Get the free Fec Form 3x

Get, Create, Make and Sign fec form 3x

How to edit fec form 3x online

Uncompromising security for your PDF editing and eSignature needs

How to fill out fec form 3x

How to fill out fec form 3x

Who needs fec form 3x?

Understanding and Navigating FEC Form 3X

Understanding FEC Form 3X

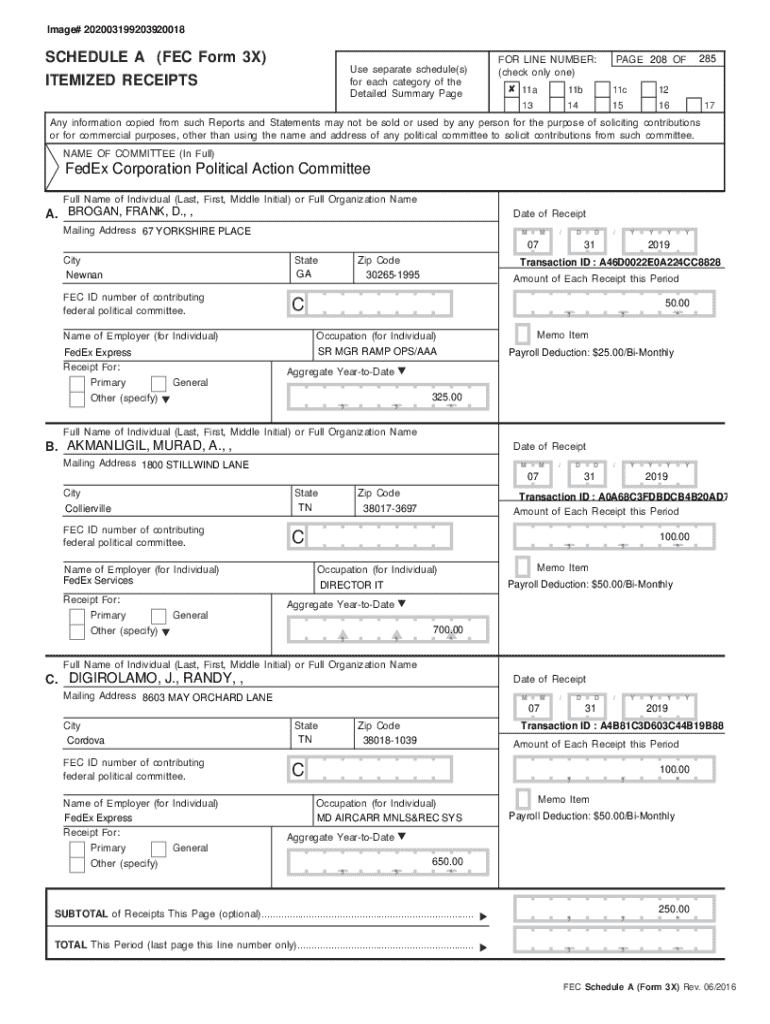

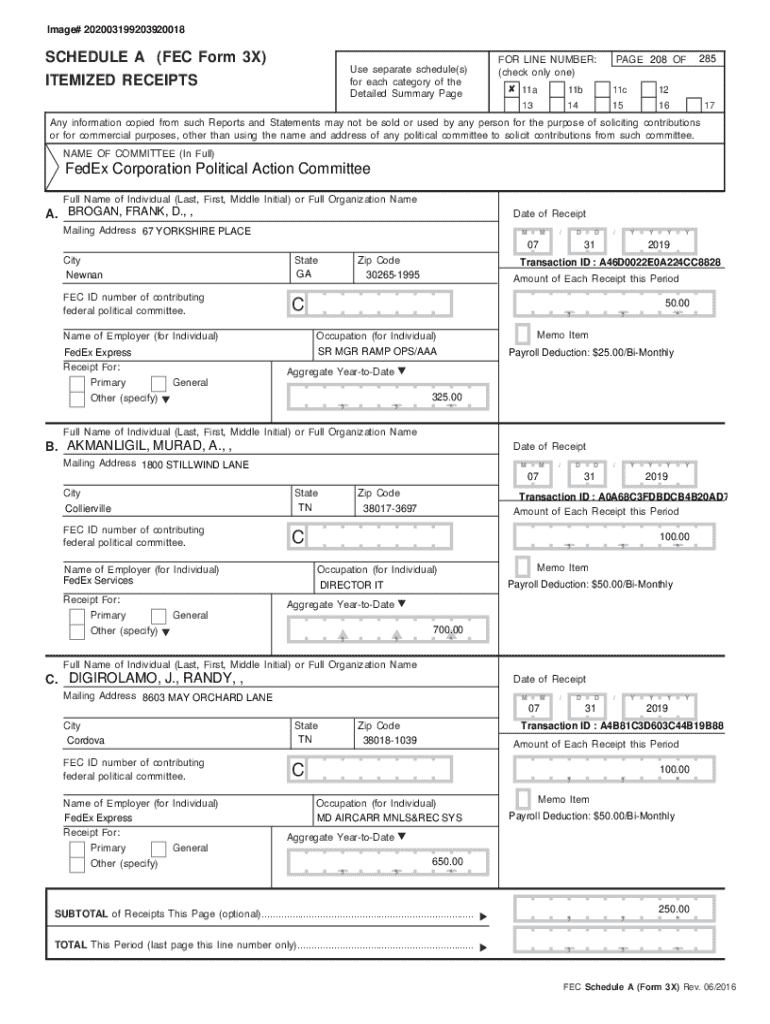

FEC Form 3X is a crucial document for political committees, candidates, and their campaigns reporting their financial activities. This short-form report is specifically designated for those who regularly file reports with the Federal Election Commission (FEC) but have more frequent reporting needs than the standard Form 3. Understanding its purpose is fundamental to ensuring compliance and maintaining transparency in campaign finance.

The FEC governs federal elections, and proper filing helps maintain the integrity of the political system. Engaging in accurate and timely reporting, as required by law, is not just an obligation but vital for maintaining public trust. The implications of inaccurate filings can be significant, potentially resulting in fines, penalties, or reputational damage, which can adversely impact both individuals and campaign efforts.

Components of FEC Form 3X

FEC Form 3X includes several components that organize the necessary financial information effectively. First, there is the Cover Page, which provides essential details about the reporting committee or candidate, including the committee name and the reporting period. An accurate cover page sets the context for the entire filing and should be completed with utmost care.

Following the cover page, the Summary of Receipts and Disbursements section presents an overview of the financial activities within the specified reporting period. This includes all contributions received and expenditures made. The Detailed Transactions section mandates a thorough accounting of all financial transactions during the period, where each contribution and expense must be reported in a specific manner to adhere to FEC regulations.

Familiarizing oneself with common terms and definitions related to campaign finance, such as contributions, expenses, and in-kind donations, also facilitates a smoother reporting process.

Who should use FEC Form 3X?

FEC Form 3X is intended for candidates and their campaigns, as well as political committees that require a more expedited schedule for reporting financial activities. Whether a national committee, state committee, or local campaign committee falls under the FEC's jurisdiction, anyone engaged in raising or spending money for federal elections must comply with these reporting obligations.

Deciding when to use Form 3X as opposed to other forms like Form 3 or Form 3P depends largely on the frequency of financial activity and reporting requirements. For instance, Form 3 is standard for those who file quarterly, while Form 3P accommodates candidates who collect or spend under $5,000. Understanding the nuances in these forms can save time and prevent errors, keeping your campaign activities compliant with regulations.

Step-by-step instructions for completing FEC Form 3X

Completing FEC Form 3X accurately begins with thorough preparation. First, you must gather all financial data relating to contributions, transfers, and expenditures from your campaign. Having a clearly organized accounting system will streamline this process, ensuring all allocations are readily available when it’s time to fill out the form.

It's essential to understand your filing deadlines, as other critical reporting dates may overlap. Adequate preparation will prevent last-minute scrambles and potential inaccuracies in your report. Once you have everything ready, start filling out each section of the form - beginning with the cover page, which should clearly list the relevant identification details like your committee name and relevant election year.

Next, move on to the Summary of Receipts and Disbursements. This section must encapsulate the total funds received and expenses incurred, ensuring numbers are straightforward and compliant with FEC reporting standards. Finally, the Detailed Transactions section will require lines for every individual transaction, using precise definitions for contributions and expenses, such as fundraising allocation or in-kind contributions, so all expenditures are clearly accounted for.

Before submitting, always review your form multiple times. Creating a checklist for accuracy can help catch potential errors. Double-check figures to ensure they match the reports from your accounting system, cross-referencing values in accordance with the regulations set forth by the FEC. This diligence helps prevent the most common filing errors.

Filing frequency and deadlines

Determining your filing schedule is crucial for compliance with FEC regulations. Typically, committees might adopt a regular filing frequency that corresponds with the activity level; some opt for quarterly filings, whereas others may require monthly updates if they are actively engaging in transactions. It is essential to establish a rhythm for reporting that reflects your campaign's engagement in fundraising and expenditures.

Moreover, it’s imperative to keep track of important deadlines. Since campaigns can have varied financial activities leading up to an election, understanding when quarterly versus special elections arise will be valuable. For example, if a special election looms, candidates should be keenly aware that certain reporting schedules may shift to accommodate the heightened activity. This position ensures that campaigns remain transparent and that all financial dealings are reported to the FEC within set timelines.

Common mistakes to avoid

Mistakes in filing forms with the FEC can have serious implications for campaigns and committees. One common error involves inaccurate totals in the Summary of Receipts and Disbursements; discrepancies here can raise red flags during reviews. Also, not correctly reporting in-kind contributions or failing to update transaction records can lead to complications, leading to a high rate of errors in filings.

Another frequent issue is miscommunication regarding deadlines, which can result in late filings and corresponding penalties. Awareness of your campaign's financial activity and timely updating of records is vital. To mitigate these errors, adopting early planning and scheduled reviews of financial data can aid in preventing unnecessary oversight. Implementing standardized practices can help ensure that everyone involved is aware of their responsibilities, promoting a more organized and successful reporting process.

Tools and resources available on pdfFiller

pdfFiller stands out as a robust platform for managing FEC Form 3X. With easy-to-use editing and collaboration features, users can effortlessly modify templates to suit their reporting needs efficiently. The interface allows users to format their documents accurately, facilitating clear communication and optimal reporting practices.

The platform also includes significant eSigning capabilities, allowing committees and campaigns to easily collect necessary signatures for their forms without the hassle of printing and scanning. This feature is pivotal in enhancing efficiency and ensuring timely submissions for critical filings. Furthermore, interactive tools available within pdfFiller can generate FEC Form 3X instantly, assist in tracking changes made over time, and manage different versions of submissions seamlessly.

FAQs about FEC Form 3X

As with many regulatory requirements, questions often arise regarding FEC Form 3X. A common concern is: what happens if a deadline is missed? Notably, missing deadlines can result in penalties, ranging from fines to heightened scrutiny of future filings. It is critical to stay informed and proactive, ensuring all necessary preparations are in place long before deadlines to prevent issues.

Another frequent query pertains to amending submitted forms. If errors are discovered post-submission, the FEC allows for amendments to correct inaccuracies. It’s crucial to provide a clear explanation for the changes and re-submit the update promptly. Additionally, many users wish to know how they can access past filings; utilizing data entry systems can facilitate tracking down previous submissions when needed.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send fec form 3x for eSignature?

How do I make edits in fec form 3x without leaving Chrome?

Can I create an eSignature for the fec form 3x in Gmail?

What is fec form 3x?

Who is required to file fec form 3x?

How to fill out fec form 3x?

What is the purpose of fec form 3x?

What information must be reported on fec form 3x?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.