Get the free Statement of Information

Get, Create, Make and Sign statement of information

Editing statement of information online

Uncompromising security for your PDF editing and eSignature needs

How to fill out statement of information

How to fill out statement of information

Who needs statement of information?

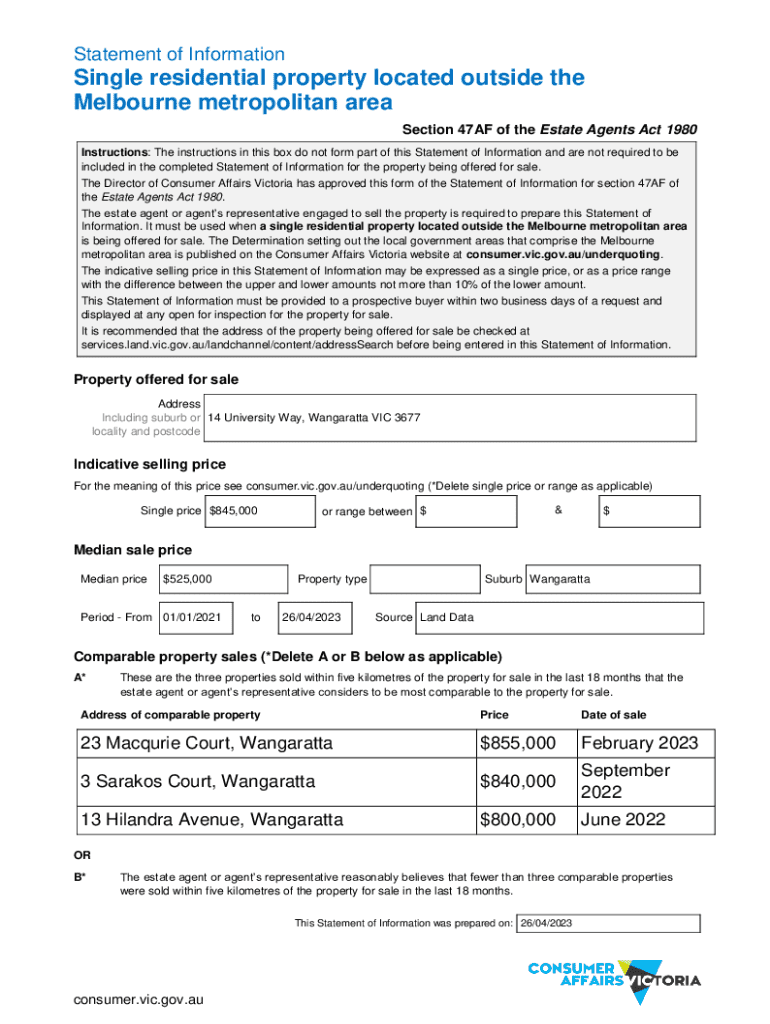

Understanding the Statement of Information Form

Understanding the Statement of Information form

The Statement of Information form serves as a crucial document for various business entities in maintaining transparency and compliance with state regulations. Essentially, it outlines key information about a business, such as its name, address, and the names of its officers and directors. This document is not only a requirement but also a reflection of a company's legitimacy and operational information, making it a vital piece in maintaining good standing with regulatory bodies.

Importance cannot be overstated; timely and accurate filing of this form ensures a business can avoid potential issues, including administrative dissolution or penalties. This is especially crucial for corporations and limited liability companies (LLCs), which are often bound by statutory regulations that govern their operations and require transparency through formal disclosures.

Who needs to file?

Most businesses, including corporations and limited liability companies (LLCs), must file the Statement of Information. Specific requirements can vary by state, but generally, any entity registered to conduct business must comply. Partnerships and non-profit organizations may have different obligations, so it’s important to consult local statutes.

Failing to submit this crucial form can lead to significant penalties. In many states, missing the filing deadline can result in a suspension of business privileges or forfeiture of the entity’s rights to operate. It can also accrue late fees, complicating matters further and impacting business operations negatively.

Key components of the Statement of Information form

When preparing to file the Statement of Information, it's critical to understand what mandatory information needs to be included. Generally, the required fields cover essential details, ensuring that regulatory bodies have up-to-date information about the entity.

Along with the mandatory fields, there may be additional optional sections to consider when filing your Statement of Information. Adding extra details, such as a business description or operational locations, can provide a more comprehensive view of the company, potentially benefiting future interactions with stakeholders.

Filing tips for the Statement of Information

Accuracy in completing the Statement of Information form is paramount. Common mistakes such as typos or outdated information can lead to compliance issues. Therefore, carefully checking all provided data before submission is essential to ensure integrity and correctness.

It's also crucial to update your information promptly whenever there are changes within the company. This includes any alterations in directorship, business address, or operational status. Being proactive in maintaining updated filings will prevent unnecessary complications and ensure continuity in business operations.

Tips for efficient completion

Gathering necessary data ahead of time will streamline the filling process. Create a checklist of the required information and organize documents that support your submission.

Technology can significantly enhance the efficiency of form completion. Utilizing document preparation software, such as the tools offered by pdfFiller, allows for easy edits, electronic signatures, and collaborative features. This means multiple team members can access and contribute to the document simultaneously, making the process much faster.

Statutory filing requirements

Understanding the filing deadlines for the Statement of Information is essential for compliance. Generally, businesses are required to submit this document within a six-month period following their incorporation or registration. Failure to meet this deadline can carry consequences.

Marking key dates in your calendar and setting reminders can help avoid missed deadlines. It is advisable to check with the relevant secretary of state or business programs division regarding specific due dates for your given jurisdiction as these can fluctuate depending on local regulations.

Implications of late filing

Late filing can lead to a series of repercussions, including fees and possible impacts on your business status. Most states impose a financial penalty for every month that the form is overdue. Additionally, persistent failure to file can result in administrative actions, including suspension or forfeiture of business privileges.

Understanding these implications serves to emphasize the necessity of adhering to filing deadlines and maintaining an organized document management system. Regular reviews of your business filings are a proactive measure to ensure compliance with all legal obligations.

Methods for submitting the Statement of Information

1. File online - fastest service

Filing the Statement of Information online is often the quickest method. Many states offer an online portal where businesses can complete and submit the form directly. This approach facilitates instant confirmation of submission, providing peace of mind.

Using platforms like pdfFiller, you can easily edit the Statement of Information, then electronically sign it before submitting it through the state’s website. This reduces friction and allows for tracking of your submission status.

2. File by mail or in person

For those preferring traditional methods, submitting by mail is another option. Carefully follow the instructions provided by your state to ensure proper submission. This may include sending the completed form to a specific address and including the requisite filing fee.

If opting for in-person submission, gather all necessary documents and arrive at the designated office during business hours. Speaking directly with a representative can often clarify any last-minute questions regarding the form.

Document management best practices

Utilizing tools like pdfFiller can significantly enhance document management regarding the Statement of Information. Not only can you edit and sign forms efficiently, but the platform also offers collaborative features that allow team members to contribute or review the form.

Optimizing your document storage methods is beneficial as well. Store completed forms in the cloud using pdfFiller’s organized file management system. This ensures easy retrieval of documents when needed, allowing for better compliance management.

Common questions and troubleshooting

Many individuals encounter common concerns when filing the Statement of Information. Questions such as how to correctly fill out specific sections or where to submit the form often arise. Reviewing FAQs provided by your state’s business division can help alleviate confusion.

Additionally, resources such as pdfFiller provide customer support that can assist you during the filing process. Engaging with support teams can offer solutions to any challenges encountered, ensuring your filing is both timely and accurate.

Related resources

Having access to the correct forms is crucial. Links directly to download the Statement of Information can streamline the filing process. Similarly, you can find other related forms easily, which may be necessary depending on your business type.

Understanding the potential fees associated with filing the Statement of Information beforehand is also wise. Each state has its own cost structure, which can include not only filing fees but additional costs for expedited services or copies of documents.

Staying updated

Staying informed about legislative changes that affect business filings is vital for compliance. Subscribing to notifications from your state’s business programs division can provide timely information about any changes that may impact your filing requirements.

These updates can include changes to filing deadlines, fees, or even the content required in forms, all of which are important for avoiding compliance issues.

Customer support and contact information

For those using pdfFiller, reaching customer support can be straightforward and beneficial. The platform offers various methods to contact support, including email, live chat, or phone.

This ensures that businesses can receive assistance whenever they encounter challenges during the filing process or when navigating features of document management. Support resources are often readily available to guide users through their document preparation needs.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my statement of information directly from Gmail?

How can I send statement of information to be eSigned by others?

How do I edit statement of information online?

What is statement of information?

Who is required to file statement of information?

How to fill out statement of information?

What is the purpose of statement of information?

What information must be reported on statement of information?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.