Get the free The Impact of Inflation on Personal Savings and Investment ...

Get, Create, Make and Sign form impact of inflation

How to edit form impact of inflation online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form impact of inflation

How to fill out form impact of inflation

Who needs form impact of inflation?

Impact of Inflation Form: A Comprehensive Guide

Understanding the impact of inflation

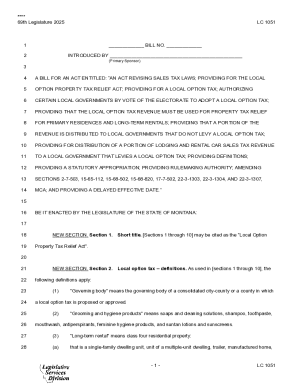

Inflation refers to the rate at which the general level of prices for goods and services rises, subsequently eroding purchasing power. It is a critical indicator of economic health, often measured through indices like the Consumer Price Index (CPI) and the Producer Price Index (PPI). Central banks monitor these indicators closely, as they can inform decisions on interest rates and monetary policy. Recognizing inflation trends can help individuals and businesses prepare for shifts in financial stability.

For individuals, inflation means that the money they earn or have saved buys less over time. This erosion of purchasing power can lead to adjustments in the cost of living, requiring employees to negotiate higher wages to meet rising expenses. Businesses face similar challenges as increased costs for raw materials can squeeze profit margins, leading to price increases on consumer goods.

Inflation can be classified into immediate and long-term effects. Immediate effects often manifest as sudden price hikes in essential goods, leading to virtual shock for consumers. Long-term inflation can result in chronic adjustments in wage expectations as employees strive for compensation that keeps pace with rising costs.

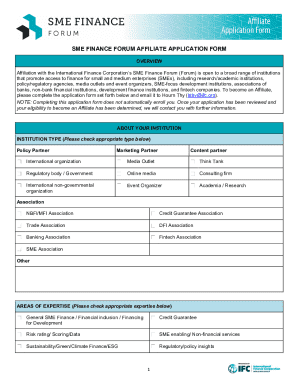

The role of forms in managing inflation-related documentation

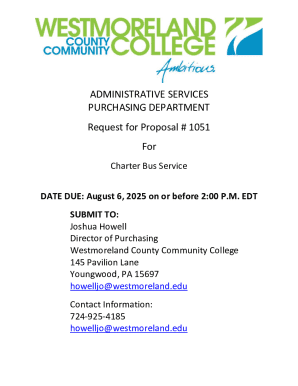

Proper documentation plays a pivotal role in managing the financial implications of inflation. Organizations must adhere to legal compliance requirements, ensuring that records are accurate and up-to-date, especially for tax purposes. An effective system for managing documentation can significantly enhance financial tracking and reporting, allowing for timely decisions based on inflation trends.

Common forms related to inflation management include tax forms that adjust for inflation, reports that track inflation impacts on individual budgets, and agreements that relate to inflation-adjusted pricing. Each of these forms requires careful completion to avoid costly penalties.

Using pdfFiller to manage inflation forms efficiently

pdfFiller provides a streamlined solution for managing inflation-related forms, allowing users to easily upload, edit, and customize their documents. To begin, users can quickly upload their PDF forms into the pdfFiller platform. From there, users can employ the suite of editing tools available, including text boxes, signatures, and checkboxes, to update their forms as necessary.

One of the standout features of pdfFiller is its eSigning capabilities. Once forms are prepared, they can be securely signed electronically, facilitating swift transactions that are crucial in fast-paced financial environments. This level of security ensures that sensitive information remains protected while providing peace of mind.

Collaborative features for teams handling inflation documentation

pdfFiller’s collaborative features allow teams to work together in real-time on critical inflation-related documentation. Teams can utilize the platform’s interactive tools, such as comments and shared editing, to facilitate an efficient workflow. This real-time collaboration ensures that everyone involved in the documentation process can provide input and verify information as needed.

To ensure accuracy, it's essential to implement a thorough team review process. Establishing best practices for collaboration, such as setting deadlines for edits and utilizing notes effectively, helps minimize errors. Clear communication is key; hence, using pdfFiller’s commenting features can streamline discussions related to document changes.

Filling out inflation-related forms: a step-by-step guide

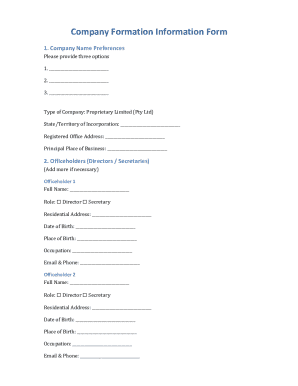

Accurate completion of inflation-related forms begins with gathering all necessary information. Key data points might include income details, cost metrics, and previous inflation adjustments that affect current submissions. It's crucial to have precise figures at hand to avoid potential mistakes.

Detailed instructions for specific types of inflation forms can vary significantly. For example, tax adjustments related to inflation may require changes in income reporting based on inflation indices, while price change notifications necessitate accurate current and proposed figures. Ensure compliance with local regulations concerning these forms.

Avoiding common pitfalls, such as misreporting figures or neglecting to account for vital adjustments, is crucial. Double-checking your information not only increases compliance but also strengthens the integrity of your submissions.

Post-submission: managing inflation form outcomes

Once forms are submitted, tracking the status of these documents using pdfFiller is essential. This feature enables users to monitor submissions and responses, providing documentation peace of mind and keeping projects on track. Understanding the outcomes of submissions—such as approvals or requests for further information—can inform future documentation strategies.

It's equally important to safeguard all completed inflation forms for future reference. Effective organization and secure storage solutions will allow users to retrieve necessary documentation when needed. Utilizing pdfFiller's storage options ensures that files are both accessible and secure.

Analyzing data from submitted forms can yield insights for future budgeting and financial planning decisions. For instance, using inflation data may help predict necessary pay adjustments or inform pricing strategies for goods and services.

Conclusion of key features relevant to inflation management

In conclusion, pdfFiller offers valuable tools for managing inflation-related documentation. The platform provides users with an accessible, all-in-one solution for form completion, editing, eSigning, and collaboration. Such capabilities are not just efficient but also crucial for maintaining compliance and accuracy in a rapidly changing economic landscape.

Embracing these resources can empower individuals and teams to effectively manage their inflation documentation, providing tools to navigate the intricacies of economic fluctuations. With pdfFiller, users are encouraged to explore the diverse functionalities available to streamline their documentation processes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send form impact of inflation to be eSigned by others?

Can I sign the form impact of inflation electronically in Chrome?

How can I fill out form impact of inflation on an iOS device?

What is form impact of inflation?

Who is required to file form impact of inflation?

How to fill out form impact of inflation?

What is the purpose of form impact of inflation?

What information must be reported on form impact of inflation?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.