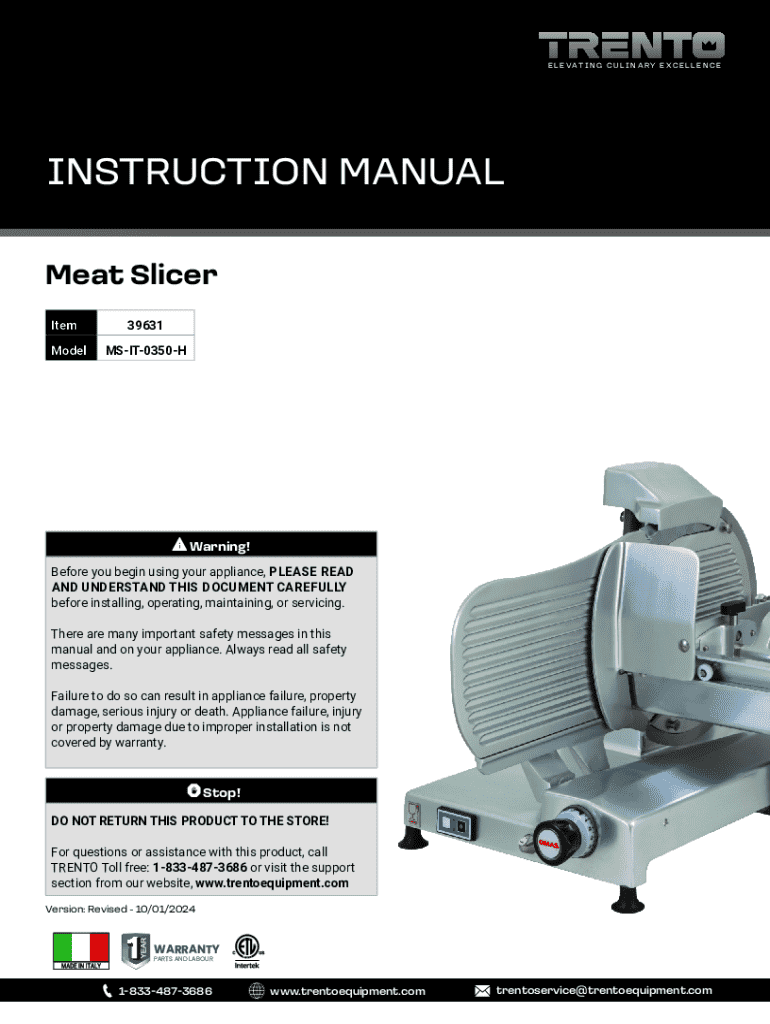

Get the free E L E Vat I N G C U L I N a R Y E X C E L L E N C E

Get, Create, Make and Sign e l e vat

How to edit e l e vat online

Uncompromising security for your PDF editing and eSignature needs

How to fill out e l e vat

How to fill out e l e vat

Who needs e l e vat?

Elevat form: A comprehensive how-to guide

Understanding the elevat form

The elevat form serves as a crucial document often used for tax reporting in various jurisdictions. It streamlines the process of VAT identification and ensures accurate data collection regarding transactions involving goods and services. This form is necessary because it helps both businesses and consumers maintain compliance with local tax laws and supports governments in tracking and managing revenue.

The elevat form's purpose extends beyond mere documentation; it plays a vital role in ensuring transparency, reducing errors during tax computations, and enhancing business operations by facilitating better financial planning and reporting.

Navigating the elevat form

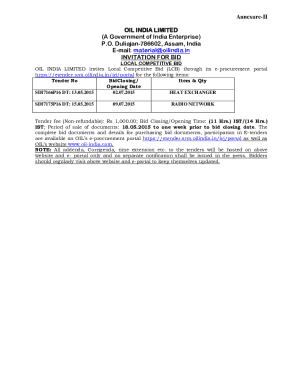

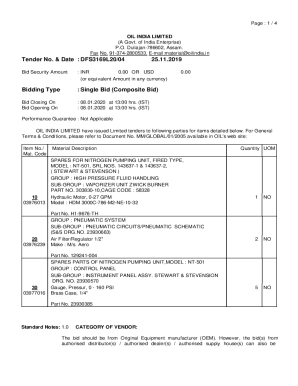

Understanding the layout of the elevat form is essential. It typically consists of several sections that require specific information, such as personal details, financial data, and any supplementary information needed for effective processing. Each of these sections serves a distinct purpose and helps in building a complete overview of the taxpayer's situation.

Common terms used in the elevat form include ‘VAT due’, which refers to the amount owed after calculating deductions; ‘input tax’, which applies to the VAT paid on purchases; and ‘output tax’, indicating the VAT collected on sales. Familiarizing yourself with this terminology can significantly smooth the completion of the form.

Step-by-step instructions for completing the elevat form

Before diving into filling out the elevat form, gather essential documents such as proof of identity, financial records, previous VAT forms, and any other relevant documentation. This preparation will streamline the process and help avoid unnecessary delays.

When filling out the form, begin with Section 1, which requires Personal Information. This includes your full name, address, and identification numbers. Section 2 focuses on Financial Details, where you need to present income, previous VAT collected, and incurred business expenses. Lastly, Section 3 requests Additional Information; here, detail any exceptional circumstances affecting your tax situation.

Editing the elevat form

After completing the elevat form, you may want to edit filled sections for accuracy or clarity. pdfFiller offers extensive editing features that allow you to modify text, add new sections, or even remove any unnecessary parts of the document effortlessly.

For effective editing, maintain clarity by using straightforward language, double-checking all figures, and ensuring compliance with current tax regulations. Avoid jargon when possible to improve readability and ensure that your form is easily understood by the recipient.

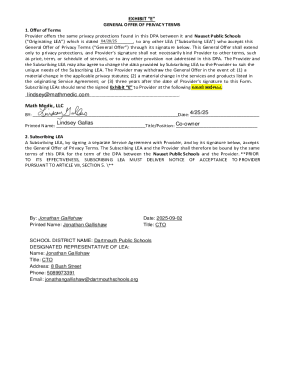

Signing the elevat form

Electronic signatures have become essential in the documentation process. The elevat form requires e-signatures to validate transactions and ensure legal compliance. By using pdfFiller, you can easily add your signature directly onto the form.

The eSigning process is straightforward: navigate to the signature section of the elevat form, select 'add signature', and either draw, upload, or type your signature. Ensure that the eSignature is clear and that you follow any additional verification steps necessary to protect document integrity.

Managing your elevat form

Once your elevat form is complete, managing it effectively is key. Cloud storage options available through pdfFiller allow you to save and access your form from anywhere. Utilize collaborative tools that enable multiple users to review and provide feedback on the document, ensuring all necessary stakeholders can contribute.

Additionally, printing the form or generating a PDF for archival purposes are easily achieved through pdfFiller's straightforward features. You can even share the document directly via email, enhancing efficiency in communication and handling.

Common issues and troubleshooting

Users often encounter challenges when filling out the elevat form. Common issues include missing information, which can lead to delays in processing, and format or compatibility issues with different devices. Recognizing these potential problems before submitting can save time and enhance accuracy.

pdfFiller provides support options for overcoming these hurdles. Utilizing the platform's help features allows users to troubleshoot efficiently and ensures that any mistakes do not impede the submission process.

Real-world applications of the elevat form

The elevat form is indispensable across multiple industries, facilitating tax compliance for businesses of all sizes. From large corporations managing VAT for high-volume sales to small retailers ensuring compliance during holiday shopping peaks, its applications are vast and varied.

Moreover, individuals use the elevat form for personal transactions that may require VAT reporting, enabling them to keep accurate records of their purchases and sales. Success stories from users demonstrate how easy and efficient the form's integrated features make tax reporting, leading to satisfied clients and improved organizational standards.

FAQs about the elevat form

Mistakes on the elevat form can happen, and the best course of action is to revise the submitted form with the correct information and notify the relevant tax authorities as necessary. If updates are required on submitted forms, make sure to consult the specific guidelines provided for amendments.

After submission, a confirmation receipt is typically provided. It's essential to keep this for your records and for any potential follow-up queries. And remember, while using pdfFiller is convenient, always check for any applicable fees linked to the form processing.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in e l e vat?

How do I edit e l e vat in Chrome?

How do I complete e l e vat on an Android device?

What is e l e vat?

Who is required to file e l e vat?

How to fill out e l e vat?

What is the purpose of e l e vat?

What information must be reported on e l e vat?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.