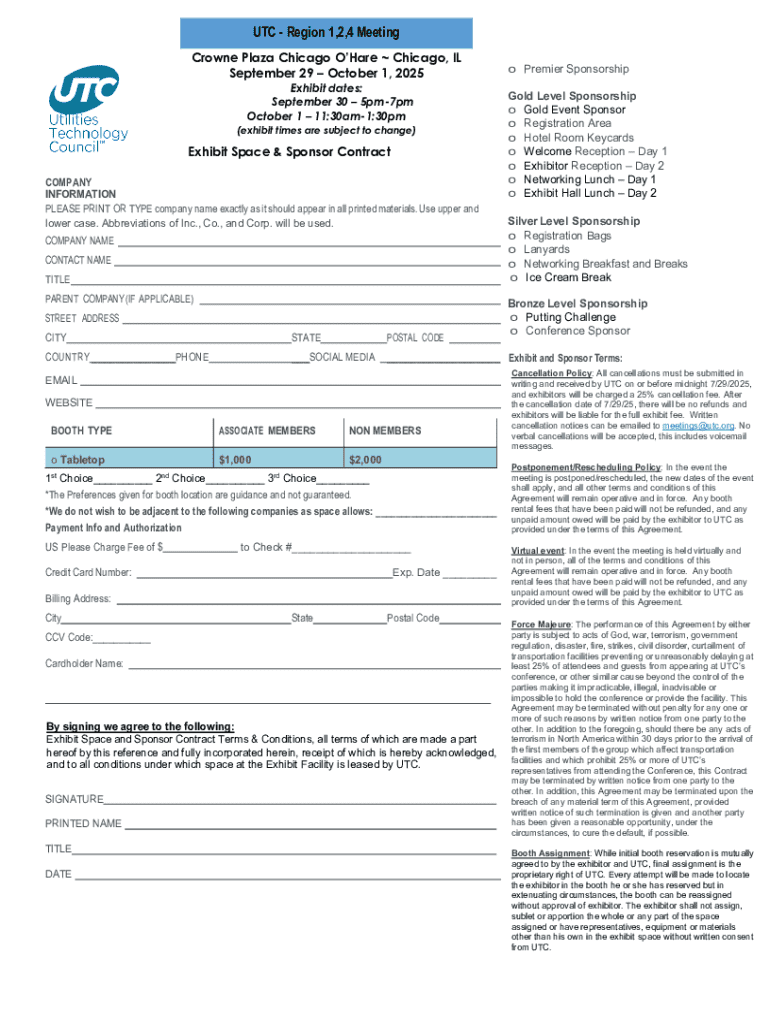

Get the free Merger or this Agreement

Get, Create, Make and Sign merger or this agreement

How to edit merger or this agreement online

Uncompromising security for your PDF editing and eSignature needs

How to fill out merger or this agreement

How to fill out merger or this agreement

Who needs merger or this agreement?

Merger or this agreement form: A comprehensive guide

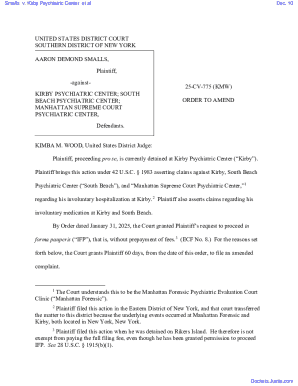

Understanding the merger agreement

A merger refers to the process where two or more companies combine to form a single new entity. This business strategy is often employed to enhance market presence, streamline operations, or gain competitive advantages. The formal agreement that outlines the terms and conditions of this merger process is known as the merger agreement. It's not merely a formality but a crucial document that delineates the responsibilities, rights, and obligations of each party involved.

The merger agreement serves as a legal foundation for the business combination, ensuring that all parties understand their commitments. This document is essential for minimizing potential disputes and providing clarity on various business aspects such as assets, valuation, and management structures. Without a well-defined merger agreement, survivors face uncertainty, which could lead to costly legal challenges or business setbacks.

Key components of a merger agreement

A merger agreement typically includes several critical components, starting with the parties involved. It's imperative to accurately identify the legal entities engaged in the merger, ensuring clarity about which business entities are merging, and their legal standing. This information establishes the framework for the subsequent terms and conditions included in the agreement.

Next, the terms and conditions section describes the structure of the merger, including any valuation considerations. This component elaborates on how the companies will be valued and what compensation, if any, will be exchanged. This section must also define the representations and warranties offered, where the involved businesses provide guarantees to each other regarding their financial health, authority to enter the agreement, and the accuracy of various disclosures.

Commonly used terms in a merger agreement

A merger agreement is filled with specialized terminology that can be complex for those unfamiliar with legal and business jargon. Familiarizing oneself with critical terms can greatly enhance understanding and decision-making during the merger process. For instance, 'due diligence' refers to the comprehensive investigation both parties conduct to evaluate each other's assets and liabilities before the merger finalizes.

Other essential terms include 'indemnification,' which entails a party's commitment to compensate for harm or loss, and 'buyout,' referring to acquiring another party's shares or equity interests. Breaking down this legal jargon promotes clarity and ensures that all involved parties have a unified understanding of their rights and obligations.

When to use a merger agreement

Determining whether to utilize a merger agreement depends significantly on specific business circumstances. Companies typically seek mergers to foster growth, enhance market reach, or create strategic alliances. In these cases, a well-crafted merger agreement is indispensable to outline mutual benefits, responsibilities, and expectations.

Several indicators may suggest it's time to draft a merger agreement. For instance, if companies are experiencing simultaneous growth or seeking synergy to optimize resources, the likelihood of complexities increases. Engaging professional legal counsel in such scenarios is crucial for avoiding potential pitfalls, ensuring comprehensive coverage of all essential terms.

Drafting a merger agreement: Step-by-step process

Drafting a merger agreement requires meticulous planning and coordination among stakeholders to ensure all aspects are covered. The first step involves preliminary discussions where parties negotiate and agree on fundamental terms. Establishing open lines of communication at this stage is vital for fostering trust and understanding.

Next, assembling necessary information is crucial. This involves gathering relevant financial statements, assets, legal standing, and market data to facilitate informed decision-making. Engaging legal counsel can provide invaluable expertise, ensuring all legal implications are accounted for while drafting the agreement.

Sample merger agreement

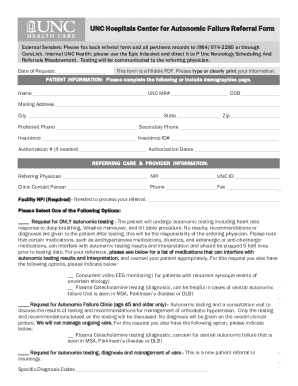

Using a sample template can significantly streamline the process of creating a merger agreement. A well-structured template includes illustrated sections that delineate essential components, such as the identification of parties, terms of the merger, and critical legal considerations. This format simplifies drafting by providing a clear framework, reducing the likelihood of oversights.

Customizing the template according to specific business needs is vital. Considerations like industry-specific regulations, varying market conditions, and unique company structures should be factored into the agreement to ensure it accurately reflects the evolving landscape of the merged entities.

Related documents and tools

Accompanying documents serve an essential purpose in relation to a merger agreement. Non-Disclosure Agreements (NDAs) are indispensable to protect sensitive information throughout the merger discussions. Additionally, a Letter of Intent (LOI) is often used in the initial phases to express intentions without forming a binding commitment, paving the way for the formal merger agreement.

Interactive tools, such as those provided by pdfFiller, enhance the document creation experience. These tools facilitate easy collaboration, making it simple for teams to edit, sign, and share documents securely. This ensures that all parties are engaged and informed throughout the merger process.

FAQs about merger agreements

Understanding merger agreements invites numerous questions, often driven by uncertainties surrounding complex legal matters. One common inquiry revolves around how valuations are determined, with experts suggesting that factors such as market value, financial health, and asset evaluations heavily influence this figure.

Other frequent concerns include the implications of breach of contract and the necessity of legal counsel. Engaging professionals from the onset is widely deemed best practice to navigate the intricacies involved and safeguard against missteps that could derail the merger.

Navigating challenges in merger agreements

The process of forming merger agreements can be fraught with challenges and pitfalls. Common issues may include miscommunication, differing organizational cultures, and legal disputes stemming from unclear terms. Being aware of these potential roadblocks allows businesses to prepare more effectively, ensuring smoother negotiations.

Strategies for addressing these challenges may involve proactive conflict resolution measures, such as mediation or arbitration, which can provide an avenue for amicable resolution in case disagreements arise. Establishing clear lines of communication and maintaining transparency throughout the negotiation process are also pivotal in minimizing future complications.

Innovative features of pdfFiller for document management

Leveraging a cloud-based platform like pdfFiller can revolutionize how businesses manage their documents. This technology provides easy access to documents from any location, enabling teams to collaborate seamlessly regardless of geographic constraints. With built-in tools for eSigning, editing, and reviewing, businesses can streamline their merger agreement process, enhancing efficiency.

Moreover, pdfFiller ensures the security and compliance of sensitive documentation. The platform's features guarantee data protection, which is paramount when managing merger agreements and associated confidential information. This assurance allows companies to focus on their core objectives without fearing compromising sensitive data.

Seeking professional help

Consulting legal experts is often essential in navigating the complexities inherent to merger agreements. When dealing with intricate valuation methods, legal compliance, and potential risks, professional guidance can illuminate pathways toward effective deal execution. Finding resources like those provided by pdfFiller can enhance understanding and equip businesses with the tools they need for seamless document management.

Overall, seeking professional help is highly recommended to minimize risks associated with merger agreements. Using expert resources ensures that all legalities are addressed and that the agreement accurately reflects the evolving landscape of the merged entities.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit merger or this agreement in Chrome?

Can I create an eSignature for the merger or this agreement in Gmail?

How do I fill out the merger or this agreement form on my smartphone?

What is merger or this agreement?

Who is required to file merger or this agreement?

How to fill out merger or this agreement?

What is the purpose of merger or this agreement?

What information must be reported on merger or this agreement?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.