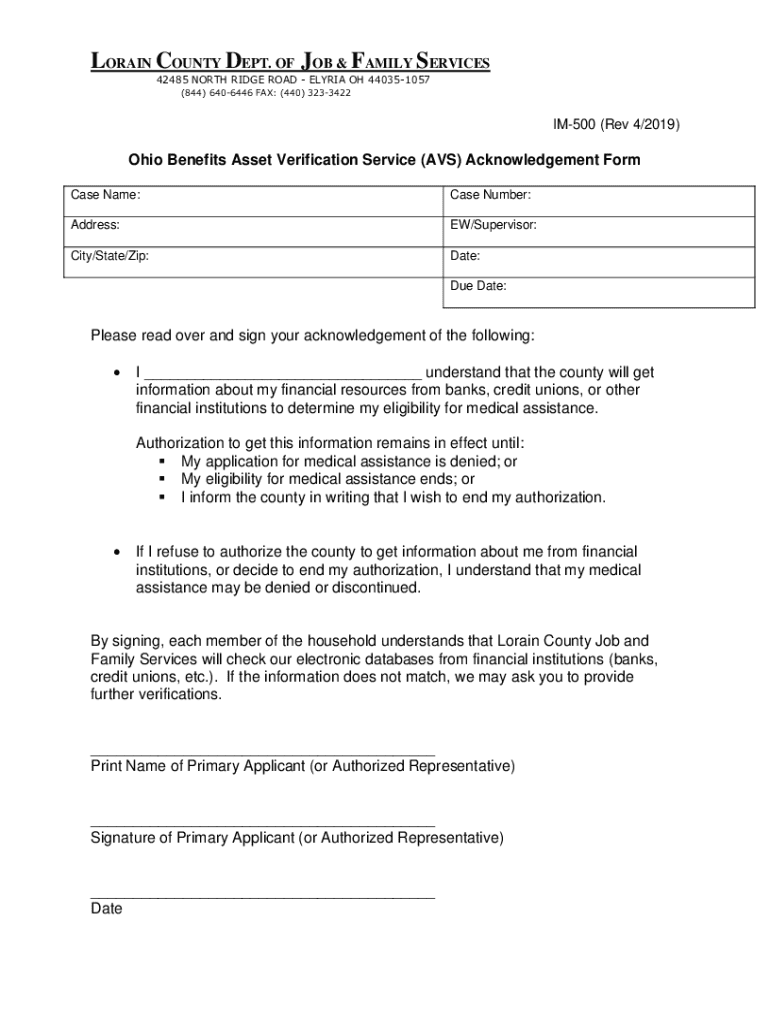

Get the free Ohio Benefits Asset Verification Service (avs) Acknowledgement Form

Get, Create, Make and Sign ohio benefits asset verification

Editing ohio benefits asset verification online

Uncompromising security for your PDF editing and eSignature needs

How to fill out ohio benefits asset verification

How to fill out ohio benefits asset verification

Who needs ohio benefits asset verification?

Ohio Benefits Asset Verification Form: A Comprehensive Guide

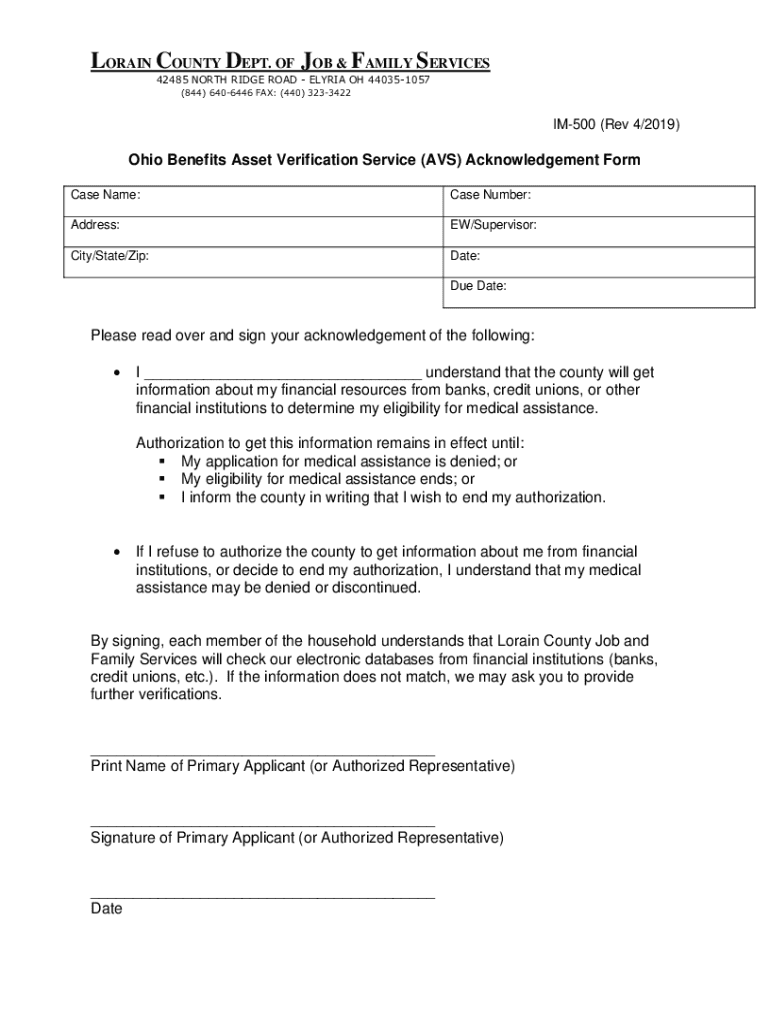

Understanding the Ohio Benefits Asset Verification Form

The Ohio Benefits Asset Verification Form is a crucial component of the application process for various state benefits, including Medicaid and food assistance. This form is designed to provide verification of assets, ensuring that applicants meet the eligibility criteria for financial assistance programs. Accurate information is essential, as discrepancies can lead to delays or denials in receiving benefits.

The asset verification process typically requires individuals to disclose various financial resources, including bank accounts, investments, and other significant holdings. By accurately completing this form, applicants help the Ohio Department of Job and Family Services (ODJFS) assess their financial situations and make informed decisions regarding benefit eligibility.

Who needs to complete the Ohio Benefits Asset Verification Form?

Any applicant seeking state benefits in Ohio may need to complete the Asset Verification Form. This requirement applies to individuals applying for programs like Medicaid, where asset limits are strictly enforced. Specifically, those with income or resource levels that fall outside established thresholds must provide detailed financial information.

Situations requiring asset verification include changes in financial status or when applying for a new program after a significant life event, such as marriage or job loss. Additionally, different benefit programs may have varying requirements; for instance, while Medicaid necessitates thorough asset disclosure, food assistance programs may focus more on income than on asset verification.

Step-by-step instructions for completing the form

Before filling out the Ohio Benefits Asset Verification Form, applicants should collect all necessary documentation. This may include bank statements, property deeds, investment records, and any other relevant financial documents that illustrate current asset levels. Understanding the asset limits for the specific benefit program is also vital, as exceeding these limits can result in ineligibility.

Each section of the form requires careful attention. The first part requires personal information, including the applicant's name, address, and social security number. Following personal information, applicants need to report all sources of income and detail assets — ensure every asset is listed accurately without omissions. Lastly, signatures and dates must be clearly completed to validate the form.

Tools and features for efficient form management

Utilizing tools such as pdfFiller can significantly streamline the process of managing the Ohio Benefits Asset Verification Form. pdfFiller offers a suite of document editing and management capabilities that can help applicants fill out their forms quickly and accurately.

Among its features are eSignature capabilities, allowing users to sign documents digitally without printing them. Document sharing options enhance collaboration, particularly for teams involved in assisting individuals with benefit applications. These tools can save time and reduce errors significantly, all in a secure, cloud-based environment.

Editing and modifying the Ohio Benefits Asset Verification Form

If errors are discovered after completing the Ohio Benefits Asset Verification Form, pdfFiller’s editing tools provide simple solutions. Users can easily add additional information or comments as necessary. Correcting mistakes is straightforward; simply go to the relevant section and make the required changes.

Once the form is complete, saving and exporting options are available in various formats, ensuring that users can keep their records organized and accessible. Formats supported include PDF and DOCX, among others, making it easy for users to archive their completed forms.

Submitting the Ohio Benefits Asset Verification Form

After completing the Ohio Benefits Asset Verification Form, knowing how to submit it is essential. The submission process varies; applicants can typically submit the form online through the Ohio Benefits portal or in person at local county offices. Alternatively, mailing the form is also an option for those who prefer to do so.

Post-submission, applicants should expect a timeframe for processing that can differ based on the benefit program. It is crucial to keep records of when and how the form was submitted, as well as any confirmation received, to track progress effectively.

Tracking the status of your application

Monitoring the application process after submitting the Ohio Benefits Asset Verification Form is vital for applicants to stay informed. Typically, applicants can log into their Ohio Benefits account to check the status of their applications. This online tool provides updates on whether more information is needed or if a decision has been made.

For follow-up inquiries, having contact information for the local county office is essential. Be aware of expected processing times for each program, as this can vary widely. Understanding these timelines allows applicants to know when to expect a response and helps reduce anxiety during the waiting period.

Related forms and additional resources

Applicants may find themselves needing additional forms alongside the Ohio Benefits Asset Verification Form, such as the Medicaid Application and Food Assistance Application. A comprehensive understanding of these additional forms is essential to ensure eligibility across programs.

Resources are available online to help clarify asset verification requirements. The Ohio Department of Job and Family Services provides up-to-date and detailed information regarding all forms and processes. Having easy access to this information can help applicants navigate their benefit applications more seamlessly.

Best practices for maintaining compliance and accuracy

Accuracy in the information provided on the Ohio Benefits Asset Verification Form is paramount; therefore, maintaining up-to-date documentation is crucial. Regularly reviewing and organizing financial records can prevent lapses and errors, particularly when there are changes in financial situations.

Recommendations for record management include keeping copies of all submitted documents and correspondence with state agencies. Understanding the legal implications of providing inaccurate information can not only affect eligibility but also result in potential legal consequences.

Leveraging cloud-based solutions for document management

Employing cloud-based solutions like pdfFiller enhances the ability to manage government forms such as the Ohio Benefits Asset Verification Form. These platforms offer various advantages, including easy access from any device and secure online storage, ensuring essential documents are always on hand.

Users have reported increased efficiency and reduced stress while managing their paperwork, allowing them to focus more on their applications. Accessing pdfFiller’s services is seamless, making the entire process from filling out forms to final submission straightforward and user-friendly.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find ohio benefits asset verification?

How can I fill out ohio benefits asset verification on an iOS device?

How do I fill out ohio benefits asset verification on an Android device?

What is ohio benefits asset verification?

Who is required to file ohio benefits asset verification?

How to fill out ohio benefits asset verification?

What is the purpose of ohio benefits asset verification?

What information must be reported on ohio benefits asset verification?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.