Get the free Reported Daily Short Positions

Get, Create, Make and Sign reported daily short positions

How to edit reported daily short positions online

Uncompromising security for your PDF editing and eSignature needs

How to fill out reported daily short positions

How to fill out reported daily short positions

Who needs reported daily short positions?

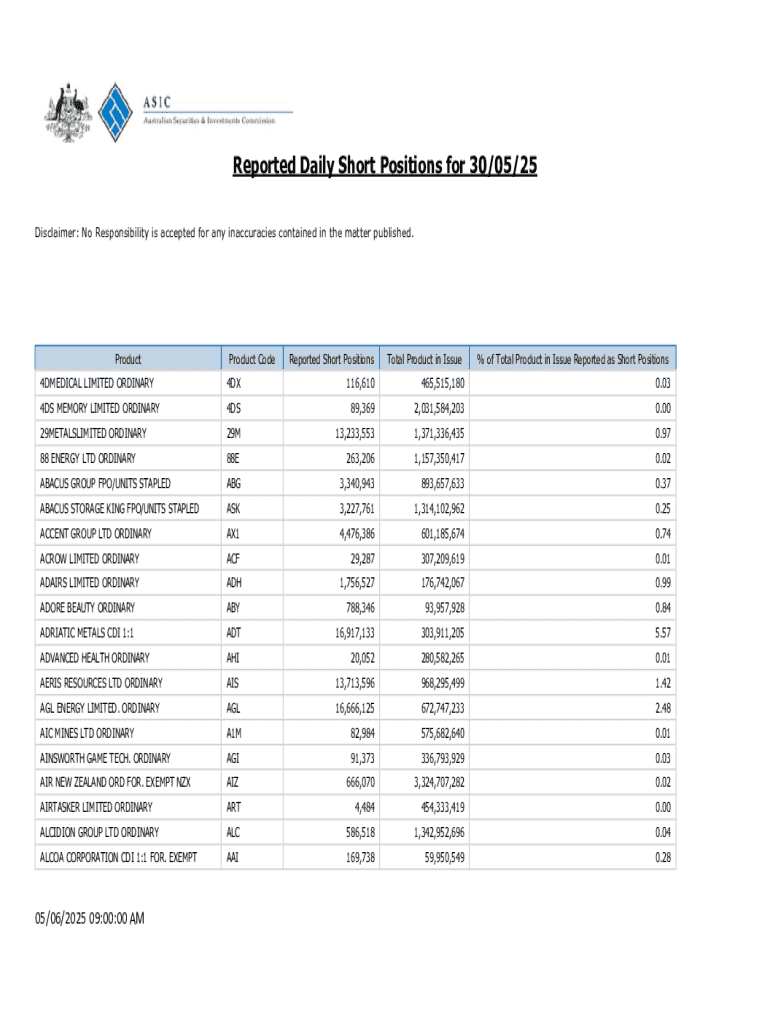

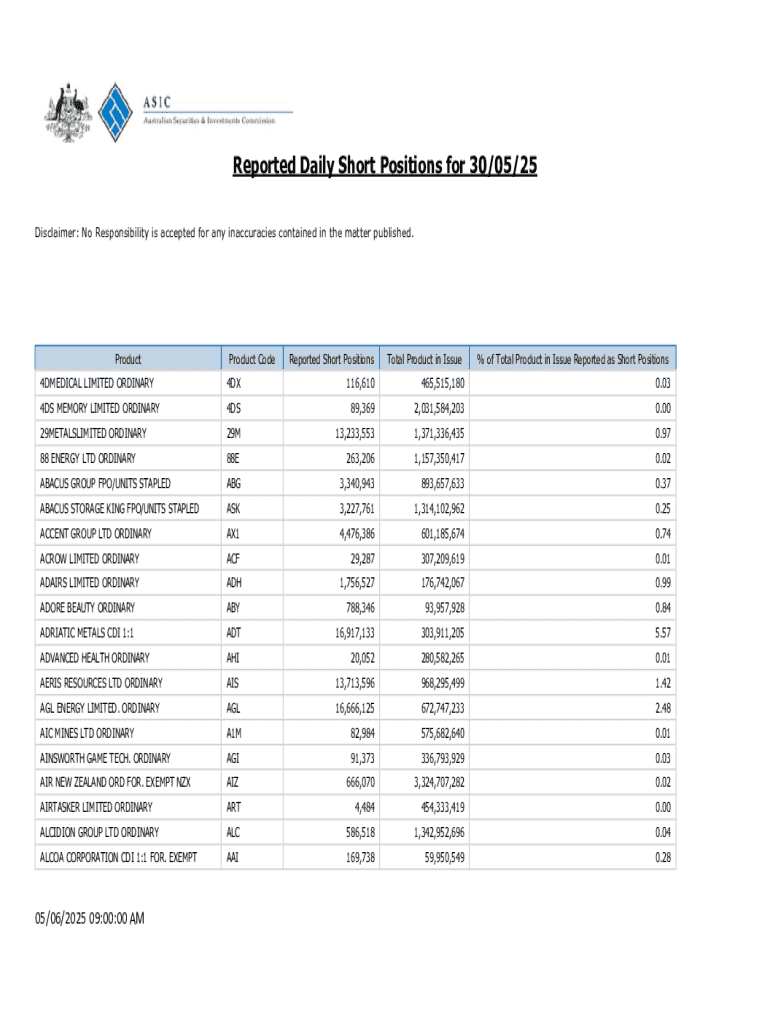

Understanding the Reported Daily Short Positions Form

Understanding short selling

Short selling is the practice of selling securities that an investor does not currently own, with the intention of buying them back later at a lower price. This strategy is employed when investors believe that the price of a stock will decline. The seller borrows the shares and sells them on the open market, expecting to later repurchase them at a reduced price to return to the lender. This process, while risky, can yield significant profits if executed correctly.

The reporting of short positions is vital as it provides transparency about market sentiment and activity. Regulators and market participants benefit from understanding where the market believes prices may decline. Furthermore, substantial short positions can impact stock prices, potentially leading to greater volatility as investors react to these movements.

Overview of the reported daily short positions form

The reported daily short positions form is a mandatory filing that provides insights into the short selling activities of brokerage firms and institutional investors. Its main purpose is to enhance market transparency by providing regulators and other market participants with a clear picture of short selling practices across different securities.

Regulatory bodies like the SEC have established compliance frameworks requiring these reports to ensure that all market players are operating fair and informed markets. Those who must file this form include brokers, dealers, and institutional investors who engage in short selling activities. Non-compliance can lead to severe penalties.

Key components of the reported daily short positions form

Filling out the reported daily short positions form accurately is crucial for compliance. Key components include essential fields that must be completed correctly to ensure the information is valid and usable by regulatory bodies. These fields include the security identifier, date of short selling activity, the number of shares sold short, and a short sale audit trail.

Understanding each component is vital. For instance, the security identifier such as CUSIP or SEDOL helps in uniquely identifying the security in question. The date of short selling activity punctuates when the transaction occurred, while the number of shares short provides insight into how much of that security is being shorted. The short sale audit trail usually requires organizations to maintain a record of their short sale transactions.

Step-by-step guide to completing the form

Completing the reported daily short positions form requires careful preparation. Begin by gathering all necessary information to ensure you understand the market updates and data sources relevant to your short selling activities. Accurate pre-filling preparation helps prevent errors that could lead to compliance issues.

Follow these step-by-step instructions to complete the form: First, fill in the header information, including your firm's details and contact information. Next, input your position data, detailing all required fields about your short positions. After that, certify that all information provided is accurate before submitting the form to the relevant regulatory body. Finally, maintain comprehensive records for compliance review to safeguard against future audits.

Digital tools for reporting

Utilizing digital tools like pdfFiller can drastically simplify completing and submitting the reported daily short positions form. pdfFiller offers a range of features that make form reporting efficient and secure. With cloud-based access, you can seamlessly collaborate with team members and edit forms from anywhere, facilitating a dynamic approach to handling regulatory submissions.

The platform allows for easy editing and signing of PDFs, ensuring compliance professionals can confirm submissions without facing difficulties. In addition, pdfFiller prioritizes data security and compliance, which is particularly critical in the heavily regulated world of finance. This streamlines the reporting process, making it suitable for both individuals and teams who need accurate, timely reporting.

Troubleshooting common issues

When filling out the reported daily short positions form, common errors may arise that can lead to rejections or comments from regulators. These can include inaccurate data entries, missing signatures, or failure to adhere to specific format requirements. It's crucial to know how to rectify these issues quickly.

In cases where your form is rejected, take a proactive approach by reviewing the comments provided by the regulatory body carefully. Address the areas cited and ensure all required changes are made before resubmitting. Having a clear FAQ on your internal resources about form submission can aid compilers in avoiding these errors.

Best practices for maintaining short position records

Maintaining accurate records of short positions is crucial for compliance and auditing purposes. Organizations should prioritize effective organization and storage of reports to quickly access necessary information. This practice not only furthers compliance but also enhances the ability to analyze patterns in short selling activities over time.

Periodic reviews of short-selling strategies can also provide insights into the overall market trends. Engaging compliance professionals to ensure these records align with legal requirements and analyzing these documents can assist in refining trading strategies through detailed data views.

Market insights and analysis

Understanding recent trends in short selling activity is essential for investors looking to make informed decisions. Monitoring daily reports can provide critical insights into market sentiment, which can often indicate potential future movements. When there is an increase in short selling against a specific stock, it could imply that investors expect a decline; conversely, reductions in short selling might suggest growing confidence in that stock.

By analyzing daily short position data, investors can glean potential buying opportunities or avoid pitfalls. Therefore, being attuned to these analytics allows for strategic positioning in the market, informed by the activities of others, thereby enhancing one's investment strategy.

Related links and additional insights

For those looking to dive deeper into the world of short selling and reported daily short positions forms, numerous resources are available. Regulatory bodies often provide guidelines and educational materials that can help brokers and compliance professionals grasp their obligations. Furthermore, recent publications pertaining to market trends and the impact of short selling can enhance one’s understanding of these complexities.

Engaging with industry professionals and participating in mediation case dialogues can also offer insights that flesh out the theoretical knowledge acquired from reading materials. Understanding how experienced negotiators handle arbitration and mediation can provide practical strategies for approaching these compliance tasks.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send reported daily short positions for eSignature?

Where do I find reported daily short positions?

Can I create an eSignature for the reported daily short positions in Gmail?

What is reported daily short positions?

Who is required to file reported daily short positions?

How to fill out reported daily short positions?

What is the purpose of reported daily short positions?

What information must be reported on reported daily short positions?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.