Get the free Ite Ow-8-espte

Get, Create, Make and Sign ite ow-8-espte

How to edit ite ow-8-espte online

Uncompromising security for your PDF editing and eSignature needs

How to fill out ite ow-8-espte

How to fill out ite ow-8-espte

Who needs ite ow-8-espte?

A comprehensive guide to the ite ow-8-espte form

Understanding the ite ow-8-espte form

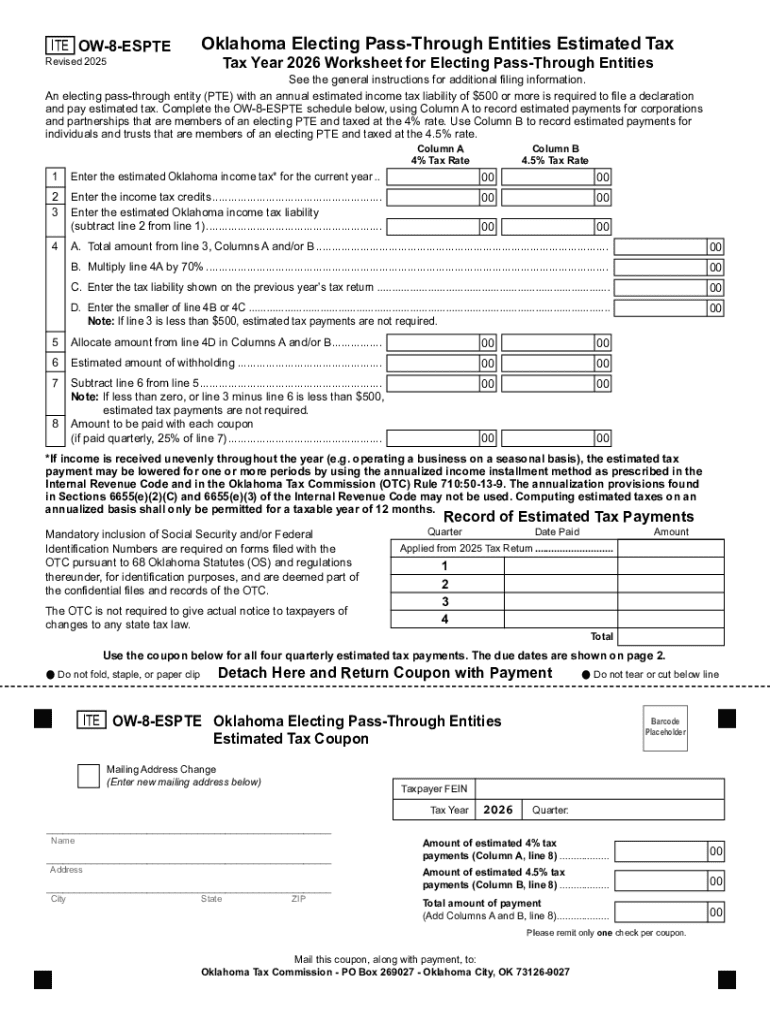

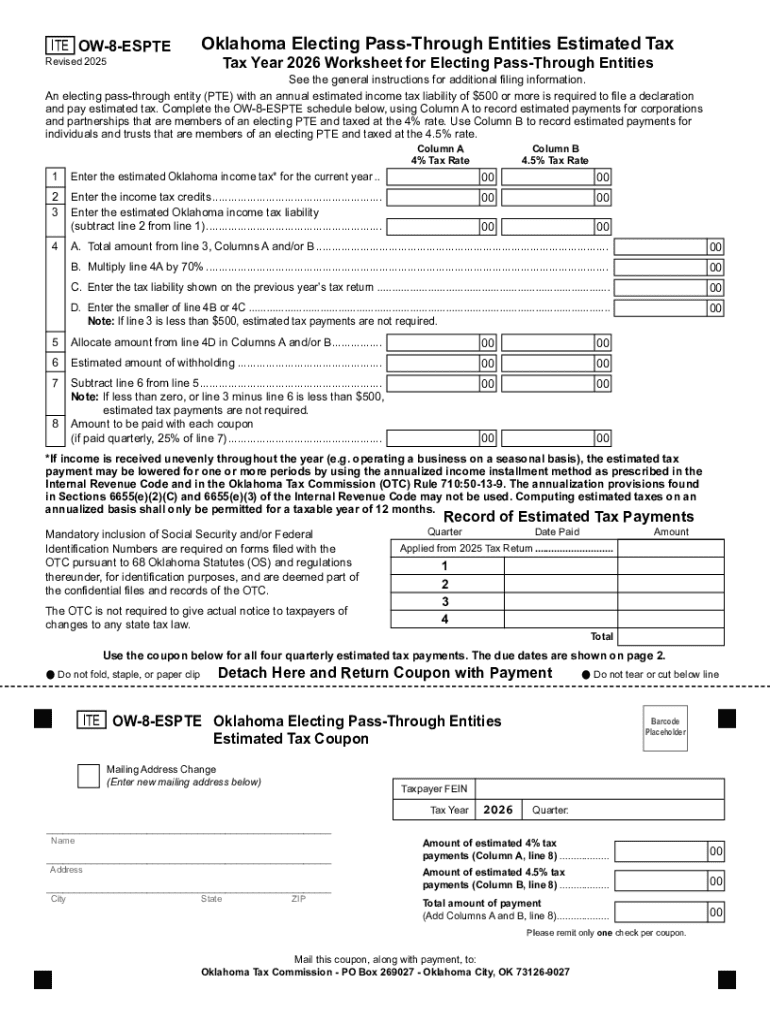

The ite ow-8-espte form is a crucial document required for various administrative processes. Its primary purpose is to facilitate accurate reporting and compliance with state tax regulations. Understanding its significance in legal documentation and financial reporting cannot be overstated, especially for individuals and organizations aiming to maintain proper record-keeping.

This form plays a vital role in ensuring transparency during tax filings. It can also serve as supporting documentation during audits or legal inquiries, effectively showcasing the diligence with which individuals or teams manage their financial obligations.

Preparing to use the ite ow-8-espte form

Before diving into filling out the ite ow-8-espte form, it’s crucial to gather all necessary information. Key details often include your tax identification number, income details, and any relevant deductions applicable to your situation. Having this information readily available will not only streamline the process but also minimize errors.

In addition to the essential information, utilizing the right tools can significantly enhance your efficiency. pdfFiller offers interactive options that simplify the completion of forms like the ite ow-8-espte form. This tool allows you to edit PDF documents seamlessly, ensuring you won't be stuck navigating cumbersome word processors.

Step-by-step instructions for completing the ite ow-8-espte form

Completing the ite ow-8-espte form requires careful attention to detail. Each section serves a specific purpose, and the following instructions will guide you through the process.

While filling Section 1, ensure that your name matches the records of the tax authority. In Section 2, common pitfalls include forgetting to total income from multiple sources. For Section 3, it is essential to attach all proof of deductions to avoid denial during processing.

Editing the ite ow-8-espte form with pdfFiller

Once you’ve completed the form, you might find the need to edit or make adjustments. pdfFiller's editing features are user-friendly and allow for seamless modifications. You can simply click on any section to edit text, add notes, or even remove unnecessary entries.

Moreover, pdfFiller enhances collaboration. If you're working as part of a team, you can invite colleagues to edit or review your form. This collaborative feature includes functionalities for commenting, ensuring everyone can provide input and feedback efficiently.

eSigning the ite ow-8-espte form

eSigning the ite ow-8-espte form adds a layer of authentication and ensures it is legally valid. Understanding the requirements surrounding eSignatures is essential. When using pdfFiller, eSignatures are fully compliant with legal standards, making the signing process secure and straightforward.

To eSign, simply follow these steps: First, click the ‘eSign’ button, select your signature style, and place your signature on the document. Once completed, the signed document is automatically saved within your account for future reference.

Safeguarding and managing your completed ite ow-8-espte form

Security is paramount when dealing with sensitive documentation. pdfFiller provides several options for saving and storing your completed ite ow-8-espte form securely. You can save it directly to your local storage, or choose to keep it in your pdfFiller account, utilizing features such as encrypted storage for added protection.

Sharing your document can be done safely within the platform. Utilize the share option to send links to others while ensuring that permissions are correctly set to protect your information. Additionally, track changes and versions with simple controls that allow you to revert to previous iterations if needed.

Troubleshooting common issues with the ite ow-8-espte form

Encountering problems while filling out the ite ow-8-espte form can be frustrating. Common issues include misplacement of information, technical troubles with the platform, or challenges with saving your form. Thankfully, pdfFiller provides robust support options to assist you in overcoming these hurdles.

For instance, if you encounter difficulties submitting your completed form, rechecking your internet connection and ensuring your browser is up to date are good first steps. Additionally, reaching out to pdfFiller customer support can provide you with personalized assistance tailored to your specific issue.

Advanced tips for working with the ite ow-8-espte form

To maximize your efficiency with the ite ow-8-espte form, consider implementing a few advanced strategies. Familiarizing yourself with shortcuts in pdfFiller can significantly reduce time spent completing forms. Also, exploring options to customize your form by adding additional fields or notes can streamline your data collection process.

By customizing the format to fit your specific needs, you create a tool that truly serves your purpose, allowing you to gather the necessary information without unnecessary hassle.

Conclusion: Leveraging pdfFiller for all your form needs

Navigating the complexities of the ite ow-8-espte form is simplified through the robust features of pdfFiller. This cloud-based platform offers everything you need to edit, eSign, collaborate, and manage documents efficiently. By utilizing pdfFiller, you empower yourself to meet all your documentation needs without hassle.

From easiness in filling out forms to enhanced security in document management, pdfFiller equips you with tools for seamless collaboration. Explore the many forms and templates available on the platform to further streamline your productivity and organization.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send ite ow-8-espte to be eSigned by others?

How do I fill out the ite ow-8-espte form on my smartphone?

Can I edit ite ow-8-espte on an iOS device?

What is ite ow-8-espte?

Who is required to file ite ow-8-espte?

How to fill out ite ow-8-espte?

What is the purpose of ite ow-8-espte?

What information must be reported on ite ow-8-espte?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.