Get the free Successfully Filing Insurance Claims: A Step-by-Step Guide

Get, Create, Make and Sign successfully filing insurance claims

How to edit successfully filing insurance claims online

Uncompromising security for your PDF editing and eSignature needs

How to fill out successfully filing insurance claims

How to fill out successfully filing insurance claims

Who needs successfully filing insurance claims?

Successfully Filing Insurance Claims Form: A Comprehensive Guide

Understanding the insurance claims process

The insurance claims process can often feel daunting, especially after experiencing loss or damage. Understanding the nuances of your insurance policy is crucial to ensure a seamless experience. Homeowners, auto, and health insurance are among the most common types of claims, each with its unique protocols and requirements.

Many people fall prey to misconceptions about insurance claims, such as believing that all damages are automatically covered or that filing a claim will always lead to premium increases. Recognizing the specifics of what your insurance covers, including exclusions and limitations, will set the foundation for a successful claim.

Preparing for your claim

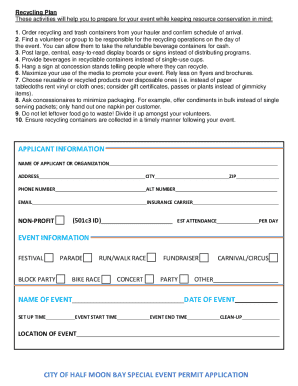

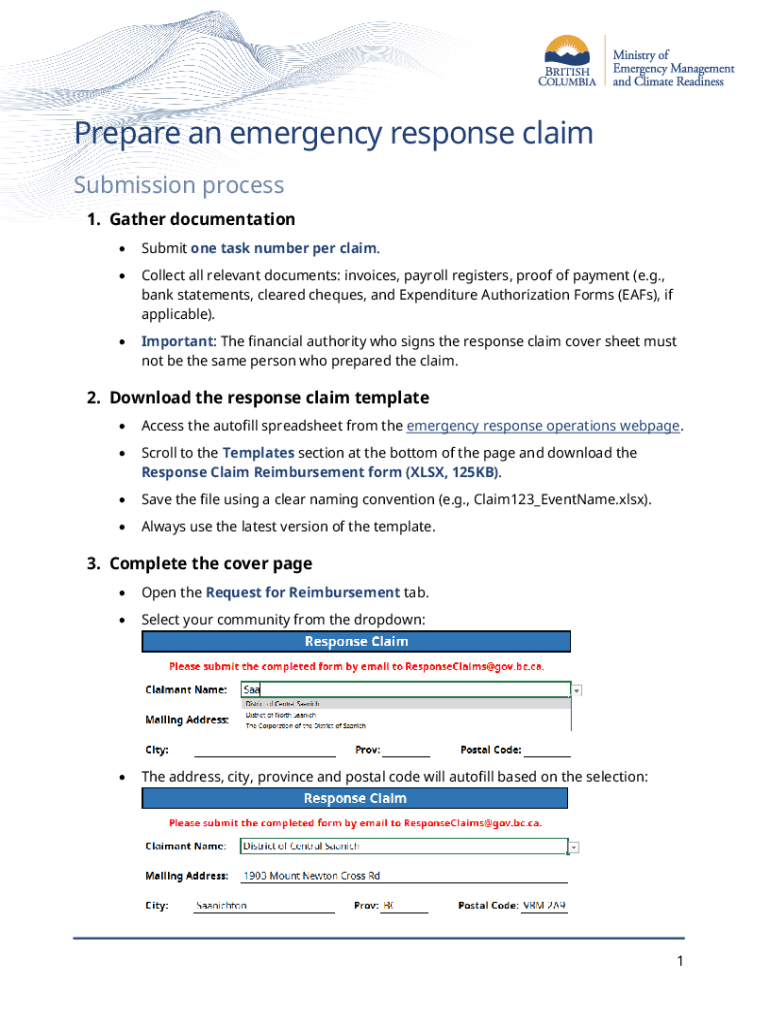

Preparation is key when filing an insurance claim. Start by gathering all essential documentation. This includes your policy documents, which outline coverage limits and conditions, and incident reports detailing what happened. Don't forget to collect any relevant correspondence you've had with your insurer, as this will provide context for your claim.

You should also familiarize yourself with claim timelines and deadlines. Many insurers require that claims be submitted within a certain period after the incident. Furthermore, take the time to assess the extent of your loss accurately, as this will influence the compensation you seek.

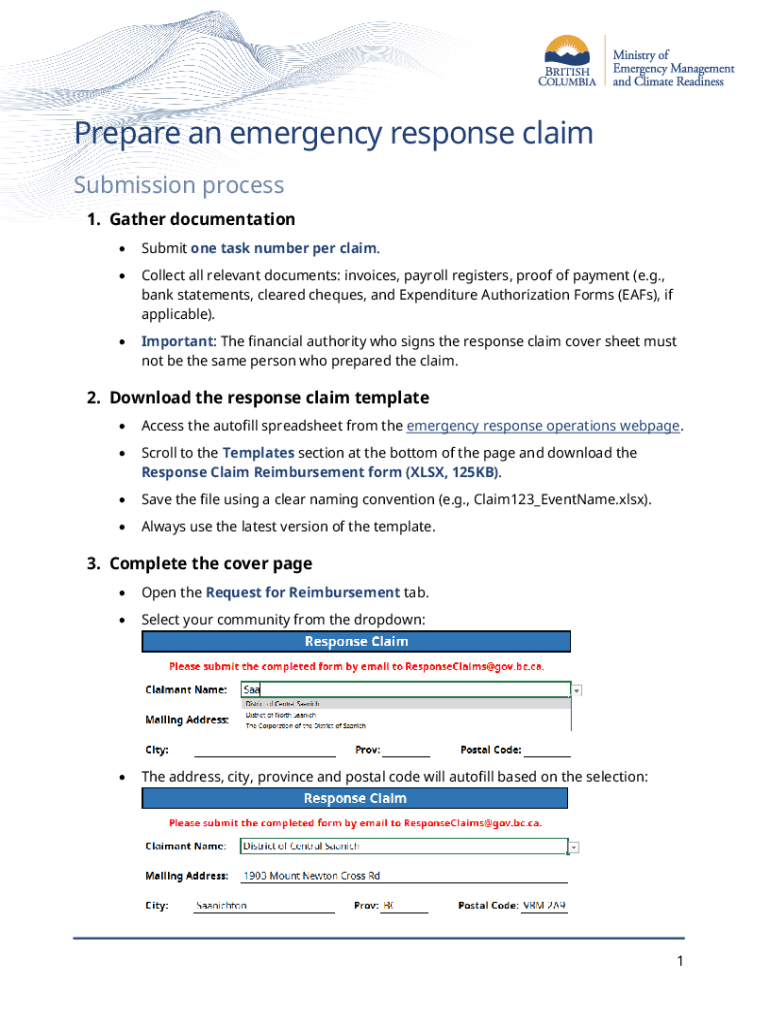

Step-by-step guide to successfully filing your insurance claims form

Filing an insurance claims form doesn't have to be overwhelming. Follow this step-by-step guide:

Tips for ensuring a smooth claims experience

To navigate the claims process smoothly, maintain records of all communications, including dates, names, and details of your interactions with your insurer. A claims checklist can be particularly useful to ensure that you have all your documents and evidence organized.

Utilizing tools like pdfFiller can enhance your claims experience. It allows you to edit and share claims forms easily and offers eSigning for quick processing. This means you can manage your documentation efficiently, ensuring that you have everything in order without the hassle of physical paperwork.

Common challenges in filing claims and how to overcome them

Filing insurance claims can encounter roadblocks. Delayed responses are common; understanding your insurer's processing times can mitigate frustration. If your claim is denied, review the reasons provided and gather additional evidence to support your case.

Complex claims situations, such as total loss or liability claims, may require additional documentation and scrutiny. Being proactive and organized, and frequently communicating with your adjuster will help you navigate these challenges effectively.

Leveraging technology for insurance claim success

In today's digital age, technology has streamlined the insurance claims process. pdfFiller simplifies this journey by providing easy access to forms and templates that you can fill out and submit directly. Its cloud-based document management features allow for easy collaboration with teammates or family members assisting in the claims process.

With the added benefit of cloud storage, your crucial documentation is backed up and accessible from anywhere. This not only eases anxiety but also increases the chances of a favorable outcome in your claims process.

Real-life success stories

Many individuals have successfully navigated the insurance claims process through diligence and the right resources. Testimonials from users often highlight how they overcame common obstacles like delays or misunderstandings regarding their coverages.

Case studies reveal that those who document their communications and maintain an organized approach to their claims can significantly improve their chances of success. These stories stand testament to the importance of preparation and efficient use of document management tools in the claims process.

Wrapping up your claim efficiently

After your claim is settled, it's crucial to conduct a post-claim review. Reflect on what worked, what didn't, and how you can improve for future claims. Keeping organized records is essential, not just for your peace of mind but also for any future claims you may need to file.

Staying informed and prepared can significantly impact your insurance claim experience, converting it from a stressful ordeal to a manageable task by leveraging tools like pdfFiller. The right documentation and a strategic approach can greatly enhance your chances of a favorable outcome.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send successfully filing insurance claims for eSignature?

How do I make changes in successfully filing insurance claims?

How do I complete successfully filing insurance claims on an iOS device?

What is successfully filing insurance claims?

Who is required to file successfully filing insurance claims?

How to fill out successfully filing insurance claims?

What is the purpose of successfully filing insurance claims?

What information must be reported on successfully filing insurance claims?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.