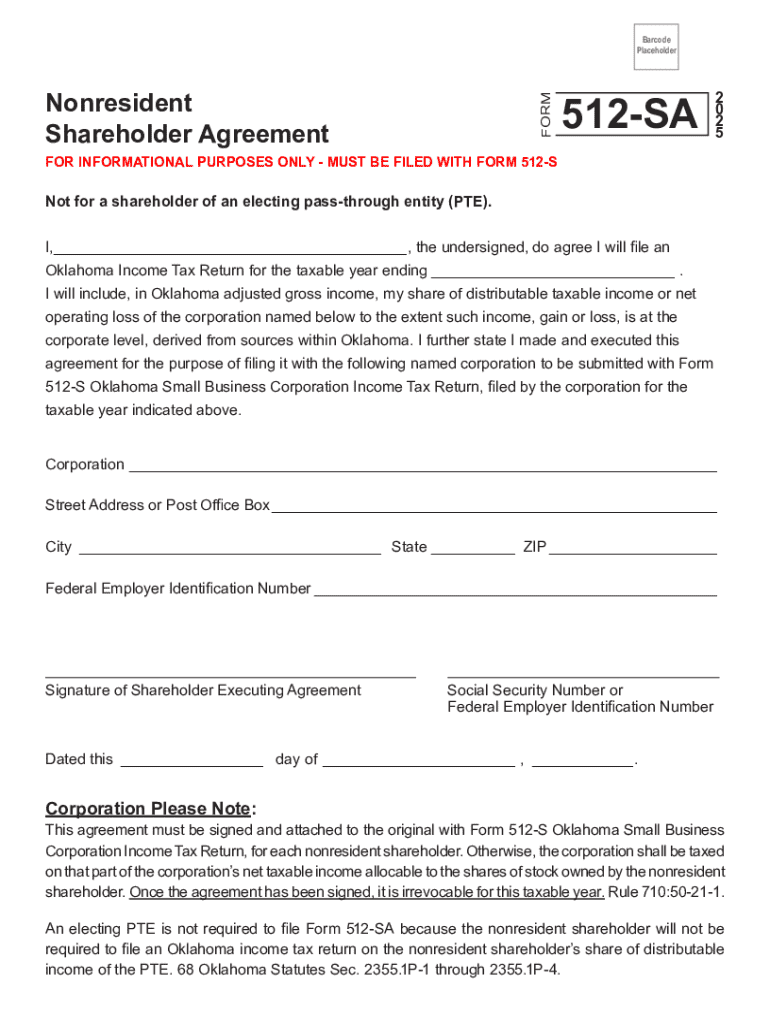

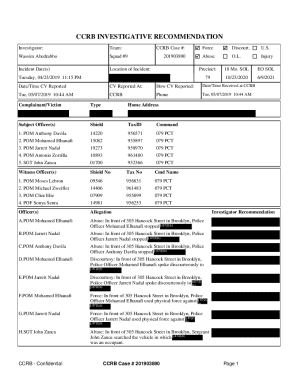

Understanding the 512-SA form

The 512-SA form serves a critical purpose within specific administrative processes. As an essential document filled primarily by companies and individuals required to report certain financial or operational information, this form ensures compliance with regulations and maintains transparency in operations.

Scenarios necessitating the 512-SA form may vary widely, encompassing everything from tax documentation to information required for regulatory compliance. Understanding when this form is needed can prevent complications and delays, ensuring smoother processes.

Who should use the 512-SA form?

The primary users of the 512-SA form include business professionals, accountants, and regulatory agencies. Each group plays a unique role in ensuring the form is filled out accurately and submitted on time.

Key stakeholders encompass anyone involved in the regulatory process or needing to submit corporate financial information, ensuring that all required data is captured. This recognition helps streamline the compliance process, benefiting everyone involved.

Key components of the 512-SA form

Understanding the components of the 512-SA form is fundamental before diving into how-to instructions. The form typically includes sections for personal identification, financial reporting, and declarations necessary for the regulatory framework.

Important terminology to grasp involves terms like 'declarant', 'financial year', and 'submission deadlines'. Familiarizing yourself with these definitions can significantly enhance accuracy and efficiency while completing the form.

Step-by-step instructions for completing the 512-SA form

Filling out the 512-SA form starts with gathering necessary information. Before beginning, ensure you have access to all relevant documents, including previous tax returns, financial statements, and regulatory guidelines that apply to the form.

Tips for organizing your information include creating a checklist of required documents and dividing them into categories, such as personal identification and financial details. This structured approach will enable you to address each section systematically.

Filling out the 512-SA form

The 512-SA form is divided into distinct sections, each serving a specific purpose. For instance, the personal information section requires your name, address, and identification numbers, while the financial reporting section necessitates detailed income and expense reports.

To ensure accuracy, double-check each entry before moving on to the next section. Watch out for common pitfalls such as typos or mismatched numbers, which could delay processing or lead to rejections of your submission.

Using pdfFiller to complete the form

Utilizing pdfFiller to fill out the 512-SA form offers several advantages. The platform simplifies the form-filling process with user-friendly templates, automated data entry features, and options for saving your progress.

Accessing the 512-SA form template on pdfFiller is straightforward. Simply search for the form on the platform, select the appropriate template, and start filling it out digitally. This not only saves time but enhances accuracy.

Editing and customizing the 512-SA form

pdfFiller provides a robust suite of editing tools designed to enhance your experience when modifying the 512-SA form. Users can easily modify text, add images, and even make annotations, facilitating a comprehensive review process.

Collaborative editing options are particularly beneficial for teams, allowing multiple stakeholders to review and suggest changes in real-time. This feature streamlines teamwork, making consultations more productive.

Personalizing your 512-SA form

Customizing the 512-SA form to fit specific needs can enhance its effectiveness. Consider incorporating branding elements such as logos or preferred color schemes to make the document identifiable and representative of your organization.

Additionally, adjusting formatting options allows for improvements in readability and professionalism, which can significantly impact the perception of your submission.

Signing the 512-SA form with pdfFiller

One of the notable features of pdfFiller is its electronic signing functionality. With eSigning, you can add your signature directly onto the 512-SA form without needing to print, sign, and scan.

The legal validity and security accompanying eSigning with pdfFiller meet most compliance requirements, thereby ensuring your document is legally binding. This convenience accelerates the entire approval process.

Step-by-step guide to signing the form

To add a signature using pdfFiller, click on the 'Sign' feature, create or upload your signature, and position it on the document where necessary. Ensure that the signature fields are properly placed to meet compliance standards.

Double-check the placement and format of the signature to ensure it complies with any specific regulations applicable to the form.

Managing and sharing the 512-SA form

Once you’ve completed the 512-SA form, managing your documents effectively is imperative. Utilize pdfFiller's cloud-based storage options to save your completed forms securely for easy access anywhere, anytime.

Best practices for document management include organizing forms by date or type, which aids efficiency when retrieving information. Ensure regular backups to prevent data loss.

Sharing the 512-SA form

Sharing the 512-SA form with stakeholders can be achieved securely through pdfFiller. Utilize the platform's sharing options, which allow you to send forms via email or generate shareable links, enhancing collaboration without compromising security.

Tracking document status and recipient actions is straightforward with pdfFiller’s dashboard, providing updates on who has viewed or edited the form.

Common questions about the 512-SA form

Users frequently encounter specific questions regarding the 512-SA form. Most inquiries revolve around submission timelines, data requirements, and troubleshooting form completion issues. Addressing these topics preemptively can expedite processes.

Common troubleshooting includes checking for missing fields or data mismatches. Solutions typically involve cross-referencing documents to correct errors before submission.

Best practices for successful form submission

To ensure successful form submission on the first attempt, double-check all entries, confirm the completeness of information, and ensure compliance with applicable regulations. A final review step by another trusted colleague can mitigate mistakes.

Prior to submission, verify all signatures and check documentation to maintain integrity and compliance throughout the process.

Troubleshooting and support

Understanding the common issues encountered with the 512-SA form can save time and frustration. Misplaced information, incorrect formatting, and unclear instructions are frequent challenges users face during the completion process.

Solutions often involve using the resources available within pdfFiller, including help guides and customer service, to resolve issues efficiently.

Getting help with pdfFiller

For additional support, pdfFiller offers various customer service channels, including live chat and email support. Accessing tutorials and guides can also augment your understanding of the platform’s functionalities, making form completion easier.

Utilizing these support resources can significantly reduce the learning curve associated with using the 512-SA form and pdfFiller’s features.

Enhancing your document management with pdfFiller

Leveraging pdfFiller's full capabilities means exploring other forms and templates available on the platform. This diversity allows users to not only manage the 512-SA form but also other essential documents related to their work.

Seamless integration with existing workflows and platforms enhances efficiency and organization within any business setting. The adaptability of pdfFiller makes it a comprehensive solution for various document management needs.

Why pdfFiller is your preferred document solution

Choosing pdfFiller as your document solution provides unique value propositions, including user-friendly tools, strong security features, and a streamlined process for completing complex forms like the 512-SA. Customer success stories underscore the effectiveness of these features in real-world scenarios.

Companies using pdfFiller report increased productivity and a significant reduction in errors related to document management, reflecting the overall benefits of utilizing a dedicated platform for form completion.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my 512-sa in Gmail?

Where do I find 512-sa?

How can I fill out 512-sa on an iOS device?

What is 512-sa?

Who is required to file 512-sa?

How to fill out 512-sa?

What is the purpose of 512-sa?

What information must be reported on 512-sa?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.