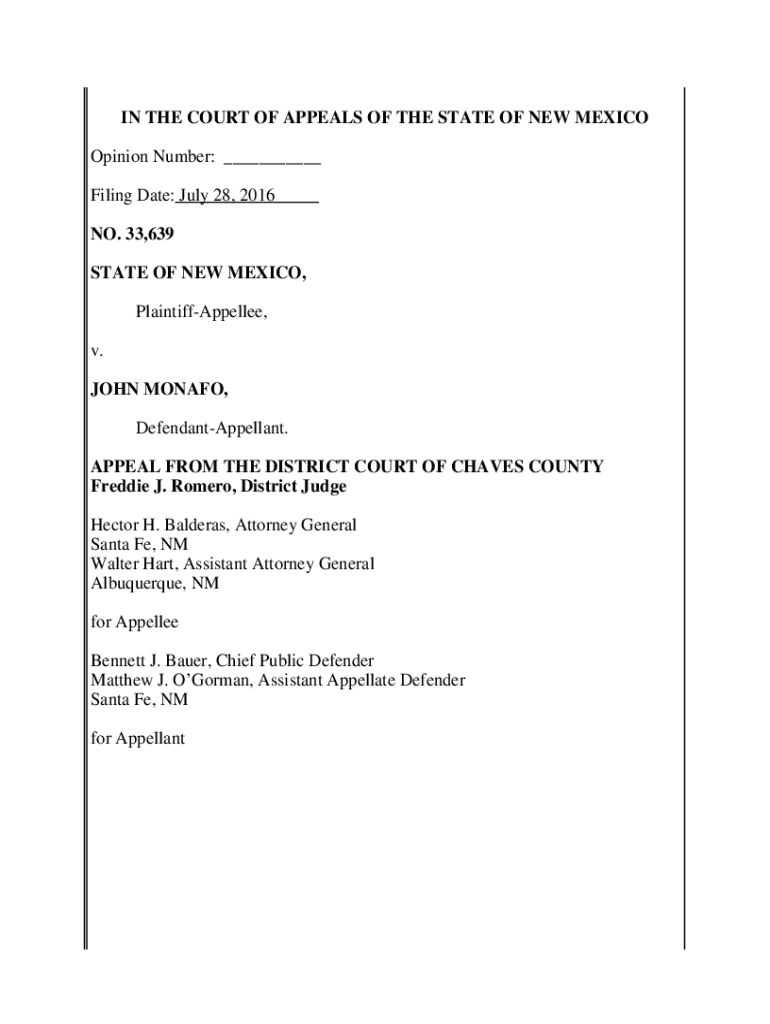

Get the free State of New Mexico, PlaintiffAppellee, v. John Monafo, ... - coa nmcourts

Get, Create, Make and Sign state of new mexico

How to edit state of new mexico online

Uncompromising security for your PDF editing and eSignature needs

How to fill out state of new mexico

How to fill out state of new mexico

Who needs state of new mexico?

State of New Mexico Form: A Comprehensive How-to Guide

Understanding New Mexico forms: A comprehensive overview

New Mexico forms refer to the various official documents required by residents, businesses, and governmental agencies within the state. These forms encompass a wide array of applications, registrations, and legal documents used in taxation, business operations, and other administrative functions. As the state's regulatory environment evolves, understanding how to navigate these forms becomes crucial for compliance and efficiency.

Accurate form submission is essential to avoid delays, errors, and potential legal issues. Whether you're filing your personal income taxes or registering a new business, ensuring that all required information is included and accurate can save you from complications and fines. Forms can be complex and are often governed by specific regulations; hence, familiarity with the types and their applications is vital.

The key types of forms in New Mexico include tax forms, business registration forms, and various legal documents required by state agencies. Each category serves a distinct purpose, making it essential for individuals and businesses to understand which forms apply to their unique situations.

Key New Mexico forms and their uses

Several critical forms are essential for everyday operations in New Mexico, most notably personal income tax forms. The primary form is the Form PIT-1, which every resident must complete to report their income and calculate taxable obligations. It's imperative to understand not only the form's components but also the filing guidelines specific to New Mexico.

In addition to tax forms, business forms are essential for entrepreneurs starting their ventures. This includes permits for various industries, from construction to hospitality, as well as licenses that ensure businesses comply with state regulations. Familiarizing yourself with these requirements can streamline the process significantly.

Step-by-step guide to filing New Mexico forms

Successfully filing New Mexico forms entails a systematic approach. The first step is identifying the correct form based on your requirements, such as tax obligations or business registrations. The state's Department of Taxation and Revenue website is a valuable resource for locating specific forms, helping you avoid any misapplication.

Once the correct form is established, gather all required information. Documentation may include tax identification numbers, previous returns, and details specific to your business activities. Organizing your information ahead of time can simplify the completion process, minimizing the time spent filling out each section.

When completing the form, pay special attention to the details requested on documents like Form PIT-1. Common errors include mismatches in names, incorrect Social Security numbers, and miscalculated deductions. To mitigate mistakes, aim to review each field carefully as you fill it out.

Before submission, take the time to review and double-check your form thoroughly. A checklist can be instrumental for ensuring you have all necessary elements in order. Once finalized, you can choose between electronic submission via pdfFiller or traditional paper filing, ensuring to address envelopes correctly.

Editing and managing New Mexico forms with pdfFiller

pdfFiller provides cloud-based tools that facilitate the editing and managing of New Mexico forms conveniently. With features designed to enhance document workflows, users can easily edit, sign, and collaborate on forms without needing to download additional software. This capability particularly benefits teams working on business registrations or tax submissions.

Utilizing pdfFiller’s features can streamline form management. You can create folders dedicated to different types of submissions, whether they are personal tax returns or business licensing documents. Sharing access with team members or accountants ensures collaborative efforts are transparent and efficient.

Frequently asked questions about New Mexico forms

Many individuals have questions regarding the nuances of form submission in New Mexico. A common concern is what steps to take if a mistake is made on a submitted form. Typically, you can amend forms, such as income tax returns, by following the specific amendment procedures outlined by the New Mexico Department of Taxation and Revenue.

Additionally, understanding processing times can alleviate anxiety regarding submissions. Processing times can vary based on the form type and the volume of submissions; typically, tax returns are processed within a few weeks during peak seasons. For business registrations, completion times can differ based on the complexity of licenses required.

Interactive tools for seamless form management

pdfFiller offers advanced features designed to optimize document workflows. Integrating with third-party services allows users to streamline their processes, enabling a unified approach to handling forms, whether for taxes or business registrations. Additionally, analytics tools can help track form submissions, providing insights into completion rates and turnaround times.

Real-time collaboration is a vital aspect of effective form management, especially for teams who need to work together on complex documents. With pdfFiller, team members can give feedback and suggest edits simultaneously, ensuring that documents are completed accurately and efficiently.

Tips and best practices for efficient form management

Staying updated with changing regulations surrounding New Mexico forms is critical for compliance. Resources, such as state publications and the Department of Taxation and Revenue website, provide essential updates on new forms and any alterations in existing processes. Subscribing to newsletters or alerts can keep you informed.

Timeliness is another key factor; understanding submission deadlines prevents unnecessary penalties. Each form type often has specific due dates, and missing them can result in fines or delayed processing. Marking these deadlines on your calendar aids in maintaining timely submissions.

Conclusion

Efficient management of New Mexico forms is attainable with the right tools at your disposal. pdfFiller streamlines the process of editing, signing, and storing forms in an accessible cloud-based platform. By understanding the intricacies of form submissions and leveraging pdfFiller’s features, individuals and teams can navigate the complexities of form management with confidence.

Explore the capabilities of pdfFiller today, and enhance your document handling experience whether you are filing taxes or managing business registrations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete state of new mexico online?

Can I create an electronic signature for signing my state of new mexico in Gmail?

How can I fill out state of new mexico on an iOS device?

What is state of New Mexico?

Who is required to file state of New Mexico?

How to fill out state of New Mexico?

What is the purpose of state of New Mexico?

What information must be reported on state of New Mexico?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.