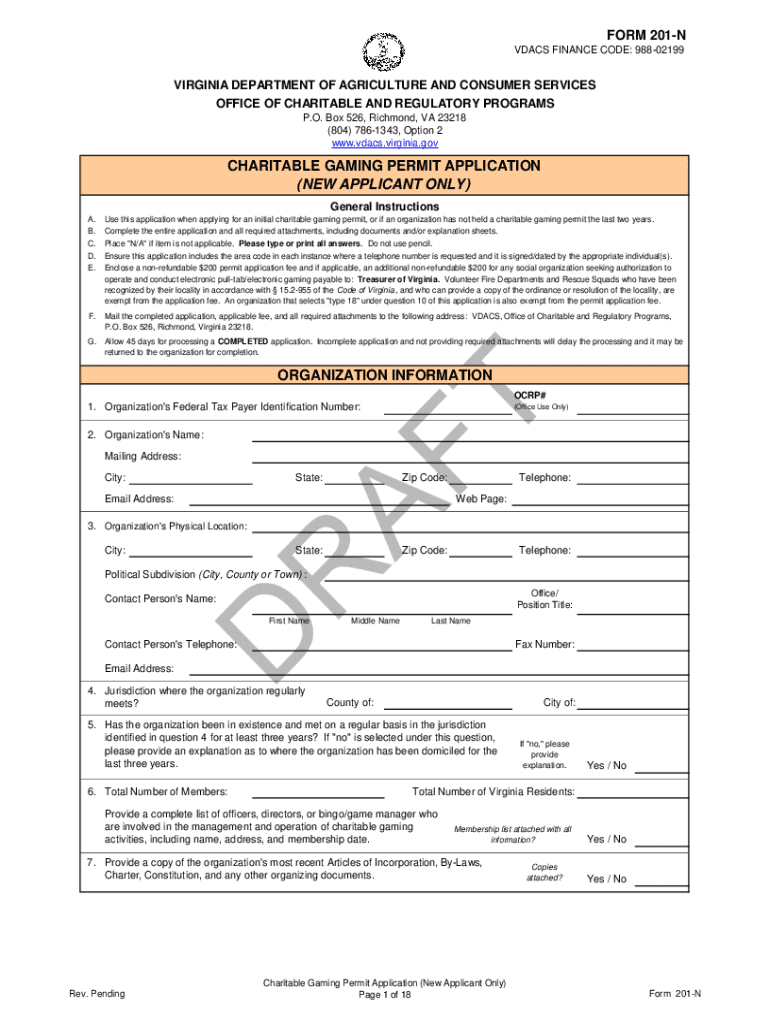

Get the free Form 201-n

Get, Create, Make and Sign form 201-n

How to edit form 201-n online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 201-n

How to fill out form 201-n

Who needs form 201-n?

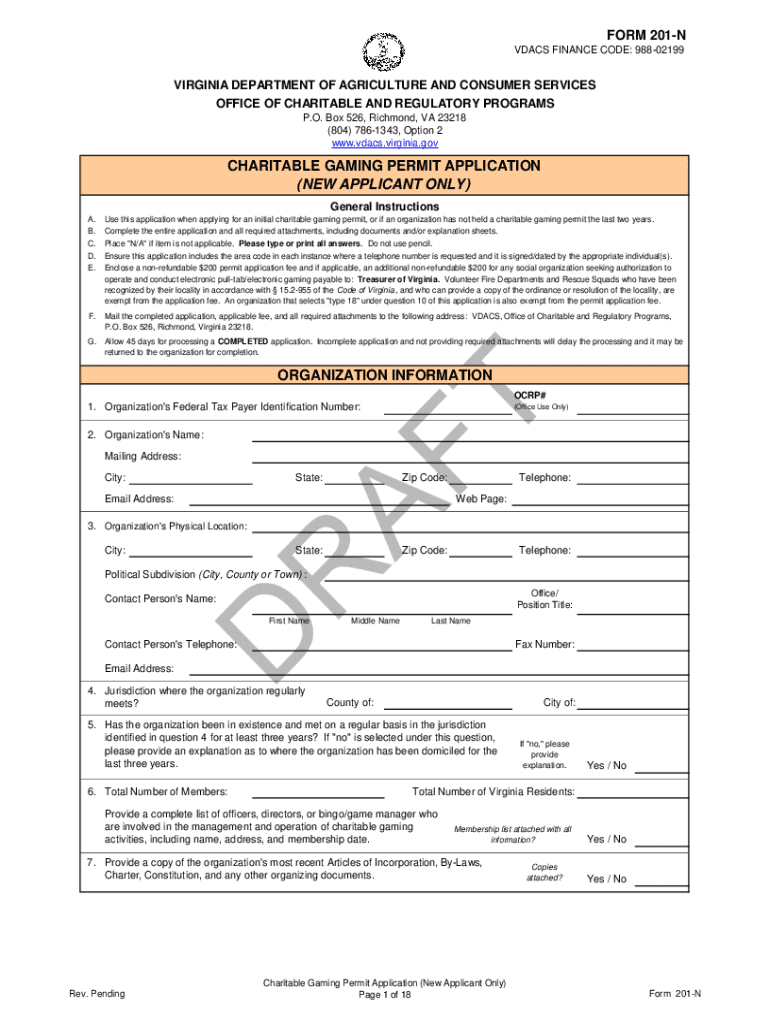

Comprehensive Guide to the 201-n Form

Understanding the 201-n Form: Purpose and Importance

The 201-n Form is a vital document primarily used for tax reporting and compliance in various jurisdictions. Its main purpose is to provide detailed information concerning income, deductions, and necessary declarations by individuals or entities who are engaging in specific financial activities. The accurate completion of this form ensures that all required parties receive the necessary information for their records.

Individuals and organizations whose financial activities fall within certain thresholds often need to fill out the 201-n Form. This can include freelancers, small business owners, or nonprofits that receive grants. The importance of the 201-n Form largely lies in its role in avoiding legal complications. Submitting this form improperly may result in penalties, audits, and even documentation disputes, significantly affecting both personal and business finances.

Preparing to fill out the 201-n Form

Before diving into the filling out process, gathering the essential information and documents is critical. Users should prepare personal identification details, financial records, and any supporting documents that pertain to income and deductions. This might include tax documents from previous years, bank statements, and receipts for claimed expenses.

Additionally, individuals should consider the time required to complete the form fully. An uninterrupted environment will significantly improve accuracy and efficiency when filling out the documentation.

Step-by-step instructions for filling out the 201-n Form

Filling out the 201-n Form can be broken down into clear steps to facilitate a smoother experience. Starting with the Personal Information section, users must accurately enter their full name, address, and pertinent identification number. It’s essential to ensure that all names match governmental records to avoid confusion or delays in processing.

The next step involves detailing your Financial Overview. This portion requires users to report income and deductions accurately. For clarity, you might utilize an example of income sources and classified deductions to understand the calculations accurately. Ensure that everything aligns with your financial statements to prevent discrepancies.

Finally, the signature and date section must not be overlooked. This validates the document, confirming that the information is correct and truthful. Users can explore electronic signature options available through pdfFiller to ensure compliance and convenience.

Editing and modifying the 201-n Form

Editing the 201-n Form in pdfFiller is a simple yet robust process. Users have diverse editing capabilities, such as modifying text fields, adding images, or uploading additional documents for context. The platform’s editing tools include easy navigation through your document, allowing for adjustments without complications.

If you've submitted the form but later discover errors, it’s crucial to understand the process for making changes. Most submissions allow for modifications within a specific timeline; consult the relevant authority’s guidelines for accuracy. Prompt correction is essential for maintaining compliance and avoiding potential issues.

Signing the 201-n Form

Understanding different methods for signing the 201-n Form can streamline completing your submission. Where possible, you may choose between traditional print and sign or innovative eSignatures. With advances in technology, utilizing secure and compliant electronic signature options will save time and reduce paperwork.

To add an electronic signature through pdfFiller, follow simple instructions provided with the platform. This feature not only enhances legal compliance but also maintains the integrity of the document while facilitating efficient processes.

Managing and storing your 201-n Form

Effective document management is essential for maintaining the integrity of your filed forms. Users should implement best practices for saving, storing, and organizing their completed 201-n Forms digitally. Regularly backing up documents on a secure cloud service ensures that they are readily accessible whenever needed.

Sharing your completed 201-n Form with necessary stakeholders can also be straightforward. Options available within pdfFiller allow for quick sending through email or generating links for collaborators, enhancing communication without friction.

Frequently asked questions about the 201-n Form

As individuals prepare to fill out the 201-n Form, they may have common queries. One typical question is: What if I make a mistake while filling it out? Generally, mistakes on the form can be rectified before submission by making necessary alterations within the platform.

For individuals with complex situations, such as international income, tailored reporting may be required. It's recommended to seek guidance from a tax professional to navigate these complexities efficiently.

Conclusion

The 201-n Form may initially seem daunting, but utilizing comprehensive tools like pdfFiller makes the process manageable. From filling out to securing signatures and storing the document, the platform empowers users with seamless document management capabilities. By adopting a digital solution for your form management, you can navigate submission processes efficiently and with confidence.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send form 201-n for eSignature?

How do I edit form 201-n straight from my smartphone?

How do I fill out form 201-n using my mobile device?

What is form 201-n?

Who is required to file form 201-n?

How to fill out form 201-n?

What is the purpose of form 201-n?

What information must be reported on form 201-n?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.