Get the free The Impost Of Government Taxes And Charges On Farm ... - ageconsearch umn

Get, Create, Make and Sign form impost of government

How to edit form impost of government online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form impost of government

How to fill out form impost of government

Who needs form impost of government?

Understanding the form impost of government form: A comprehensive guide

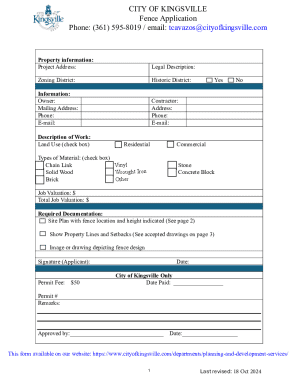

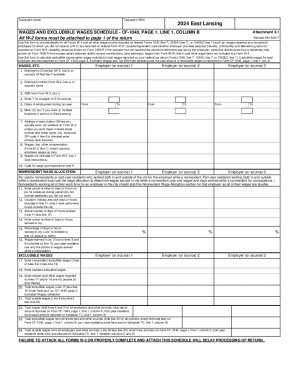

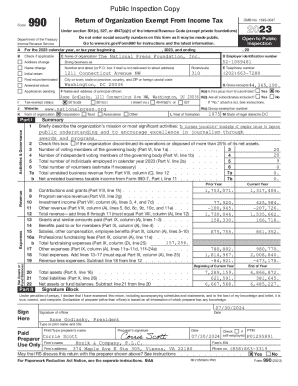

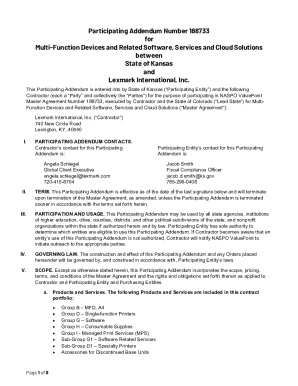

Overview of the form impost of government form

The form impost of government form is a critical document used in various governmental processes, such as taxation, licensing, and public service applications. Predominantly, it aims to collect pertinent information necessary for regulatory compliance and government intervention in several sectors. This form plays a significant role in the transparency and tracking of financial transactions between citizens and the government.

Understanding the importance of the form impost is vital for citizens and businesses alike. It is often required for official activities and can influence approval times for applications and access to services. Utilizing this form correctly can expedite processes, leading to faster resolutions and permits.

Key components of the form

The form impost of government form typically contains several key components that ensure it meets its intended purpose. A well-structured document will include various sections and fields designed to collect specific types of information. Each section serves a distinct function, helping to standardize submissions and streamline processing.

Common terms associated with the form include 'impost,' referring to a government fee or tax, and 'documentation,' which necessitates accurate record-keeping. Understanding these terms is crucial as they directly impact the information you need to gather.

Step-by-step instructions for filling out the form

Completing the form impost accurately is crucial for the success of your application. Preparation involves gathering all required information and understanding your eligibility based on current governmental policies and regulations that may vary in specificity depending on your location.

Once you are prepared, filling out the form should be systematic. Begin with personal identification information, followed by your financial details, and lastly prepare any necessary supporting documents.

Section 1: Personal Identification

This section requires basic personal identification details such as your full name, address, and phone number. Accuracy is vital as any discrepancies can result in delays or rejections. Double-check that your name matches exactly with any official documentation.

Section 2: Financial Information

In this section, you will need to provide information about your financial situation, including income sources, debts, and other assets. It’s essential to be thorough and precise as errors may lead to complications during processing.

Common mistakes to avoid include underreporting income or failing to disclose debts, which can undermine the integrity of your submission.

Section 3: Supporting Documentation

This final section contains guidelines for attaching necessary documents. Required documents may include proof of income, identification verification documents, or any additional paperwork stipulated by the specific process you are pursuing. Ensure these are prepared and organized in advance to facilitate a smooth submission process.

Editing the form using pdfFiller

Utilizing pdfFiller for form editing provides numerous benefits. This tool allows for intuitive editing, making it easy to fill out, sign, and manage your form impost of government form seamlessly. The ability to collaborate in real-time with others in your organization enhances efficiency.

Furthermore, pdfFiller offers cloud storage, which ensures your documents are securely accessible from anywhere. This is particularly useful for storing multiple versions of forms or tracking changes over time.

To ensure compliance, regularly check your entries against the latest government requirements while working within pdfFiller to minimize errors.

Signing and submitting the form

After accurately completing the form impost of government form, the next step is to sign and submit it. Electronic signatures—eSignatures—are becoming more widely accepted, but it’s crucial to understand the legal implications surrounding their use. Using pdfFiller simplifies this process significantly.

To eSign using pdfFiller, simply select the eSignature option, follow the prompts to generate your signature, and place it where required. Ensure that all signatories complete their parts to avoid delays in submission.

Troubleshooting common issues

Mistakes can happen, even with thorough preparation. Common errors in the form impost of government form can include incomplete fields, missing signatures, or incorrect financial information. Identifying and rectifying these issues quickly is essential.

If your form is rejected, it's advisable to review the feedback provided by the government office. Often, they will give insight into what was wrong, enabling you to correct it effectively. Keeping communication lines open with relevant offices can help clarify any doubts moving forward.

Managing your form record

Once the form impost of government form is submitted, managing its record is your next significant step. Using tools like pdfFiller enhances your ability to keep organized and accessible records. This platform allows for easy access to your form history, enabling you to track revisions and statuses effectively.

Efficient document storage is critical to ensure you can retrieve the form when needed, be it for follow-up actions or potential audits. You can categorize documents by type or submission date, improving searchability.

Additional tips for users

When engaging with government forms, accuracy, and confidentiality must always be prioritized. Employing best practices such as keeping sensitive information secure and routinely checking form requirements will save time and effort in the long run.

Utilizing pdfFiller's expansive library of templates for various forms can further streamline your processes. If you encounter challenges, reaching out to pdfFiller's help center can provide you with the necessary guidance to navigate specific issues.

Discussion of the impost and its broader implications

The form impost of government form is more than just a procedural document; it can significantly impact government policy and the economic landscape. Understanding the implications of the impost helps individuals and enterprises navigate their financial responsibilities while promoting transparency and accountability in public services.

The importance of this form could expand in the future, as governments strive to update regulations and embrace electronic processing systems. Adapting to these changes will not only enhance accessibility for submitting forms but also streamline paperwork management.

Success stories

Real-world applications of the form impost of government form highlight its effectiveness in facilitating government interactions. Businesses that have successfully navigated their applications report quicker processing times due to thorough initial submissions. Positive feedback consistently mentions the role of proper documentation and the significance of being informed about government protocols.

Testimonials from users who have utilized pdfFiller's features point to a significant increase in successful submissions and decreased time spent managing forms. The ease of accessing resources and support directly correlates to higher satisfaction and result-oriented behaviors.

Interactive tools and resources

To further assist users, several interactive tools and resources are available at pdfFiller. For instance, calculators that estimate impost fees can provide clarity on financial obligations, while an extensive FAQ section can address common inquiries related to the form impost of government form.

Additionally, access to legal advice or expert guidance can empower users as they navigate through the complexities of governmental interactions. Proper utilization of these resources can translate to enhanced clarity and confidence in handling government forms.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send form impost of government to be eSigned by others?

How do I complete form impost of government online?

Can I edit form impost of government on an Android device?

What is form impost of government?

Who is required to file form impost of government?

How to fill out form impost of government?

What is the purpose of form impost of government?

What information must be reported on form impost of government?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.