Get the free Corporate Card Program

Get, Create, Make and Sign corporate card program

How to edit corporate card program online

Uncompromising security for your PDF editing and eSignature needs

How to fill out corporate card program

How to fill out corporate card program

Who needs corporate card program?

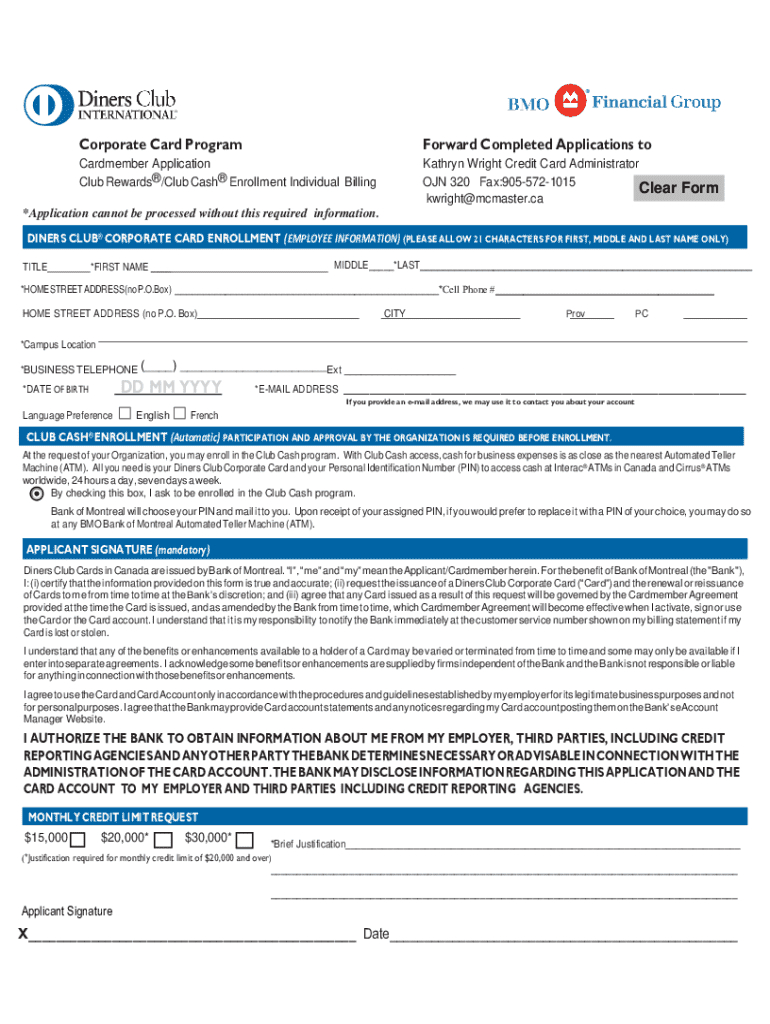

Navigating the Corporate Card Program Form: A Detailed Guide

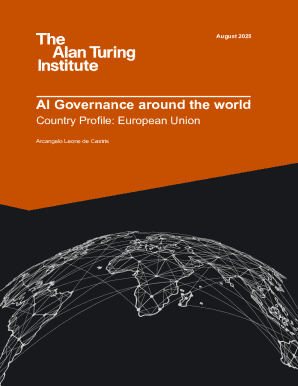

Understanding the corporate card program

A corporate card program is an essential financial tool for businesses, allowing organizations to manage expenses efficiently. These cards are typically issued to employees for business-related expenses, offering a streamlined method for tracking expenditures while enhancing control over company finances. The primary purpose is to facilitate spending and increase transparency about where funds are allocated. Benefits include improved cash flow management, the ease of expense tracking, and the potential for enhanced reporting capabilities.

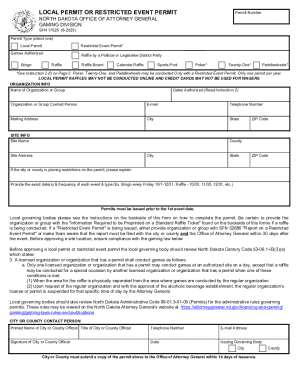

Requirements for obtaining a corporate card

Obtaining a corporate card is not merely a straightforward process; certain eligibility criteria are in place to ensure that only suitable organizations and individuals are granted access. Organizations must often be registered entities with a compliant business model and a history of financial responsibility. And on an individual level, each applicant might have to meet specific criteria, including employment status, job role, and purpose of card use.

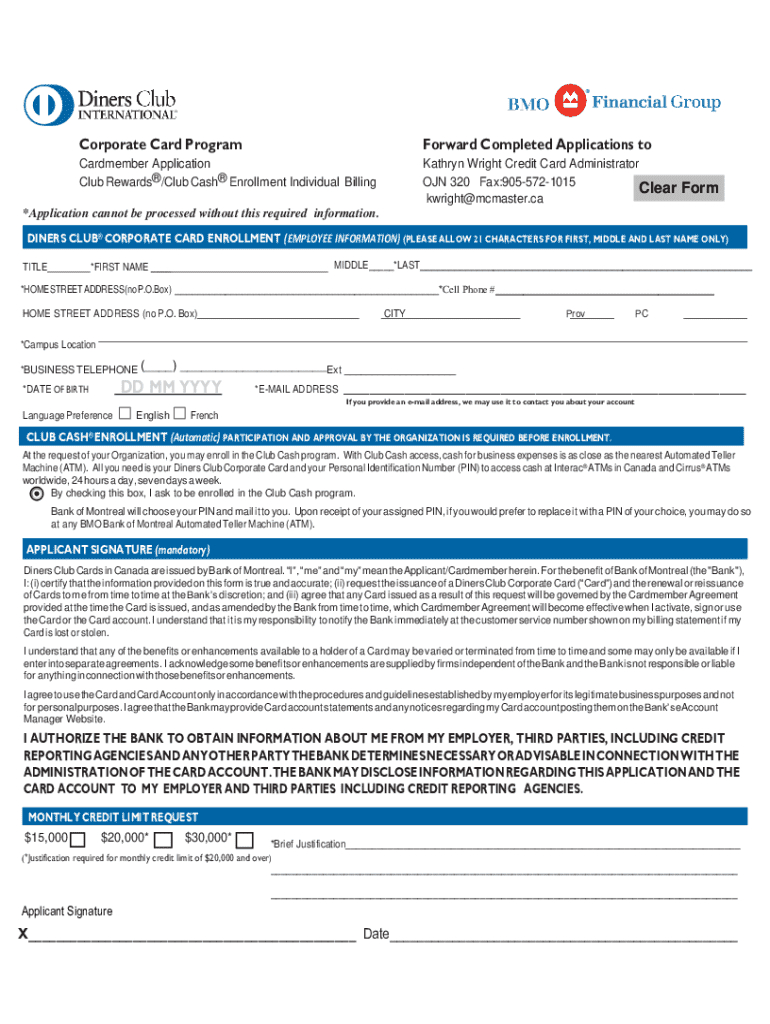

Step-by-step guide to completing the corporate card program form

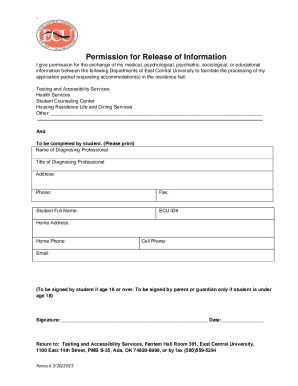

Accessing the corporate card program form is the first step in the application process. For users engaging with pdfFiller, navigating to the specific document section is crucial. With the platform's search features, finding the right form should be a seamless experience, focusing on the term 'corporate card program form' within the platform's interface.

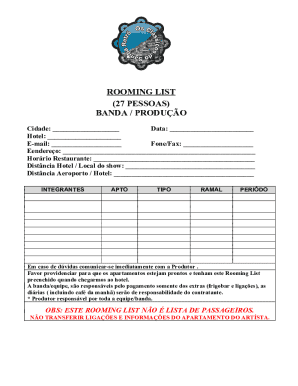

Once you find the correct form, accurately inputting your business information is essential. Required fields typically include the legal business name, address, and Tax ID number. One common pitfall is neglecting to double-check these entries—minor errors can lead to significant delays. When providing cardholder information, each individual’s full name, position, and spending limits must be outlined; accuracy here ensures the integrity of financial reporting.

Additional information on cardholder profiles

Creating distinct cardholder profiles is vital in a corporate card program. Each profile keeps track of expenditures transparently, allowing for easier management and accountability. Businesses should define roles within the profiles clearly, determining the access levels for spending and oversight. Depending on their role within the organization, cardholders might have different spending responsibilities and limits, tailored to reflect their position.

Managing these profiles goes beyond simply creating them; regularly updating and maintaining these profiles is key. In cases of employee turnover, deactivating profiles promptly protects against unauthorized spending and potential financial losses. Conversely, reactivating profiles for returning employees involves a systematic approach to ensure continuity in access without compromising security.

Understanding card types and transaction limits

Organizations typically have various corporate card options, each tailored to meet different needs. Standard cards might suit daily operational expenses, while premium cards could offer enhanced rewards and features, catering specifically to business travel. Understanding these options assists corporate leaders in making informed decisions about which type best suits their operational needs.

Setting transaction limits for cardholders is another critical component of financial management. Every employee role can carry a different responsibility level, necessitating tailored limits. For instance, a traveling employee may have higher limits than someone whose responsibilities revolve around local expenditures. Customizing transaction limits benefits the company by mitigating risk and facilitating better tracking of spending trends.

Handling card renewals and replacements

The process for renewing corporate cards typically follows a structured timeline. Businesses should implement a reminder system for renewals, as overlooking expiration dates can result in operational disruptions. Generally, documentation may be required that mirrors the initial application, emphasizing ongoing verification of both business and cardholder data.

In instances where a card is lost or stolen, specific steps must be taken to request a replacement. It's important to act quickly by reporting the incident through the designated channel provided by the card issuer. Cardholders often face fees and a brief waiting period during replacement processing, making it critical to have contingency plans for uninterrupted access to funds.

Managing expenses with corporate cards

Establishing best practices for expense reporting helps maintain financial transparency and accountability. Utilizing tools available on pdfFiller can enhance accuracy, making it easier to collect receipts and input data directly into the expense tracking system. Moreover, integrating corporate cards with accounting software can streamline financial operation processes, allowing real-time visibility into spending.

Monitoring and analyzing expenses is equally important. Taking advantage of the reports generated by the corporate card program means businesses can identify trends in spending, which aids in budget setting for future periods. Additionally, setting up alerts for overspending can prevent financial pitfalls, ensuring that expenses remain within the predetermined limits.

Compliance and security measures

Compliance with organizational policies and legal regulations is non-negotiable when it comes to corporate card use. Every user must understand the guidelines set forth regarding acceptable spending, expense reporting, and card usage protocols. This compliance ensures that the company remains within legal boundaries while maintaining internal control over expenditures.

Security measures are equally important. Features such as encryption protect sensitive data, while fraud protection capabilities safeguard against unauthorized transactions. Training for cardholders around security practices is vital, empowering them to recognize red flags potentially indicating fraud, thereby enhancing overall program security.

FAQs about the corporate card program

New cardholders often have questions about handling disputes and the correct procedures if their transactions are declined. Having a clear protocol for addressing these issues helps to streamline the resolution process, ensuring cardholders feel supported and informed. Companies should also communicate policies regarding expense limits and sought approvals to prevent unauthorized spending.

Addressing consequences of misusing corporate cards is crucial as well. All cardholders should be aware that inappropriate use can lead to disciplinary actions, emphasizing the importance of understanding and adhering to company policies to avoid potential fallout.

Tips for successful management of the corporate card program

To maximize the benefits of a corporate card program, ongoing training for cardholders can be invaluable. Regular sessions focusing on the responsible use of funds, reporting processes, and changes in company policy foster a culture of accountability and informed spending. Additionally, conducting periodic reviews of company policies related to corporate cards ensures that they remain appropriate and reflective of the organization's evolving needs.

Leveraging pdfFiller for ongoing management is another strategy to enhance program efficiency. Utilizing the platform's tools for document management enables teams to manage form submissions, track expenditures, and collaborate efficiently. This ensures that card management processes remain smooth, organized, and accessible to all stakeholders.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in corporate card program?

Can I create an electronic signature for the corporate card program in Chrome?

How do I complete corporate card program on an iOS device?

What is corporate card program?

Who is required to file corporate card program?

How to fill out corporate card program?

What is the purpose of corporate card program?

What information must be reported on corporate card program?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.