Get the free Gst Reg-06

Get, Create, Make and Sign gst reg-06

Editing gst reg-06 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out gst reg-06

How to fill out gst reg-06

Who needs gst reg-06?

Comprehensive Guide to the GST REG-06 Form

Understanding the GST REG-06 Form

The GST REG-06 form is a pivotal document in the Goods and Services Tax (GST) registration process. Its primary purpose is to facilitate the registration of businesses, individuals, and entities under the GST regime, enabling them to collect and pay GST on their taxable supplies. This form plays a vital role in streamlining the registration process, ensuring compliance, and fostering transparency in the tax system.

The significance of the GST REG-06 form cannot be overstated. It not only serves as a formal request for obtaining a GST registration number (GSTN) but also acts as a repository of necessary information needed for tax administration. Accurate completion of this form helps prevent delays and complications in the registration process.

Who needs the GST REG-06 Form?

The GST REG-06 form is crucial for various stakeholders, including individuals, sole proprietors, partnerships, limited liability partnerships (LLPs), and corporations that engage in the sale of goods or services. Essentially, anyone whose aggregate turnover exceeds the threshold limit prescribed under the GST laws is required to register for GST and consequently must complete the GST REG-06 form.

For specific entities, such as non-resident taxpayers or entities involved in e-commerce operations, additional sections in the form address their unique considerations. Understanding whether you qualify for GST registration based on your business type and operation structure is paramount for ensuring compliance.

Detailed breakdown of the GST REG-06 Form

The GST REG-06 form contains multiple components that are crucial for registration. Each section requires particular information and supporting documents to ensure the accuracy and completeness of your registration request. The primary sections of the form include Personal details, Business information, Principal place of business address, and more.

When filling in the form, you'll generally need the following documents: proof of identity (such as Aadhar or PAN card), proof of address of the business, and partnership or incorporation documents for corporate entities. This information is vital for establishing your identity and the legitimacy of your business.

Step-by-step guide to filling out the GST REG-06 Form

Preparation is key when filing the GST REG-06 form. Begin by organizing all necessary documents. Important documents typically include a PAN card, bank statements, proof of address, and registration certificates if applicable. Keeping these documents in a single folder will streamline your process.

When actually filling out the form, it's essential to go section by section thoughtfully. Start with Personal Details, ensuring correct spellings and accurate information. Follow this by carefully detailing Business Information along with the precise Address of Principal Place of Business, which is crucial for correspondence and compliance checks. Lastly, ensure Bank Account Details are correct as this directly relates to your GST transactions.

Verifying your information

Once you’ve filled out the GST REG-06 form, the next step is verification. It’s crucial to double-check every entry to ensure information is accurate and complete. Inaccuracies may lead to processing delays or rejection of the application. A second set of eyes can be beneficial, so consider having a colleague review the details.

Utilizing tools like document editors available in pdfFiller can help you verify your information. These tools support merging, editing, and commenting on documents, allowing for a thorough review before submission.

Submitting the GST REG-06 Form

After completing the form, the next step is submission. The GST REG-06 can be submitted online via the GST portal, which is the recommended method due to its efficiency and the ability to track the submission progress. You will need to navigate to the registration section of the portal, upload the completed form, and associated documents.

Alternatively, offline submission through a hard copy of the form can be done at your nearest GST office. However, this method can be less efficient due to manual processing. Regardless of the submission method, expect a processing timeline of about 7-15 working days. You will receive notifications regarding the status of your application.

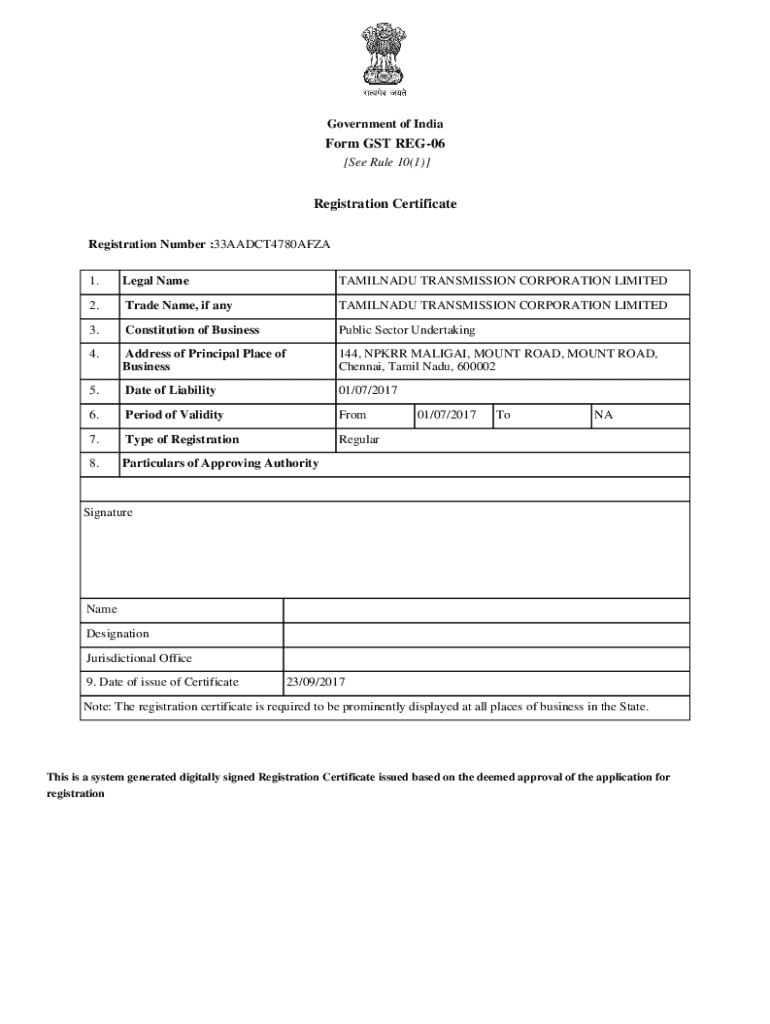

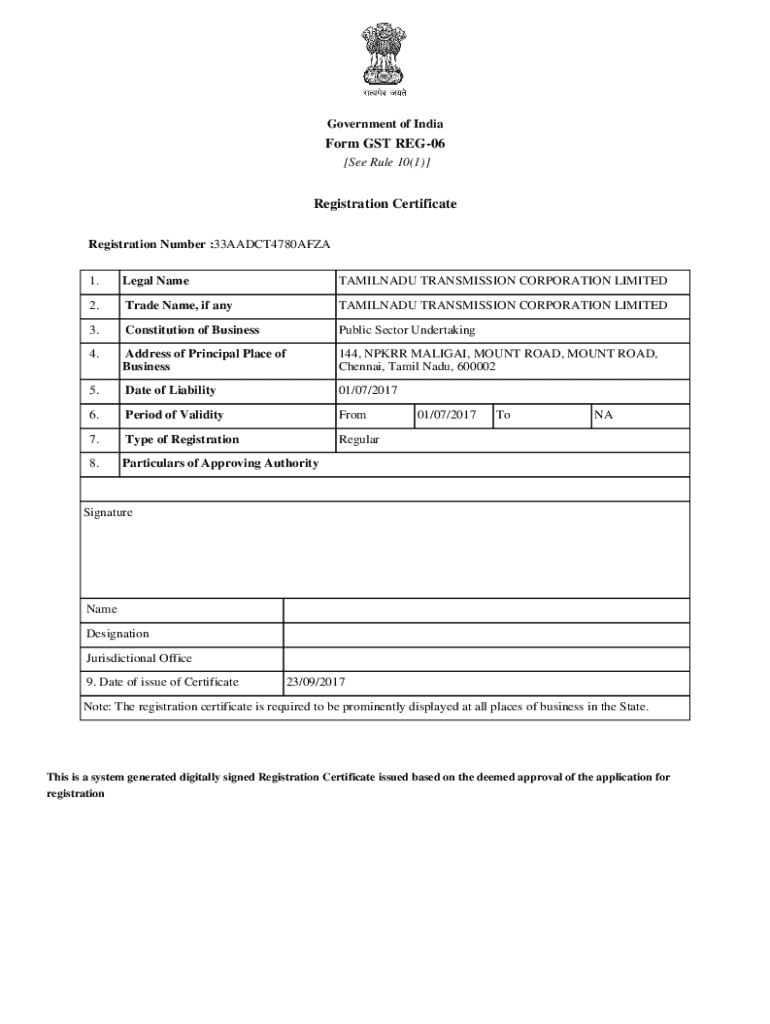

Accessing your GST registration certificate

Once your application is processed and approved, you will receive your GST registration certificate. The certificate can be downloaded from the GST portal, requiring you to log in with your credentials to access the 'Services' tab and navigate to 'Download GST Certificate'.

Your GST registration certificate is vital as it contains important details such as your GSTN, the type of business, and the state of registration. Each detail is critical for compliance with GST regulations, and keeping a copy for your records is recommended.

Managing your GST registration

Managing your GST registration involves keeping your details updated. If there are any changes in business structure, such as the addition of partners or a change in business address, you must amend your GST REG-06 information immediately. Amending details can usually be done through the GST portal.

Renewal of your GST registration typically occurs every five years, although you must stay current with any applicable changes in GST regulations during that time. Failure to renew may result in cancellation of your GSTN and potential penalties, stressing the importance of adhering to renewal timelines.

Utilizing pdfFiller for managing your GST forms

pdfFiller significantly enhances your experience with managing the GST REG-06 form. Its seamless editing capabilities allow users to modify existing documents easily, ensuring you can tailor your submissions precisely to requirements. This feature can save considerable time and reduce the risk of errors.

Additionally, pdfFiller's collaborative tools facilitate teamwork, allowing individuals and teams to work together in drafting and finalizing GST-related documents. The eSigning feature also enables secure and quick electronic signatures, eliminating the need for physical paperwork.

Interactive tools and templates

pdfFiller offers a range of interactive templates for GST documentation, making it easy to create, edit, and manage your forms online. These templates are designed to be user-friendly and customizable, ensuring that you can fill them out accurately and efficiently, whether you are looking at the GST REG-06 form or related documents.

Furthermore, pdfFiller provides additional resources on GST compliance, offering tools that can help you manage your wider GST obligations seamlessly. Utilizing these resources ensures that you remain compliant while saving valuable time and effort.

FAQs regarding the GST REG-06 Form

Many users have queries surrounding the GST REG-06 form. For instance, common questions include who can assist with the filling process and if a third party can submit the form on your behalf. Generally, a tax professional or GST consultant can provide guidance, while third-party submissions are accepted with proper authorization.

First-time filers should keep several tips in mind. Organizing your documents beforehand, cross-checking details, and familiarizing yourself with the GST portal can enhance your filing experience. The preventive steps will smoothen your journey through the registration process and reduce anxiety.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an eSignature for the gst reg-06 in Gmail?

How can I fill out gst reg-06 on an iOS device?

Can I edit gst reg-06 on an Android device?

What is gst reg-06?

Who is required to file gst reg-06?

How to fill out gst reg-06?

What is the purpose of gst reg-06?

What information must be reported on gst reg-06?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.