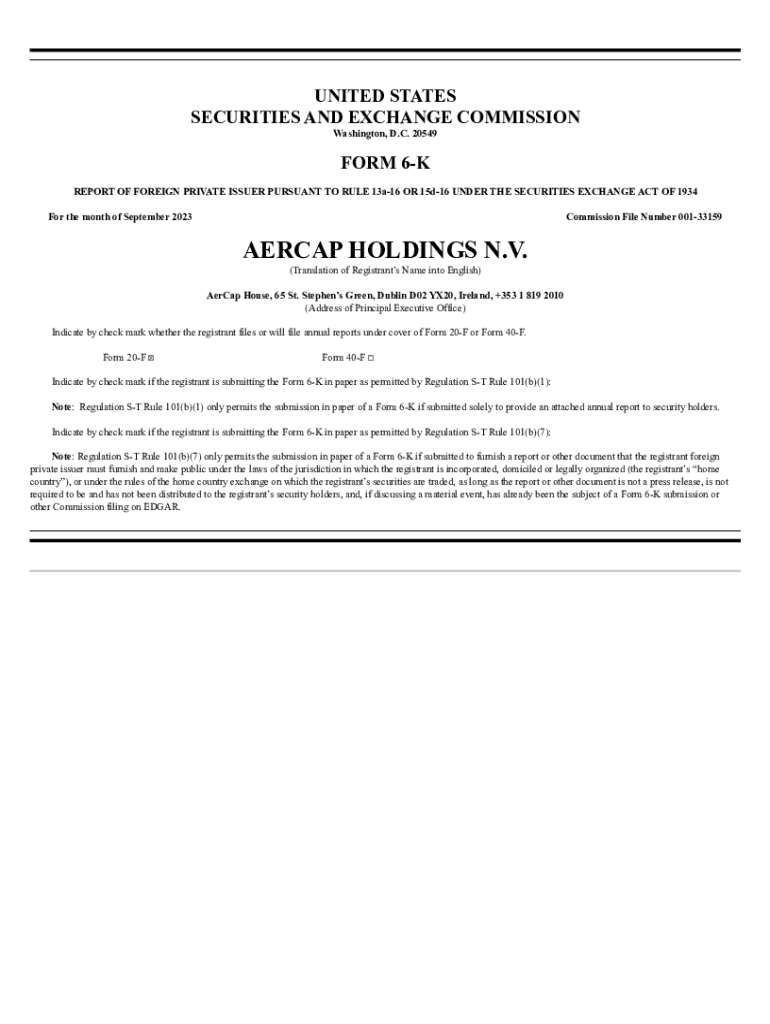

Get the free Form 6-k

Get, Create, Make and Sign form 6-k

Editing form 6-k online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 6-k

How to fill out form 6-k

Who needs form 6-k?

Form 6-K Form: A Comprehensive Guide

Understanding the Form 6-K

A Form 6-K is a report that foreign companies must file with the U.S. Securities and Exchange Commission (SEC). It is primarily used to provide information about significant events that may affect the company’s financial status. This form serves as a key tool for maintaining transparency and helps investors remain informed about the company’s operations.

The purpose and importance of the Form 6-K lie in its role as a bridge connecting foreign entities with U.S. investors. By providing timely updates on material events, it ensures that investors have access to critical information necessary for making informed decisions.

Foreign companies traded on U.S. exchanges are required to file Form 6-K, thereby ensuring compliance with SEC regulations. Unlike domestic public companies, which file Forms 10-K or 10-Q, the Form 6-K specifically caters to foreign issuers who may not be subject to the same reporting standards.

Key differences in the filing methodologies exist between Form 6-K and other SEC forms. For example, while Form 10-K is a comprehensive summary of a company's annual performance, Form 6-K focuses specifically on ongoing developments.

Key components of Form 6-K

The Form 6-K requires essential information that must be meticulously detailed. This includes the company's information, which typically encompasses the name, address, and stock ticker symbol. This foundational data ensures that the SEC and investors correctly identify the reporting entity.

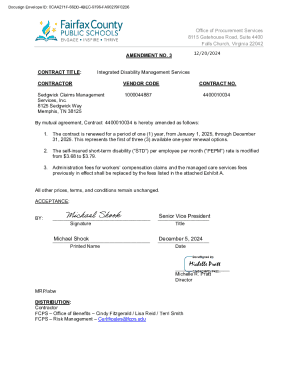

A thorough description of the material event is also critical. Companies must articulate the nature of the event, outlining why it is significant. For instance, if a foreign company is undergoing a major acquisition, the Form 6-K should detail how this acquisition could reshape its market dynamics.

The format and structure of the Form 6-K are straightforward, typically requiring a designated section for each component mentioned. Common attachments may include financial statements, board resolutions, or press releases that support the reported material event. Ensuring these documents are accurately presented is crucial for compliance.

Step-by-step guide to filling out Form 6-K

Filing the Form 6-K involves a detailed, step-by-step approach to ensure accuracy and compliance. Start with Step 1: Gathering the necessary information and documents. This includes all company-related documents and any pertinent disclosures that relate to the material event.

Moving to Step 2, complete the form fields with precision. It's essential to ensure that all information reflects current and relevant data. Tips for accurate reporting include double-checking figures, ensuring that descriptions align with company reports, and using clear language.

In Step 3, a review and verification of all information is vital. Have another team member cross-check the details to minimize errors. Finally, in Step 4, follow the specific submission process. Consideration must be given to the online submission process, which is typically faster and more efficient than mailing paperwork.

Editing and modifying Form 6-K

In certain situations, you may need to amend a previously filed Form 6-K. Understanding when and how to properly amend this form is crucial for maintaining accurate records. Amendments are typically necessary when there are changes in the previously provided material event or if new information has come to light.

Utilizing tools and software for editing, such as PDF editors, can simplify this process. These tools allow for collaborative modifications, which can be particularly useful when multiple individuals are involved in preparing the form.

When collaborating on document changes, it is essential to maintain clear communication among team members to avoid confusion and ensure that each amendment is well-documented and justified.

Understanding filing deadlines

Filing deadlines for the Form 6-K can vary but are crucial for maintaining compliance with SEC regulations. Generally, the form must be filed by the time the material event occurs or immediately after its occurrence. Early submission is always advised to mitigate any risk related to compliance.

Late filings can lead to serious consequences, including fines or other regulatory penalties. It's also worth noting that failure to stay compliant can result in a loss of investor trust and a potential drop in stock price. Consequently, it is imperative to monitor and adhere to all filing deadlines rigorously.

Utilizing pdfFiller for Form 6-K

pdfFiller offers a comprehensive solution for managing Form 6-K filings. With a variety of features specifically designed for document management, pdfFiller empowers users to seamlessly create, edit, and submit their forms from a single cloud-based platform.

Accessing templates for Form 6-K through pdfFiller is straightforward. Users can simply find the relevant template and fill it out according to the specific requirements. In addition, the platform provides real-time collaboration tools, allowing team members to work together efficiently across different locations.

The benefits of using a cloud-based solution like pdfFiller include enhanced accessibility, user-friendly interfaces, and streamlined document management processes that save time and reduce the risk of errors.

Common mistakes when filing Form 6-K and how to avoid them

Common pitfalls exist when filing the Form 6-K. One prevalent mistake is submitting incomplete or inaccurate information, which could stem from rushed filing or miscommunication within the team. To combat this, ensure that every team member understands their roles and the importance of accuracy.

Additionally, misunderstandings about filing deadline requirements often lead to avoidable late entries. Keeping a shared calendar of deadlines specifically tailored for Form 6-K can assist in maintaining timelines.

By being proactive and methodical in your approach, you can significantly reduce the chances of making errors when filing the Form 6-K.

Troubleshooting common issues

When submitting Form 6-K online, there may be issues such as technical glitches or errors in the submission process. If you encounter these problems, the first step is to ensure that all information is correct before reattempting the submission.

In cases where submissions are rejected, it is crucial to understand the reasons behind the rejection. Familiarize yourself with the SEC's guidelines to facilitate smoother submissions.

Effective communication with the SEC can lead to more successful resolutions concerning document submissions. Engaging promptly and providing complete information is advisable.

Best practices for maintaining compliance with SEC regulations

Maintaining compliance with SEC regulations is paramount for foreign companies. Understanding SEC audits and reviews is essential, as these can occur either randomly or when there are indicators of non-compliance. It's wise to stay informed about the processes by which these audits are conducted.

Keeping records updated is another critical aspect of ensuring compliance. All team members involved in the filing process should have easy access to relevant documents, helping to maintain cohesion throughout the reporting cycle.

Implementing these best practices can grant peace of mind, knowing that your organization is compliant and prepared for any SEC audit.

Conclusion: Streamlining your Form 6-K processes with pdfFiller

In summary, navigating the intricacies of the Form 6-K can be streamlined using the tools available through pdfFiller. By understanding essential filing steps, utilizing collaborative features, and keeping ahead of deadlines, you can enhance your filing experience.

As you look to future-proof your document management processes, pdfFiller stands out as a solution that simplifies the creation, editing, and sharing of important documents like the Form 6-K. Empower your team with the resources needed to stay compliant and efficient.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete form 6-k online?

How do I edit form 6-k online?

How do I complete form 6-k on an Android device?

What is form 6-k?

Who is required to file form 6-k?

How to fill out form 6-k?

What is the purpose of form 6-k?

What information must be reported on form 6-k?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.