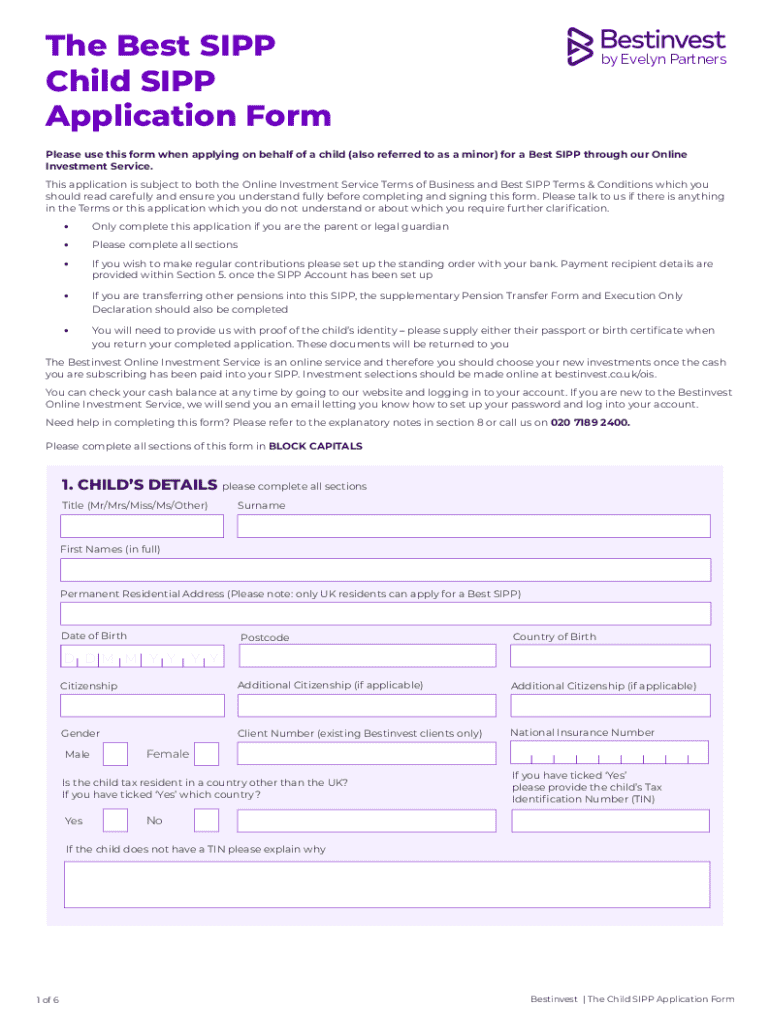

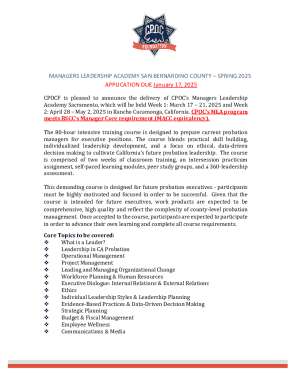

Get the free Child Sipp Application Form

Get, Create, Make and Sign child sipp application form

Editing child sipp application form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out child sipp application form

How to fill out child sipp application form

Who needs child sipp application form?

Child SIPP Application Form: A Comprehensive Guide

Understanding Child SIPP: An Overview

A Self-Invested Personal Pension (SIPP) designed specifically for children allows parents and guardians to begin setting aside funds for their child's future. This investment vehicle not only provides the flexibility to choose how the funds are managed but also takes advantage of tax relief benefits. By opening a Child SIPP, parents can educate themselves and their children about smart investing habits from an early age.

The significance of investing early cannot be overstated. When funds are set aside and invested during a child’s formative years, compounding returns over time can lead to substantial growth. A Child SIPP acts as a foundational financial tool, enabling parents to nurture their child’s future while potentially achieving higher returns than traditional savings accounts. Key benefits include tax-free growth and the ability to tailor investments according to the child’s goals or risk appetite.

Eligibility criteria for a Child SIPP

To open a Child SIPP, there are specific eligibility criteria that must be met. Generally, any child under the age of 18 can be named as the beneficiary of a Child SIPP. This means that contributions can be made in their name starting from birth. Parents, guardians, or any adult relative can open a SIPP on behalf of the child, which allows for collaborative family savings.

Contributing to a Child SIPP comes with substantial tax benefits as well. The government adds tax relief to each contribution made. For example, for every £80 contributed, the government adds an extra £20, which enhances the investment potential significantly over time. Thus, these tax incentives provide a strong encouragement for families to consider Child SIPPs as a part of their financial planning.

Steps to complete the Child SIPP application form

Filling out a Child SIPP application form may seem daunting, but by following these structured steps, the process can be simplified significantly. Grade your approach by gathering necessary documents, selecting a provider, completing the application, and ensuring everything is ready for submission.

Step 1: Gather required documentation

Before beginning the application process, ensure you have the required identification documents at hand. This includes the child’s birth certificate or passport for identity verification, as well as proof of address for the parent or guardian, such as a utility bill or bank statement. Having these documents ready will streamline the application process.

Step 2: Choosing a SIPP provider

When selecting a SIPP provider, consider factors like fees, investment choices, customer support, and accessibility of their online platform. With services such as pdfFiller, users can access a variety of Child SIPP providers that offer intuitive application processes. Research and compare different options to find a provider that meets your family's financial management goals.

Step 3: Filling out the application form

The application form typically consists of several sections. In the Personal Information Section, you need to provide the child's name, date of birth, and any relevant identification details. Additionally, details about the contributors - the parents or guardians, will also be required.

Investment choices play a crucial role in determining the future growth of the Child SIPP. While filling out the Investment Choices Section, consider the different types of investments available, including shares, funds, or bonds. Take time to evaluate each option, understanding the risks and potential returns associated with them.

Step 4: Reviewing and signing the form

Once the form is filled out, carefully review all the entered information for accuracy to avoid unnecessary delays. Tools available on pdfFiller allow for easy eSigning, where you can digitally sign the application, making the process faster and more efficient.

Step 5: Submitting the application

After signing the application, the next key step is to submit it digitally. Utilizing pdfFiller’s platform, you can easily upload and send your completed application to the chosen SIPP provider. Following submission, await confirmation of receipt, typically accompanied by next steps regarding your investment and how it will be managed.

Managing Child SIPP investments

Once your Child SIPP is established, managing its investments is crucial for ensuring it aligns with your financial objectives. Regular reviews can help determine if adjustments are necessary based on market conditions or changes in your child’s financial goals. Establish a routine for checking the performance of the investments and stay informed about any significant market events.

pdfFiller offers tools that facilitate effective investment management. Features include the ability to track performance and receive alerts related to market changes. Staying engaged with your investment strategy is essential, especially as your child approaches adulthood and begins to contemplate their future plans.

Common challenges and FAQs related to Child SIPPs

While the process of applying for a Child SIPP is generally straightforward, potential challenges may arise. For instance, certain terms and conditions may be confusing, or parents may be unclear about how to select appropriate investments. Understanding the common hurdles beforehand can help mitigate stress when filling out the Child SIPP application form.

Here are some frequently asked questions surrounding Child SIPPs that parents should consider:

Maximizing the benefits of a Child SIPP

To fully leverage the potential of a Child SIPP, it’s important to adopt long-term investment strategies that will benefit your child in the future. Regular contributions, even in small amounts, can significantly enhance the funds available as they approach adulthood. The compounding effect of consistent saving and investment creates lasting financial advantages.

Evaluate your child’s goals and set clear financial targets to inform SIPP contributions. Factors might include educational expenses, purchasing a first home, or starting a business. Planning for these milestones with disciplined contributions to a Child SIPP can provide your child with critical financial support when they need it most.

Conclusion: Empowering your child’s financial future with a SIPP

Initiating a Child SIPP sets the stage for a child’s financial independence and security. Investing early cultivates positive financial habits and prepares them for future financial challenges. By actively contributing to a Child SIPP, parents are not only safeguarding their child’s future but also instilling valuable lessons about saving and investing. Encouraging proactive investment behaviors today can have far-reaching benefits tomorrow.

Tools and resources for streamlining the application process

pdfFiller provides interactive tools that simplify completing the Child SIPP application form. The platform includes various form templates tailored to SIPP applications, making it easier to customize and fill out information accurately. Additionally, it offers customer service support to assist users who might encounter difficulties throughout the application process.

Whether you need clarification on investment choices, assistance with form completion, or have specific queries regarding Child SIPPs, pdfFiller is equipped to provide the guidance you need to ensure a seamless experience.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send child sipp application form for eSignature?

How do I make edits in child sipp application form without leaving Chrome?

Can I create an eSignature for the child sipp application form in Gmail?

What is child sipp application form?

Who is required to file child sipp application form?

How to fill out child sipp application form?

What is the purpose of child sipp application form?

What information must be reported on child sipp application form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.