Get the free Junior Sipp

Get, Create, Make and Sign junior sipp

Editing junior sipp online

Uncompromising security for your PDF editing and eSignature needs

How to fill out junior sipp

How to fill out junior sipp

Who needs junior sipp?

Comprehensive Guide to the Junior SIPP Form

Understanding junior SIPPs

A Junior SIPP (Self-Invested Personal Pension) is a savings vehicle designed for minors, enabling parents and guardians to set aside money for the child’s retirement. Unlike conventional savings or investment accounts, Junior SIPPs provide tax-effective growth, ensuring that the funds can accumulate over an extended period without incurring tax liabilities until the funds are accessed in adulthood. The primary purpose is to encourage disciplined saving and investment from a young age, laying a solid foundation for future financial security.

The key benefits of a Junior SIPP include tax relief on contributions, the opportunity to invest in a broad spectrum of assets, and the ability to establish a long-term investment strategy for the child. This proactive approach not only benefits the child as they transition into adulthood but also offers peace of mind to parents, knowing that they are actively contributing to their child’s financial future.

Key components of a junior SIPP form

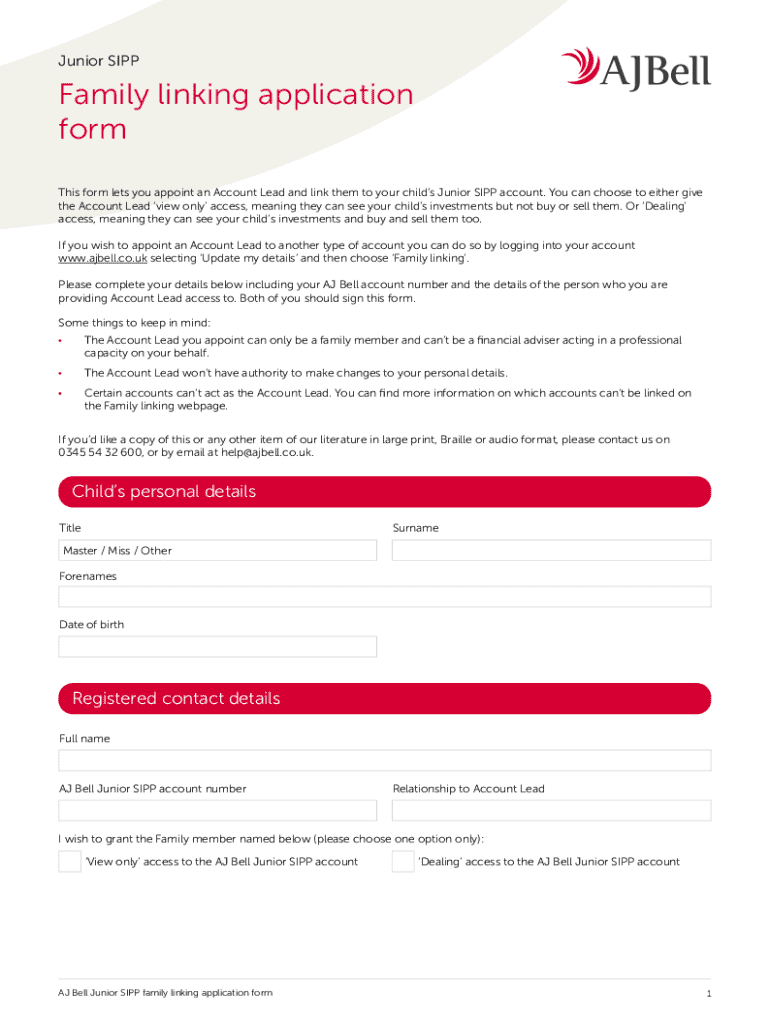

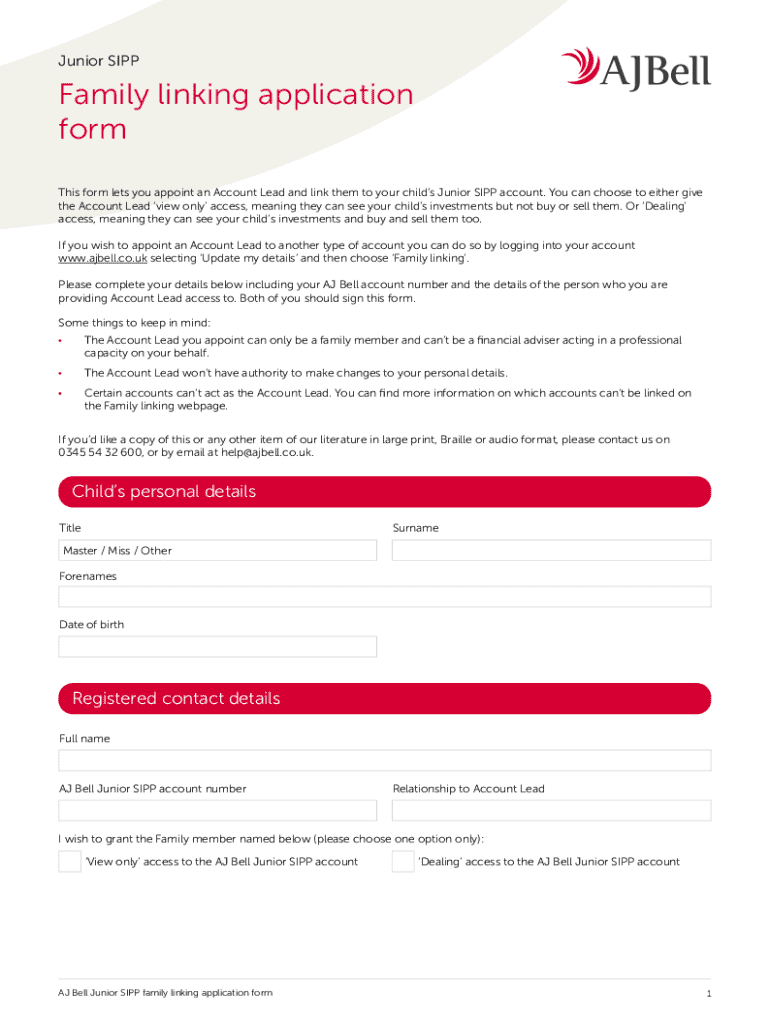

When filling out a Junior SIPP form, specific essential information is required to establish the account correctly. Typically, the form will ask for personal details about the child, including their full name, date of birth, and National Insurance number, where applicable. Additionally, personal details about the parent or guardian who is managing the fund must also be included, such as their name, address, and contact information. This information verifies the relationship and legitimizes the contributions made on behalf of the child.

Understanding the types of contributions is equally crucial. Junior SIPPs allow contributions to be made either regularly or as one-off payments, providing flexibility to fit various financial circumstances. Additionally, parents should be aware of contribution limits which are subject to annual allowances, and tax implications that may arise from exceeding these limits. The tax relief on contributions is an important consideration for maximizing the investment's value.

Step-by-step guide to filling out the junior SIPP form

Before diving into the form, it’s important to prepare effectively. Gather all necessary documents, including proof of identity for both the child and the contributing guardian. Reviewing eligibility criteria and understanding contribution limits is vital to ensure the form is completed accurately and to avoid potential issues later. Make sure all the relevant information is at hand, so filling out the form can be done smoothly and without unnecessary delays.

When filling out the form, start with the personal details section, clearly indicating the child's information. Then, specify the nature of the contributions, selecting whether they will be regular or one-off payments. It is essential to ensure that the account authorization section is filled correctly, which places responsibility on the parent or guardian regarding the account’s management. Be mindful of common pitfalls such as submitting an incomplete form or misunderstanding how tax relief applies to your contributions.

Managing your junior SIPP account

After the initial setup, choosing a provider for the Junior SIPP is critical. It is advisable to research potential platforms, comparing their investment options, fees, and any additional features they may offer. Understanding the associated fees and charges is paramount, as this will impact the funds available for growth within the account. Make sure you read the terms and conditions associated with different providers for transparency regarding any hidden charges.

Monitoring the investment growth in your Junior SIPP is equally important. Regularly tracking the performance and contributions keeps you informed about the account’s health. As the child grows older, adjustments may be necessary to align investment strategies with changing life stages and goals. Engage with financial advisers if needed, ensuring their investment portfolio remains optimized and growth-focused.

Advanced features of junior SIPPs

Junior SIPPs come with various investment options, allowing for a tailored approach to saving. Parents can typically choose from stocks, bonds, mutual funds, and other investment vehicles based on their risk appetite and objectives. This flexibility enables them to create a diverse portfolio that can benefit from market fluctuations over time. It's also crucial to regularly review investment choices to ensure they align with the changing economic landscape and the child’s future requirements.

In addition to the diverse investment options, Junior SIPPs also offer significant tax benefits. Funds grow free from income and capital gains tax, which can substantially enhance the value of the investment over time. It's important to keep abreast of any deadlines related to tax relief claims to maximize the benefits derived from this structure. Understanding the correspondence between contributions and tax relief can significantly impact financial planning.

Collaborative features of pdfFiller for junior SIPP forms

pdfFiller provides users with interactive tools to fill out and edit the Junior SIPP form digitally, facilitating a seamless experience. With its user-friendly interface, families can manage their documents efficiently, ensuring that all necessary fields are completed accurately. Users can access the platform easily via their browser, making document management straightforward, regardless of their location.

The collaborative features are particularly beneficial for families who want to share documents among multiple users. Whether you need input from other family members or advice from financial advisers, pdfFiller makes it easy to collaborate on Junior SIPP forms. Additionally, securing your documents is a priority; best practices for document management will ensure safety and compliance. The integration of eSigning capabilities guarantees the legal validity of digital signatures, streamlining the overall process.

FAQs about junior SIPPs

When exploring Junior SIPPs, parents and guardians often have questions regarding fees, contributions, and the overall functionality of the accounts. This frequently asked questions section aims to clarify common inquiries. For instance, many wonder how much can be contributed annually and whether there are any limitations on the types of investments allowed. Understanding these critical aspects is fundamental to making informed decisions and maximizing the growth potential of the account.

Moreover, inquiries about the fees associated with managing a Junior SIPP are common. Families should seek clear details about initial setup fees, ongoing charges, and any costs related to withdrawing funds or changing investment strategies. Each junior SIPP provider may have a different fee structure; therefore, thorough comparison and understanding are essential for effective financial planning.

Additional considerations

As a Junior SIPP account matures, there are key milestones that warrant review and updates of contributions. Typically, consider reviewing the account annually or during significant milestones, such as birthdays or educational transitions. It's an opportunity to assess whether the contribution levels still align with the family’s financial goals and the child’s evolving needs. The world of investments can shift dramatically, and being proactive can result in greater growth.

Strategies for maximizing growth as children approach adulthood should be an ongoing consideration. As the child nears the age of 18, parents should consult with financial advisers on how to best transition the funds from the Junior SIPP to a standard SIPP or other investment vehicles. The aim is to ensure continued growth and viability in the investment strategy while also remaining compliant with regulations.

Interactive tools on pdfFiller

To maximize the efficiency of managing Junior SIPP forms, pdfFiller offers excellent editing and customization tools. Users can easily modify the Junior SIPP form template to suit specific needs, whether it’s updating personal information or adjusting contribution details. The intuitive browser-based interface allows seamless access, ensuring that users can create and edit documents from anywhere, meeting the demands of a mobile lifestyle.

In addition, pdfFiller's document sharing capabilities stand out. They allow families to collaborate on important decisions, share their Junior SIPP forms with financial advisers, or obtain insights from others involved in the child’s financial planning. This collaborative aspect enhances transparency and inclusion, ensuring that significant financial decisions concerning the child are made collectively. By leveraging pdfFiller’s sophisticated tools, families can streamline their documentation process and strengthen their overall financial strategy.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I fill out the junior sipp form on my smartphone?

How do I edit junior sipp on an iOS device?

How do I complete junior sipp on an Android device?

What is junior sipp?

Who is required to file junior sipp?

How to fill out junior sipp?

What is the purpose of junior sipp?

What information must be reported on junior sipp?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.